A financial management system (FMS) is important in business because it centralises your financial information. This streamlines and optimises your financial processes and gives you absolute clarity when making decisions to drive your business forward.

What is a financial management system (FMS)?

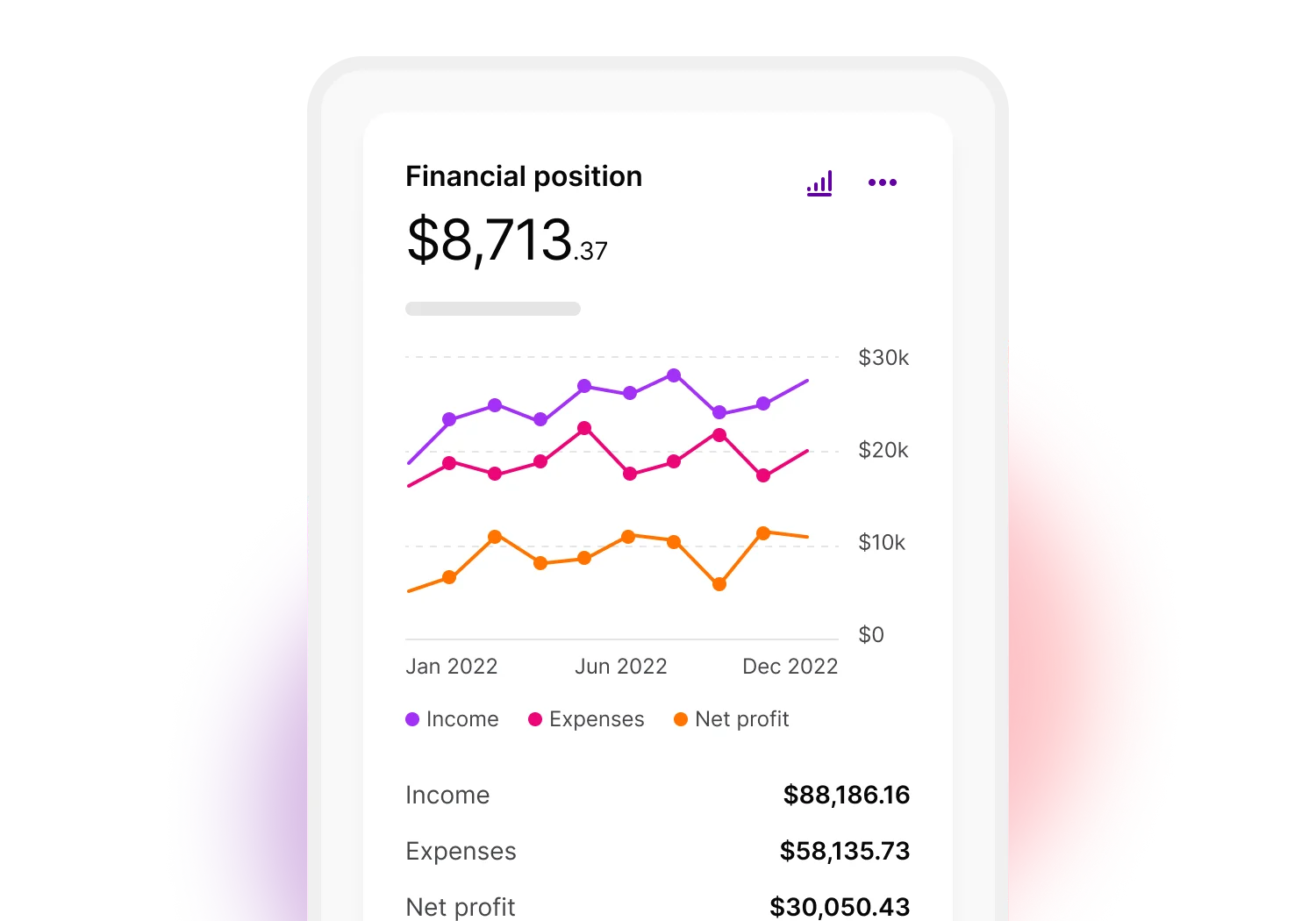

A financial management system is the software and processes businesses use to manage assets, income and expenses in one centralised hub. While it supports your day-to-day operations with things like invoicing and cash flow management, its main purpose is to help you maximise profits and drive better long-term outcomes for your business. In a nutshell, it provides you with a clear picture of your business's financial health — it's the financial brain of your business.

Who needs a financial management system?

Most businesses need a financial management system, particularly if you want to scale up your operations. It helps you make smarter, more informed decisions. Some common signs your business is ready for an FMS include:

You spend more time working in spreadsheets than in your system.

Month-end processes take more than a few days.

You lack understanding of your financial position.

Budgeting and planning are difficult.

You're asked for financial information that's difficult to deliver.

You're struggling to keep track of expenses, assets and liabilities.

Auditors are coming back with numerous questions.

Complying with tax and regulatory requirements has become tricky.

What are the key features of a financial management system?

The key features of a financial management system typically fall into the following five categories:

1. Revenue, cash and treasury management

Accounting tools let your finance team automate billing processes and view payments as they happen, while cash and treasury management tools give you crucial insight into cash flow and liquidity. These help you mitigate risk within your business and ensure you comply with relevant regulations for recognising revenue.

2. Governance, risk and compliance

Governance, risk and compliance (GRC) tools provide a structured approach for managing challenges in the business landscape while keeping you aligned with your goals. They enable you to identify and mitigate different types of risk by synchronising data across business functions, ultimately building resilience and improved performance.

3. General accounting

Financial management systems take care of your business's day-to-day general accounting activities, making them faster and more accurate. You can automate repetitive and routine tasks like posting to the general ledger, processing accounts payable and accounts receivable, and manage taxes with ease.

4. Financial reporting

Financial reporting tools are a key feature of a robust FMS. They help with planning, forecasting and budgeting, and give you clarity on your business's overall financial performance. Financial reporting tools let you quickly generate accurate balance sheets, profit and loss statements and custom reports to monitor your business's performance against your goals.

5. Asset management

Asset management systems are crucial for strategically managing all tangible and intangible assets within your business across their full life cycle. This includes tracking their appreciation and depreciation, assessing their performance and alignment with your goals, and forecasting future asset needs.

Benefits of an FMS

The benefits of an FMS are more streamlined standard accounting processes, improved reporting and forecasting capabilities and better-informed decisions backed by accurate, centralised and real-time financial data. Here's how FMS delivers:

Improved financial visibility and planning

Improved financial visibility and planning are key for predicting your future financial activities and plotting a path to success. Your FMS can help you identify new business opportunities and mitigate potential financial risk.

Improved compliance

Improved compliance means you stay on track with relevant accounting standards. An FMS delivers up-to-date information, increased accuracy and an audit trail. Most will also let you auto-generate financial reports that tick all the legal boxes.

Better, more accurate reporting

Better, more accurate reporting is a direct result of an FMS that seamlessly integrates across your business. It'll gather data from various sources (in real-time), giving you access to deep insights and quality reporting.

Increased productivity

Increased productivity comes hand-in-hand with automation. As a key feature of financial management systems, you can expect fewer errors, streamlined processes and significant time savings. And with all your financial information centralised, it's easily accessible across the business.

Better cash flow management

Better cash flow management is always important for business – and that is where an FMS can help too. With efficient and accurate tracking of cash inflows and outflows in real-time, you'll be well-positioned to optimise your cash reserves and monitor liquidity.

Difference between a financial management system and accounting system

The difference between a financial management system and an accounting system comes down to the core purpose of the system. While both deal with financial data, accounting systems solely focus on recording and reporting transactions. Financial management systems, on the other hand, cover a wider range of functions to drive strategic future growth.

The three main differences between the two are:

1. Purpose

Accounting system - Records and reports past financial transactions

Financial management system — Provides relevant and robust data to plan for future growth

2. Core objective

Accounting system — Provides insight into the financial position of your business

Financial management system - Aids decision making for future projects, drives return on investment and ensures assets are maximised

3. End-user

Accounting system - Accountants, bookkeepers and auditors responsible for maintaining accurate financial records

Financial management - Finance managers and CFOs involved in financial planning and strategic decision making

How to choose a financial management system

To choose the right financial management system, you first need a good handle on your specific business needs. Consider these factors:

Scalability

An FMS must have scalability to grow with your business. As your business grows, your needs get more complicated. Look for a scalable and adaptable FMS with functions you need now and those that you may need in the future.

Customisation

Do you require customisable software? Off-the-shelf solutions will be more affordable and quicker to implement, but if they don’t fully meet your needs, you may not get the value you’re looking for from your system.

Integration

Integration is a big factor to consider. A good FMS needs to integrate with other systems and software used in your business. Without it, you won't get consistent or comprehensive financial insights.

Cloud vs on-premises

Cloud-based platforms allow simple, real-time collaboration across your business (and often lower upfront costs). On-premise FMS solutions give you more control over your data and infrastructure.

Security

Security should feature highly on your list. Typically cloud-based FMS lead the charge. Data encryption protocols, regular security updates, advanced access requirements and built-in disaster recovery capabilities are typically standard.

Usability

Usability means an FMS can be easily adopted across your business. Look for an easy-to-navigate and intuitive interface and also consider how much ongoing support and training is provided.

Financial management system (FMS) FAQs

What is the difference between financial management systems and financial management reporting?

The difference between financial management systems and financial management reporting is that financial management systems focus on managing operations and processes. Financial management reporting focuses on communicating key financial information to stakeholders to help with decision-making.

What financial management systems are needed for a small business?

The four most essential financial management systems for a small business are accounting software, budgeting tools, invoicing software and cash flow management tools.

What are examples of an FMS?

MYOB's cloud ERP is an example of a financial management system that pulls together complex financial information from across your entire business.

What is the difference between finance management and financial management?

The difference between finance management and financial management is that finance management typically refers to the overarching management of a business's finances. This includes things like investment decisions and financial strategy. Financial management focuses on the day-to-day within your business, including budgeting, accounting and reporting.

Retire the crystal ball – get real clarity with an FMS

A robust financial management system is a must-have for driving your business into the future. It gives you valuable, accurate and timely insight – pulled from multiple data sources – so you can make informed decisions and steer your business towards long-term success.

Ready to get real clarity? MYOB's cloud-based platform is the financial management system you need in your back pocket. Get started with MYOB today.

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.