You can pay your suppliers or employees into their bank accounts by creating a bank file (also called an ABA file) then uploading it to your bank for processing.

Setting up for bank files

There's a few one-off tasks you need to do before you can create bank files for electronic payments. This includes making sure a specific category is set up in MYOB (an electronic clearing category), entering your suppliers' and employees' bank account details, and entering the bank account details where your electronic payments will be paid from.

1. Check your Electronic Clearing Category

When you record a payment in MYOB that's going to be paid electronically (via bank file), the payment is temporarily held in an MYOB category called the electronic clearing account. The payments sit there until you're ready to upload them to your bank for processing using a bank file. When the payments are added to a bank file, they're cleared from the electronic clearing account.

Unless you or your accounting advisor has changed the default categories in MYOB, the electronic clearing account should already exist in your MYOB business.

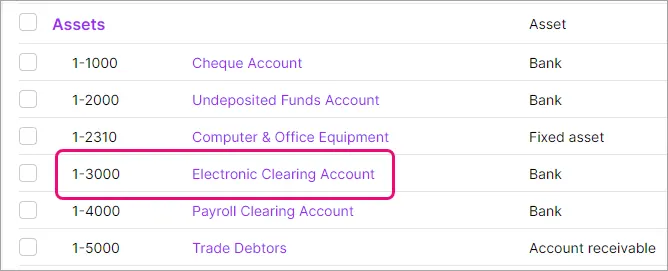

You can check via the Accounting menu > Categories (Chart of accounts) > Assets tab. Here's what it'll look like:

If you need to create a new category for this purpose, see adding, editing and deleting categories.

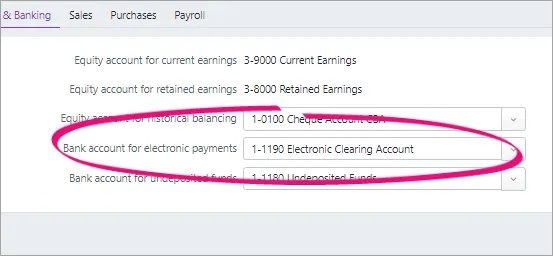

You'll also need to make sure this category is set as the linked category for electronic payments (Accounting menu > Manage linked categories > Categories & Banking tab). This just ensures that your electronic payments work correctly behind the scenes in MYOB.

If you have a different category set up as as your electronic clearing account, you'll need to choose it here and click Save.

2. Enter your suppliers' and employees' bank account details

To pay funds into a supplier's or employee's bank account, you'll need to enter their bank account details in MYOB.

Entering supplier bank account details

Click Contacts on the menu to open the Contacts page.

Choose Supplier in the Contact type list.

Click a supplier's name to open their details. If you need to add a new supplier, click Create contact and follow the steps to add a supplier.

Enter the supplier's banking details, including BSB number, Bank account number, Bank account name, Statement text and Remittance advice email address.

Click Save.

Repeat for each supplier you want to pay electronically.

Entering employee bank account details

Go to the Payroll menu > Employees.

Click the employee's name to open their details.

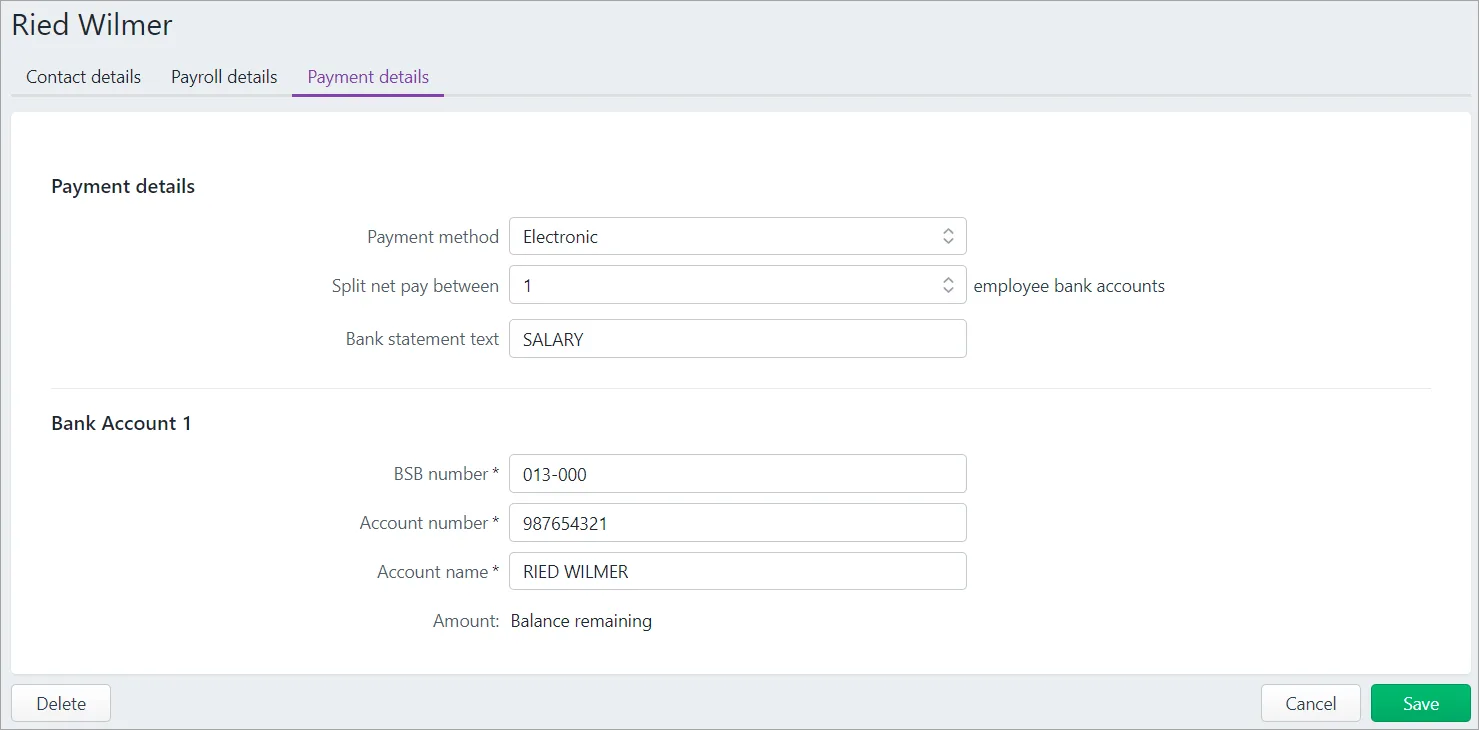

Click the Payment details tab.

For the Payment method, choose Electronic.

In the Split net pay between field, choose how many bank accounts you're paying into for this employee. If it's more than one, enter the details of each. More about splitting an employee's pay into multiple accounts.

Enter the Bank statement text to appear on the employee's bank statement for the electronic payments you make to them.

Enter the employee's banking details. Here's our example:

Click Save.

Repeat for each employee you'll be paying electronically.

3. Enter your business bank account details

The last thing you need to do is enter the banking details for the business bank account your electronic payments will come from. You'll be able to get these details from the account's bank statement or from your bank.

Go to the Accounting menu and choose Categories (Chart of Accounts).

Click the category that represents the business bank account your electronic payments will be paid from.

This category must be a Bank type. More about category types.

Enter the banking details. If unsure about any of these details, check with your bank:

Enter the BSB, Bank account number and Bank account name.

Enter your Company trading name. If your trading name is too long, enter as many letters as possible or shorten it.

Select the option I create Australian Banking Association (ABA) files for this account.

Type the three-letter Bank code that identifies your bank, for example, NAB, ANZ, CBA or WBC. Check with your bank if unsure.

Type the Direct entry user ID (sometimes called the APCA ID). This ID is assigned by your bank when you registered with them to process direct credits. Check with your bank if you're unsure about this.

If your bank file requires a self‑balancing transaction, select the option Include a self-balancing transaction.

When you're done, click Save.

You're now set up to pay your suppliers and employees using bank files.

You can pay your suppliers or employees into their bank accounts by creating a bank file (called an ABA file) then uploading it to your bank for processing.

Setting up for bank files

There's a few one-off tasks you need to do before you can create bank files for electronic payments. This includes making sure a specific account is set up in AccountRight (an electronic clearing account), entering your suppliers' and employees' bank account details, and entering the bank account details where your electronic payments will be paid from.

1. Record your bank account details

Before you can process electronic payments, you need to record the details of the bank account your electronic payments will come from.

To record your bank account details

Go to the Accounts command centre and click Accounts List. The Accounts List window appears.

Select the bank account (that is, an account with a Bank or Credit Card account type) that you want to use for electronic payments.

Click Edit. The Account Information window appears.

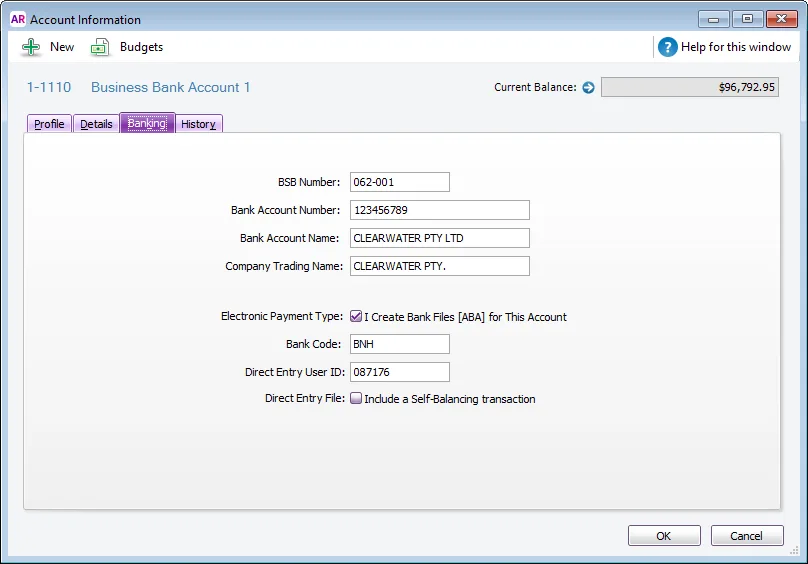

Click the Banking tab.

Enter your bank account details in the fields. Copy this information exactly as it appears on your bank statement or chequebook.

10 digit bank account numbers

In most cases where a bank account number is 10 digits long, the first character is a zero and this can be omitted in AccountRight. However we recommend you check this with your bank first to ensure it's OK to do this in your situation.

Select I create Bank Files (ABA) for This Account and enter the electronic payment file (ABA file) details.

Bank processing details required

You may need to contact your bank for the following details.

Type the three-letter Bank Code that identifies your bank, for example, NAB, ANZ, CBA or WBC. Check with your bank if unsure.

Type the Direct Entry User ID (sometimes called the APCA ID). This ID is assigned by your bank when you registered with them to process Direct Credits.

If your bank file requires a self‑balancing transaction, select Include a Self-Balancing transaction.

Click OK to return to the Accounts List window.

Repeat from step 2 for each bank account you want to make electronic payments from.

2. Check your electronic clearing account

When you record a payment in AccountRight that's going to be paid electronically (via bank file), the payment is temporarily held in an AccountRight account called the electronic clearing account. The payments sit there until you're ready to upload them to your bank for processing using a bank file. When the payments are added to a bank file, they're cleared from the electronic clearing account.

Unless you or your accounting advisor has changed the default accounts in AccountRight, the electronic clearing account should already exist in your company file.

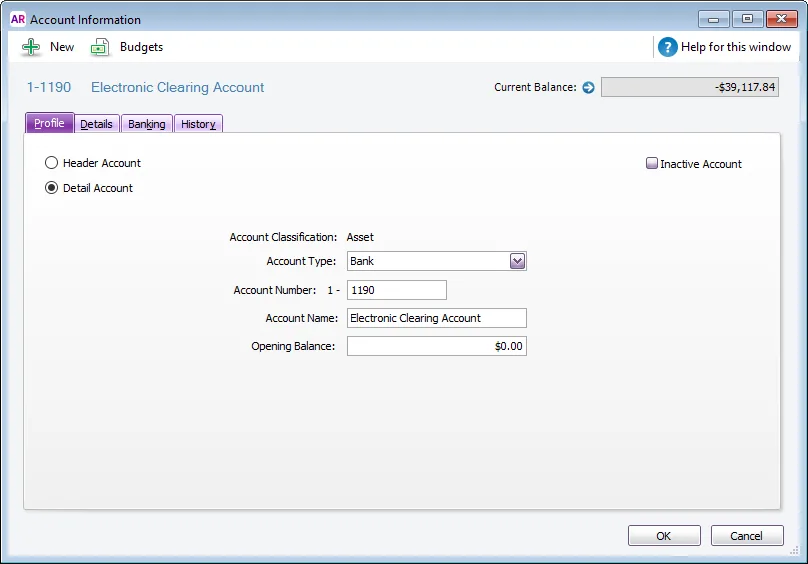

You can check via the Accounts command centre > Accounts List > Asset tab. Here's what it'll look like:

If you need to create a new account for this purpose, see adding, editing and deleting categories.

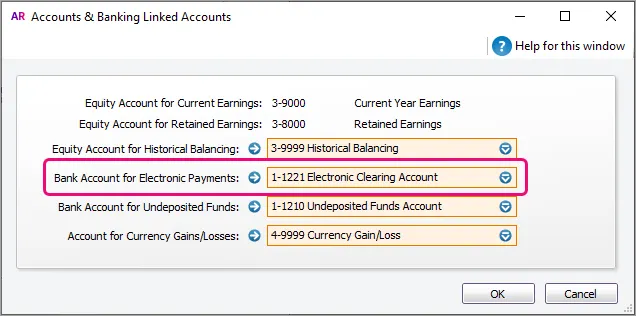

You'll also need to make sure this account is set as the linked account for electronic payments (Setup menu > Linked accounts > Accounts & Banking Accounts). This just ensures that your electronic payments work correctly behind the scenes in AccountRight.

3. Enter your suppliers' and employees' bank account details

To pay funds into a supplier's or employee's bank account, you'll need to enter their bank account details in AccountRight.

To enter a supplier's bank account details

Go to the Card File command centre and click Cards List. The Cards List window appears.

Locate the supplier you pay electronically and click Edit. The Card Information window appears.

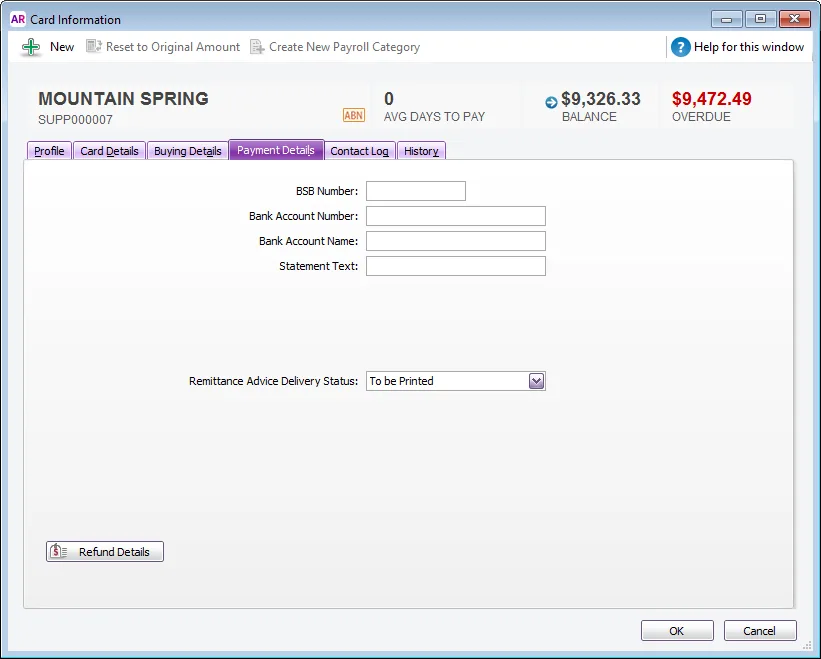

Click the Payment Details tab.

Enter the supplier’s bank account details.

In the Statement Text field, type the text you want to appear on your supplier’s bank statements. For example, you may want the text ‘monthly rent’ to be shown on your real estate agent’s bank statement since this will be a recurring transaction each month.

Select the Remittance Advice Delivery Status. You can choose to print the remittance advice or email it directly to your supplier. Learn more about how to print or email remittance advices.

(Not Basics) Click Refund Details and enter the payment method by which the supplier refunds you and click OK. The Card Information window appears.

Click OK to return to the Cards List window.

Repeat from step 2 for each supplier you pay electronically.

To enter an employee's bank account details

Go to the Card File command centre and click Cards List. The Cards List window appears.

Locate the employee you pay electronically and click Edit. The Card Information window appears.

If you haven’t created a card for the employee, you can create one now by clicking New in the Cards List window and entering the employee’s details.

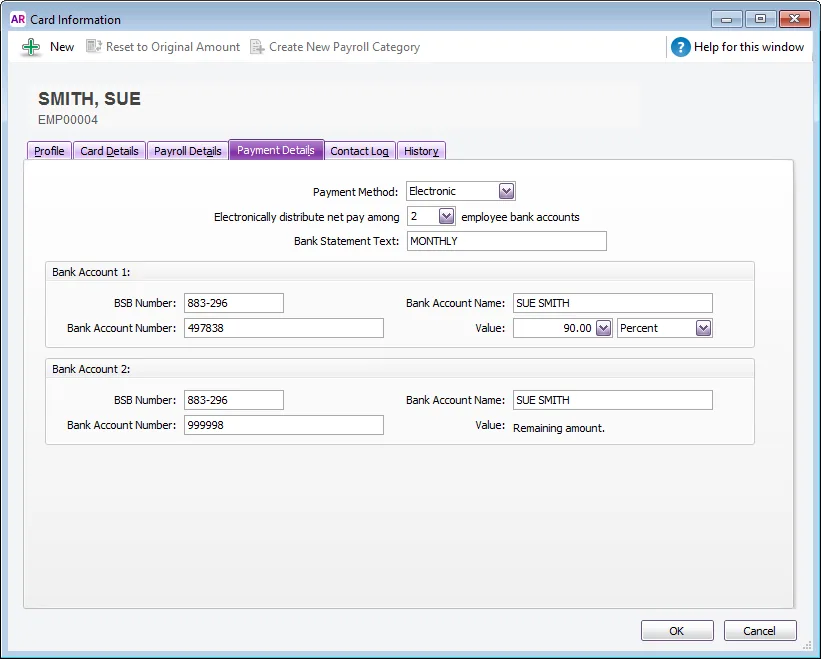

Click the Payment Details tab.

Select Electronic from the Payment Method list.

(Plus, Premier) Select the number of bank accounts (up to three) the employee wants their pay to be distributed to.

Enter the employee’s bank account details.

Type the statement text you want to appear on the employee’s bank statements, for example ‘monthly pay’.

(Plus, Premier) If you're distributing to more than one account, in the Value field, type the amount or percentage of the pay to be deposited into the account and select the distribution method (Percent or Dollar). Note that the final account will receive the remaining amount of your employee's net pay.

Click OK to return to the Cards List window.

Repeat from step 2 for each employee you pay electronically.

What's next?

After setting up and recording electronic payments, you'll be able to make electronic payments with a bank file.