If you need to fix something in a pay, deleting it might not be the best thing to do. In fact, it might actually make things worse.

For example, if you've already paid an employee then you delete their pay, your payroll information in MYOB won't match what's actually happened. Instead, you should adjust the employee's next pay.

The only time we'd recommend deleting a pay is if you've just recorded it and no payment has been made. To delete an entire pay run, you'll need to delete all the individual pays within it.

For help fixing, deleting or reversing an individual pay or an entire pay run, see Fixing a pay.

What determines if a pay can be deleted or reversed?

It's only possible to delete or reverse a pay if the pay is:

NOT part of a processed electronic payment

NOT part of a Pay Super payment

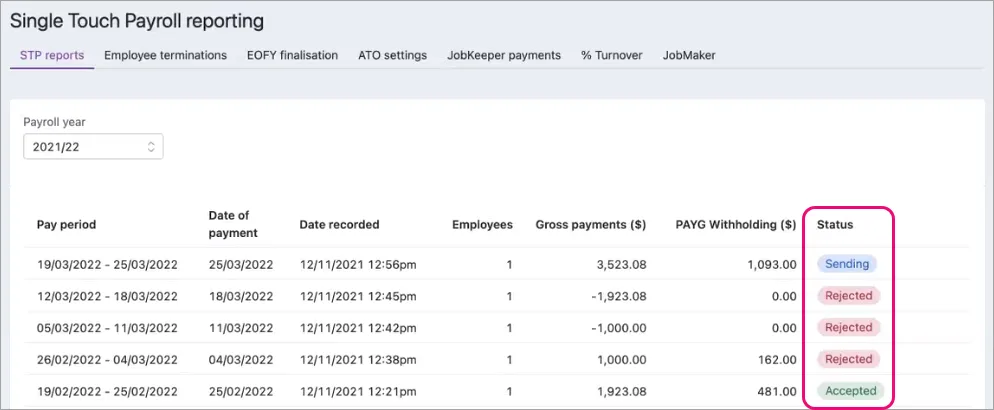

For pays that have been submitted to the ATO via Single Touch Payroll, the status of the report submission determines if you can delete the pay or if you'll need to reverse it instead.

This table shows whether MYOB will allow you to delete or reverse a pay based on its status in the STP Payroll Reporting Centre. For example, if the status is Sent you'll only be able to reverse the pay.

Status | Can delete? | Can reverse? |

|---|---|---|

Rejected | Yes | |

Not Sent | Yes | |

Sent | Yes | |

Accepted | Yes | |

Accepted with errors | Yes |

For reports that are not accepted by the ATO, e.g. Rejected or Not Sent, the report status will remain as a historical record. Once you've fixed whatever caused the issue, your employees' latest year-to-date payroll totals will be submitted to the ATO once the next pay run is accepted.

How do I delete or reverse a pay?

Before deleting or reversing a pay you need to decide the right approach. For all the details see Fixing a pay.

AccountRight Plus and Premier only

If you need to fix something in a pay, deleting it might not be the best thing to do. In fact, it might actually make things worse.

For example, if you've already paid an employee then you delete their pay, your payroll information in AccountRight won't match what's actually happened. Instead, you should adjust the employee's next pay.

The only time we'd recommend deleting a pay is if you've just recorded it and no payment has been made. To delete an entire pay run, you'll need to delete all the individual pays within it.

For help fixing, deleting or reversing an individual pay or an entire pay run, see Fixing a pay.

What determines if a pay can be deleted or reversed?

It's only possible to delete or reverse a pay if the pay is:

NOT part of a processed electronic payment

NOT part of a Pay Super payment

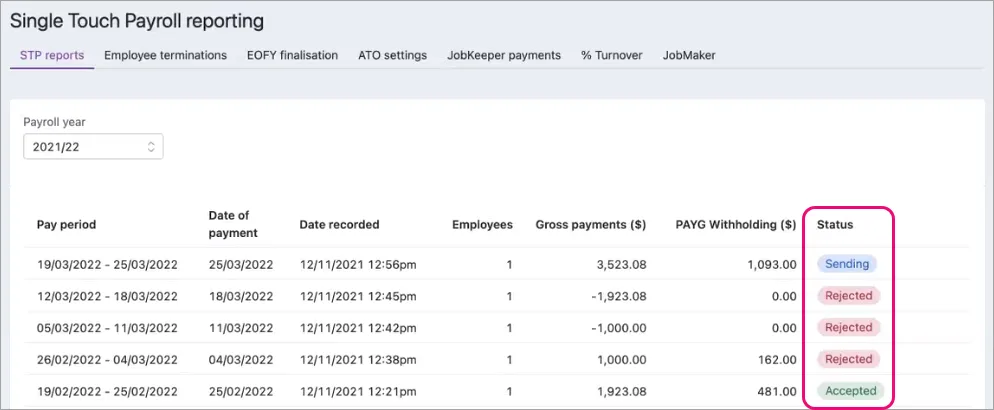

For pays that have been submitted to the ATO via Single Touch Payroll, the status of the report submission determines if you can delete the pay or if you'll need to reverse it instead.

This table shows whether MYOB will allow you to delete or reverse a pay based on its status in the STP Payroll Reporting Centre. For example, if the status is Sent you'll only be able to reverse the pay.

Status | Can delete? | Can reverse? |

|---|---|---|

Rejected | Yes | |

Not Sent | Yes | |

Sent | Yes | |

Accepted | Yes | |

Accepted with errors | Yes |

For reports that are not accepted by the ATO, e.g. Rejected or Not Sent, the report status will remain as a historical record. Once you've fixed whatever caused the issue, your employees' latest year-to-date payroll totals will be submitted to the ATO once the next pay run is accepted.

How do I delete or reverse a pay?

Before deleting or reversing a pay you need to decide the right approach. For all the details see Fixing a pay.