Manage pay runs all in one place with MYOB

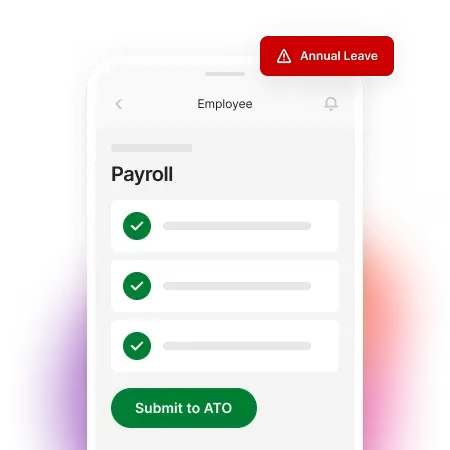

Payroll compliance, simplified

Stay in the ATO's good books. Generate and send Single Touch Payroll (STP) reports directly from MYOB Business so you can rest easy.

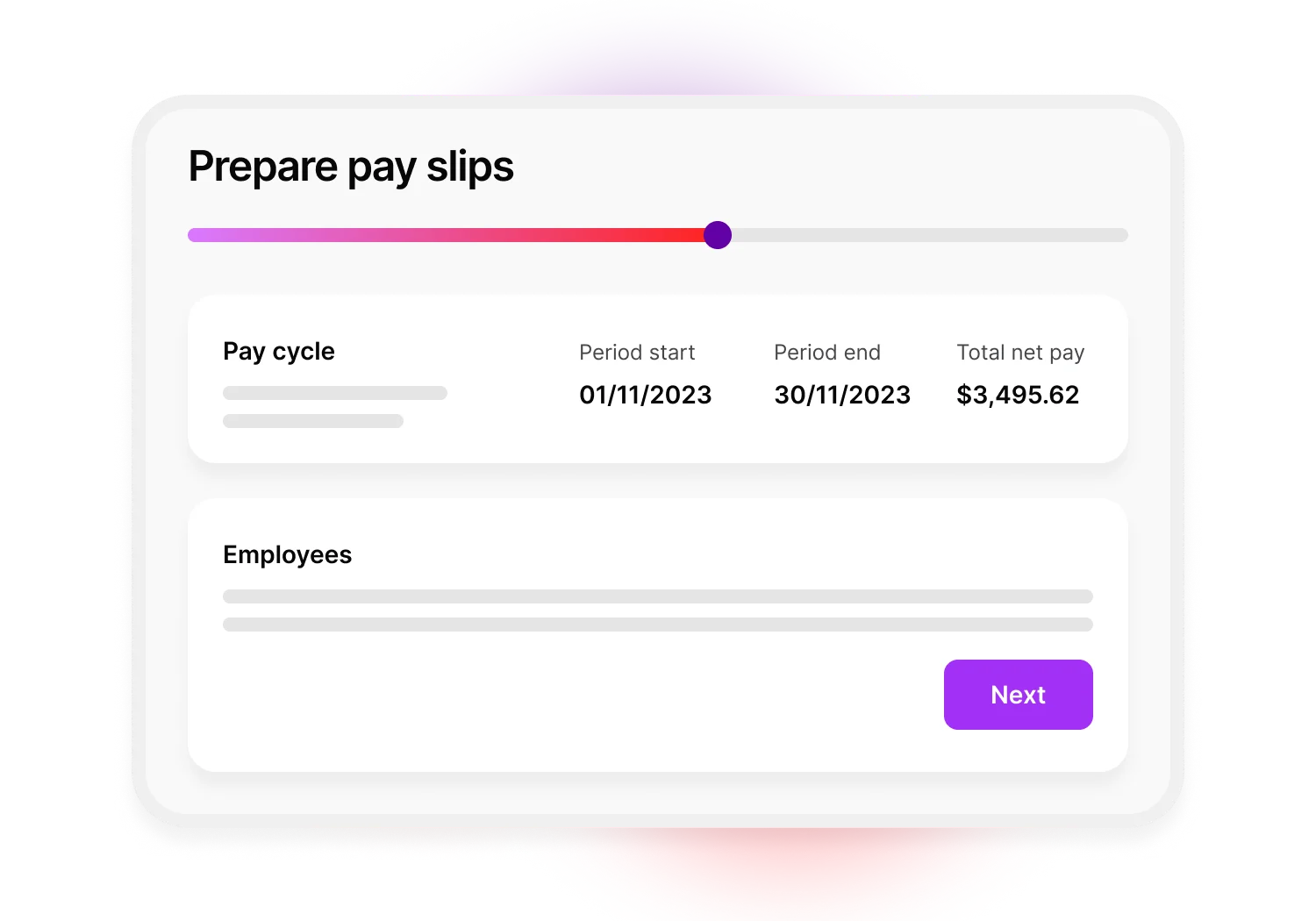

Calculate tax, superannuation and leave in just a few clicks

Automatically calculate payroll variables like superannuation, tax and annual leave all within your workflow. We’ll let you know with helpful error messages if we see something that doesn’t look right, like extra annual leave.

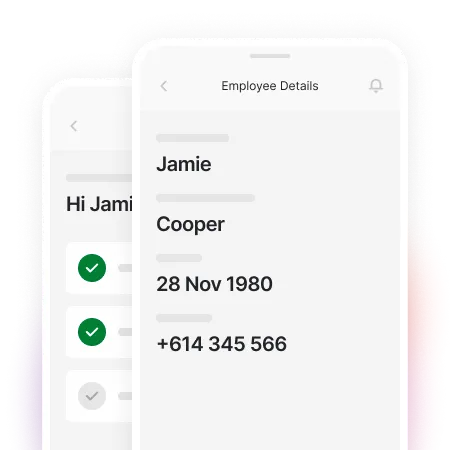

Avoid dreaded data entry. Let your employees DIY their onboarding

Your new team members can submit their bank, tax and superannuation details through our secure online form. All you need to do is add their name and email. We will handle the rest.

Need more than payroll?

Invoicing

Create customised invoices on-the-go. Track who’s paid and send automatic payments reminders to those who haven’t.

Got more complex payroll needs?

All your questions answered about MYOB cloud payroll software:

Do I need to install any software?

MYOB Business Lite and Pro are 100% web-based. No downloads required.

How long does it take to set up MYOB payroll software?

To set up MYOB payroll software, all you have to do is:

Choose the plan that's right for your business

Sign up

Invite your employees to input their payroll details

Let the software calculate the hard stuff for you

How do I migrate from another payroll software to MYOB?

You can use our free migration service to securely move your payroll data from Xero, QuickBooks Desktop or Reckon to MYOB.

If you want to migrate your payroll data from an Excel spreadsheet, follow these step-by-step instructions.

Is my data secure?

Yes. MYOB takes the security and protection of our customers’ data seriously. We use secure, encrypted channels for all communications between us and follow industry best practices including ISO 31000 Risk Management Standard.

How does Single Touch Payroll work?

Single Touch Payroll (STP) is the Australian government's method for reporting employees' payroll, tax and superannuation information to the Australian Taxation Office (ATO). If you're using MYOB payroll software, you can send the information directly from your software to the ATO.

What are the benefits of Single Touch Payroll?

Single Touch Payroll (STP) means businesses don’t need to complete payment summaries and group certificates at the end of financial year. STP software automatically sends your employees’ tax and superannuation information to the ATO. STP helps employees, too. They no longer have to wait until EOFY to see their tax information. Their details - salary, PAYG withholding and superannuation - is readily available via their myGov account.

What is payroll software?

Payroll software helps you pay your employees. It automates processes like calculating pay, superannuation, tax and annual leave. It also helps ensure that figures are accurate and follow legal and tax requirements.

What are the benefits of cloud payroll software?

Cloud payroll software, also known as online payroll software, is software that's accessed on a browser and requires an internet connection. You can access your online payroll software from a desktop, mobile or tablet, as well as all browsers.

With online payroll software, your data is stored in the cloud. Backups happen automatically, so you don’t have to constantly do them yourself.

Cloud software keeps your data secure. It has more room than other forms of data storage, meaning you can store more information.

How do I use payroll software?

Each type of payroll software is different. Cloud payroll software, like MYOB payroll, follows a standard structure. It stores financial information about your employees and uses this to generate pay, superannuation, tax and annual leave. Simple!

Is there a minimum subscription period?

Nope. And there are no lock-in contracts either. Pay monthly (or yearly to save more) and enjoy the flexibility to cancel anytime.