Here are all the new features and improvements in Practice Compliance.

February 2026

Navigate your tax forms faster with new section arrows

Up and down arrows at the top right of each section let you jump straight to the next or previous item. This lets you efficiently move through tax forms like returns, schedules and worksheets without scrolling. The forms now load faster as you work through each section separately.

If you prefer using the keyboard for navigation, use Ctrl + Shift + ↑/↓ (Windows) or Cmd + Shift + ↑/↓ (Mac).

January 2026

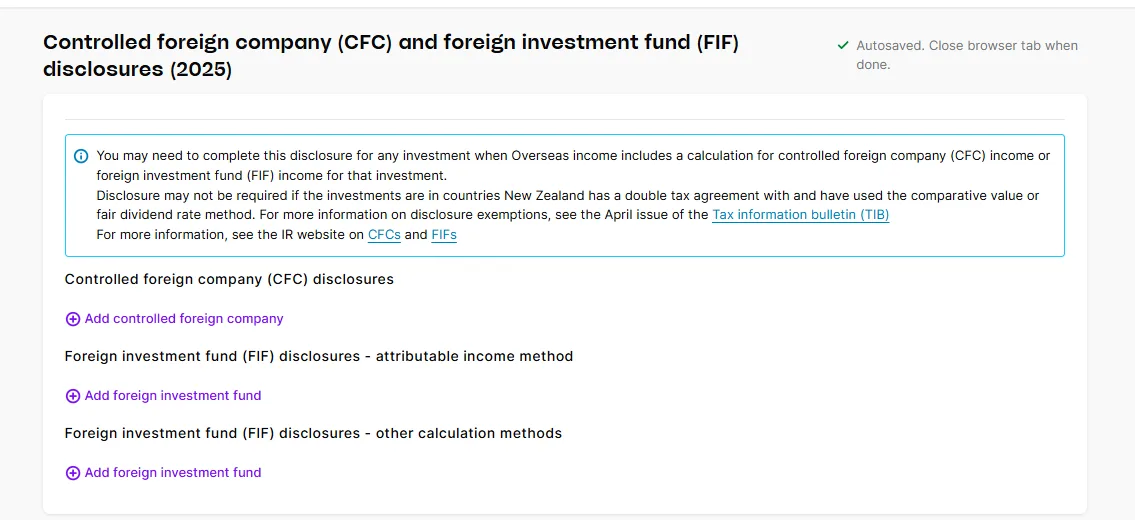

Controlled foreign company (CFC) and foreign investment fund (FIF) disclosures attachment

From 2025 tax year, you can add Controlled foreign company (CFC) and foreign investment fund (FIF) disclosures to your IR3, IR3NR, IR4, IR6, IR7, IR8, or IR9 return.

Use this attachment to complete any additional disclosures required within your tax return, instead of preparing and filing them manually.

December 2025

Business and rental statement layout improvements

We've improved the way headings and totals appear on the statements. They're cleaner, more consistent and easier to read.

October 2025

Visual improvements make more tax fields easier to read and navigate

All tax fields that have one label and one field have had the following layout improvements.

To make it easier to see which labels, fields and buttons are grouped together in the same row:

Field rows are now separated from each other by a line.

Hovering over a field row will add a highlight to the row.

No/Yes radio buttons have more space between the No and Yes option.

All tax fields that have one label and one field make better use of horizontal space. This lets more information fit on the page and means less scrolling.

Before

After

Tax forms look better and are easier to read

Fields in attachments and schedules now appear in the middle of the page and have a fixed width. This means you'll see less empty white space, and will make information more readable on large screens.

September 2025

New Income after expenses claimed field in Trust tax notices

To support updated trustee income tax rates from IR, we've updated the tax calculation when a trust or estate is being taxed as an ordinary trust.

For tax notices based on a 2025 or later tax return, you'll see Income after expenses claimed in provisional or terminal tax notices. If the trust is claiming losses, the tax rate depends on whether Income after expenses claimed is over $10,000. When the trust claims losses, the taxable income can be less than $10,000 but taxed at the higher tax rate.

You'll also see Income after expenses claimed when entering an inland assessment amount when you reconcile an assessment transaction for IR6 trusts.

August 2025

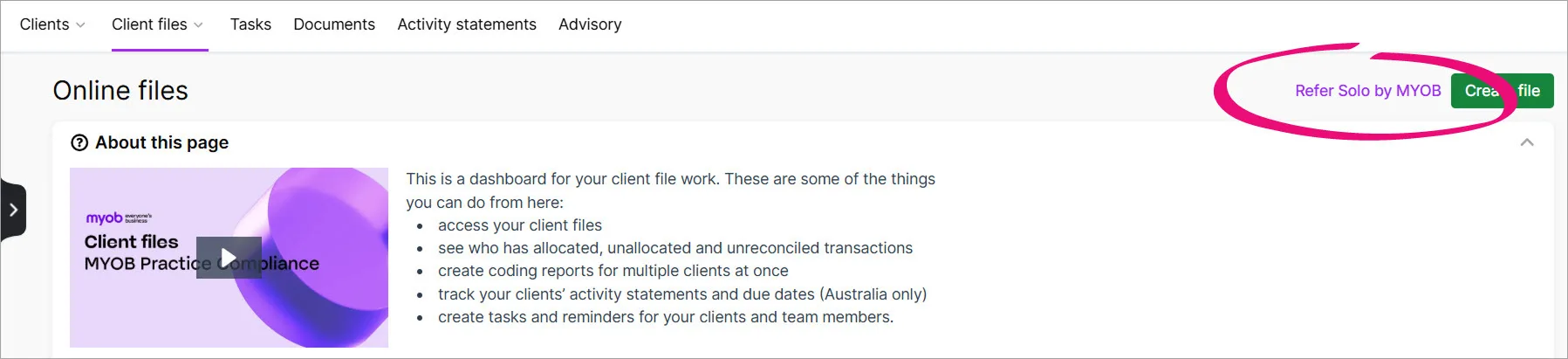

Refer your clients to Solo by MYOB from within Practice Compliance

You'll find a Refer Solo by MYOB link in the Online files page.

Referring sends your clients a discounted sign-up link. Once signed up, they can share access to their business information with you.

Easily delete MYOB assessment transactions

You can now delete MYOB assessment transactions from Data reconciliation. You previously needed to contact us to delete this type of transaction.

Before deleting, be aware that MYOB assessment transactions are normally linked to a return.

March 2025

Tax compliance for 2025 is here!

You've got all the latest updates you need for the new tax year, including:

tax return data rolled over from the previous year

rate changes

IR6 and IR3NR changes

other compliance changes and general improvements.

Learn more about the 2025 tax compliance changes.

Tax rate calculation for trustee income

Applies for IR6 trusts with 2025 tax notices or later

Trustee income is now taxed depending on the type of trust and income amount. You'll need to clear your cache to see the new rate.

The calculation is based on the compliance settings you select for your clients. You'll find two new fields in the Compliance settings to help control the calculation:

Tax trustee income as – Defaults to Ordinary trust.

Trust start date / Estate start date (date of death) – For deceased estates, you must enter the estate start date for the correct rate to be applied. For all other trusts, the start date is optional.

Tax rate calculation – Set up entity details

You can find these settings in the Entity details section of the Compliance settings page.

Select an IR6 client on the client side bar, click the Settings icon (the grey cog) on the top right of the page.

If required, click Edit and change the fields in the Entity details section.

If you change these settings, future unlocked tax notices will be recalculated based on the updated settings.

Tax rate calculation – Review tax notices

For trusts, review any 2025 and 2026 provisional tax notices that use the estimation method.

Fix tax return issues sooner

When a tax return gets pre-populated, you'll see a warning if there's a difference between the data from IR and the data in Practice Compliance. You can click a link in the message for more information about how to resolve the issue.

For example, IR may be expecting one type of tax return, but you may be preparing another type. Or IR may have one balance month, but your settings may have another month.

This lets you fix these issues earlier in the tax return process. If you don’t fix the warning when pre-populating, you'll see the warning a second time when you validate before filing in a 2025 and onwards tax return. If you don’t fix the warning when validating before filing, the tax return may be rejected.

Previous releases

To learn about changes in previous years, visit Practice Compliance release history.

Can't see these features in Practice Compliance? Clear your browser's cache and refresh the Practice Compliance tab. If you still can't see it, your practice may not have access to that feature.