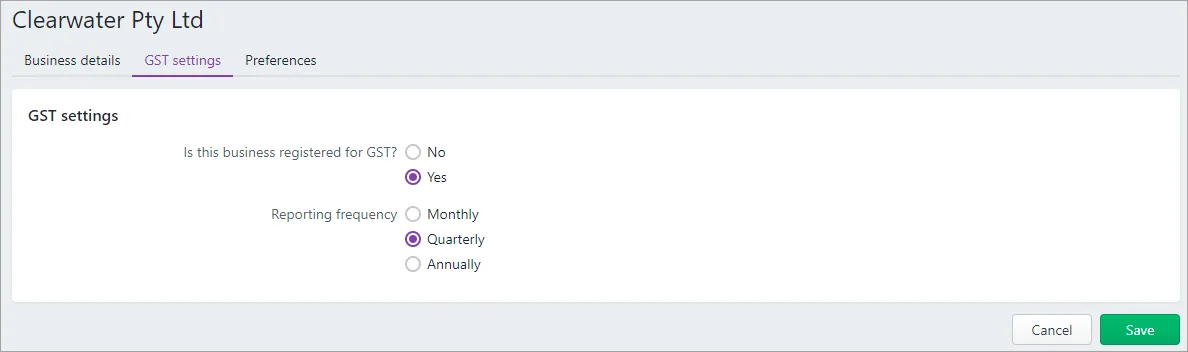

The GST settings in MYOB is where you choose if your business is registered for GST. If it is, you can set how often you report your GST to the government.

You might have set this up when you started using MYOB, but you can check or change these setting by going to the settings menu (⚙️) and choosing Business settings > GST settings tab.

This is what the GST settings look like for Australian businesses. The only difference for New Zealand businesses are the reporting frequencies (one, two or six months).

If you've chosen Yes in your GST settings (you're registered for GST), there are some tax/GST options that will be available in MYOB that you won't see if you're not registered for GST. Take a look at the information below to learn about what you'll see (or not see) in MYOB if you change your GST registration setting.

Before making any changes

Your accounting advisor likely helped you set up your GST settings when you started using MYOB, so check with them before making any changes.

Changing to a GST-registered business

If your business was previously not registered for GST but now, perhaps due to increased turnover, you're registering for GST—you can change this setting in MYOB.

Among other things, you'll now typically charge your customers GST on goods and services. For all the details on how this change will affect your business and your reporting obligations, you'll need to work with your accounting advisor and the ATO or IR.

Before changing your GST settings in MYOB, there are a few things you'll need to do:

Enter all data into MYOB up to the GST registration date.

Reconcile all your bank accounts (see Reconciling your bank accounts).

To change to a GST-registered business

Go to the settings menu (⚙️) and choose Business settings.

Click the GST settings tab.

For the setting Is this business registered for GST?, select Yes.

Click Save.

After you've made this change

Once you change to a GST-registered business, you should review the following areas in MYOB and assign GST codes where applicable.

Review the Tax/GST code field in:

-

each detail category in Categories (Chart of accounts) (see Adding, editing and deleting categories)

-

bank feed rules — in the transaction section of each rule (see Managing rules)

-

recurring transactions — in the transaction section of each recurring transaction (see Recurring transactions)

-

items — in the Selling and Buying sections of your items (see Editing items)

You may also need to include GST in budget amounts (see Working with budgets).

You'll also notice the following changes in your MYOB software to help you manage your GST obligations.

Accounting menu changes

(Australia) You can access your Tax codes, which are used to track tax paid to and by your business.

(New Zealand) You can access your GST codes, which are used to track the GST paid to and by your business.

Transaction changes

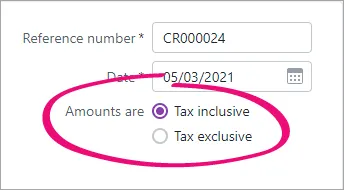

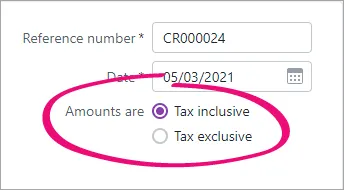

You can now choose whether the amounts in your transactions include or exclude Tax/GST.

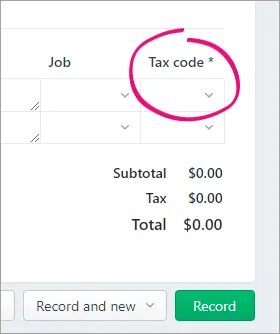

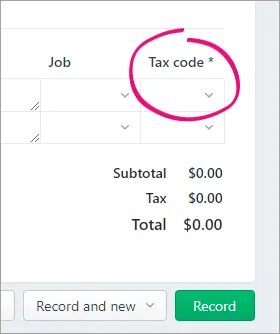

The Tax code/GST code fields are added so you can choose the type of tax to apply to each line in a transaction.

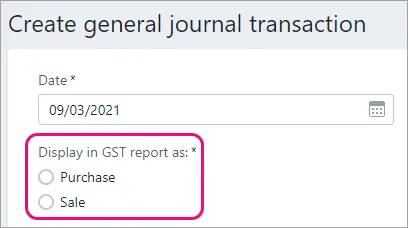

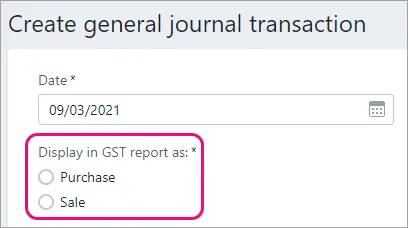

In general journals, you can choose whether the transaction will be displayed as a sale or purchase in your GST reports.

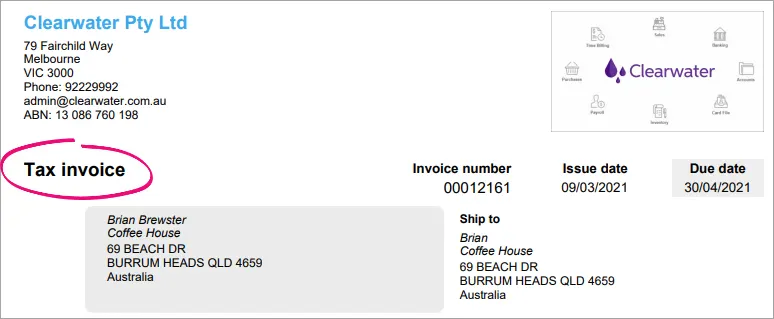

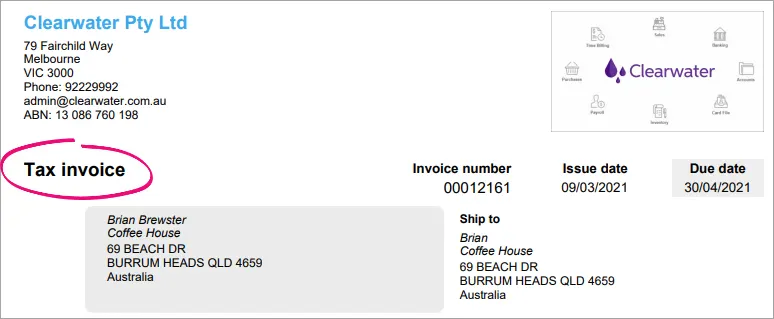

(Australia only) PDFs of your invoices will show Tax invoice instead of Invoice.

Reporting changes

The GST Auto calculate option is added to budgets.

The GST reporting method settings are added to Report settings.

Changing to a non-GST business

You'll work with your accounting advisor and the ATO or IR to make this change for your business.

Before changing your GST settings in MYOB, there are a few things you'll need to do:

Change the Tax/GST code field to N-T in:

-

each detail account in your chart of accounts (see Adding, editing and deleting accounts)

-

items — in the Selling and Buying sections of your items (see Editing items)

-

bank feed rules — in the transaction section of each rule (see Managing rules)

-

recurring transactions — in the transaction section of each recurring transaction (see Recurring transactions)

You also need to:

Enter all data into MYOB up to the cancellation date.

Reconcile all your bank accounts (see Reconciling your bank accounts)

Remove any GST calculations in your budget reports (see Working with budgets and Automatically calculating GST in a budget)

To change to a non-GST business

go to the settings menu (⚙️) and choose Business settings.

Click the GST settings tab.

For the setting Is this business registered for GST?, select No.

Read the displayed message to understand the implications of making this change.

Click Change GST settings.

After you've made this change

Once you change to a non-GST business, your MYOB software will be de-cluttered to remove some things you'll no longer need.

Accounting menu changes

(Australia) Tax codes is removed.

(New Zealand) GST codes is removed.

Transaction changes

The Tax/GST inclusive and Tax/GST exclusive options are removed.

The Tax code/GST code fields are removed. Note that the tax/GST codes won't be changed in transactions you recorded before changing your GST settings.

The Display in GST report as options are removed from general journal entries.

(Australia only) PDFs of your invoices will show Invoice instead of Tax invoice.

Reporting changes

The GST Auto calculate option is removed from budgets.

The GST reporting method settings are removed from Report settings.

Tips for running a non-GST business

Do you have a hobby business or a low-trading business? You might not need to register it for GST if your turnover is less than the GST registration threshold (find out what this is for Australia or New Zealand).

We strongly recommend you check with your accountant and the ATO (Australia) or IR (New Zealand) if you're thinking of not registering your business for GST, or changing from a registered to non-registered business, as there are penalties for non-compliance if your business is required to register.

Regardless of how much or how little trade your business does, it's worth considering setting it up in MYOB to keep track of its performance and to help you avoid any compliance issues if it starts to grow.

Example

Jennifer has started a business from home, Dolls Inside a Doll, selling quirky handmade matryoshka dolls to friends and online customers. She estimates she might sell about $200 worth of stock a month. Based on the projected turnover of her business, she won't need to register it for GST. But she does want to track her expenses and sales, so she sets the business up in MYOB.

The main thing to note about running a non-GST business is that you won't charge your customers GST.MYOB makes this easy. If you've indicated that you're not registered for GST in your GST settings, MYOB prevents you from choosing a tax code when entering transactions.

You also may not need to lodge an activity statement or GST return at end of period (but we recommend that you confirm this with your accounting advisor or the ATO/IR).

You may also need to keep track of your current and projected turnover to ensure you're not going over the GST registration threshold (find out what this is for Australia or New Zealand).

You can view your turnover by running business reports each month in MYOB.

Invite your accountant into your business, so they can monitor it and advise when you need to change its GST status. See Invite your accountant or bookkeeper.

Need to switch your accounting method from cash to accrual?

Click the settings menu (⚙️) and choose Report settings > Business settings tab. For all the details see Report settings.