In this article

In this guide, you’ll learn about the accounts receivable turnover ratio. You’ll learn what it’s for, the formulas used, how to calculate it, its limitations and what you can do to make it better.

What is the accounts receivable turnover ratio?

The accounts receivable turnover ratio is an efficiency ratio used in financial statement analysis. It measures how quickly and effectively you convert your accounts receivable into cash (within a specific accounting period).

A high turnover ratio may mean that your debt collection and credit policies are efficient and that most customers pay their debts quickly.

A low turnover ratio may suggest your debt collection and credit policies are too loose, or that your customers aren’t creditworthy or financially viable.

What is the purpose of the accounts receivable turnover ratio?

The primary purpose of the accounts receivable turnover ratio is to understand how efficiently you’re collecting payments from your customers.

Regularly tracking this metric can help you identify areas for improvement in your collection processes and credit policies, and analyse how any changes you make support positive or negative cash flow.

Your accounts receivable turnover ratio is also helpful for financial forecasting. It should be included in your balance sheet forecast to accurately project future accounts receivable and help you better manage your cash flow.

Accounts receivable ratio formula

The accounts receivable turnover ratio formula is broken down into the following components:

Average accounts receivable

Average accounts receivable is the average total amount owed to your business by your customers over a set period. Average accounts receivable calculation:

Average AR = (Beginning Accounts Receivable + Ending Accounts Receivable) ÷ 2

Net credit sales

Net credit sales represent the total sales you’ve made on credit, minus any sales returns, allowances or discounts. Net credit sales calculation:

Net Credit Sales = Gross Credit Sales – Returns – Allowances – Discounts

Accounts receivable turnover

The accounts receivable turnover indicates how many times, on average, you collect receivables over a given period. Accounts receivable turnover calculation:

Accounts Receivable Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable

Accounts receivable turnover in days

Accounts receivable turnover in days shows the average days your business takes to collect receivables. Accounts receivable turnover calculation:

Accounts Receivable Turnover in days = 365 ÷ Accounts Receivable Turnover Ratio

4 steps to calculate accounts receivable turnover

Calculate your business's accounts receivable turnover and turnover in days with these four easy steps:

1. Calculate net credit sales

To calculate your net credit sales, subtract sales returns, allowances and discounts from your gross sales figure. This calculation gives you a clear view of the actual sales you’ve made on credit.

2. Calculate accounts receivable

To calculate your average accounts receivable, add the beginning and ending accounts receivable balances for your chosen period and divide by 2. This average will give you a more accurate gauge of receivables over time by smoothing out any significant fluctuations.

3. Calculate accounts receivable turnover ratio

Calculate your accounts receivable turnover ratio by dividing your net credit sales number by your average accounts receivable figure. Both numbers must represent the same accounting period.

4. Calculate accounts receivable turnover in days

To calculate accounts receivable turnover in days, divide 365 by your accounts receivable turnover ratio. This calculation gives you a clearer picture of your average collection period (in days), which is useful for benchmarking.

Example of the accounts receivable turnover ratio

Let’s say your business has the following financial results for the year:

Net credit sales = $500,000

$40,000 in accounts receivables at the start of the year

$55,000 in accounts receivables at the end of the year

Average Accounts Receivable

($40,000 + $55,000) ÷ 2 = $47,500

Accounts Receivable Turnover Ratio

$500,000 ÷ $47,500 = 10.5

In the above example, your accounts receivable ratio of 10.5 means you’re converting your receivables to cash 10.5 times over the given year.

It’s often also useful to look at this in terms of the number of days it takes to collect payment. You can do this by dividing 365 days by the accounts receivable turnover ratio:

Accounts Receivable Turnover (in days)

365 ÷ 10.53 = 34.7

Based on the above, your customers take an average of 34.7 days to pay their receivables.

Limitations of the accounts receivable turnover ratio

The limitations of the accounts receivable turnover ratio primarily come down to the following:

Seasonal skews

Seasonal skews and fluctuations aren’t accounted for and can distort your average accounts receivable figures.

Industry context

Industry context plays a vital role in analysing accounts receivable turnover ratios, making it difficult to compare across sectors.

For example, a supermarket typically has a high ratio because it’s cash-heavy. In contrast, manufacturers with extended payment terms usually have a low ratio.

Total sales vs net sales

Using total sales instead of net sales skews results. If you’re evaluating another business's accounts receivable turnover ratio, ensure you understand exactly how they calculated it.

How to improve your accounts receivable turnover ratio

Improving your accounts receivable turnover ratio is essential for maintaining your business's cash flow. Here are four actions you can take to improve yours:

Have clear payment terms

Clear payment terms remove any confusion and delays that come with it. All agreements, contracts and invoices should tell customers when payments are due, to set expectations right from the start. You could also offer discounts to encourage customers to pay early.

With MYOB Business, you can fully customise your invoices. Add your logo, branding, business information and payment terms so customers know how they need to pay you, and when.

Invoice clients and customers promptly

Invoice clients and customers promptly so you’re not giving them an excuse to pay late. Late invoices often lead to late payments. You can avoid that with accounting software that lets you create and send invoices at the click of a button.

MYOB Business does just that. Turn quotes into invoices with pre-filled GST calculations and customer details.

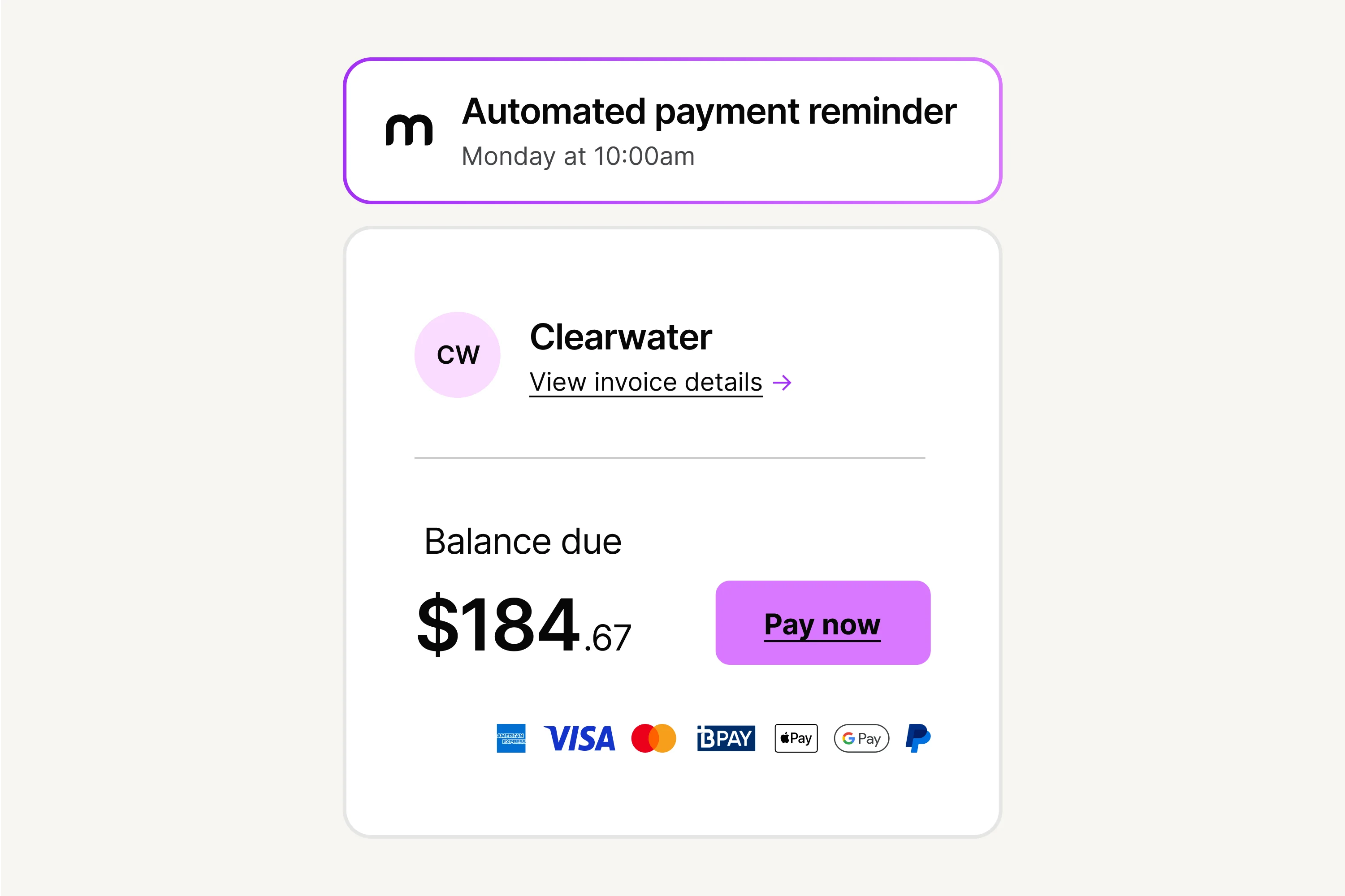

Set automated invoice reminders and follow- ups

Set automated invoice reminders and follow-ups to keep your customers on track. Proactive reminders reduce the likelihood that they’ll forget to pay.

With MYOB, you can set automatic payment reminders, so you don’t have to spend time chasing late payers – your accounting software will do the work for you.

Offer multiple payment methods

Multiple payment method options make it easier for your customers to pay you faster. Whether by credit card, electronic funds transfer, Google Pay or Apple Pay, more options equal greater convenience.

With MYOB, you can add a Pay Now button to your invoices, so customers can pay from their mobiles in just a few clicks. MYOB’s payment options include all the major credit cards, PayPal, Apple Pay, Google Pay and BPay. ^

Accounts receivable turnover FAQs

What is a good accounts receivable ratio?

A good accounts receivable turnover ratio varies widely by industry. However, in general, a higher ratio is better.

What does a high accounts receivable ratio tell you?

A high accounts receivable turnover ratio means your customers pay their debts quickly. Sometimes, a high ratio can indicate something negative. For example, credit policies that are too strict might see debts swiftly repaid but may put clients off, and limit sales growth.

What does a low accounts receivable ratio tell you?

A low accounts receivable turnover ratio can mean you're not collecting your receivables efficiently or your invoice terms are too long. It shows that your customers are taking a while to pay their debts, which can hurt your cash flow and increase the risk of bad debts.

Think less, do more, about your accounts receivable turnover ratio

Tracking your accounts receivable turnover ratio can provide your business with invaluable insight into the root cause of cash flow issues and allow you to evaluate how effective any changes you make to accounts receivable processes are. But as a business owner, it can be just another thing to think about.

Accounting software like MYOB helps you think less but do more. You can easily track your accounts receivable and automate your invoicing and payment reminders to keep your cash flowing. Get started today!

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.

^ Applications for Online Payments are subject to approval. Fees apply: $0.25 per transaction + 1.8% of total invoice. Fees are inclusive of GST and will be automatically passed on to your customers unless you turn off surcharging. Payment accepted via Visa, Mastercard, AMEX, Apple Pay, Google Pay and PayPal. You can also choose to enable BPAY but cannot pass on a surcharge to customers who pay via BPAY. View terms and conditions.