In this article

Accepting payments over the phone may not seem like something a modern business needs to consider. But some customers may prefer — or have to — pay you over the phone. And, if you’re chasing late payers, taking phone payments means you may be able to get paid as soon as you call.

What are payments over the phone?

Payments over the phone let you complete a transaction on a call. Most commonly, your customer will share their credit card information for you to enter into your payment system.

Why take payments over the phone?

Taking payments over the phone may seem a bit outdated compared to online payments, but it may still be worth doing. Here’s why:

Convenience for customers

Convenience for customers is key. Offering more payment options means they can choose the method that suits them.

Improved cash flow

You may be able to improve cash flow with over-the-phone transactions, especially if a client isn’t paying their invoice. If you get a late payer on the phone, they may be able to settle the invoice immediately with a credit card.

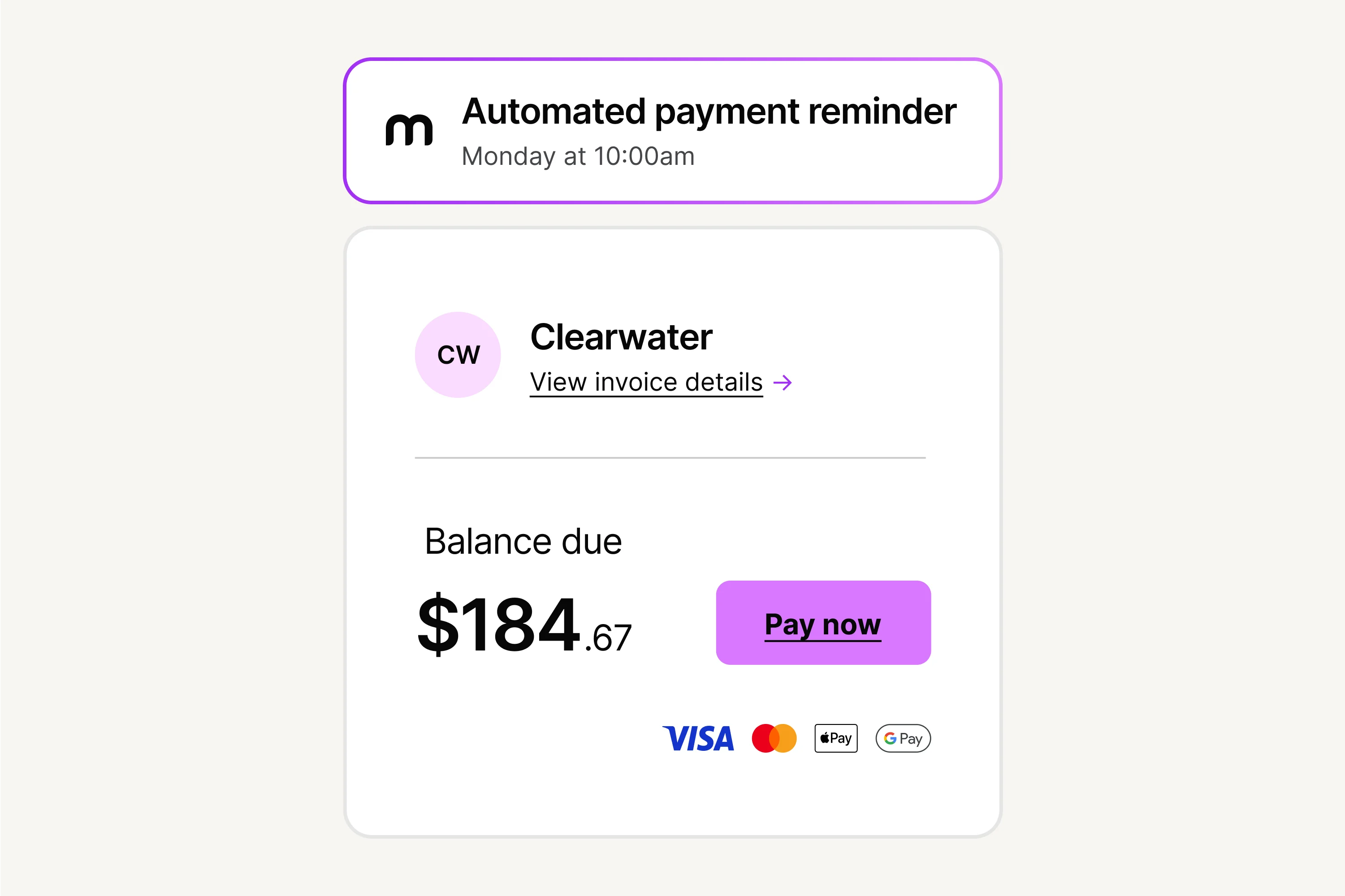

Tip: MYOB Business tracks invoices and payments and sends automatic invoice reminders for overdue invoices. This means you don’t need to spend your time chasing down late payers. MYOB can do this for you!

Increased scalability

You may be able to widen your customer base by taking phone payments. It means you can sell to people who can’t or don’t want to pay online.

3 methods to take payment over the phone

There are three methods to take payments over the phone:

Input card details into a physical card terminal

If you have a physical card terminal, you can directly input the details. You’ll need the customer’s credit card details, including card number, expiry date and CVV code.

Use a payment processor with a virtual terminal

You can use a payment processor with a virtual terminal, which is a digital version of your physical point-of-sale terminal. You input the details into the system online, rather than into a physical machine.

Use a mobile payment processing app

With a mobile payment processing app, you can take payments on your mobile. You input the customer’s credit card details into the app, which connects to a payment gateway.

Tip: MYOB seamlessly connects with a range of point-of-sale solutions, including Lightspeed. This means you don’t need to spend time manually entering and reconciling sales data in your accounting software. You can spend less time on admin and more time growing your business.

With MYOB, you can also add a ‘Pay Now’ button to your invoices and accept online payments. This means your customers can pay you directly from the invoice, using their mobile devices. MYOB offers a bunch of payment options your customers can choose from: Apple Pay™, Google Pay™, VISA and MasterCard. ^

Risks and challenges of over-the-phone payments

Some risks and challenges of over-the-phone payments you should consider are:

Errors in manually entering card information

Errors are possible when manually entering card information. Get one digit wrong and you’ll get an error message, which may make things frustrating for your customers.

Fraud risks

Fraud risks are higher with over-the-phone payments. You can’t easily verify your customer’s identity, so there’s more chance you’ll let a fraudulent payment slip through.

Data security risks

Data security risks should be managed by ensuring your payment gateway complies with the Payment Card Industry Data Security Standard (PCI DSS).

TIP: Use MYOB Business. Our payments gateway is fully compliant with PCI DSS standards, so you can keep customer data safe and your money secure.

How to take payments over the phone

To take debit and credit card payments over the phone, follow these steps:

1. Decide on which method to use

Decide between the methods to use – payment app, physical card reader or online terminal.

2. Enter the customer’s card details

Enter customer details including card number, expiry and the card verification value (CVV). This is a three or four-digit number, usually found on the back of the card. Hit enter to submit the transaction for processing.

3. Confirm the payment

Confirmation of the payment will come through fast — the payment gateway will return an approved or declined message.

4. Send the customer a receipt

Send the customer a receipt once the transaction has gone through. Many payment processors automatically send a digital invoice to the customer via email.

What regulations need to be followed when taking payment over the phone?

The PCI DSS regulations you need to follow when taking payments over the phone protect your customers and your business. If you’re accepting credit card payments, your payment gateway must comply with the regulations, including the use of:

encryption technologies to scramble and secure data

Secure Socket Layer (SSL) certificates

SSL encryption

Two-factor authentication (2FA).

The simplest way to comply is to choose a PCI-DSS compliant payment gateway, such as the one offered free with MYOB.

How to accept payment over the phone FAQs

Is taking payment over the phone safe?

Yes, taking payments over the phone is usually safe, as long as you have the right security measures in place to protect customer data..

What is the best method of accepting over-the-phone payments?

The best method for accepting over-the-phone payments depends on which suits you and your customer best. For example, you may need a physical point-of-sale terminal if you make sales in store as well as over the phone. Otherwise, a mobile payment processing app may be all you need.

What are the available alternatives to taking over-the-phone payments?

There are many available alternatives to taking over-the-phone payments, including bank transfers and e-commerce checkout gateways.

Tip: If you’re running an online store, you can integrate MYOB Business, MYOB AccountRight and MYOB Acumatica with some of the most popular e-commerce software. This gives you a complete business management platform.

Workflow automation means that each sales order can trigger inventory updates, notify your warehouse, send shipment information to your customer and update your financials.

Get ready to ring in your payments

With MYOB, you can connect your point-of-sale software and accept payments over the phone if that suits you and your customers. If you send invoices, you can add a ‘Pay Now’ button to them. This will let your customers choose from a range of online payment options, so they can pay in just a few clicks.

Sign up today and get paid faster with MYOB.

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.

^ Applications for online invoice payments are subject to approval. Online invoice payments in New Zealand is managed by MYOB and delivered by Stripe. Fees apply when clients pay their invoices with online invoice payments i.e. 2.7% + $0.25c per transaction. No set up or cancellation fees. Rate applies to VISA, MasterCard, Apple Pay and Google Pay transactions.