If your tax return is late or overdue, the penalty can be substantial and there may sometimes be legal consequences. It’s an expensive, stressful and surprisingly easy mistake to make. That’s why having a good handle on what happens if your tax return is late or overdue is important.

What is an overdue tax return?

An overdue tax return hasn’t been filed in time to meet the due date specified by Inland Revenue (IRD).

What is the penalty for not filing or paying your taxes on time?

The penalty for not filing or paying your taxes on time depends on the type of return due and your overdue return. By law, you must file tax returns by their due dates unless you have applied for an extension of time (EOT) with the IRD. To find out when each return needs to be filed, you can search the IR database of key dates.

Which types of unpaid or overdue taxes are eligible for penalties?

Several types of unpaid or overdue taxes are subject to penalties in New Zealand. These include:

Income tax returns (IR 3 and IR 4)

Income tax returns that are unpaid or overdue are eligible for penalties based on your net income.

Employment information (IR 348)

If you don’t file your employment information online when you should, the IRD may charge a non-electronic filing penalty.

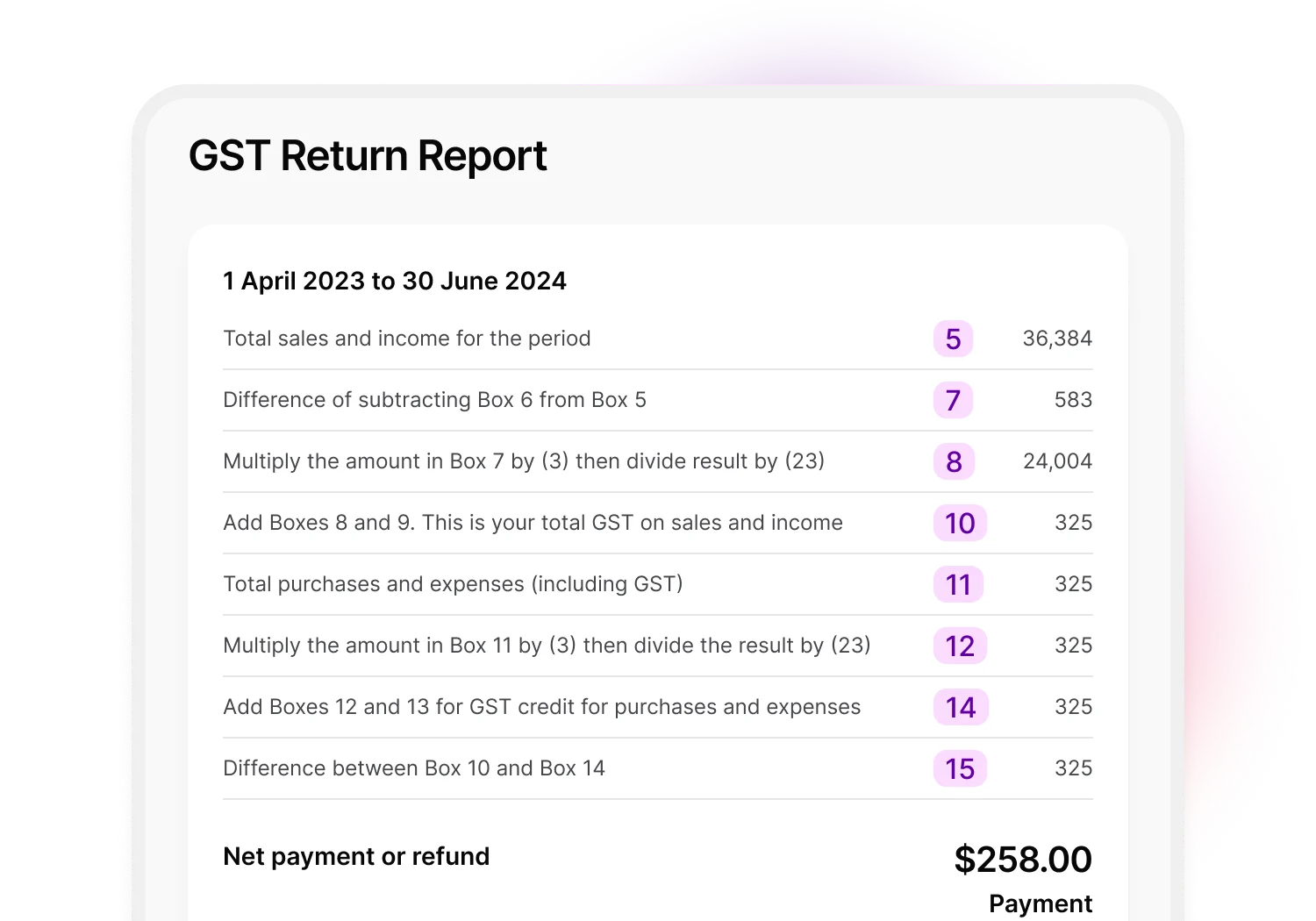

GST returns (GST 101 and GST 103)

GST returns are subject to late filing penalties. When your GST return is due depends on whether you use accrual or cash accounting.

Residential land withholding tax

Residential land withholding tax is deducted from some property sales and paid to the IRD. Failure to pay this tax or not paying it on time results in penalties.

Tip: Use MYOB Business to calculate and lodge GST and PAYE with IRD automatically. The GST software records and prefills your report — you just review it and hit send. This saves you time and helps ensure you’re never late again.

Penalties associated with overdue tax returns

The IRD charges penalties associated with overdue tax returns starting from the day after your payment was due. This is broken down into three stages:

A 1% penalty will be charged the day after the payment due date.

4% penalty for remaining tax (including penalties) on the seventh day after the payment due date

1% penalty every month the remaining tax (including penalties) is unpaid.

If your tax is being reassessed, the IRD will set a new due date and in some cases, the IRD may waive these penalties.

Are there legal consequences for overdue or late tax returns?

There can be legal consequences for overdue or late tax returns, as failing to lodge them is a criminal offence. In severe cases of non-compliance or tax evasion — including not keeping the correct records for your business, providing false or misleading information or manipulating sales data — you could be prosecuted by the IRD and fined or imprisoned.

How do I get up to date on tax returns?

You can get up to date on outstanding tax returns by contacting the IRD and having your IRD number handy or logging into your MyIR account. You can see what tax returns are overdue and work through the requirements from there. Alternatively, contact a registered tax agent who can help you navigate the entire process and liaise with the IRD on your behalf.

Overdue tax return FAQs

Am I liable for an overdue tax penalty if I have engaged a tax agent?

Even if you have engaged a tax agent, the ultimate responsibility is yours. However, tax agents can qualify for extensions on deadlines. If they’ve told the IRD about any issues that have caused a delay, your penalties can be waived.

Can I lodge a tax return from 10 years ago?

You can lodge a tax return from 10 years ago. However, penalties and interest are likely to apply for late lodgement.

Do I need to lodge a tax return if I didn’t earn over the past 12 months?

You don’t generally need to lodge a tax return if you didn’t earn an income or have other tax obligations. However, if you’re a provisional taxpayer, you may still need to file a return. It’s best to double-check with the IRD.

Never miss a return again with MYOB

Tax returns are daunting enough without adding the pressure of penalties and potential legal consequences. Fortunately, keeping the IRD happy with accurate returns and prompt payment is easy with MYOB accounting software on your side.

You’ll never miss a return again. Get started today.

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.

MYOB is not a registered entity pursuant to the Tax Administration Act 1994 and therefore cannot provide taxation advice to clients. If you have a query concerning taxation including filing your GST returns or annual tax statements, then you should consult with your accountant or other registered tax adviser.