Prepare for a successful EOFY with MYOB

Welcome to the 2025 End of Financial Year! Let's tackle it together. As a valued MYOB customer, we're dedicated to ensuring a seamless tax season for your business.

Access our helpful guides, key dates and checklists to prepare for EOFY and the upcoming financial year with confidence.

Stay ahead with the key EOFY dates you need to know

Unsure when you need to make payments for GST, income tax and employer deductions to the ATO? We've created a handy overview for you right here.

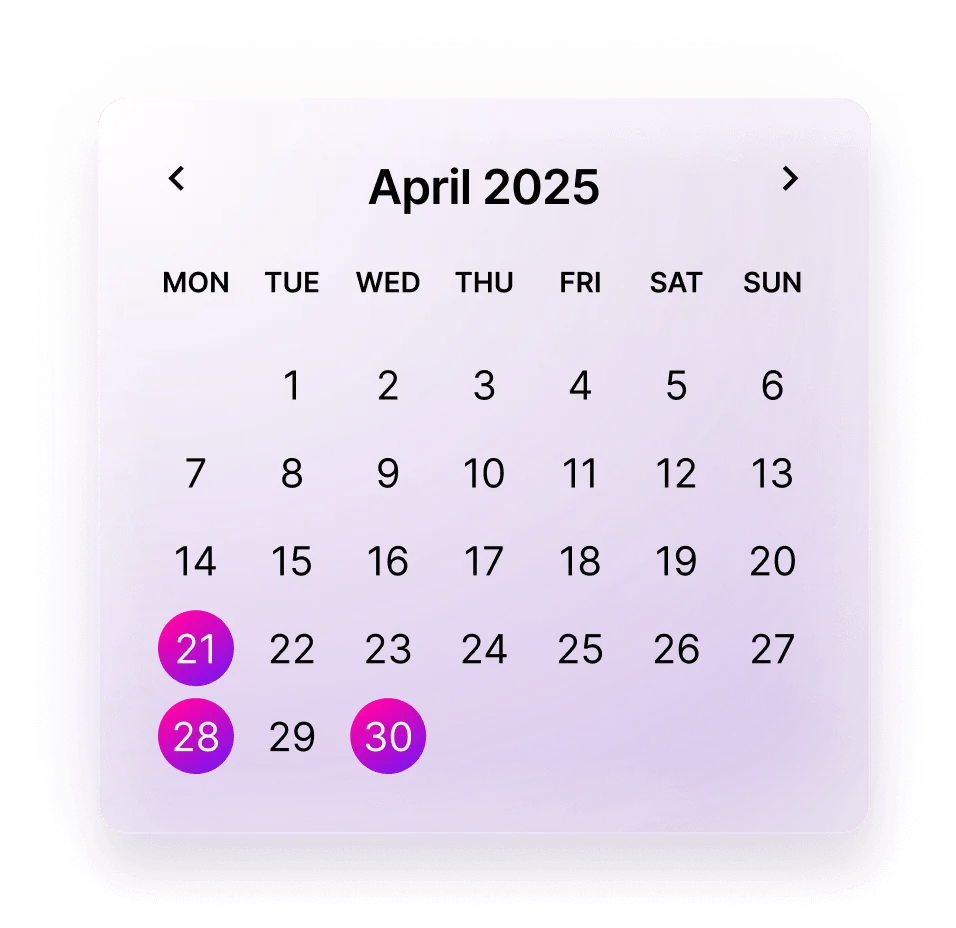

April key dates

21 April

Lodge and pay quarter 3, 2024–25 PAYG instalment activity statement for head companies of consolidated groups.

Lodge and pay March 2024 monthly business activity statement.

28 April

Lodge and pay quarter 3, 2024–25 activity statement if electing to receive and lodge by paper and not an active STP reporter.

Pay quarter 3, 2024–25 instalment notice. Lodge the notice only if you are varying the instalment amount.

Make super guarantee contributions for quarter 3, 2024–25 to the funds by this date.

30 April

Lodge TFN report for closely held trusts if any beneficiary quoted their TFN to a trustee in quarter 3, 2024–25.

Preparing for EOFY with MYOB has never been easier

Use these handy resources for a step-by-step guidance to help you understand your tax time tasks and breeze through EOFY.

Your MYOB software checklist for this EOFY

Use this checklist to help you navigate the end-of-year process in MYOB Business and MYOB AccountRight and prepare for the year ahead.

Navigate EOFY tasks with our digital tools

End of financial year tasks

MYOB's EOFY toolkit streamlines your tasks, from inviting your accountant to starting a new financial year.

End of payroll year tasks

Learn how to finalise pay runs, reconcile payroll data and prepare reports for submission to the ATO effortlessly.

MYOB Academy

Dive into our training courses, learning paths and how-to videos to help you build your business with MYOB.

Explore these EOFY resources

7 key things to get on top of for EOFY

There’s nothing like a bit of a deadline pressure to really get you into gear, and there’s no deadline quite like end of financial year (EOFY) for business owners (that’s 30 June for the majority of businesses).

It’s your first year in business – Here’s what you need to know about EOFY

EOFY can be a stressful time especially if you’re in your first year of business. But you don’t have to feel like you’re lost in the wilderness, here's why.

How does tax work in Australia?

As a business owner, you may have wondered, “How does tax work in Australia?” or “When do you have to pay tax in Australia?”

Sole trader tax deductions: How to maximise your tax return

A sole trader is the simplest form of business structure. The owner is legally responsible for all aspects of the business, including any debts and losses.