When you've found a client's Data reconciliation entry, you can click the row to open the entry page.

When you open a client’s Data reconciliation entry by:

-

selecting All clients in the client side menu and going to Tax > Data reconciliation, this opens the entry for the period displayed in the Period column

-

selecting a client in the client side menu and going to Tax > Data reconciliation, this opens the current period for the client.

You can use the Period drop-down in the opened entry to open a different period.

The page displays the following information, if there's data available for that section.

Period summary | IR balance owing – The balance value from the IR data feed for the tax type and period. Total IR assessment value – The total assessment value from the IR statements section of the page, for the tax type and period. Note that if the IR balance owing and Total IR assessment value fields have no value, the fields won't show any value and will appear empty. The fields will only show a value of $0.00 if the fields have a value of 0, rather than no value. |

|---|---|

Unreconciled transactions | Displays all unreconciled transactions. If there are any new transactions to reconcile, you'll find them here. See Receiving your client's IR data below to learn more about when we receive IR data. |

IR Statements | Shows a client's expected payments to Inland Revenue, including: assessment transactions for expected provisional or terminal tax amounts penalties incurred for late payments interest incurred for late, underpayments, or missed payments. You can select the Group by transaction type checkbox to sort the statement rows into collapsible groups, or leave it deselected to display the statement rows in date order. |

Reconciled transactions | Reconciled transactions are grouped together in this section. If you notice a mistake in a group of transactions, you can unreconcile them. The transactions move back to the Unreconciled transactions section, where you can fix the mistake by reconciling them again. |

Receiving your client's IR data

We check for new Inland Revenue (IR) transactions every day, using IR's Transaction data services (TDS) feed. Any new IR transactions will automatically appear in your client's Data reconciliation page, ready for you to reconcile.

-

A client must be a Tax client to receive their TDS data.

-

TDS now uses a request model.

When we receive the data

If a client's account has had any activity since we last received the data, we receive transactions for the client from IR. Any new transactions are received after every business day. So if there are new transactions, you'll see the data on Tuesdays to Saturdays, unless it's after a public holiday.

If you don't want to wait for the data

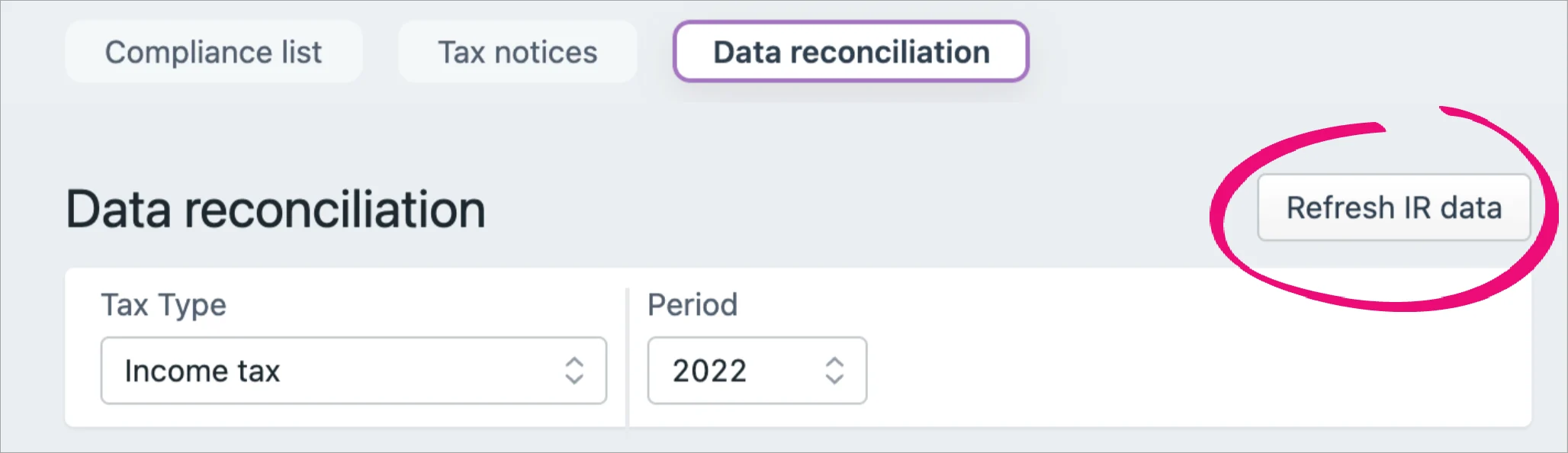

You can check for new transactions for all possible tax types (Income tax, Tax credits, Student loan and Working for families) at any time. Just click Refresh IR data on the top right of the Data reconciliation page.

Manually refresh IR data

Search and select the client on your client sidebar.

Click Compliance on the top menu bar and select Data reconciliation.

Click Refresh IR data.