In this article

If your tax return is late or overdue, the penalty can be substantial, and there may sometimes even be legal consequences. It’s an expensive, stressful and surprisingly easy mistake to make. That’s why having a good handle on what happens if your tax return is late or overdue is essential.

What is an overdue tax return?

An overdue tax return is when you haven’t lodged the return in time to meet the due date specified by the Australian Taxation Office (ATO). If you earn more than the tax-free threshold, you’re required to lodge a return.

What is a failure to lodge on time (FTL) penalty?

A failure to lodge on time (FTL) penalty is a fee the ATO charges if you don’t complete and lodge your tax return by the specified date. This fee applies to your reports and statements, too. If you fail to lodge, the ATO will contact you, letting you know any penalty amounts and the deadline for payment.

You might not be penalised if you’ve got a good track record of lodging your returns on time. However, if you’ve missed several returns, you’re more likely to face a penalty, which increases the longer your return remains overdue.

To avoid an FTL penalty, you must file your tax return by the due date, even if you can’t immediately pay the amount you owe. If this is the case, you may be able to set up a tax debt payment plan.

Which lodgements are eligible for FTL penalties?

There are many lodgements liable for FTL penalties, not just your income tax return. These include:

Activity statements

Activity statements are subject to FTL penalties if you don’t lodge them on time. Due dates for lodging and paying your business activity statements depend on your GST turnover.

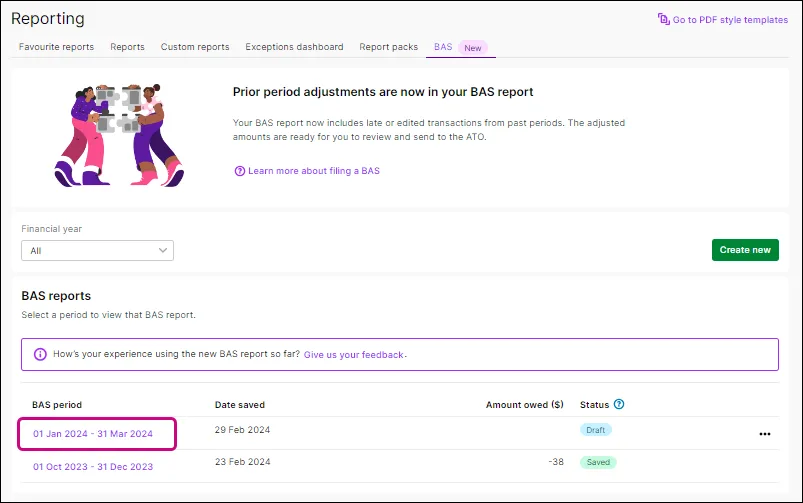

Tip: Generate your business activity statement in MYOB Business. MYOB tracks and records your GST and pre-fills your BAS, ready for you to review and hit send.

FBT returns

Employers must lodge Fringe Benefits Tax (FBT) returns annually. Failure to lodge these returns on time can result in FTL penalties. Sometimes, the ATO can launch an investigation into your business activity.

Annual GST returns

You may be eligible to report and pay your GST annually if you’ve voluntarily registered for GST and your GST turnover is under the current GST threshold of $75,000 for businesses and $150,000 for non-profit organisations.

PAYG withholding annual reports

Businesses should report their PAYG withholding through their single-touch payroll (STP) software. If they’re unable to do so, they must lodge a PAYG withholding payment summary annual report. The due dates vary depending on the amount withheld and whether the business is using a registered agent.

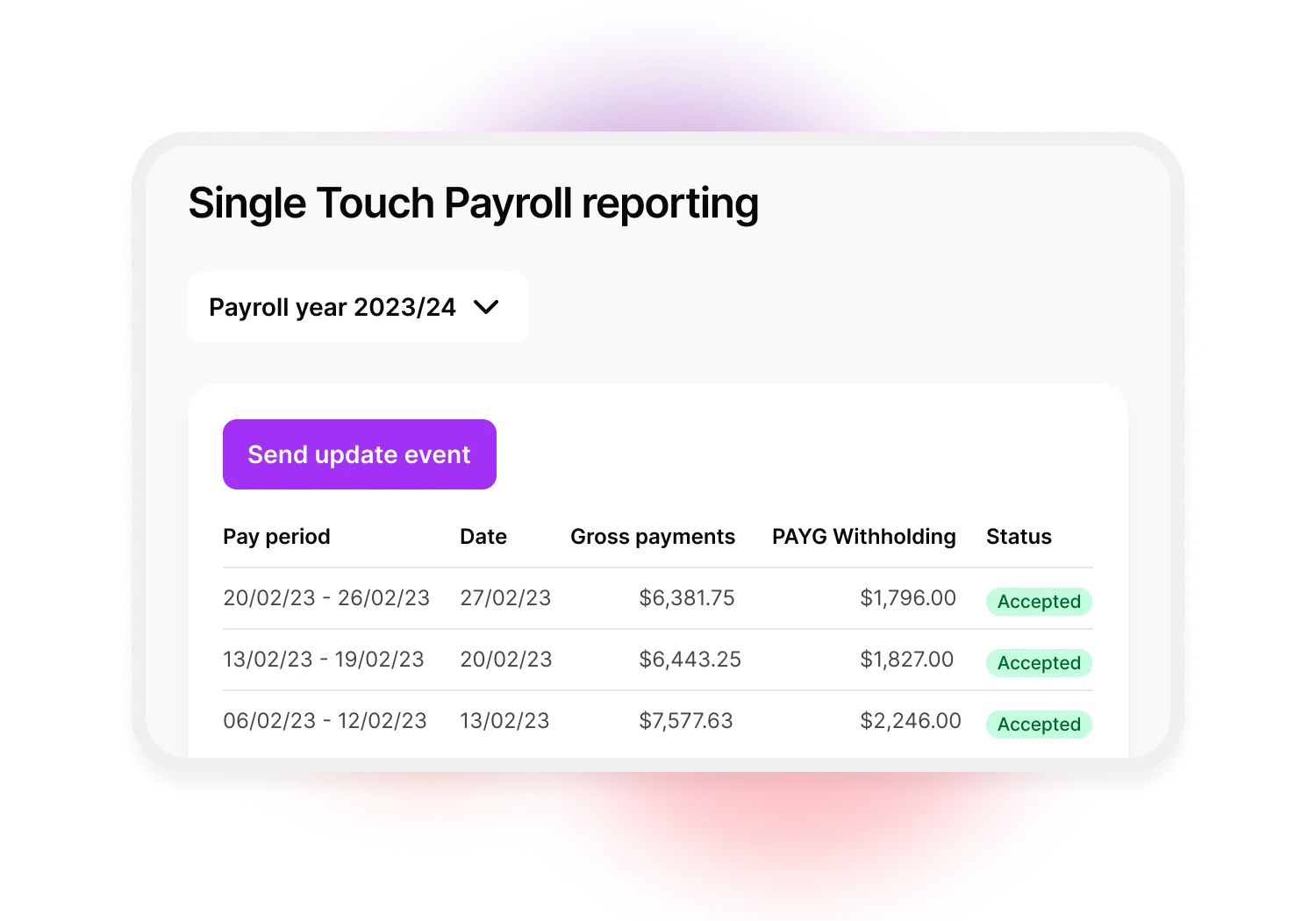

Tip: Use MYOB’s cloud payroll software to generate and send Single Touch Payroll Reports from your payroll software to the ATO.

Taxable payment annual reports

Taxable payments annual reports (TPAR) need to be lodged by 28 August every year. They’re required if your business makes regular payments to contractors or subcontractors.

Single-touch payroll reports

Single-touch payroll (STP) reports send payroll information, including salaries and wages, PAYG withholding and superannuation liability information directly from your accounting or payroll software to the ATO. FTL penalties may apply if you don’t supply this information and aren’t covered by a referral or exemption.

Penalties associated with overdue tax returns

The penalties associated with overdue tax returns depend on the size of your business and how late you are to lodge. There are penalty units for every 28 days your return is overdue, and the value of a penalty unit can change. Here's how the ATO calculates FTL penalties for businesses of different sizes:

FTL penalty for small businesses

The FTL penalty for small businesses is calculated at the rate of one penalty unit for each 28 days that the return or statement is overdue. Small businesses have an assessable income or GST turnover of less than $1 million.

FTL penalty for medium businesses

The FTL penalty for medium businesses is calculated by multiplying the penalty unit by two. A medium business has an assessable income or current GST turnover of over $1 million and less than $20 million.

FTL penalty for large businesses

The FTL penalty for large businesses is calculated by multiplying the penalty unit by five. A large business has an assessable income or current GST turnover of $20 million or more.

Are there legal consequences for overdue or late tax returns?

There can be legal consequences for overdue or late tax returns — failing to lodge is a criminal offence. The ATO can and does prosecute for FTL offences, but it’s usually a last resort.

How do I get up to date on tax returns?

You can get up to date on outstanding tax returns by contacting the ATO or by logging onto your MyGov account. The ATO will let you know which tax returns are outstanding. You can also work with a registered tax agent. They can tell you exactly what needs to be reported and can help you get up to date.

Overdue tax return FAQs

Am I liable for an FTL penalty if I have engaged a tax agent?

You may avoid being liable for an FTL penalty if you’ve engaged a registered tax agent and provided them with all the relevant tax information for them to lodge by the due date.

If this is the case and the agent hasn’t been reckless or deliberately disregarded the law, you may be eligible for safe harbour and not liable for an FTL penalty.

Can I lodge a tax return from 10 years ago?

You can lodge a tax return from 10 years ago. Note, penalties and interest are likely to apply for late lodgement.

Do I need to lodge a tax return if I didn’t earn over the past 12 months?

You may still need to lodge a tax return, even if you didn’t earn income in the past 12 months. The ATO has various tools to help you work out if you need to lodge a tax return. You can check with the ATO or a tax professional to find out whether you need to lodge.

What are the tax return deadlines?

Due dates for lodging reports and returns vary according to your business size and structure. Consult the ATO for key lodgement and payment dates for business.

Never miss a return again with MYOB

Tax returns are daunting enough without adding the pressure of penalties and potential legal consequences. Fortunately, these are avoidable, especially with MYOB accounting software on your side.

All the information you need to lodge your return is at your fingertips (and easy to share with your accountant). Track your GST, pre-fill your BAS and generate and send STP reports to the ATO directly from MYOB Business. Make sure you never miss a due date again.

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.

MYOB is not a registered entity pursuant to the Tax Agent Services Act 2009 (TASA) and therefore cannot provide taxation advice to clients. If you have a query concerning taxation, including filing your BAS return or annual tax statements, then you should consult with your accountant or other registered tax adviser.