An employment termination payment (ETP) is a specific lump sum payment made to an employee because their employment has finished.

ETPs include payments for unused rostered days off, payments in lieu of notice, a gratuity or 'golden handshake', and more. For a full list of payments that are ETPs, visit the ATO website.

And because you'll be reporting your ETPs to the ATO via STP, all you need to do is set up your ETP payroll categories and do a pay run. Easy!

Rules, tax and other final pay headaches

Final pays can get complicated and they have specific rules and tax treatment. And no two final pays are the same. So we recommend you speak to an accounting advisor about the specifics of your final pay. They'll clarify what needs to be paid and ensure you stay in the good books with the ATO. You can also invite your accountant into your AccountRight company file so you can work on your books together.

To learn about tax on final pays, see this ATO information. For the rules, calculators and other final pay resources, check the Fair Work website.

1. Set up ETP payroll categories

Before processing your first ETP, you need to set up ETP payroll categories. You'll assign these payroll categories to the employee who's leaving, but you can re-use them any time you pay an ETP. Tell me more about payroll categories.

ETPs can be made up of taxable and non-taxable pay items, and tax-withheld deductions. We'll step you through how to create all 3 payroll categories below, but you may not use all 3 for each ETP you pay. Please see the ATO website or speak to your accounting advisor if you're unsure what a terminated employee is owed.

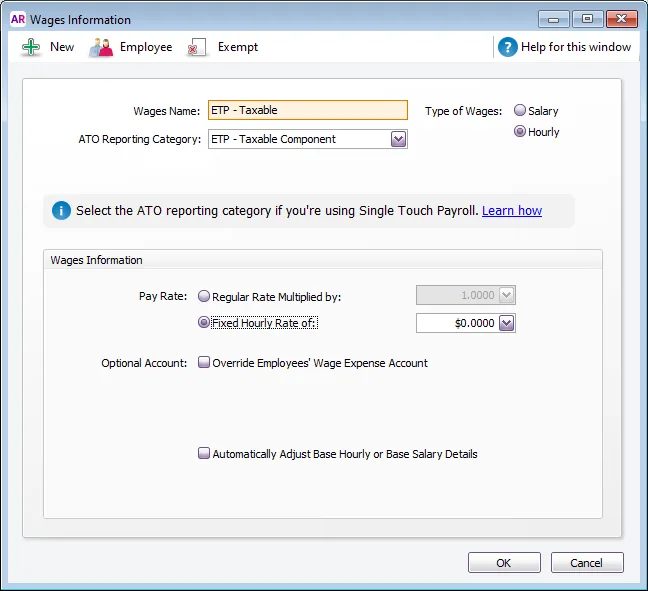

Creating the ETP taxable earning

Go to the Payroll command centre and click Payroll Categories.

On the Wages tab, click New.

Enter a Wages Name. We recommend naming it ETP - Taxable or similar to easily find it in your payroll category lists and identify it on pay slips.

For the ATO reporting category, choose ETP - Taxable Component.

For the Type of Wages, select Hourly. You'll do this regardless of an employee's pay basis.

For the Pay Rate, choose Fixed Hourly Rate of and leave 0.0000 in the next field. You can change the amount when you process an ETP pay run.

Click Employee and select the employee being paid the ETP, then click OK.

Click OK to save the payroll category.

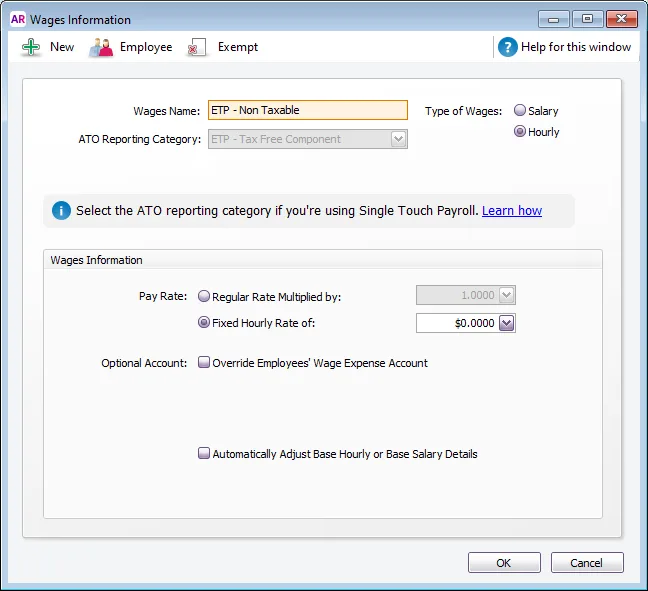

Creating the ETP non-taxable earning

Go to the Payroll command centre and click Payroll Categories.

On the Wages tab, click New.

Enter a Wages Name. We recommend naming it ETP - Non Taxable or similar to easily find it in your payroll category lists and identify it on pay slips.

For the ATO reporting category, choose ETP - Tax Free Component.

For the Type of Wages, select Hourly. You'll do this regardless of an employee's pay basis.

For the Pay Rate, choose Fixed Hourly Rate of and leave 0.0000 in the next field. You can change the amount when you process an ETP pay run.

Click Employee and select the employee being paid the ETP, then click OK.

Click OK to save the payroll category.

Create the ETP tax-withheld deduction

Go to the Payroll command centre and click Payroll Categories.

Click the Deductions tab.

Enter a Deduction Name. We recommend naming it ETP - Tax withheld or similar to easily find it in your earnings lists and identify it on the pay slips.

For the ATO reporting category, choose ETP - tax withholding.

Ensure the Linked Payable Account has the applicable account specified. If you're not sure, check with your accounting advisor. You can leave all other values at their default.

Click Employees and select the employee being paid the ETP, then click OK.

Click Exempt and ensure PAYG Withholding is NOT selected. If it is, deselect it. This ensures it's an after tax deduction which doesn't reduce the calculated PAYG.

Click OK then click OK again to save the payroll category.

Superannuation on ETPs

Generally ETPs don't attract superannuation, but this will depend on the ETP you're paying. To get clarification, check with your accounting advisor or speak to the ATO. Here's some ATO information that might help.

If an ETP does not attract superannuation, you'll need to prevent super from calculating on the ETP pay items you've just created.

To prevent super calculating on an ETP

-

Go to the Payroll command centre and click Payroll Categories.

-

Click the Superannuation tab.

-

Click to open the superannuation payroll category to be excluded from the ETP, for example Superannuation Guarantee.

-

Click Exempt and select the ETP taxable and ETP non-taxable payroll categories.

-

Click OK then click OK again to save.

-

Repeat for any other superannuation payroll categories to be excluded from the ETP.

2. Process an ETP pay run

After you've set up your ETP payroll categories and assigned them to the terminated employees, you're ready process the ETP pay run.

Start a new pay run. Need a refresher?

Select the employee being paid the ETP.

Click the blue zoom arrow to open their pay details.

For any non-ETP earnings or deductions, enter 0 in the Hours or Amount column. This is because you should only pay ETPs in this pay run.

Enter required amounts against the applicable ETP pay items.

Click ETP Benefit Type.

This button only appears once you've entered values against an ETP wage category in the pay. If it doesn't appear after entering values against an ETP wage category, check that your ETP wage categories have an ETP ATO Reporting Category selected, such as ETP - Taxable Component, or ETP - Tax Free Component.

Choose the applicable Benefit Type and Benefit Code. If you're not sure what to choose here, check with the ATO or your accounting advisor.

Click ETP Benefit Type.

This button only appears once you've entered values against an ETP wage category in the pay. If it doesn't appear after entering values against an ETP wage category, check that your ETP wage categories have an ETP ATO Reporting Category selected, such as ETP - Taxable Component, or ETP - Tax Free Component.

Choose the applicable Benefit Type and Benefit Code. If you're not sure what to choose here, check with the ATO or your accounting advisor.

Click OK.

Clear all other hours and amounts from the pay. This ensures only the ETP amounts are paid and no super or leave is accrued on this pay.

When you're finished, click Save.

Click Next.

Review the pay cycle, pay dates and the total net pay. When you're ready, click Record.

When prompted to send your payroll information to the ATO, enter your details and click Send.

Email or print pay slips. Need to change an employee's pay slip delivery method?

On the Email pay slips tab, select the employees requiring their pay slips to be emailed then click Email.

On the Print pay slips tab, click the document icon to display the employee's pay slip in a new window. You can now save or print the pay slip.

Click Next.

Finally, you can click Pay employees via bank file to create a bank file to pay the ETP directly into your employee's bank account.

When you're done, click Close.

What next?

If you haven't already, you'll also need to pay the employee their final regular pay and pay out any applicable leave. You'll also need to advise the ATO of the termination.

For all the details see Processing a final pay.