AccountRight does a great job of keeping accounting jargon behind the scenes, so you don’t have to worry about debits and credits, and other accounting principles and rules.

But if you’re a bookkeeper, or you like to check what's happening under the hood, you might want to know what happens to Receive Items transactions when a supplier bill is received. If the supplier bill contains a different price to what you've previously recorded, you might also notice some differences in amounts when checking transactions (using the Recap feature) against transaction journals.

These price differences are nothing to be concerned about — recapping a transaction uses the latest item price, while transaction journals use the cost of items at the time a transaction was entered.

Let's take a look at an example:

When you purchase an item, the average cost and quantity is updated..

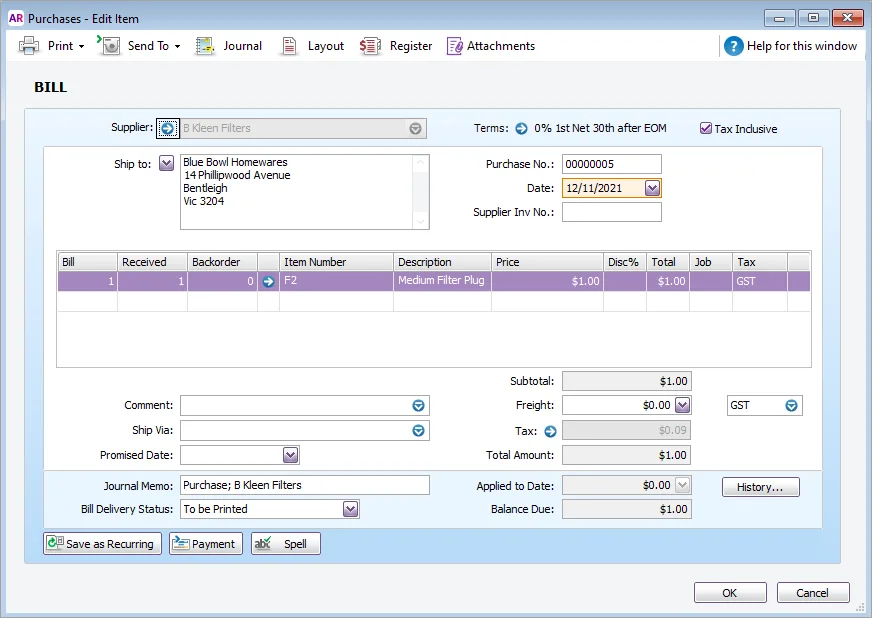

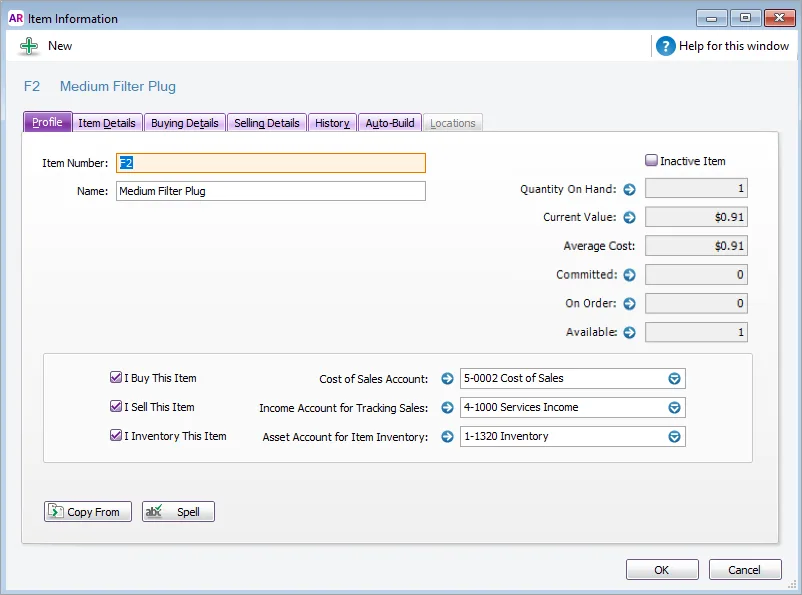

You purchase an item that costs $1:

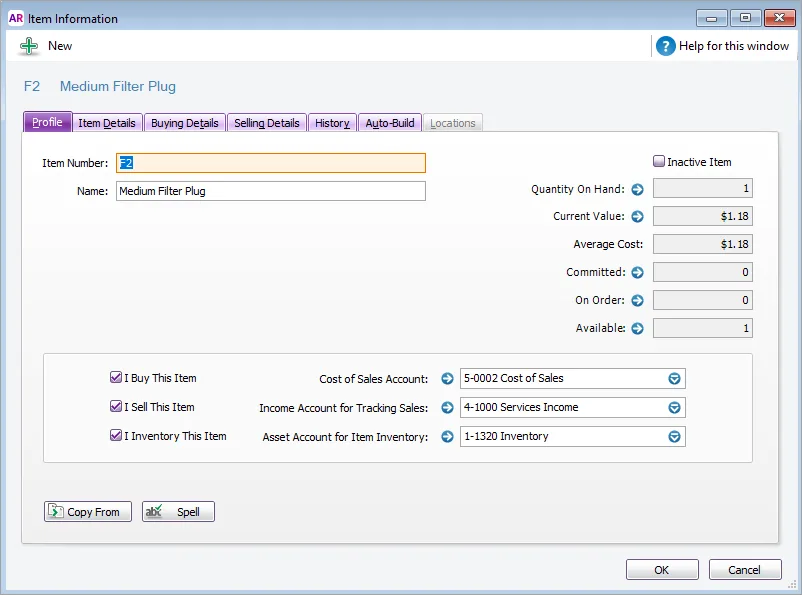

When you record the purchase, the Quantity On Hand goes up by one and the Average Cost (the Current Value divided by the Quantity On Hand) of the item is set at $0.91:

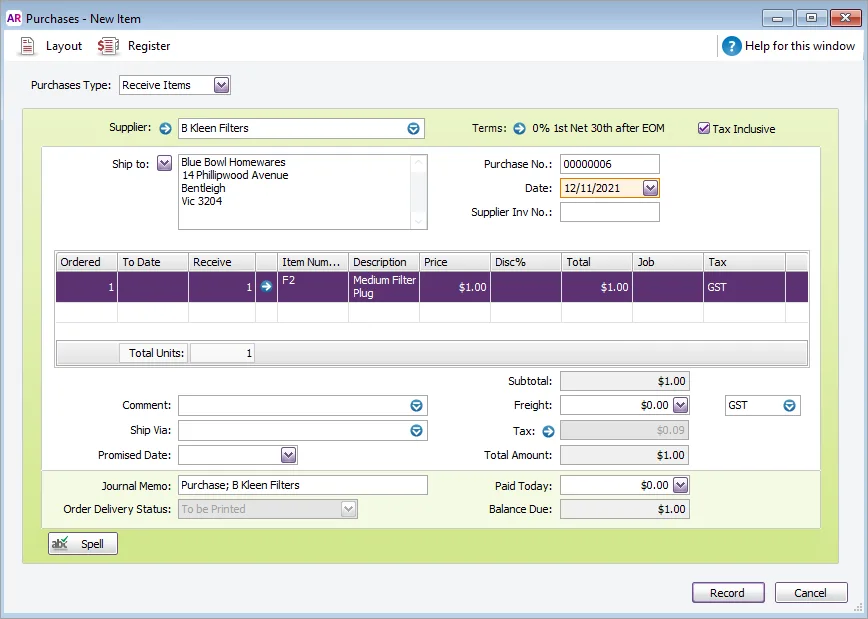

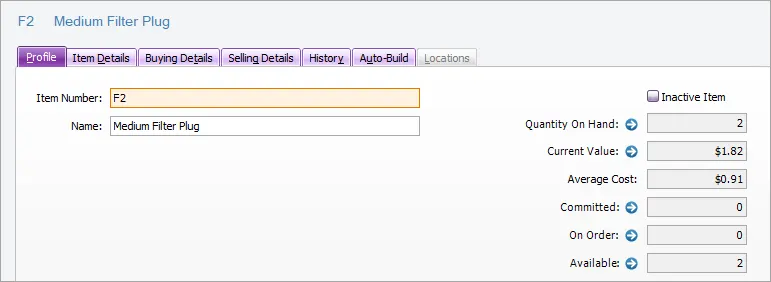

You receive another of the item (without a supplier bill), the quantity and value increase...

Another item arrives, this time without a supplier bill. You record a Receive Item purchase for this and the Price you use is the last purchased price:

When you receive the item, the Average Cost stays the same, but the Current Value and Quantity On Hand has gone up:

You sell one of the item, the sale reflects the current item cost...

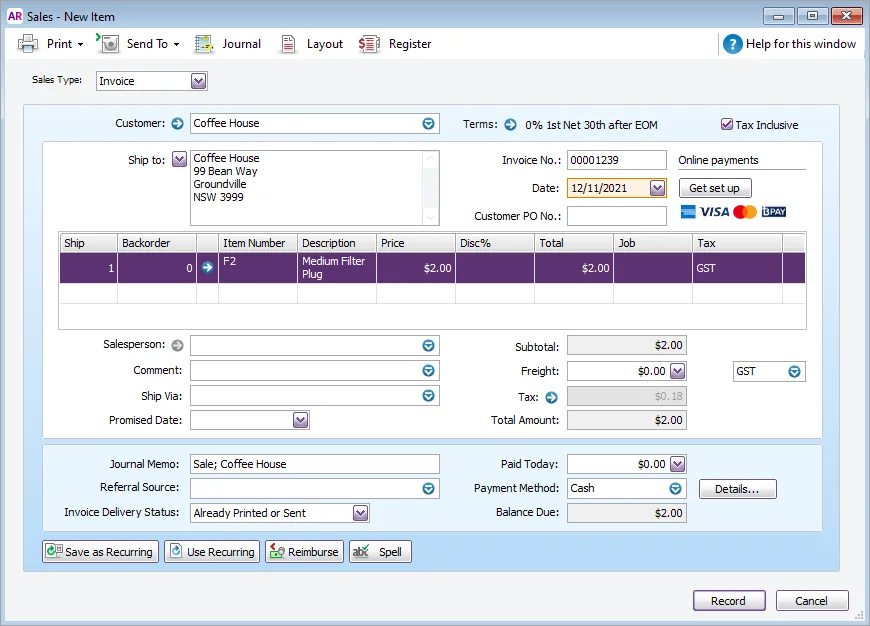

You sell one of these items (and you still haven't received a supplier bill for the second item you received):

Recapping the transactions shows average cost of the item being $0.91c:

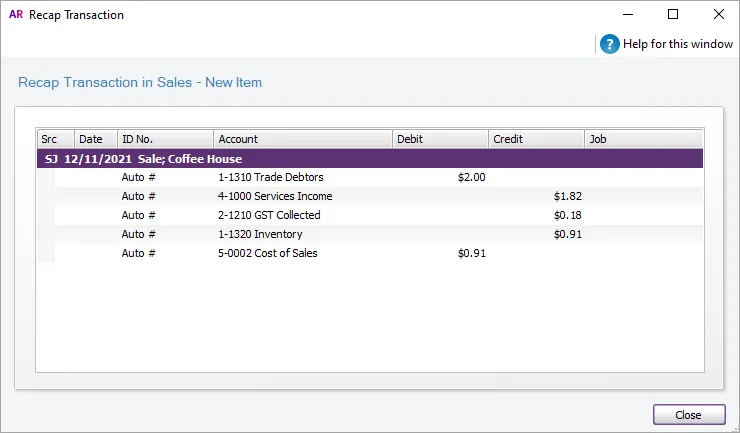

and the Transaction Journal shows the same costs:

You convert the Receive item purchase to a bill - and update the price, average cost increases to reflect the price increase...

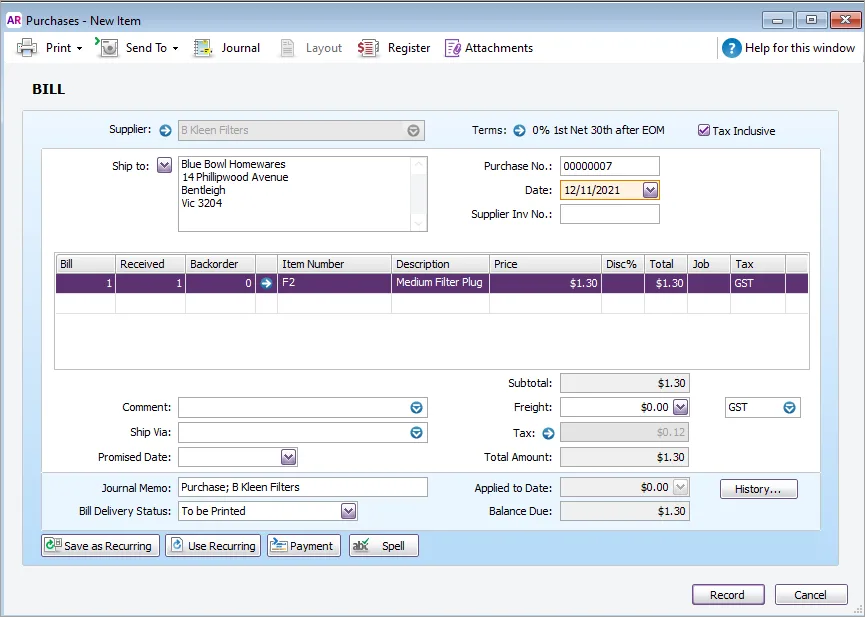

The supplier bill arrives with the confirmed cost. You convert the Receive Item purchase to a bill, but update the item price from $1 to $1.30:

After recording the bill, the Average Cost gets recalculated to $1.18:

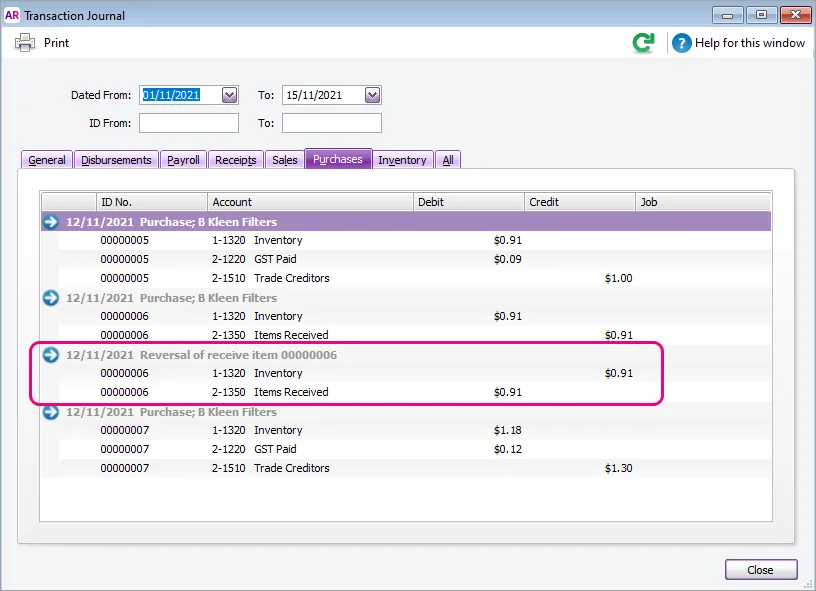

...and the Receive Item gets automatically reversed:

This is an automatic system reversal that happens even if the security preference, Transactions CAN'T be Changed; They Must be Reversed is not selected.

The price change appears when you recap the sale, but not when viewing the sale in the Transaction journal...

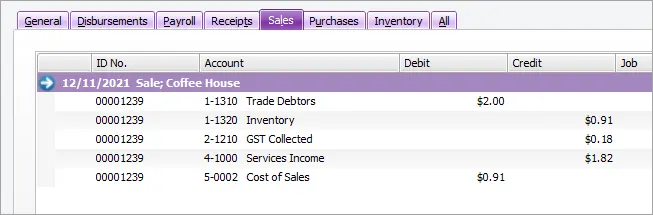

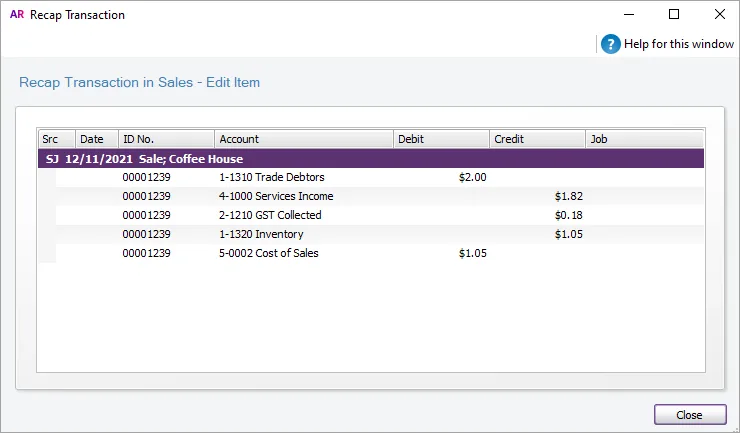

If you open the sales invoice and recap it, the Inventory amount has increased from $0.91 to $1.05:

This reflects what would happen if you were to record this transaction now — if you click OK in the invoice, the new costing would be applied.

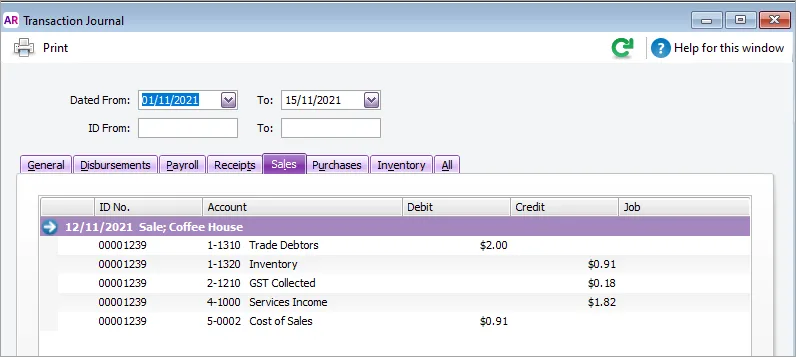

The Transaction journal window still reflects the original inventory cost (before the Receive item was converted to a bill with a higher item cost):

The difference between Inventory price in the recapped sale and the Transaction journal is expected AccountRight behaviour, as recapping a transaction applies the latest costings, while the Transaction journal is a record of transaction entries at the time.