There’s a one-time setup process you need to complete before you can start preparing activity statements. This might take 10-15 minutes to complete.

Before you begin

-

Enter your ABN/TFN and your GST Branch in MYOB. How do I check this?

Get activity statement help from an MYOB Partner

We recommend that you use the experience and knowledge or your accountant or MYOB Partner to take care of your activity statements for you.

If you:

already have an MYOB Partner, make sure you've invited them into your business

are an MYOB Partner, we recommend preparing activity statements in MYOB Practice.

To set up your activity statement

In MYOB, go to the Accounting menu and choose Prepare BAS or IAS.

Click Get started.

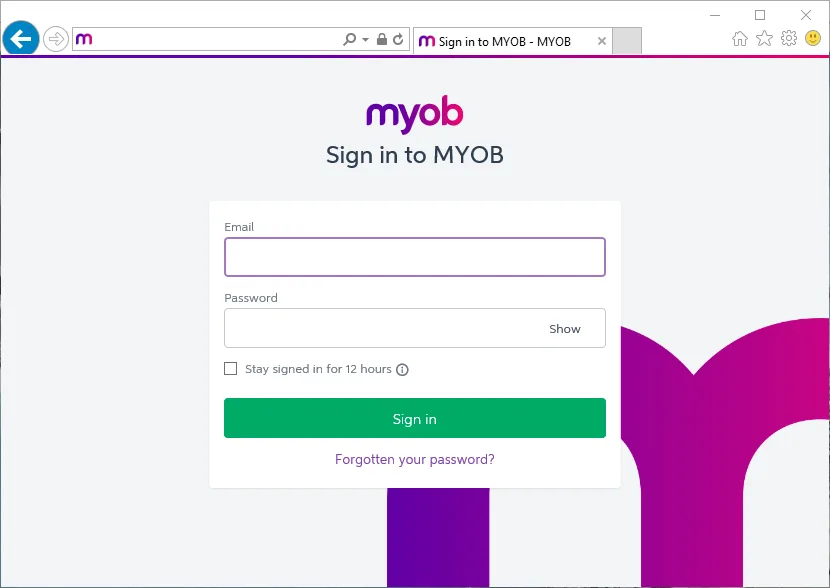

If prompted, sign in to your MYOB account.

When the online activity statement dashboard appears, click Get started.

Select whether you're preparing this activity statement for your own business (or a business you work for), or as a registered agent for another business.

Note that if you're preparing a non-business IAS, you should still select I lodge as a business.Enter your name. If you’re an agent, you’ll need to provide your Registration number and ABN to lodge the form with the ATO. Click Next.

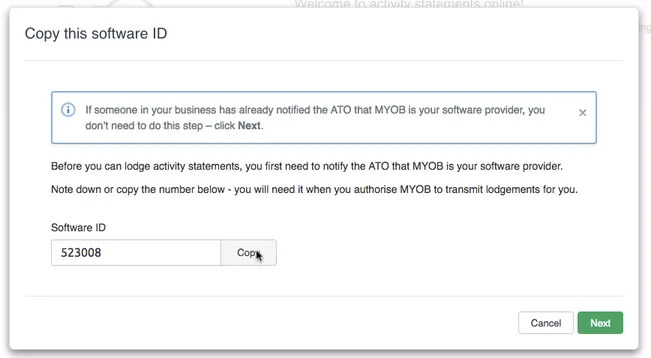

You’ll now be shown a unique Software ID. This ID enables you to lodge activity statements with the ATO using MYOB.

Click Copy to save the Software ID to your Windows clipboard and then paste it into a document (or you can just write down the ID). Click Next.If you have a myGovID and you can access it now, complete the following steps to nominate MYOB as your software provider with the ATO. Don’t have a myGovID, or can’t access it right now? You can call the ATO to complete this process by phone instead - call 1300 852 232.

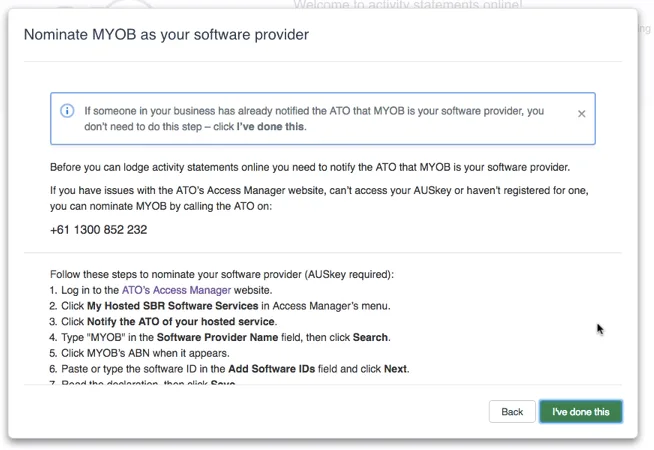

Log in to the ATO’s Access Manager website (https://am.ato.gov.au).

Click My Hosted SBR Software Services in Access Manager’s menu.

Click Notify the ATO of your hosted service.

Type "MYOB" in the Software Provider Name field, then click Search.

Click MYOB’s ABN when it appears.

Paste or type the software ID in the Add Software IDs field and click Next.

Read the declaration, then click Save.

Return to the Nominate MYOB as your software provider message, and click I've done this.

When the online activity statement dashboard appears, click Check field setup in the banner. You can now set up your GST and PAYG Withholdings activity statement fields.

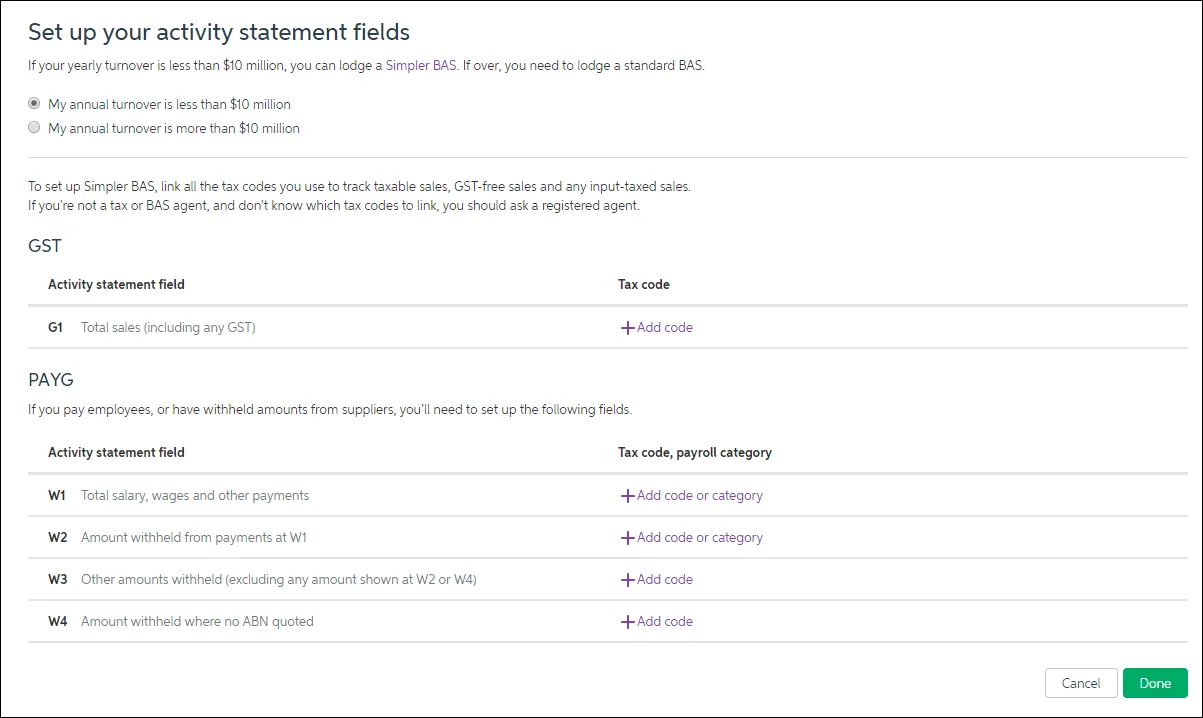

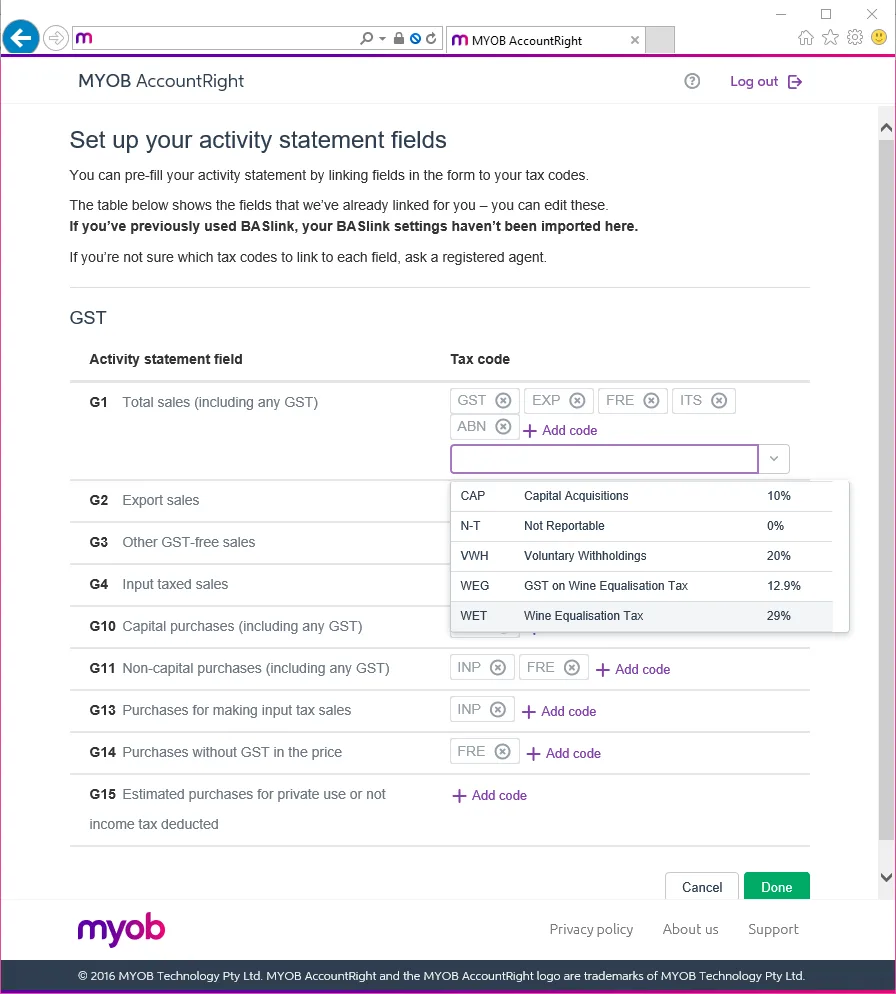

Select whether your annual turnover is less than or more than $10 million. If it's less than $10 million, you can lodge a simpler BAS, meaning that you have fewer GST fields to complete on your form.

(BAS only) For the GST fields, link the tax codes you’ve used in MYOB to the relevant fields on the statement.

Click + Add code to link a tax code to a field, or click the tax code’s x icon to unlink it.For the PAYG fields, link the payroll categories and tax codes you use to track the salaries, wages and other payments to employees and others at W1, and the amounts you withhold from those payments at W2.

Link the tax codes you use to track withholdings (other than those already reported at W2 or W4) at W3, and the amounts withheld due to suppliers not providing their ABN on their invoices at W4.

Click Done.

Now, each time you go to the Accounting menu > Prepare BAS or IAS > Get started, the online activity statement dashboard will retrieve information from the ATO and show the statements you can complete via MYOB. If you’re an agent, note that you'll only see activity statements for the business you've signed into.

FAQs

I'm having issues nominating MYOB as my software provider

If you have issues with the ATO’s Access Manager website, can’t access your myGovID or haven’t registered for one, you can nominate MYOB by calling the ATO on 1300 852 232.

I need to change my setup or details

If you need to change your tax code setup, authorised person, or change how year-end adjustments recorded in MYOB affect your BAS:

In MYOB, go to the Accounting menu and choose Prepare BAS or IAS.

If prompted, sign in to your MYOB account.

Click the Settings option.

If you change the tax code setup, it will not affect any returns that are already in progress. You’ll need to open the statement that’s in progress, choose to Edit it, and then click Update from ledger, to use the new tax code setup details.

Note that doing this will replace the values of all fields that are automatically calculated based on the tax code setup.

Where can I get more information about my activity statement fields?

To learn what should be reported in each activity statement field, visit the ATO website.

Where can I find my GST software ID?

The GST software ID is displayed during the set up steps above. If you forgot to copy the GST software ID you can access it as follows:

In MYOB, go to the Accounting menu and choose Prepare BAS or IAS.

If prompted, sign in to your MYOB account.

Click the Settings option and choose Get software ID.

How do I set up the activity statement fields for FBT, Fuel Tax Credits, or PAYGI?

Currently only the GST and PAYG Withholding fields can be linked to tax codes in MYOB. So if you need to complete other fields, like the T fields, you'll need to fill in those values manually when completing your activity statement.

How do I change my reporting period?

Your GST reporting and payment period would have been set when you registered with the ATO, based on the turnover of your business at the time.

If you need to change your GST reporting period, contact the ATO.

There’s a one-time setup process you need to complete before you can start preparing activity statements online. This might take 10-15 minutes to complete - watch this video to learn about the setup steps.

Before you begin

-

Your company file must be online before you can start this process. If your file isn’t online yet, see Put your company file online.

-

Make sure you've entered your ABN/TFN and your ABN Branch in AccountRight.

To set up your online activity statement

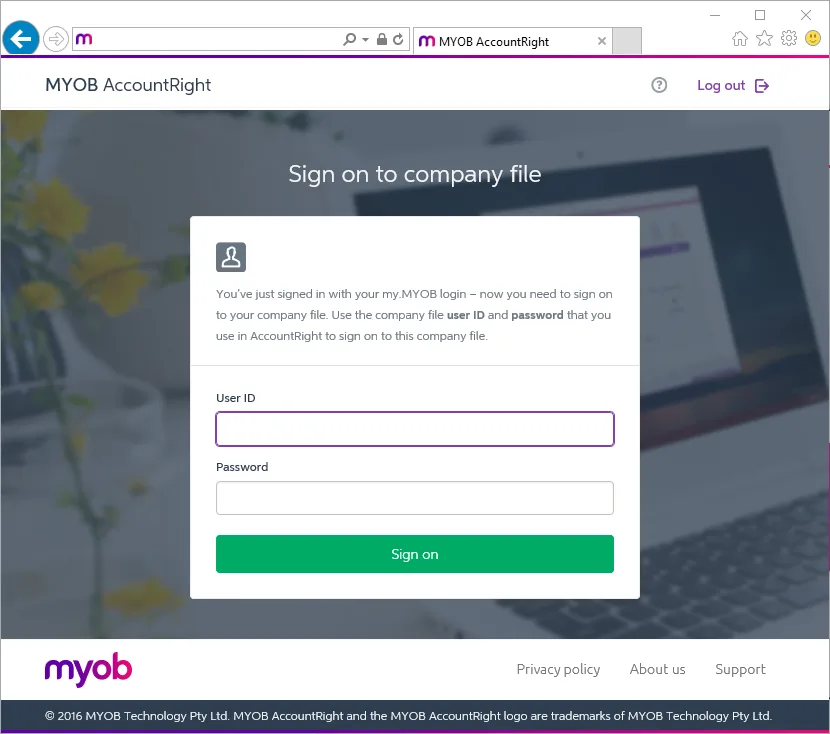

Start AccountRight and open your online company file.

Click Prepare BAS/IAS in the Accounts command centre.

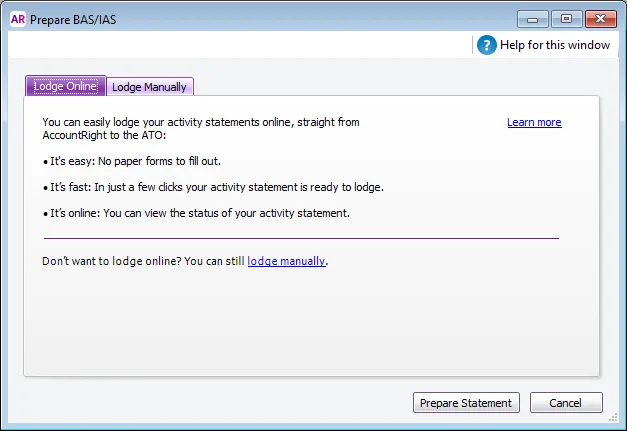

In the Lodge Online tab, click Prepare Statement.

Sign in to your MYOB account, as you normally do when accessing your online AccountRight company files. This will be an email address and password.

If you haven’t linked your MYOB account to your company file user account, you’ll be prompted to enter your User ID and password. If prompted, enter the user account details you normally use when opening this company file. This will be a username (not an email address) and password.

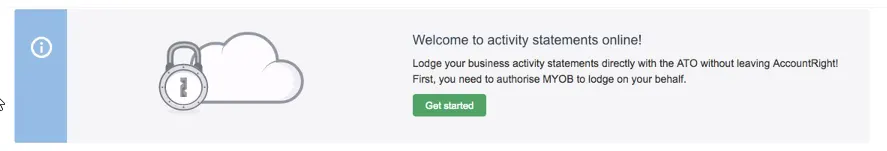

When the online activity statement dashboard appears, click Get started.

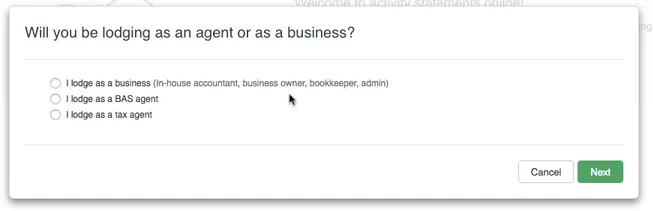

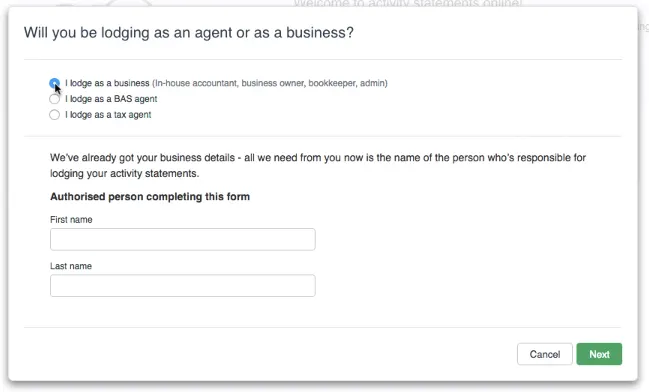

Select whether you're preparing this activity statement for your own business (or a business you work for), or as a registered agent for another business.

Note that if you're preparing a non-business IAS, you should still select I lodge as a business.

Enter your name. If you’re an agent, you’ll need to provide your Registration number and ABN to lodge the form with the ATO. Click Next.

You’ll now be shown a unique Software ID. This ID enables you to lodge activity statements with the ATO using AccountRight.

Click Copy to save the Software ID to your Windows clipboard and then paste it into a document (or you can just write down the ID). Click Next.

Nominate MYOB as your software provider with the ATO. You can do this by using the ATO's Access Manager website (using your myGovID), or call the ATO to complete this process by phone - call 1300 852 232.

Log in to the ATO’s Access Manager website (https://am.ato.gov.au).

Click My Hosted SBR Software Services in Access Manager’s menu.

Click Notify the ATO of your hosted service.

Type "MYOB" in the Software Provider Name field, then click Search.

Click MYOB’s ABN when it appears.

Paste or type the software ID in the Add Software IDs field and click Next.

Read the declaration, then click Save.

Return to the Nominate MYOB as your software provider message, and click I've done this.

When the online activity statement dashboard appears, click Check field setup in the banner.

You can now set up your GST and PAYG Withholdings activity statement fields.

Did you previously use BASlink?

If you've used BASlink to prepare your statements, your BASlink settings won't be brought across here. You’ll need to set up the fields again. If you need help setting up the fields, speak to a registered BAS agent or tax agent.

Eligible for Simpler BAS?

From 1 July 2017, if your annual turnover is less than $10 million, you're eligible to lodge a Simpler BAS. Select your turnover and we'll display just the fields that you need to set up.

(BAS only) For the GST fields, link the tax codes you’ve used in AccountRight to the relevant fields on the statement.

Click + Add code to link a tax code to a field, or click the tax code’s x icon to unlink it.

For the PAYG fields, link the payroll categories and tax codes you use to track the salaries, wages and other payments to employees and others at W1, and the amounts you withhold from those payments at W2.

Link the tax codes you use to track withholdings (other than those already reported at W2 or W4) at W3, and the amounts withheld due to suppliers not providing their ABN on their invoices at W4.

Click Done.

The online activity statement dashboard will retrieve information from the ATO and show the statements you can complete online. If you’re an agent, note that you'll only see activity statements for the business you've signed into.

FAQs

I'm having issues nominating MYOB as my software provider.

If you have issues with the ATO’s Access Manager website, you can nominate MYOB by calling the ATO on 1300 852 232.

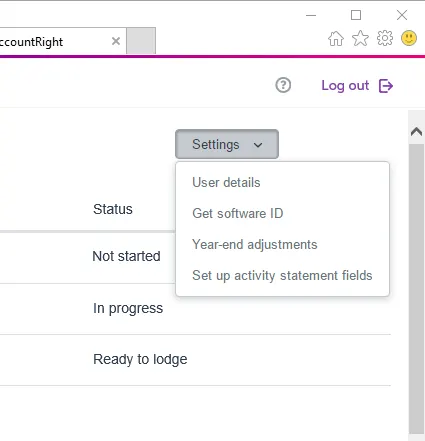

I need to change my setup or details

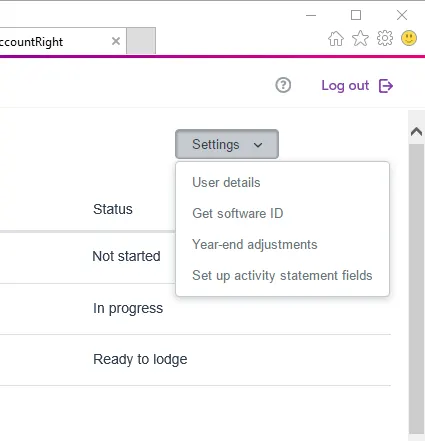

If you need to change your tax code setup, authorised person, or change how year-end adjustments recorded in AccountRight affect your BAS:

Open your AccountRight online company file.

Click Prepare BAS/IAS in the Accounts command centre.

In the Lodge Online tab, click Prepare Statement.

Click the Settings option.

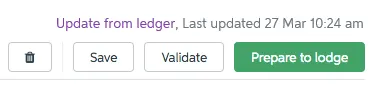

If you change the tax code setup, it will not affect any returns that are already in progress. You’ll need to open the statement that’s in progress, choose to Edit it, and then click Update from ledger, to use the new tax code setup details.

Note that doing this will replace the values of all fields that are automatically calculated based on the tax code setup.

Where can I get more information about my activity statement fields?

To learn what should be reported in each activity statement field, visit the ATO website.

Where can I find my GST software ID?

The GST software ID is displayed during the set up steps above. If you forgot to copy the GST software ID you can access it as follows:

Open your AccountRight online company file.

Click Prepare BAS/IAS in the Accounts command centre.

In the Lodge Online tab, click Prepare Statement.

Click Settings and choose Get software ID.

How do I set up the activity statement fields for FBT, Fuel Tax Credits, or PAYGI?

Currently only the GST and PAYG Withholding fields can be linked to tax codes in your AccountRight company file. So if you need to complete other fields, like the T fields, you'll need to fill in those values manually when completing your online activity statement.

How do I change my reporting period?

Your GST reporting and payment period would have been set when you registered with the ATO, based on the turnover of your business at the time.

If you need to change your GST reporting period, contact the ATO.