AccountRight Plus and Premier only

Some employers allow employees to take time off instead of being paid overtime pay. To track time off in lieu (TOIL) hours entitled to employees, use the following information as a guide.

Setting up and paying TOIL

To pay an employee for TOIL, you'll first need to set up:

a wage category to show TOIL hours earned

another wage category to show TOIL hours paid

an entitlement category to keep track of TOIL hours owed (TOIL balance)

1. Create a wage category for TOIL earned

Go to the Payroll command centre and click Payroll Categories.

Click the Wages tab and then click New.

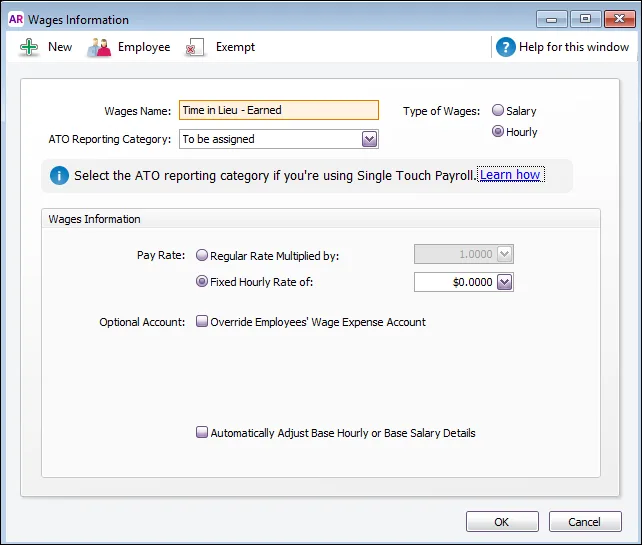

Name the new category Time in Lieu - Earned.

For the Type of Wages select the Hourly option.

If you report payroll information to the ATO through Single Touch Payroll, select the applicable ATO Reporting Category. Typically this will be the same ATO Reporting Category you've selected for your Base Hourly or Base Salary wage categories. Learn more about assigning ATO reporting categories for Single Touch Payroll reporting.

For the Pay Rate, select Fixed Hourly Rate of $0.00.

Click Employee and select all employees who are eligible for time in lieu and then click OK.

Click OK.

2. Create a wage category for TOIL taken

In the Payroll Categories List window, click the Wages tab, and then click New.

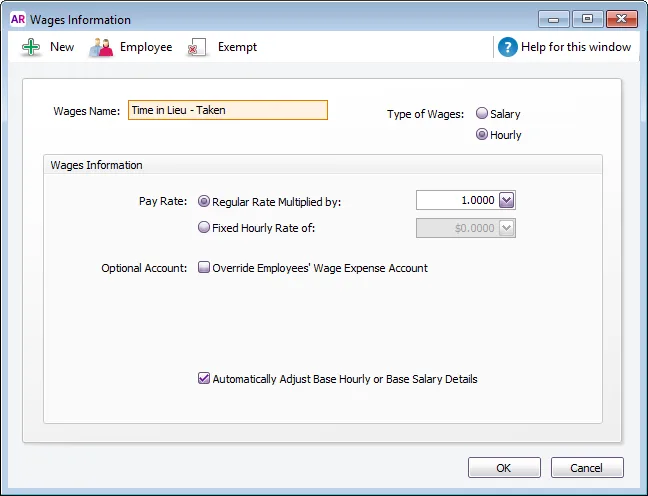

Name the new category Time in Lieu - Taken.

For the Type of Wages, select the Hourly option.

For the Pay Rate, select Regular Rate Multiplied by 1.0000.

Select the Automatically Adjust Base Hourly or Base Salary Details option. This will ensure that any hours allocated to this wage category will automatically be deducted from the employee's base wages.

Click Employee and select all employees who are eligible for time in lieu and then click OK.

Click OK.

3. Create an entitlement category to keep track of TOIL balances

In the Payroll Categories List window, click the Entitlements tab and then click New.

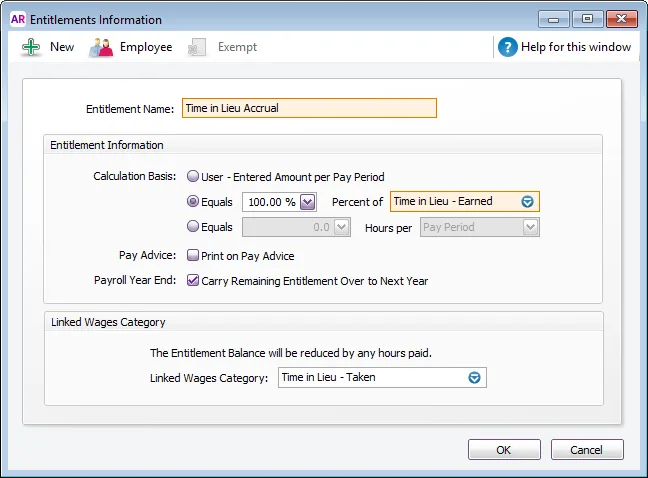

Name the new category Time in Lieu Accrual.

Set the Calculation Basis to Equals [100%] Percent of [Time in Lieu - Earned].

Set the Linked Wage Category to Time in Lieu - Taken.

(Optional) If you want accrued time in lieu to show on employee pay slips, select the option Print on Pay Advice.

(Optional) If you want accrued time in lieu to carry over each payroll year, select the option Carry Remaining Entitlement Over to Next Year.

Click Employee and select all employees who are eligible for time in lieu and then click OK.

Click OK.

4. Process a pay with TOIL

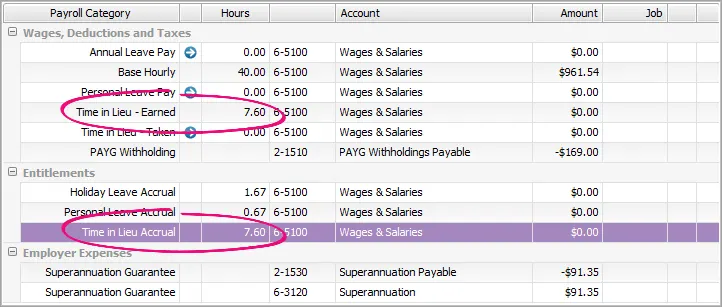

When an employee works overtime that will be paid as time off in lieu, enter the number of hours in the Hours column of the Time in Lieu - Earned wage category. The Time in Lieu Accrual entitlement will shows the same number of hours as being added.

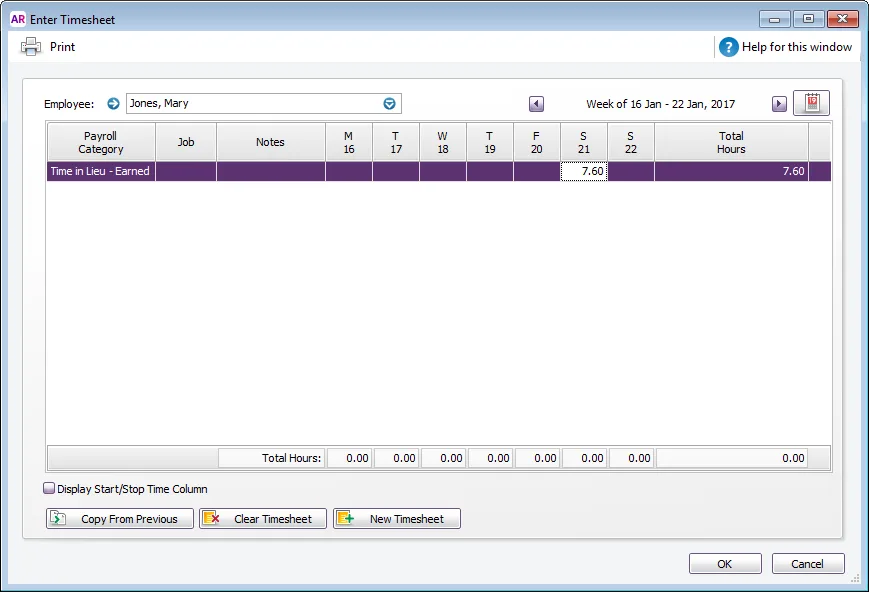

You can use timesheets to keep track of hours worked that will be paid as time in lieu.

When the employee takes the time off, you enter the hours taken in the Hours column of the Time in Lieu - Paid wage category. The Base Hourly amount automatically reduces by the amount of time in lieu.

FAQs

How can I see time in lieu activity (taken and earned) for an employee?

Use the Entitlements Balance [Summary] report.

Go to Reports menu > Index to Reports > Payroll tab > Entitlements group > Balance Summary.

How do I stop time in lieu from accruing leave entitlements?

If your industry award or employment agreement excludes leave from accruing on time in lieu payments, you can cater for this in AccountRight. If you're not sure if this applies to you, check with the ATO or the FairWork Ombudsman.

To stop leave from accruing on time in lieu:

Go to Payroll > Payroll Categories > Entitlements tab > open the leave entitlement category.

Click Exempt.

Select the Time in Lieu - Earned and Time in Lieu - Taken wage categories.

Click OK.

Repeat steps 1 - 4 for each type of leave you don't want to accrue on time in lieu.

How do I stop time in lieu from accruing superannuation?

If your industry award or employment agreement excludes superannuation from accruing on time in lieu wage categories, you can cater for this in AccountRight. For clarification on the payments that superannuation guarantee contributions are calculated on, see the ATO guidelines.

To stop super from accruing on time in lieu wage categories:

Go to Payroll > Payroll Categories > Superannuation tab > open the superannuation category.

Click Exempt.

Select the Time in Lieu - Earned and Time in Lieu - Taken wage categories.

Click OK.

Repeat steps 1 - 4 for each superannuation category you don't want to accrue on time in lieu.