Get started

AccountRight Plus and Premier only

Time Billing is an ideal management tool for businesses that need to track their time, such as accountants and lawyers. You can also track incidentals (such as items used) to complete the work.

There are some preferences that should be set before you start.

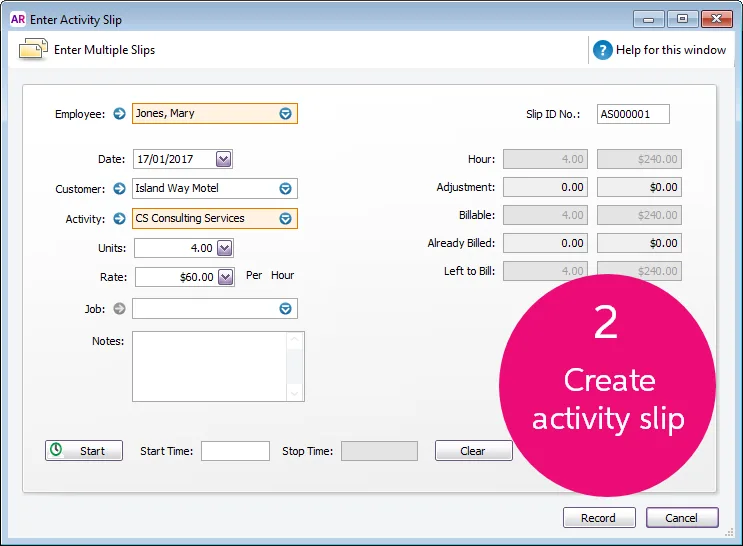

You can also set billing rates that will automatically appear when you create an activity slip. The billing rate can also be set for a customer, employee, supplier or for the activity itself. You can still override these rates when you create the activity slip.

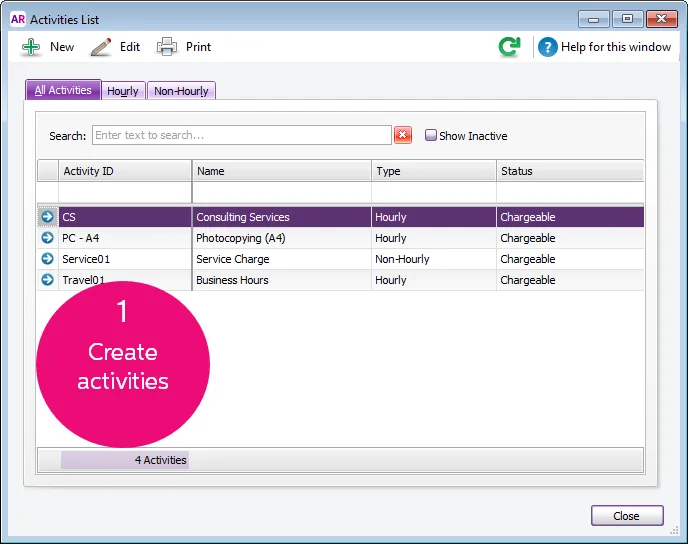

An activity is a task or service provided by your business to track costs and then bill customers using time billing invoices. You first need to create activities so that they can then be used in an activity slip.

Create an activity slip

Create activity slips to record time-based activities performed for a customer. They will form the basis of the invoices that you send to them. Up until that time, consider them as a way to record your work in progress for your customers.

You can also create multiple activity slips at once to save time, while not entering as much detail for each. Although you can view them at a later stage and add more detail if you want.

Timesheets are used to record all the hours worked by hourly employees or to record extra hours worked by employees that are paid based on a standard pay. If you pay employees for time-billing activities, you can also enter activity details on timesheets and use these details to create activity slips.

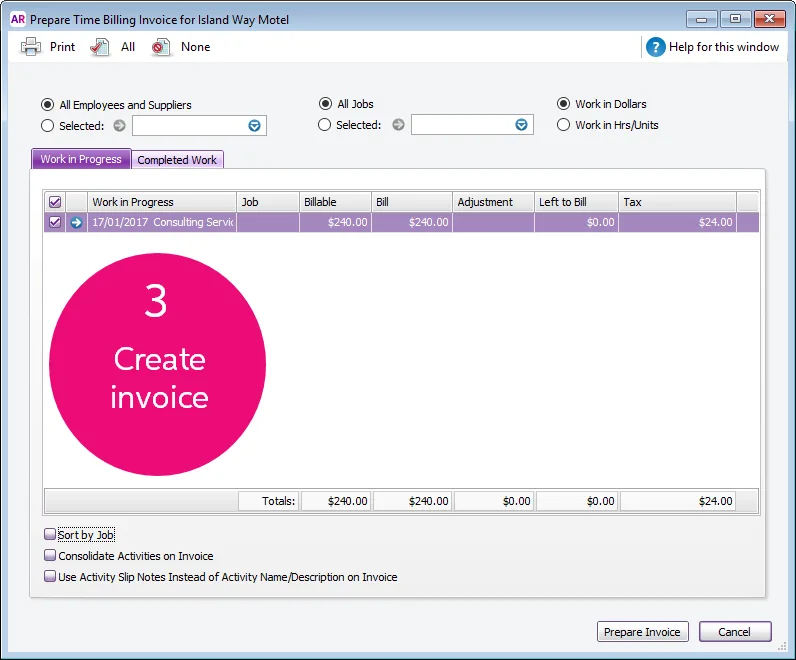

Bill for time

Once your activities have been entered, use them to create time billing invoices, ready to send to your customers.

Any items that you have sold to your customers can also be included with the activities in a single time billing invoice (this must be enabled in your preferences).

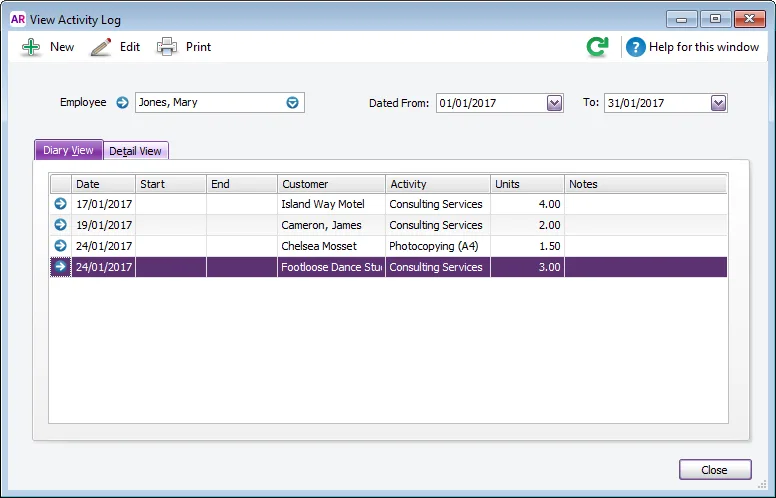

Review

You can review your activity slips at any time by using the Activity Log. From here, you can also edit or delete activity slips.

Work you’ve completed for your clients that you haven’t billed yet is called Work In Progress. Your accounting records will only reflect a sales transaction when you bill your customer for the activities.

However, some accountants consider that, from an accounting perspective, your clients owe you for your work in progress even if you haven’t yet billed your clients for it.

If your work in progress routinely represents a significant amount of money, you should consider adjusting your accounting records to reflect this. Consult your accountant for advice on how to do this.