You may need to amend your tax return if you have made a mistake, forgotten to add items like a deduction or an offset, or if something has changed after you've lodged your tax return.

Amending a tax return allows you to describe the reasons for the amendment, and the amendment type (ATO error or Taxpayer error) and indicates the amendment number (1-9). A maximum of nine amendments may be lodged electronically in any tax year for each tax return i.e. the first amendment, and up to eight subsequent amendments

You can amend tax returns from tax year 2022 for Individual and 2023 for other return types.

Individual

Company

Note: Loss carry back change in choice schedule is not available in an amended Company 2023 tax return. Create an amendment in AE/AO to make any changes to the loss carry back amounts.Trust

Partnership

Note: If you need to amend partnership returns created before 3 March 2025, make sure you've answered the Is this an amendment? question and completed Amendment number, type and reason on the front cover.

Amend a tax return

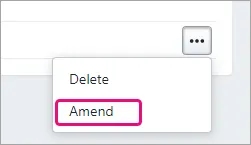

At the end of the tax return that you want to amend, click the ellipses and select Amend.

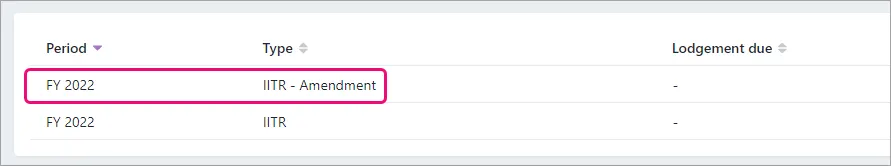

This will create another return (for example IITR - Amendment) in the Compliance page and the Individual tax return – Amendment opens.

We'll copy the data from the previously lodged return into the amendment. For example, if you're amending for the first time, we'll copy the data from the original return if in Lodged status.

Go to the question Is this an amendment? and select Yes. You can find this question below the Date of Birth field.

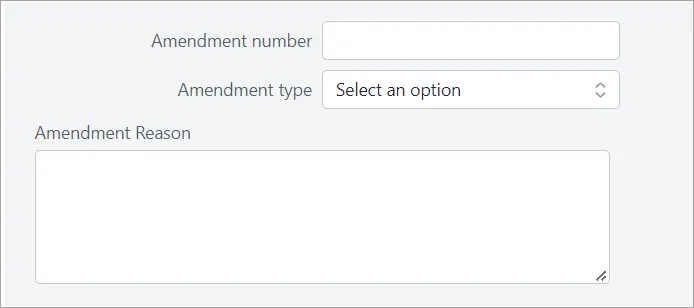

Enter an Amendment number. You can only enter between 1-9 as a maximum of only 9 amendments are allowed in a tax return.

Select ATO error or Tax payer error at Amendment type.

Enter a reason for the amendment.

Drag the right side corner to make the box bigger.

FAQs

How do I amend a tax return that was not lodged by me?

Create a tax return using the Add new button in Practice Compliance and, optionally, enter the details of the original return that was lodged to the ATO.You can't manually change the status of the original return to Lodged. While we're working on editing the status manually, you can create an amendment on a return that has an In progress status. You're also able to delete an In progress original return.

If you amend a tax return in practice, will the status show in AE/AO?

We're working on integrating the status back into AE/AO.