Before you can prepare a tax return, tax notice or reconcile data for a client, you need to configure their Tax settings. Settings you change here will apply to Practice Compliance only.

If you've upgraded from MYOB AE/AO Tax, then we've imported your client's phone number, address, IRD number, family group and associations details into Practice Compliance.

A client must be a Tax client to prepare tax notices and retrieve Inland Revenue data for them.

Year-based compliance details

The Agency, Return required and Extension in the Year-based tax details section roll over from the previous tax year. The other year-based options will reset to the default. It's a good idea to check all compliance settings before you start a tax year.

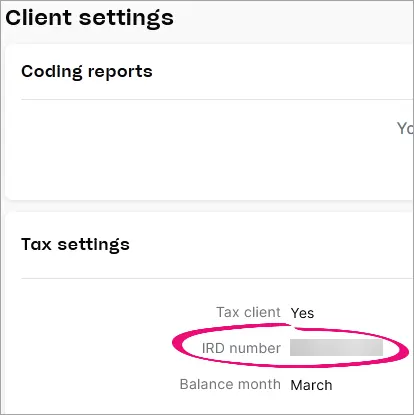

IRD number

You can also use the Tax settings to check a client's IRD number by selecting a client on the client side menu, and click the Settings icon (the grey cog) on the top right of the page.

There are also a couple of other ways that you can check IRD numbers.

Configure your client's Tax settings

The option for the 50/50 split for provisional tax instalments is found in the Year-based tax details section of the following steps.

Select a client on the client side bar, and click the Settings icon (the grey cog) on the top right of the page.

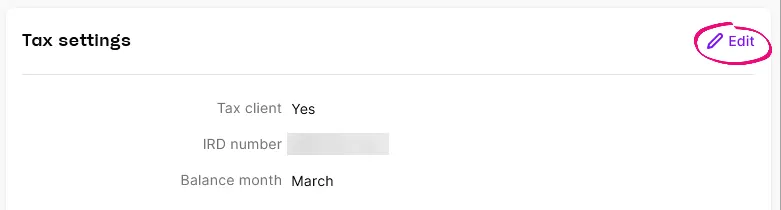

Under Tax settings, click Edit. The fields in the Tax settings become editable.

Edit the required fields:

Tax settings:

Tax client – Answer Yes if you'll be filing this client's tax return, if you want to create tax notices for this client or you want to receive IR data for this client.

IRD number – The client's 8 or 9-digit IRD number.

Balance month – The last month in your client's accounting year.

GST details:

If you use MYOB AE/AO, GST details are imported from AE/AO when you migrate to Practice Compliance. You can edit the details here, but they won't sync back to AE/AO.

GST Registered – Lets you identify which clients are registered for GST.

Agent prepares GST – Lets you identify if the agent prepares GST for the client.

GST taxable period – How often you file your GST returns. This value isn't automated or updated from IR. You need to set this if you want to create tax notices for this client.

Last month of GST period – Use in combination with GST taxable period to help you keep track of when GST returns are due. This value isn't automated or updated from IR.

Entity details – Entity-specific settings.

Trustee income is taxed depending on the type of trust and income amount.

For IR6 trusts with 2025 tax notices or later, for deceased estates, you must enter the estate start date for the correct rate to be applied. For all other trusts, the start date is optional.

For the Year-based tax details, select the year for which you want to view the client's tax settings and complete the year-based tax fields as required. You need to set these if you want to create tax notices for this client for the relevant tax year.

If you change year-based settings for one year, then select a different year and change those year-based settings, Practice Compliance will remember and save the settings you changed for all years when you click Save.

Initial provisional tax liability – Select Yes if this is the first year the taxpayer started to derive assessable income from a taxable activity. If you answer Yes, enter the Start date of taxable activity in the field that appears.

When you file the return, the setting for the start date of taxable activity is sent to IR along with the total provisional tax amount.

Eligible for a 50/50 split of provisional tax in 20xx? – Select Yes if you want the client to pay provisional tax across two equal instalments instead of the usual three instalments.

The 50/50 split is also reflected in the tax return page and in the tax statement. If a tax notice or return already exists before you select Yes for this setting, the split is only reflected in the notice or return if they are still in progress and aren't locked.

When you file the return, the 50/50 split setting isn't sent to IR.

Agency – select the tax agent you want to use to file the tax return.

Return required – answer No if a tax return is not required to be filed this year.

Extension – answer Yes if your client's due dates for filing returns and paying terminal tax have been extended.

L letter – answer Yes if this client has been issued an L letter.

D letter – answer Yes if this client has been issued a D letter.

When you're done, click Save.

If you changed the GST taxable period, Balance month or Extension, read the confirmation dialog and click Confirm.

For ways to find clients with incorrect settings for tax notice creation, see Make sure the tax settings allow tax notice creation.

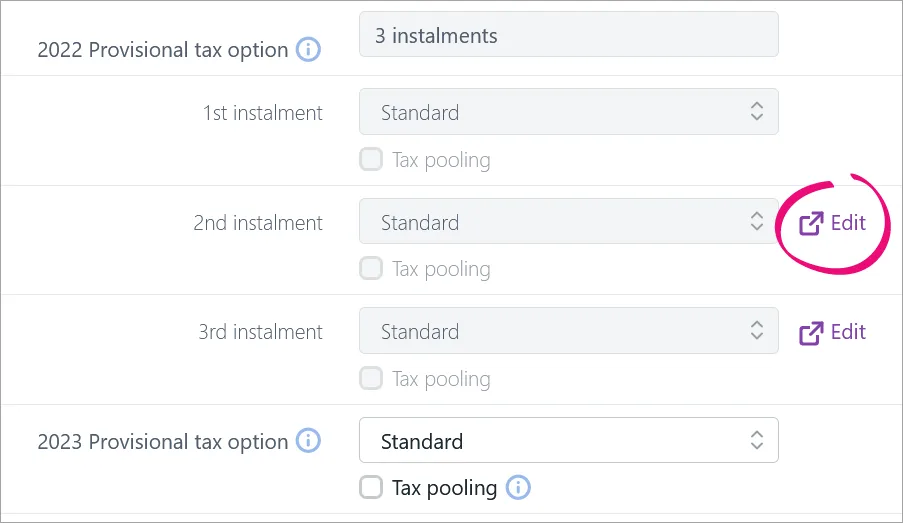

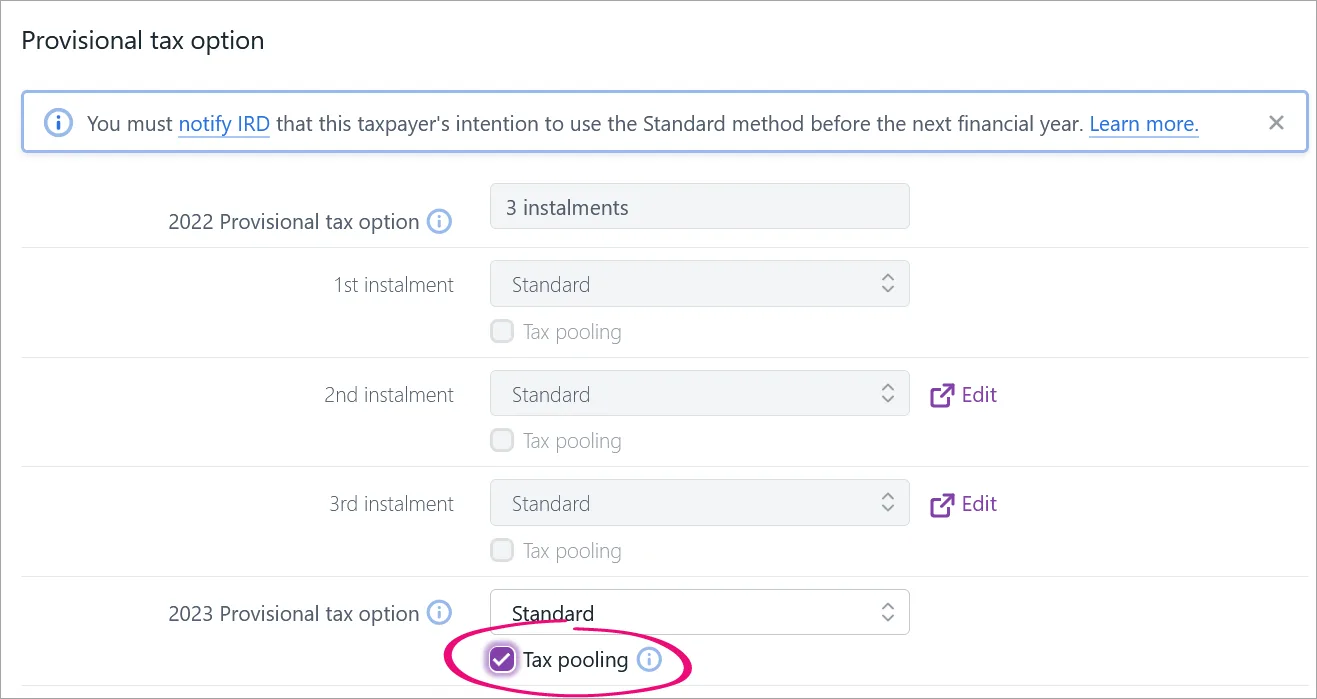

Update the provisional tax option

We'll create tax notices using the settings you specify here.

-

The option for the 50/50 split for provisional tax instalments is found in the Tax settings section.

-

If you want to change the settings for tax notice in the current period, you'll need to do so from within the tax notice itself.

Select a client on the client side menu, and click the Settings icon (the grey cog) on the top right of the page.

Scroll until you see the Tax notice settings, then click Edit.

To change the provisional tax option for the current year, click Edit to open the tax notice.

To change the provisional tax option for the following year, select the provisional tax option from the drop-down. Tax notices created for the following year will have this option selected by default.

If you want to pool instalments, select Tax pooling.

Click Save to save your changes.

Update the tax notice delivery preference

The Delivery preference is how you'll send tax notices to your client. If you choose portal, when you click Send to client from within a tax notice, you'll have the option to create a task for your client. If you choose Send manually, then you'll need to send the tax notice yourself via email, or other means.

Select a client on the client side menu, and click the Settings icon (the grey cog) on the top right of the page.

Scroll until you see the Tax notice settings, then click Edit.

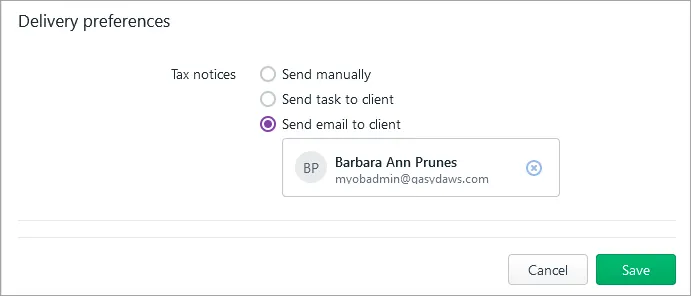

Under Delivery preferences, select either:

Send manually if you want to manually download tax notices to provide to your client via other means.

Send task to client to send tax notices to your client via the client portal.

A client must have a portal to select this option.

Send email to client and select the email address you want to send tax notices to.

Don't see the email address you want use? If you use MYOB AE/AO, you can add or update your client's email addresses in AE/AO (see To change a client's email address in AE/AO below).

Click Save to save your changes.

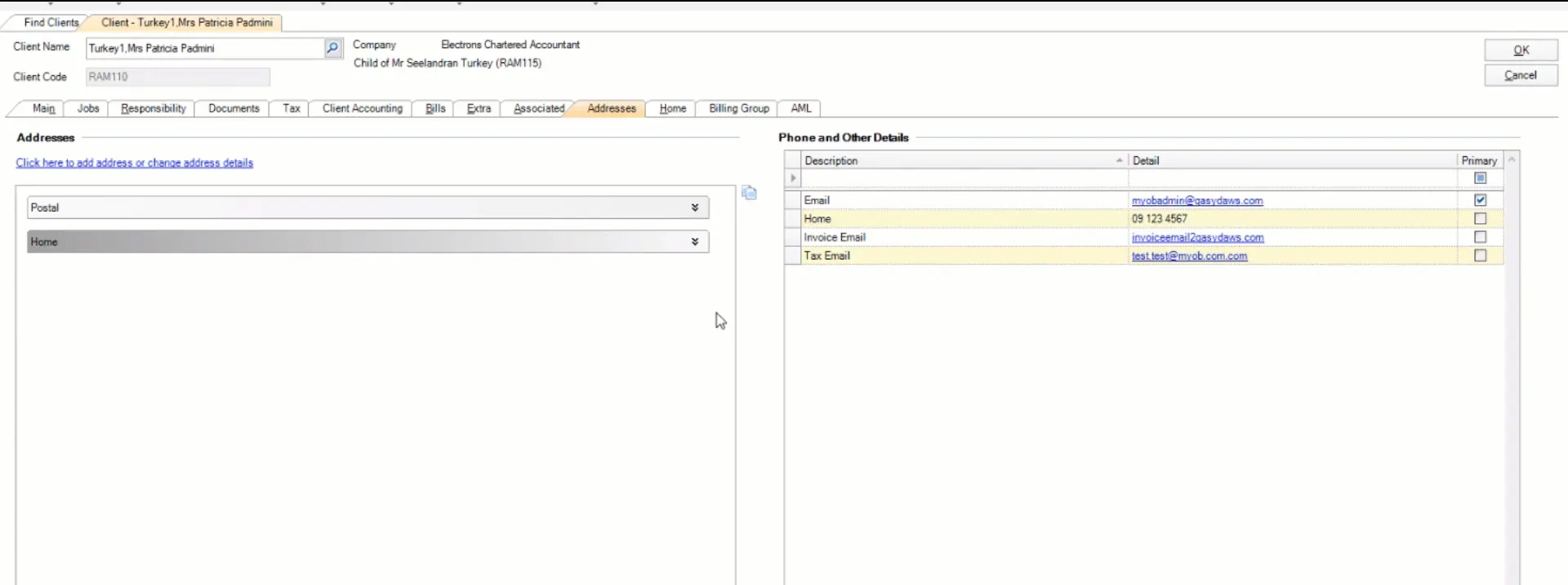

Change a client's email address in AE/AO

This information only applies if you have both MYOB Practice Compliance and MYOB AE/AO.

To add or change an email address in Practice Compliance, you need to edit the Tax Email or Email address in AE/AO.

In AE/AO on the desktop, select the relevant client and open the Address tab.

Under Phone and Other Details, select the row of the email you want to change.

Press Delete and select Yes in the pop-up window.

Under the Description cell, click the blank cell and a drop-down arrow will appear.

Click the drop-down arrow and select the relevant option.

Under the Detail cell, enter the new email address. Check that the email address is correct.

Press Enter to save the new email address.

To confirm the changes, in Practice Compliance, select the client, click the grey cog icon on the top right of the page and check the Delivery preferences) You should now see the updated email address.

For more tax setup topics, Setting up Tax in Practice Compliance.