How you include PIE income, and whether you need to, depends on the tax year and return type.

In some cases, we'll automatically create the Portfolio investment entities (PIE) income schedule with pre-populated data. Otherwise, you can manually add and complete the PIE schedule.

Add a PIE schedule

If your client has PIE income, but doesn't have pre-populated data in their return, manually add the Portfolio investment entities (PIE) income schedule into the return.

Enter PIE income and credits into a schedule for a 2021 IR3 onwards

Learn more about the PIE income calculation legislation changes for refunding overpaid PIE tax in IR3, in IR's Tax Information bulletin (page 32).

For 2021 returns, you'll calculate the PIE income using a different calculation to the rest of the IR3 return. The result will be included in the final tax calculation.

In the Tax return page, click Tax workpapers & schedules to expand.

Click the Portfolio investment entities (PIE) income schedule to open it.

The schedule page opens in a new tab.

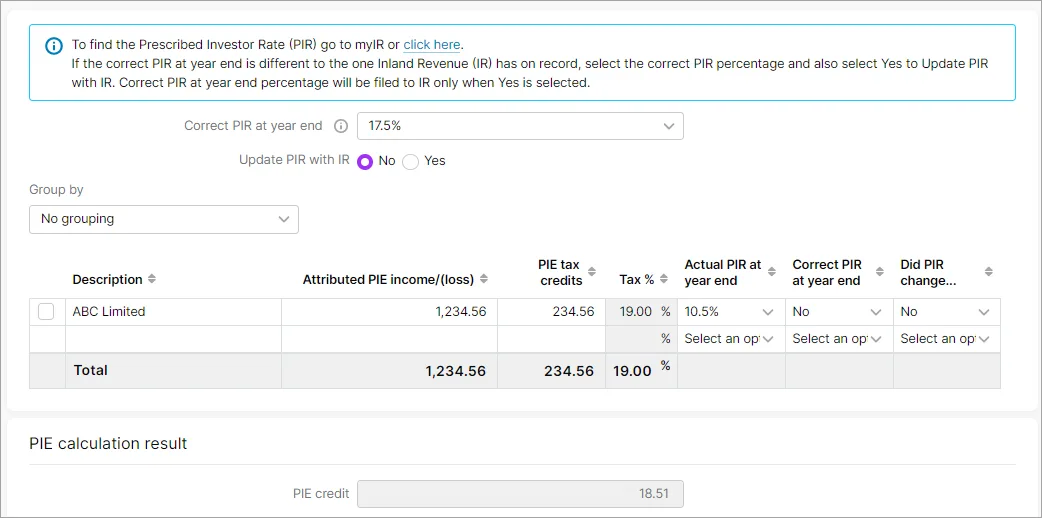

To find your client's PIR, you can look in myIR or use the IR’s find my prescribed investor rate tool.

On the Portfolio investment entity (PIE) income page, click the Correct PIR at year end drop-down and select the relevant option.

2023 returns onward: If you want to file the Correct PIR at year end percentage to IR, select Yes at Update PIR with IR. You only need to do this if the rate is different to what IR currently has on record.

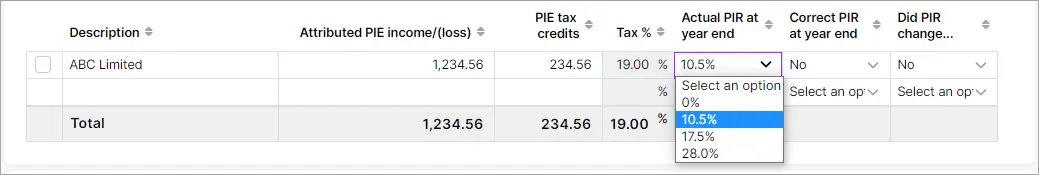

In the table, select the relevant option in these three fields:

Actual PIR at year end

Correct PIR at year end

Did PIR change during the year?

The calculation will appear in PIE calculation result:

If the result is a PIE debit, it'll be added to the tax to pay.

If the result is a PIE credit, it'll be deducted from any tax to pay.

To learn more, check out IR's help page and factsheet for New Zealand residents.

Enter PIE income and credits into a schedule for IR3NR, IR4, IR6, IR7 or a 2020 IR3

-

Before 2023, if PIE is needed, you can manually add it and enter income and tax credits.

-

From 2023 onwards, PIE income and tax credits are pre-populated.

-

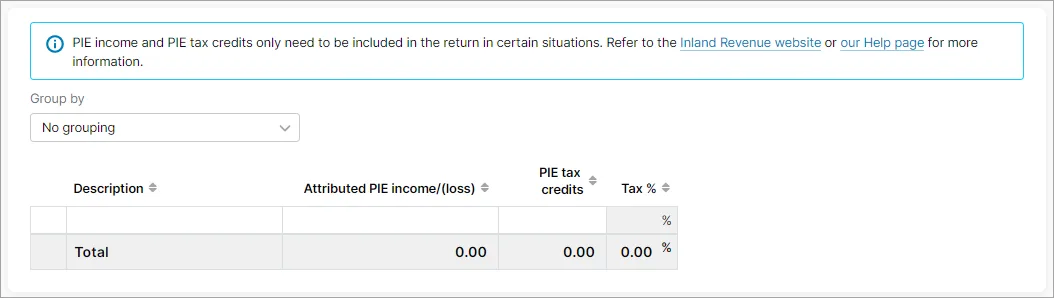

PIE income and tax credits only need to be included in specific situations. You may need to delete the PIE data from the field in the return or delete the PIE schedule if:

-

PIE tax credits are negative

-

PIE tax credits have already been deducted at the correct PIR for the full year. Check your client's PIR in myIR or use IR’s find my prescribed investor rate tool.

-

-

PIE income and tax credits get included with the standard income and tax credits in the return. PIE income will be taxed at the relevant rate for the return type. For example, PIE income in an IR6 will be taxed at 33% when it needs to be included in the return.

In the Tax return page, click the Tax workpapers & schedules to expand it.

Click the Portfolio investment entities (PIE) income schedule to open it.

The schedule page will open in a new tab.

In the table, enter the relevant information into the fields. You can only enter a positive PIE tax credit amount for IR3NR, IR4, IR6 and IR7 returns. If you have a negative amount, review whether you need to include the PIE income and tax credits from that source:

Description

Attributed PIE income/(loss)

PIE tax credits.

Return type | Requirements for entering PIE income and PIE tax credits |

|---|---|

IR3 (2020) | You only need to enter the PIE income and tax credits in specific situations. Check IR's help page or factsheet for New Zealand residents to see if this applies to your return. If you enter PIE tax credits, you can’t claim more than the allowable amount. If you file the incorrect amount to IR, the return will be rejected with a 2011 error. Use this formula to calculate how many PIE tax credits your client is eligible to claim: [(tax on taxable income/taxable income) x PIE income] |

IR3NR | You only need to enter the PIE income and tax credits in specific situations. Check IR's help page or factsheet for non-residents to see if this applies to your return. Use this formula to calculate how many PIE tax credits your client is eligible to claim: [(tax on taxable income/taxable income) x PIE income] If the PIE tax was taxed at the incorrect PIR rate, any shortfall is required to be paid. Notify IR via secure mail of any underpayment. |

IR4 | You only need to enter the PIE income and tax credits in specific situations. Check IR's help page or factsheet for companies to see if this applies to your return. |

IR6 | You only need to enter the PIE income and tax credits in specific situations. Check IR's help page or factsheet for trustees to see if this applies to your return. Any PIE income that is allocated as beneficiary income is taxed at the marginal rate. It is not included in the PIE calculation in the individual's tax return. For more information, refer to the Information handling section of IR's help page. |

IR7 | In most cases, PIE income shouldn't be entered in the IR7 return. The partners should have provided the PIE their own IRD number, and any income should be entered directly in the receiving partner's return. For more information, check IR's help page on PIE for partnerships and the Joint investments and partnerships section of IR3's fact sheet. |