You’ll also need to know how tax works in Australia so you can stay compliant and minimise the disruption a tax audit can cause your business.

In this guide, you'll learn why tax audits happen, the ATO's tax audit process and the potential consequences of a tax audit.

What is a tax audit?

A tax audit is when the Australian Tax Office (ATO) investigates your business to ensure you’ve paid enough tax and followed your tax obligations.

If you’re struggling to meet your tax obligations due to cash flow problems, you need to tell the ATO you’re experiencing financial difficulty. The ATO offers several tax debt payment plans, and you can use their payment plan estimator to work out an affordable plan.

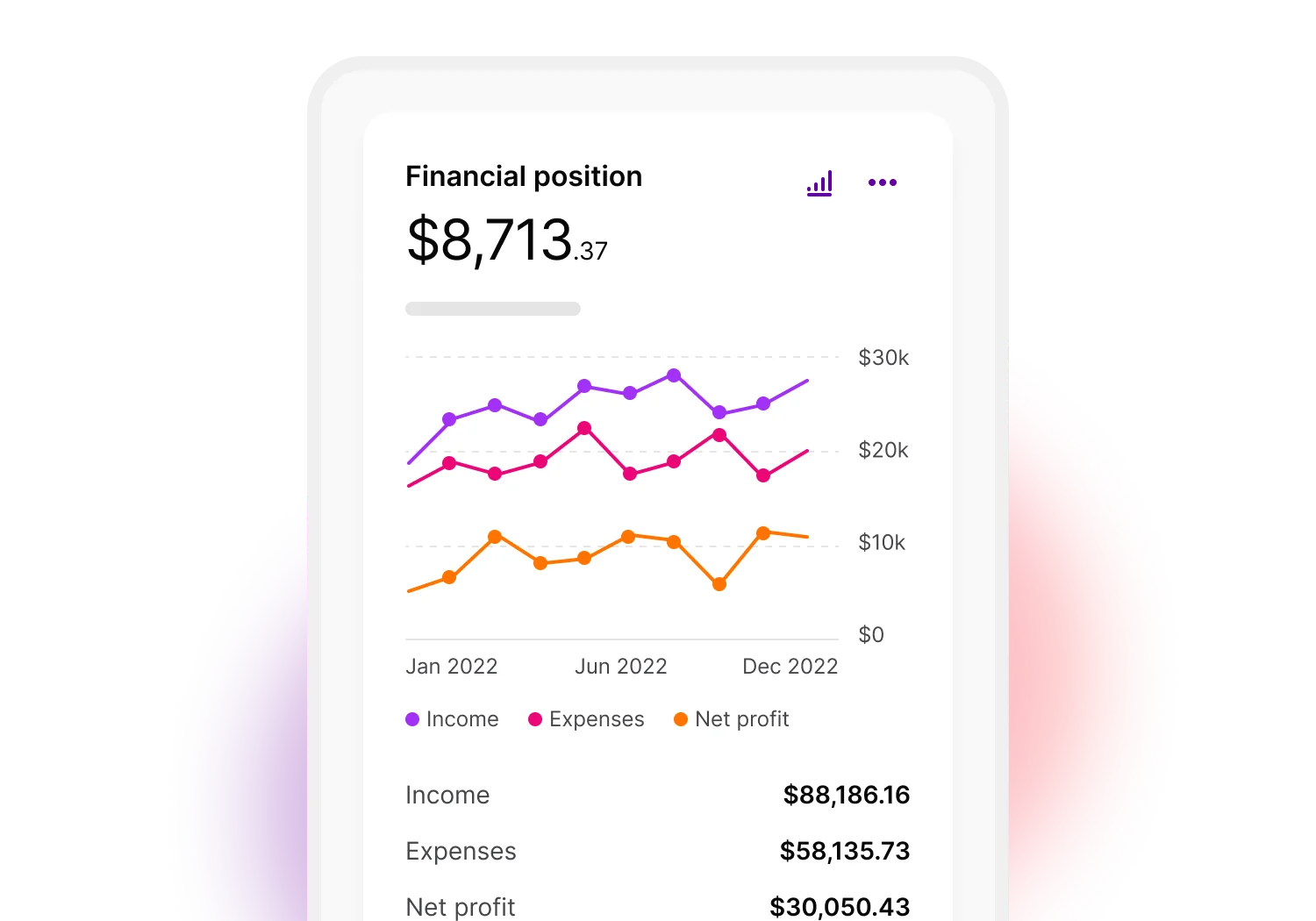

Tip: MYOB gives you a real-time view of your cash flow from your dashboard. If money's tight, you can also apply for business finance directly from your software.

Who conducts tax audits in Australia?

The ATO conducts tax audits in Australia.

Why do tax audits happen?

Tax audits usually happen when the ATO suspects you’ve failed to meet one or more of your tax obligations as an individual or business owner. The ATO occasionally audits businesses at random, but if they select your business for an audit, it’s probably down to one of the following reasons:

Failure to lodge tax returns and BAS statements

Failure to lodge tax returns and BAS statements can quickly trigger an ATO audit. Ensure you know the due dates for your business activity statements, income tax reports, goods and services tax instalments and other tax returns.

Discrepancies between tax returns and financial records

The ATO identifies discrepancies between tax returns and financial records through data matching. Data matching is where the ATO compiles data from third-party sources and compares it with their records of your tax. If you’ve incorrectly reported your income or business expenses, the ATO will detect discrepancies. You could end up with a tax bill with added penalties or interest.

Regularly reconcile your business activity statements to ensure there are no discrepancies. If you notice any mistakes in a BAS you’ve already submitted, refer to ATO guidance on fixing mistakes or making adjustments sooner rather than later.

Significant fluctuations in income

Significant fluctuations in income will attract attention from the ATO and can trigger an audit. If your business suddenly takes off and you’re earning far more than you have in previous financial periods, congratulations! But it’s more crucial than ever to keep accurate records to prove the legitimacy of your transactions in case the ATO asks.

Claiming deductions you’re not eligible for

Claiming deductions you’re not eligible for can lead to a tax audit. Deductions must be work-related expenses connected to assessable income. You can’t claim for private expenses like food or clothes for your family, traffic fines or entertainment expenses.

What can be audited by the Australian Tax Office?

Examples of what can be audited by the Australian tax office include:

Declared income

Declared income includes money your business makes from cash and online sales, assessable government payments, capital gains and cash prizes. Carefully record all payments on your income statement and check it regularly to ensure you declare everything you need to. The ATO may audit your business if they think you’re not declaring all your assessable income.

Employer obligations

Your employer obligations include withholding tax from employee earnings (PAYG withholding). Then you must report and pay the withheld amount to the ATO. You must also report and pay superannuation for eligible employees and any fringe benefits tax you owe.

Tip: With MYOB's in-built payroll software, you can generate and send Single Touch Payroll reports from your software to the ATO.

GST and BAS claims

GST and BAS claims can be audited by the ATO. You can claim credit for any GST you’ve paid on goods and services for your business, so make sure you know how to calculate and report your GST. Read the ATO's BAS and GST tips for help preparing and submitting your BAS and GST credit claims.

Tip: With MYOB, GST is automatically recorded and pre-filled to your BAS, ready for you to review and send to the ATO.

Vehicle tax deductions

The ATO can also audit vehicle tax deductions. For any motor vehicle you use to help run your business, you can claim tax deductions for fuel, repairs and registration costs. Visit the ATO's website to find out how to calculate your business vehicle expenses.

How is a tax audit conducted?

A tax audit is conducted, in most cases, by following these steps:

Notification from the ATO

Notification from the ATO is the first step in the audit process. They’ll usually call you to arrange a suitable time to conduct the initial meeting. They’ll then follow up with written confirmation of the date, time and agenda.

Initial meeting

In the initial meeting, an ATO auditor will explain what prompted the decision to audit you. Their explanation is known as the ‘risk hypothesis’. They’ll tell you what information they need to complete their investigation.

They’ll discuss how to access your business information. You can willingly provide the requested records (the cooperative approach) or they can use their formal access powers.

Audit scope

The audit scope is usually covered in the initial meeting. The ATO writes up a formalised audit scope and provides it to you as part of an audit management plan. The plan outlines the periods the ATO wants to investigate, the expected completion date of the audit and relevant contact details.

Examination of records

The auditor examines your financial records, including financial statements, balance sheets and expense reports. Most auditors prefer a cooperative approach, which doesn’t usually involve using the ATO’s formal powers. It means you voluntarily provide the ATO with the required information, and both parties maintain a good working relationship.

If the auditor is unsatisfied with your level of cooperation, they can use their formal powers to access your records without your permission or assistance. They can also obtain information held by third parties if needed.

Issues identified and outlined

Issues are identified and outlined in the latter stages of an audit. In most cases, the auditor will outline facts gathered during the examination in a position paper. The paper explains how these facts correspond to your legal tax obligations. Any issues or inaccuracies found by the auditor will lead to suggested amendments. Any shortfalls identified in amendments mean you’ll need to pay more tax to make up the difference.

You’ll have a chance to explain your position, which the auditor will record in the position paper. The paper will also tell you who to contact about the outlined issues.

Audit report

For many businesses, the audit report is the final phase of the audit. The report details the audit’s outcome and lists and explains any penalties and interest charges applied to your business.

The ATO generally provides an audit report within seven days of making its decision. They’ll also offer a final interview so you can discuss any penalties and interest charges and learn how to request a reduction or remission of these.

Responses and appeals

Responses and appeals are the final phase of an audit if you disagree with the ATO’s decision and decide to take action. If you're eligible for an independent review, a new tax officer will review the position paper and audit report. Check the ATO’s website to see if you’re eligible for a large market independent review or a small business independent review.

What penalties and fines can result from a failed tax audit?

The penalties and fines that can result from a failed tax audit include the following:

Interest charges

The ATO adds interest charges to tax assessments you don’t pay by the due date. Interest charges are compounding, which means the ATO adds interest to your outstanding balance and bases the following interest calculation on the new total. Compounding interest means interest charges can snowball, so you should pay debts quickly to keep charges to a minimum.

Interest is calculated from when your original bill was due or your amended assessment payment date.

Penalties

Penalties are calculated based on your circumstances. Your penalties will be much higher if the ATO finds that you have knowingly neglected your tax obligations rather than made a genuine mistake. The ATO offers significant penalty reductions if you make a voluntary disclosure. The earlier you disclose your mistake, the lower your penalty will be.

Prosecution

Prosecution is a potential consequence of a failed tax audit if you've committed any of the following criminal offences:

Making false statements during an audit

Keeping incorrect or false records

Refusing to produce documents or records requested by the ATO

Refusing to answer a tax officer's questions

Obstructing a tax officer from exercising access powers

The ATO also investigates other serious criminal breaches, such as fraud and money laundering, which the Commonwealth Director of Public Prosecutions (CDPP) prosecutes.

Tax audit FAQs

How are people selected for a tax audit?

People are selected for a tax audit for several reasons, the most common being:

Data matching: The ATO’s data matching systems identify discrepancies between your submitted business activity statements and third-party records.

Random selection: The ATO sometimes focuses on specific industries and chooses sample businesses from this industry to audit at random.

Tip-offs: The ATO receives a tip-off that you’ve engaged in non-compliant activities. These may include paying employees cash-in-hand to avoid meeting tax and employee obligations or not fully declaring your income.

Historical non-compliance: You have a history of not complying with your tax obligations.

What are the consequences of a tax audit?

The consequences of a tax audit range from having your tax assessment amended to being prosecuted for failure to comply. If you’ve failed a tax audit, you’ll need to pay the extra tax you owe, plus interest charges and penalties.

Which businesses are most likely to be audited by the ATO?

The businesses most likely to be audited by the ATO include:

Businesses making and receiving large cash payments (these are easy to record incorrectly)

Businesses in an industry that the ATO is focusing current compliance checks on

In 2022, the ATO revealed their list of the most dobbed-in industries. These include building and construction, hairdressing and beauty services, cafés and restaurants, road freight transport, management advice and related consulting services.

What is an ATO warning letter?

An ATO warning letter is a written notification that you have an overdue debt. You may receive several letters:

First notice — a payment is overdue.

Second notice — the ATO is shifting to collection mode. Collection mode means you must act now on your overdue debt to avoid penalties, legal action or involving external debt recovery agencies.

Third and final warning — severe consequences are imminent and you should act immediately to avoid further escalation.

Tidy up your tax records before the ATO comes knocking

Keeping your tax records in good order is the best way to remain compliant and avoid a tax audit. MYOB’s cloud accounting software helps you manage tax obligations with automatic GST, income and expense tracking and Single Touch Payroll reporting. With MYOB, you have a record of all your business transactions, all in one place.

Don't let an audit take you by surprise. Sign up for MYOB and get your records audit ready.

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.

MYOB is not a registered entity pursuant to the Tax Agent Services Act 2009 (TASA) and therefore cannot provide taxation advice to clients. If you have a query concerning taxation including filing your BAS return or annual tax statements then you should consult with your accountant or other registered tax adviser.