You can lodge tax returns to the ATO individually or in bulk.

1. Mark the status as Ready to Lodge

Updating the return status to Ready to lodge

The tax return must have a status of Ready to lodge.

If you sent the return to your client for review via the portal, and if the client approved the return via the portal, the status of a tax return is automatically updated to Ready to lodge.

If you've sent the tax return to your client manually, when the client sends the signed return back to you, you need to update the status individually or in bulk:

Update individually: Open the return and click Client approved & signed. This updates the status of the return to Ready to lodge. You need to do this for each tax return that is sent and signed manually.

Update in bulk:

Go to Compliance in either All clients or client-centric view.

Select the Pending signature status tab and either:

select the checkboxes next to each tax return that you want to mark as ready to lodge

if you're in All clients view, select the checkbox next to the Client name column header to mark all tax returns as ready to lodge.

Click Ready to lodge.

-

If you're updating the status of multiple returns in bulk, depending on how many returns you're updating, not all returns will update immediately. It can take roughly 10 seconds to update 100 returns. You can click Compliance at the top of the page to refresh and see how many returns remain in the Pending signature status tab above the list.

-

If you sent the return manually, but you can't see the Client approved & signed button, check the return status. If the status is In progress, In review or Ready for client review, follow the steps in Sending a tax return for client review - AU.

-

If you want to make any changes before lodging, click Send for rework.

2. Lodge the return

If you don't have access to lodge a return, make sure you belong to the Compliance administration user group.

See Permissions for tax-related tasks for more details.

Lodging tax returns in bulk

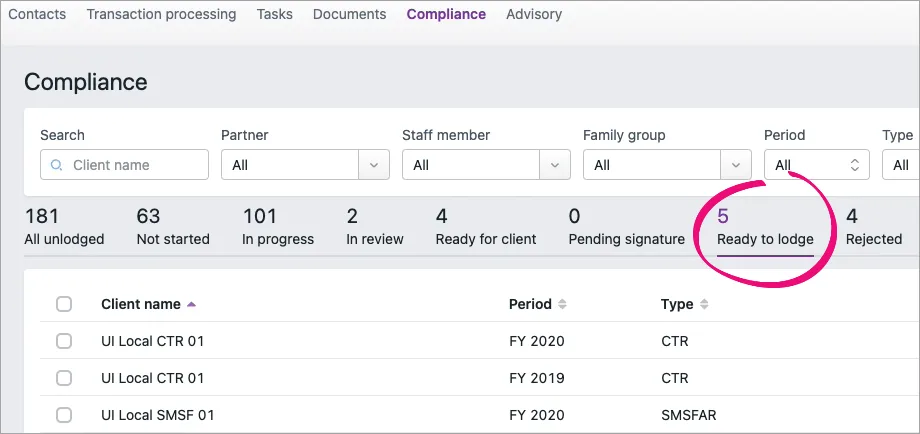

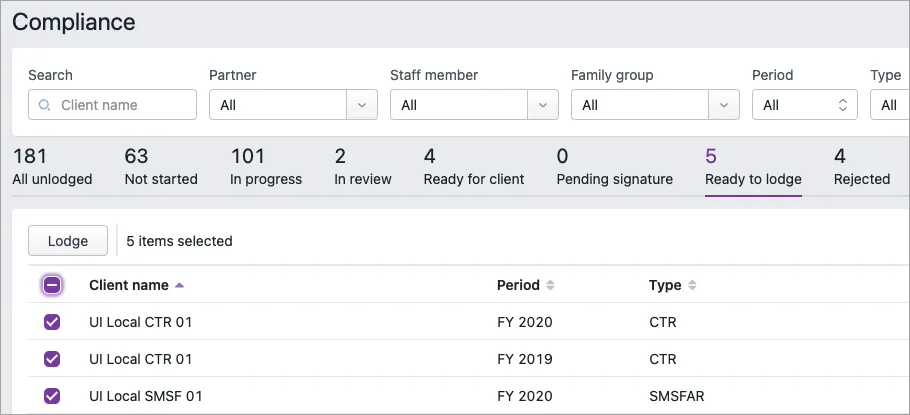

Go to Compliance in either All clients or client-centric view.

Select the Ready to lodge status tab. You'll see a list of tax returns with checkboxes next to them.

Either:

select the checkboxes next to each tax return that you want to lodge

if you're in All clients view, to select all tax returns that are ready to lodge, select the checkbox next to the Client name column header.

The Lodge button and the number of selected tax returns are displayed above the list of returns.

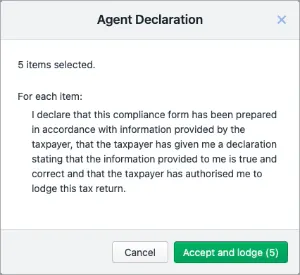

Click Lodge. The Agent Declaration confirmation dialog window appears.

Lodging individually from within a tax return

Go to Compliance and open a tax return.

Click Lodge to ATO. The return is sent.

After the ATO has processed the returns, the returns will have either a Lodged or Rejected status. You can select the Lodged or Rejected status tabs above the Compliance list to display only the returns with that status. You can also see more details about the lodgment status when you open individual returns.

After the ATO has processed the returns, the returns will have either a Lodged or Rejected status. You can select the Lodged or Rejected status tabs above the Compliance list to display only the returns with that status. You can also see more details about the lodgment status when you open individual returns.