When you do a pay run, superannuation is calculated on each of your employees' pays. How super works.

These super amounts are temporarily held in a liability account in MYOB until you pay them to your employees' super funds straight from MYOB.

You'll know how much super you need to pay by checking the Superannuation payable widget on your dashboard.

If you'd like make sure this amount is correct (it'll be wrong if your super isn't set up properly) you can use a report to confirm how much super is payable.

To confirm your payable superannuation

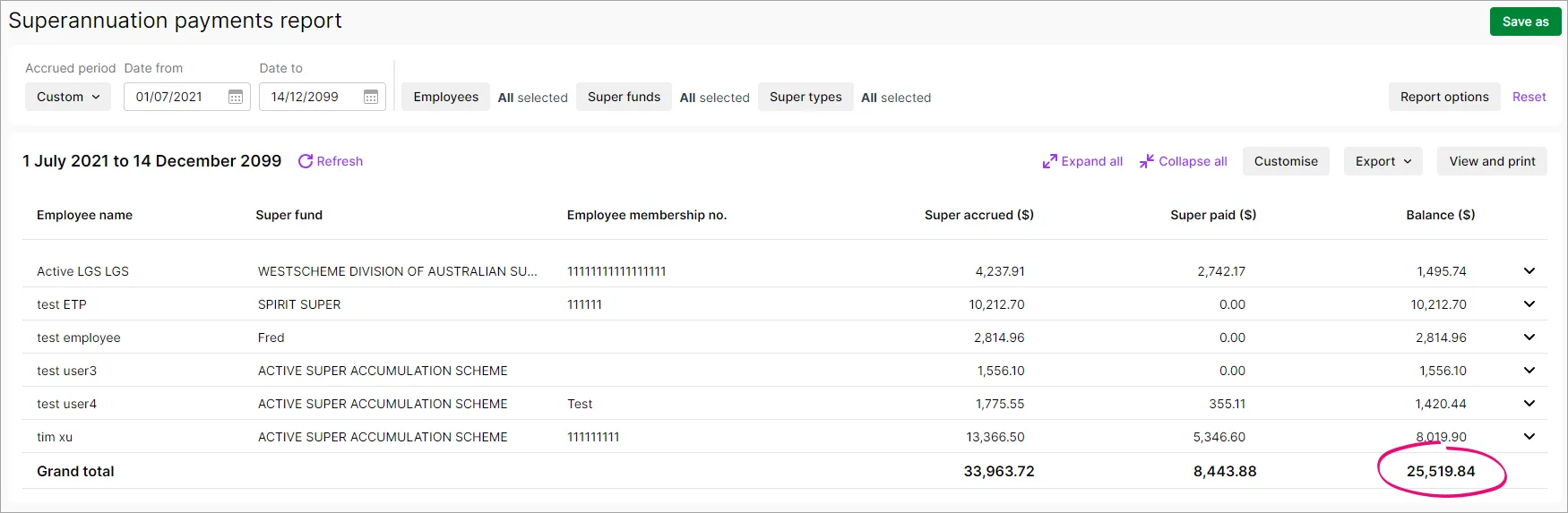

Run the Superannuation payments report to confirm exactly how much super is currently payable. Providing you're using Pay super to make your super payments, the balance shown in this report should match the amount shown on your dashboard.

Go to the Reporting menu > Reports and click the Superannuation payments report.

Set the dates from your business's opening balance date (find this by clicking the settings menu (⚙️) > Business settings) to a date in the far future, e.g. 1 Jan 2099. This will show all superannuation transactions.

Check the Balance at the bottom – this is the correct amount of super you need to pay, like this example:

If the super report and dashboard amounts don't match

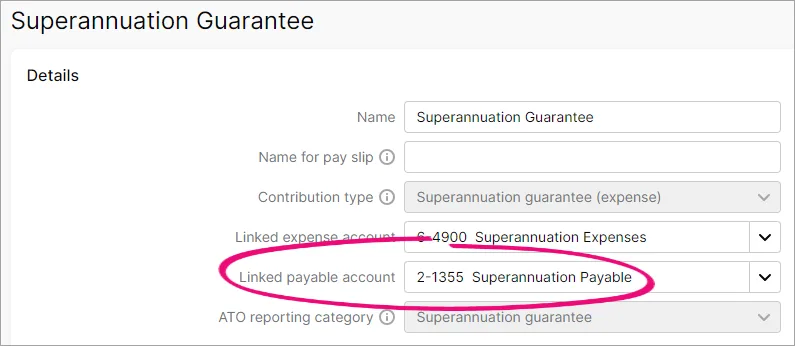

The amount shown in the Superannuation payable widget on your dashboard is the balance of the Linked payable account that's set in each of your superannuation pay items. It's how MYOB Business keeps track of the super amounts from your employees' pays. The same account should be set in each super pay item. If the wrong account is set, the super payable amount on your dashboard will be wrong and it won't match the super payments report.

To check your linked payable accounts

Go to the Payroll menu > Pay Items.

Click the Superannuation tab.

Click to open each super pay item.

Check the Linked payable account. This should be set to a liability account (starting with a 2-xxxx) called Superannuation Payable or similar, like this example:

If it's set to anything else, change it. If you're not sure which account to change it to, you'll need help from an accounting advisor or whoever set up your payroll. You might also need to transfer the super balance from the incorrectly set account into the correct super liability account. Your accounting advisor will be able to help with this too.

If the linked payable account is set to PAYG Withholding Payable

First, change the linked payable account to the correct superannuation liability account. If you're not sure which account to change it to, you'll need help from an accounting advisor or whoever set up your payroll.

Then, transfer the super balance from the PAYG Withholding Payable account into the correct superannuation liability account. This will ensure the correct amount of super payable shows on your dashboard.

To transfer the super balance from PAYG

Run the Superannuation payments report (as described above) and take note of the actual super balance payable.

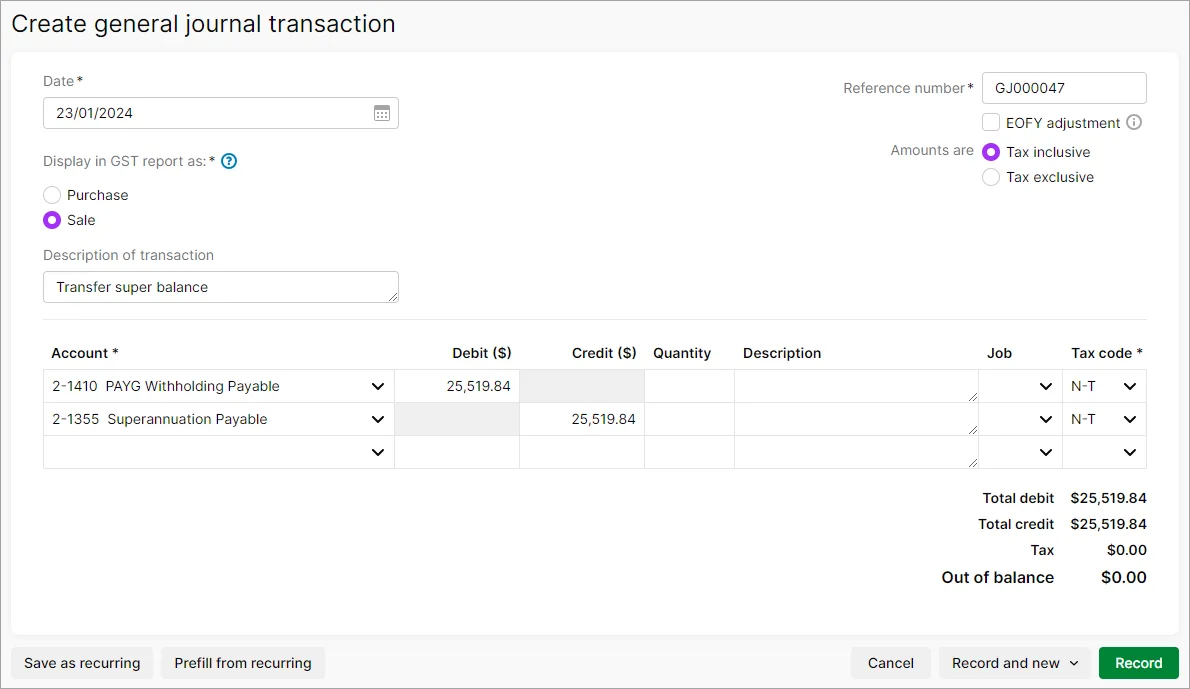

Record a general journal transaction to transfer the super balance.

Go to the Accounting menu > Create general journal.

In the first transaction line, choose the PAYG Withholding Payable account and enter the super balance (from step 1) into the Debit column.

In the next transaction line, choose the superannuation payable liability account and enter the super balance in the Credit column.

Set the Tax code on both lines to N-T.

Click Record. Here's our example: