AccountRight Plus and Premier

Payroll tax is a state tax imposed on an employer’s liability to pay wages. There are thresholds before this applies, depending on the state in which you employ staff in Australia.

An individual employer or a group of related businesses may be liable for payroll tax if their total liable wages throughout Australia exceeds the set state payroll tax threshold each year.

If you're liable to pay state or territory payroll tax, you can calculate your payroll tax amounts using the payroll information in your company file. If you're unsure about whether you're liable to pay state or territory payroll tax, contact your state or territory revenue office, or check the Payroll Tax Australia website.

Before you can report payroll tax, you need to set up your payroll tax details. After you process pays for your employees, you can run a report to display the payroll tax due for a period. Note that you can only set up payroll tax for one state or territory.

Setting up state or territory payroll tax details

Go to the Setup menu and choose General Payroll Information. The General Payroll Information window appears.

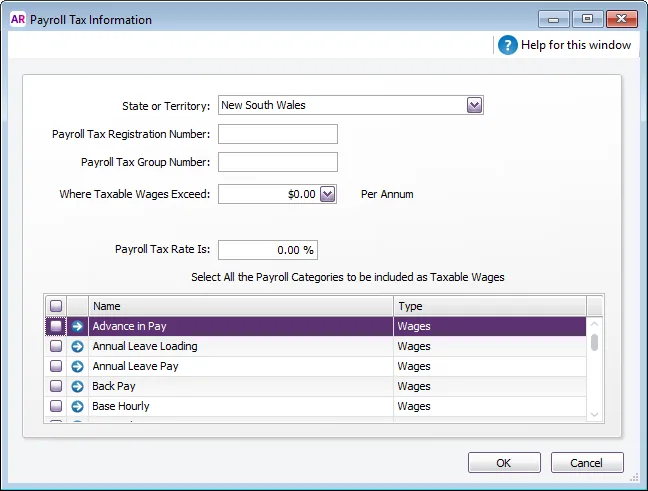

Click Set Up Payroll Tax. The Payroll Tax Information window appears.

Select your State or Territory.

Enter your Payroll Tax Registration Number and Payroll Tax Group Number. If unsure what to enter here, check with the revenue office for your state or territory.

Enter the threshold value in the Where Taxable Wages Exceed field. Based on the chosen state or territory, this will be either a per month or per annum amount

(Queensland business only) Complete the additional fields. Check with Business Queensland or your accountant if you need more information.

Enter the Payroll Tax Rate for your selected state or territory.

In the list at the bottom of the window, select the Payroll Categories to be included as taxable wages. Amounts recorded against these categories will be included in payroll tax calculations.

If you are unsure about taxable wage calculations

If you are unsure which payroll categories should be included as taxable wages, contact your state or territory revenue office.

After you have entered your payroll details, click OK.

Reporting and paying payroll tax

You can use the Payroll Tax report and the Amount by Category (Payroll Tax) report to view your payroll tax liability. You can access these reports in the Payroll tab of the Index to Reports window.

Report showing N/A?

To avoid N/A when you produce the Payroll Tax report, you should enter the date range for the entire month for which you want to view your payroll tax liability.

Once you've confirmed the amount you need to pay, you can create a Spend Money transaction to record the payment. This is typically allocated to an expense account (which you might need to create). For clarification on the specifics of the Spend Money transaction for your circumstances, check with your accounting advisor or ask an expert on the community forum.