Payday filing lets you file employment and employee information to Inland Revenue (IR). For all the details on payday filing and your obligations, visit the IR website.

It only takes a few minutes to set up payday filing (we kid you not), and all you need is your business's IRD number and your myIR login.

What if I've recorded pays before setting up?

You’ll need to get that information to IR. You can do this by either deleting the pay then reprocessing it (after setting up payday filing), or manually entering the pay run information into myIR.

Before setting up

There are a few things you'll need to check before setting up payday filing.

Make sure you've got a myIR account for your business. Learn how to get one on the IR website.

Have the IRD number for your business handy.

Add all employees into MYOB and make sure they're also added into your myIR account. Employees must have the same name and details in both places to ensure they can be matched.

Who can set up payday filing?

The owner of the business's myIR account (this could be the business owner) should set up payday filing for the business. You can delegate someone to set up on your behalf – see Delegate others to submit payday filing.

Let's get started

To set up payday filing:

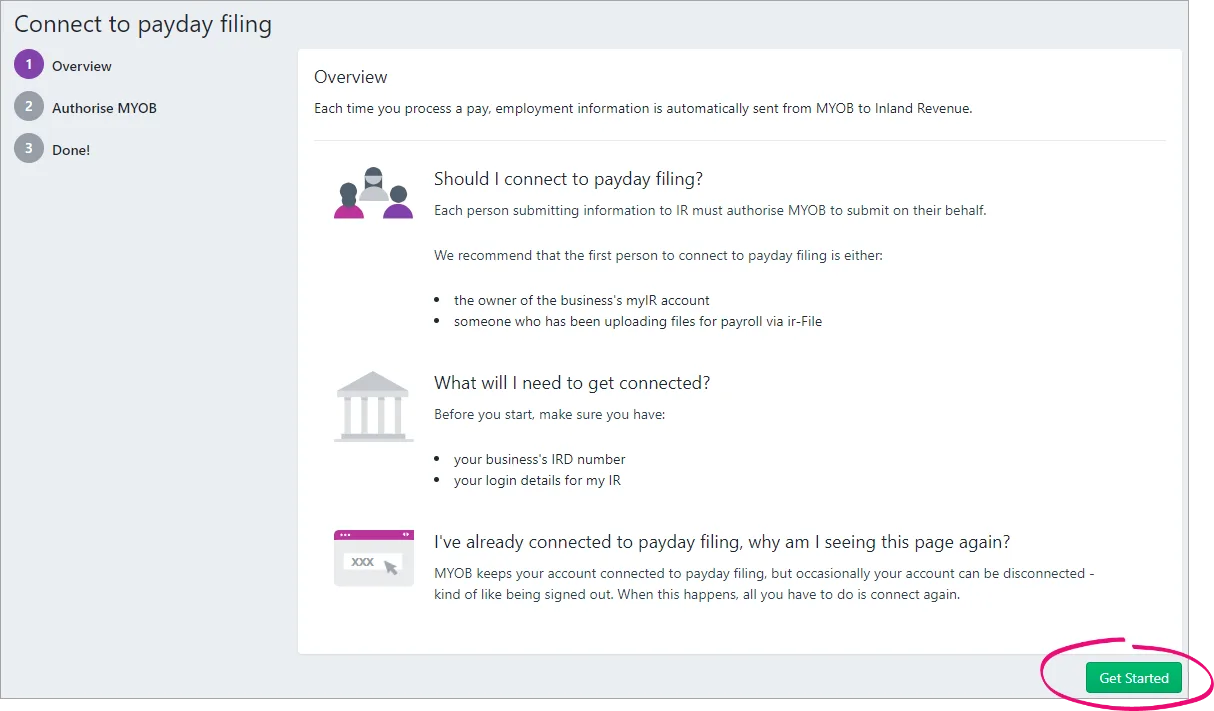

Go to Payroll > Payday filing.

Read the overview information, ensuring you know:

your business's IRD number

your login details for myIR

Click Get Started.

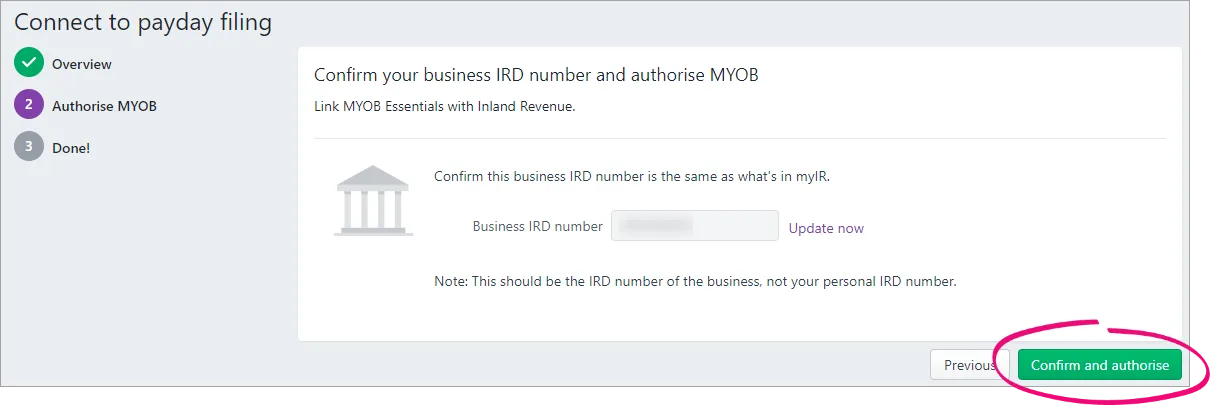

Check that the Business IRD number shown is correct. Remember, this is your business's IRD number, not your personal IRD number. If the number is wrong:

Click Update now to display your MYOB business details.

Change the IRD Number/GST Number.

Click Save.

Go back to Payroll > Payday filing, and begin the setup again.

At the Authorise MYOB step, click Confirm and authorise to open the myIR login page.

Enter your myIR user ID and password and click Login. Once the connection is complete, you'll see this confirmation screen:

What now?

Once your business is set up for payday filing, the person who set it up will be able to submit payroll and employee information to IR. Any other person who needs to do this must authorise MYOB to submit on their behalf.

Each time you process a pay, you’ll send your employment information directly from MYOB to IR. You can also check your payday filing submissions by going to Payroll > Payday filing. Learn more about Payday filing statuses and how to fix errors and rejections.

Also, when you add a new employee into MYOB Business, the employee's details will automatically be submitted to IR. More about sending new employee details to IR.

Re-authorising MYOB every 5 years

Under IR requirements, your payday filing authorisation must be renewed every five years. This means you might be prompted to re-authorise MYOB for payday filing even if nothing has changed in your setup. Re-authorisation may also be required if IR makes changes or if the authorisation is otherwise disconnected.