Last updated 10 February 2025

Each month we release improvements, new features and bug fixes to MYOB Business. You'll also notice these changes if you use AccountRight in a web browser. If you use AccountRight desktop software, see what's new.

See what's new without leaving MYOB Business

Click the help icon and look for the What's new link at the bottom of the help panel.

What we released in January

Payroll

Quicker employee setup (New Zealand only)

If your business is set up for payday filing, new employee details are now automatically sent to Inland Revenue. This means you no longer have to also set up new employees in your myIR portal. There's a new tab in the Payday filing page to see your employee submissions. More about sending employee details to IR.

Security

Helpful nudge in reports before screen locks saves you having to sign back in

Five minutes before the inactivity screen lock, a message will appear at the top of any report you have open. This gives you a chance to resume working before the screen locks.

Banking

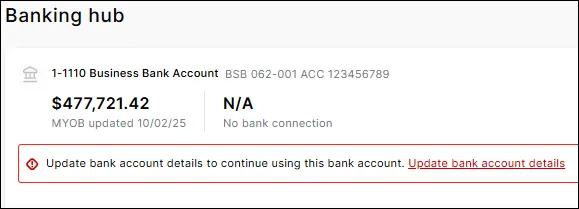

Helping you keep bank details up to date

You'll now see reminders in the Banking hub if any details are missing for your bank accounts, like the financial institution. This helps to keep your account details up to date and provides better visibility of your bank accounts in the one place.

Connect your Great Southern Bank Business + accounts (Australia only)

If you have a Great Southern Bank Business + account, you can now set up bank feeds for it in MYOB Business. You can apply via your internet banking. How to apply.

Previous releases

To learn about changes to MYOB Business in previous years, visit MYOB Business release history.