Pre-populating data from Inland Revenue

When you add a tax return, your client's Inland Revenue (IR) data gets downloaded and pre-populated into workpapers and schedules that Tax creates for you.

If you need help with a warning after pre-populating, see Fixing differences with Inland Revenue data.

About pre-populating your client's tax return

We’ll automatically create the schedules and workpapers when there’s data from IR available to use for pre-population. Check the table below for more information on which schedules and workpapers will pre-populate what type of data. This data will then integrate into the tax return.

You can edit or delete pre-populated information if it's incorrect or missing. If you need to pre-populate the data again, delete and add the tax return.

Pre-population happens only once – when you create the tax return. If Inland Revenue updates the pre-populated data after the tax return has been created, you'll need to manually update this data in your tax return to match IR.

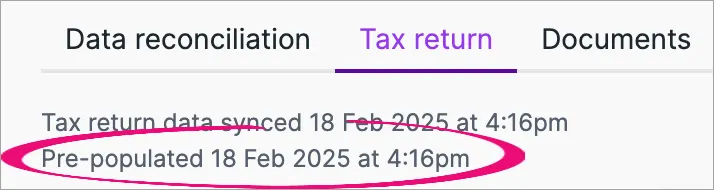

You'll see a message with the date and time that pre-populating data into a tax return is complete.

If pre-populating the data isn't successful, the date and time will be blank. You'll also see a message at the top of the return when the pre-population succeeds or fails, with more information to help you troubleshoot any issues.

You can also manually add tax workpapers and schedules.

Schedules and workpapers that get pre-populated from IR

Attachment or schedule | Income type description | Return type |

|---|---|---|

IR833 Property sale information | Sale of property details | IR3, IR3NR, IR4, IR6, IR7, IR8, IR9 |

IR4J Annual imputation return | Opening balance | IR4 |

IR8J Annual Māori authority credit account return | Opening balance | IR8 |

Dividend income | New Zealand dividends Non-resident dividends received | IR3, IR3NR, IR4, IR6, IR7 |

Estate or trust income | Estate or trust income | IR3, IR3NR, IR4, IR6, IR7 |

Expenses claimed | Non-business expense | IR3, IR3NR, |

Interest income | New Zealand interest Reserve scheme interest Non-resident interest received Approved issuer levy | IR3, IR3NR, IR4, IR6, IR7 |

Income with tax deducted from summary of income | ACC (Accident Compensation Corporation) payment ACC payment prior to 2006 ACC attendant care payment Backdated lump sum payment from ACC Backdated attendant care lump sum payment from ACC Backdated lump sum payment from Work and Income Casual agricultural employee (CAE) Election day worker (EDW) Employee share scheme (ESS) New Zealand Superannuation or veterans pension Paid Parental Leave Salary and wages Shareholder-employee salary Student allowance Work and income benefit | IR3, IR3NR |

Look-through company income | LTC income | IR6, IR7 |

Look-through company income | LTC ring fencing rental losses | IR3, IR3NR, IR4, IR6 |

Main form | Excess imputation credits | IR3, IR3NR |

Government subsidy (For 2021 onwards) | Leave support scheme Short term absence payment Wage subsidy scheme | IR3, IR3NR |

Main form | Losses brought forward from previous years | IR3, IR3NR, IR4, IR6 |

Main form | Residential land withholding tax (RLWT) credit | IR3, IR3NR |

Māori authority distribution | Māori authority | IR3, IR3NR, IR4, IR6, IR7 |

Other income | Reserve Scheme Deposit Reserve Scheme Redeposit Reserve Scheme Withdrawal | IR3, IR3NR, IR4, IR6, IR7 |

Portfolio investment entity (PIE) income | Certificates (PIE) | IR3, IR3NR, IR4, IR6, IR7 |

Residential rental income | Excess deductions brought forward | IR3, IR3NR, IR4, IR6 |

Schedular payments income | Schedular payments | IR3, IR4, IR7 |

Shareholders salaries with no tax deducted schedule | Shareholder-AIM Tax Credit Shareholder-employee salary Employee share scheme (ESS) | IR3 |

Pre-populating association details

About pre-populating associations

This information applies to tax returns up to 2023. For 2024 tax returns onwards, see Adding associations to a tax return.

The names and IRD numbers of associations will be pre-populated in tax returns if the association is present in the client details. For the association to be in the client details, you need to have added the associations to existing contacts in MYOB AE/AO. This works for:

shareholders in an IR4

beneficiaries in an IR6

settlors in an IR6

partners in an IR7

owners in an IR7 Look-through company.

Any updates to associations in the tax return in Tax in MYOB Practice Compliance won't be synced back to MYOB AE/AO.

You can also add associations manually or delete any pre-populated associations that aren't required.

Pre-populating bank account details for refunds

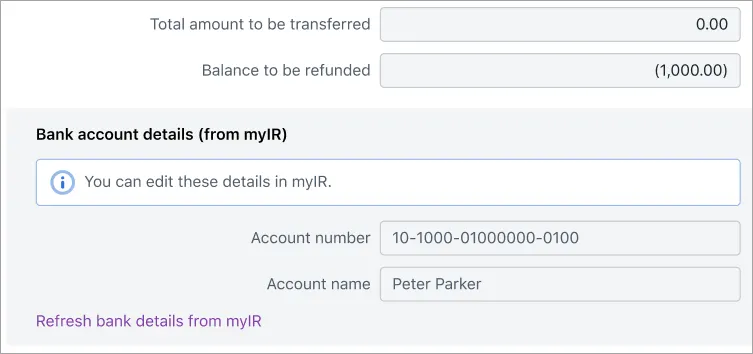

When a tax return has a balance to be refunded in the Refunds section, you'll see the bank account details associated with the tax type you're viewing.

About pre-populating bank account details

Bank account details are stored in myIR and will be used as the bank account for the refund.

The bank account details aren't automatically pre-populated when you create a tax return. You need to click Refresh bank details from myIR to see the details in Tax.

If the bank account details look incorrect or are missing in Tax, check and update the details in myIR and click Refresh bank account details from myIR in Tax. You don't need to have an Account name as part of the bank account details, but if you're not sure if the details you see in Tax are correct, you can always click the refresh link to pull through the latest details from myIR.

-

You'll see Refunds section 33 only when it's needed based on the tax return. For example, if the business income is negative, which requires a refund from IR. If the Refunds section is needed, you'll see it when you go to Tax > Compliance list and open a IR3, IR3NR, IR4, IR6 or IR526 return type.

-

Each tax type can only have one bank account associated with it.

Errors and issues...

When your client has a refund and you've refreshed their bank account into their tax return, your client's account name might be missing from the tax return.

This happens when there's no account name stored within myIR. You don't need to add the bank account name if you're happy with only the client's bank account number.If you want the account name to show, in myIR, delete the bank account, add it again with the account name and click Refresh bank details from myIR in the tax return.

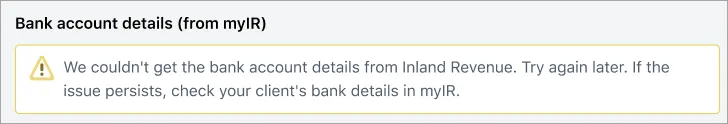

If there's an issue with getting the bank account details from myIR, you'll see a message in the Bank account details (from myIR) section.

You can still file the return if the bank account details aren't correct or don't exist. In this case, IR will hold the refund and release it when the correct bank account details have been entered in myIR.