Each month, we release improvements, new features, and bug fixes. If you also use AccountRight in a web browser, see what's new.

What's new in AccountRight version 2025.2 - released 12 March

Sales

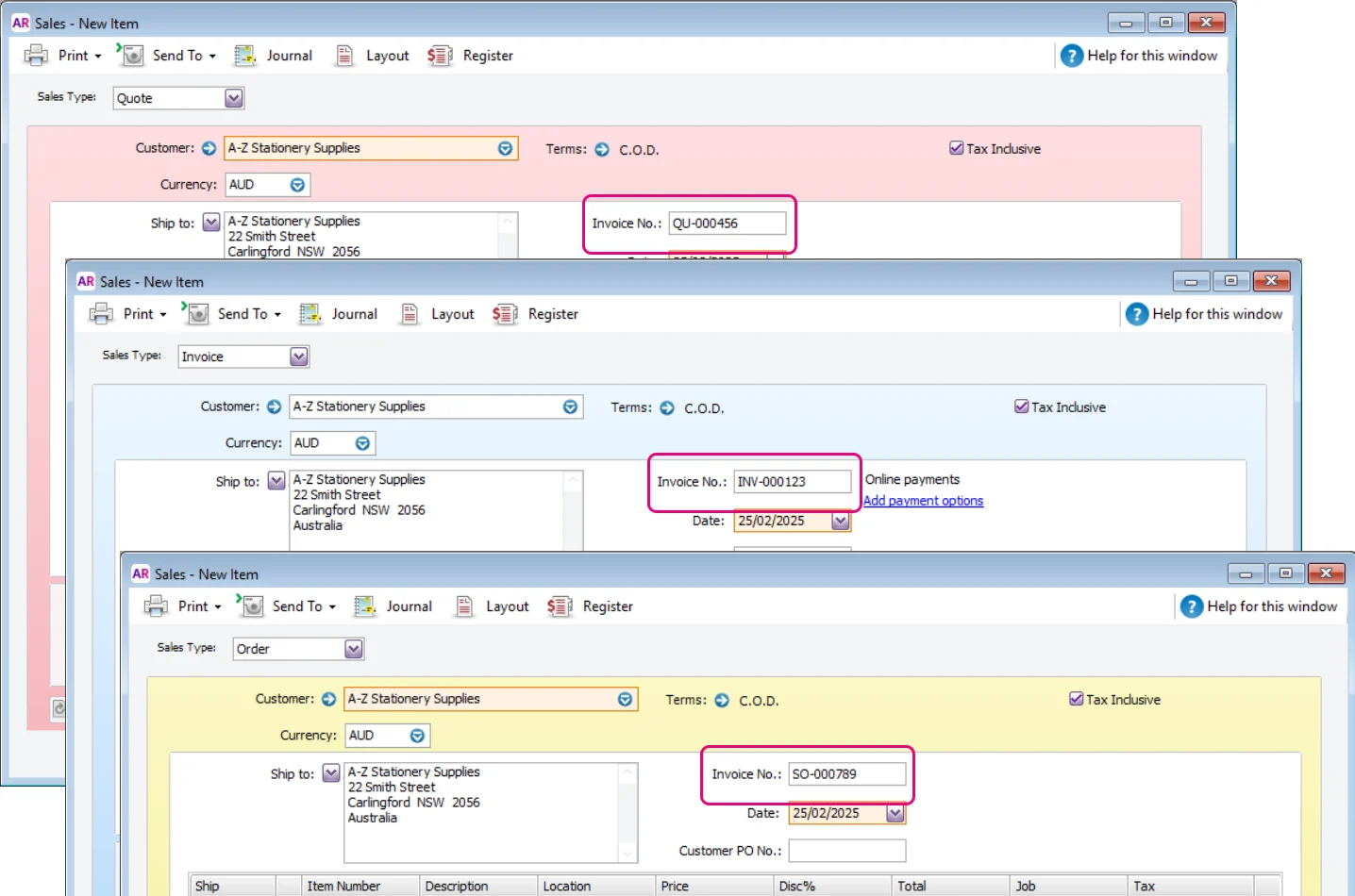

Easier to identify different types of sale

You can set up a different prefix and numbering sequence for your invoices, quotes and sales orders.

Banking

Smarter matching of transfer money transactions

AccountRight bank feeds now uses the bank description, amount and date to help identify and match money transferred between accounts, reducing the need to find and match transactions manually.

Bug fixes

Online payments settings are now remembered when you copy or use a recurring invoice.

We fixed a couple of appearance issues. Command centres are now aligned correctly when AccountRight is maximised. Also, we’ve made the appearance neater by matching the border colour to the command centre background.

Under the hood

We're always working on things behind the scenes that you might not see (or might not see yet), but lead to new time-saving features, better security, or improved performance. Here's an example:

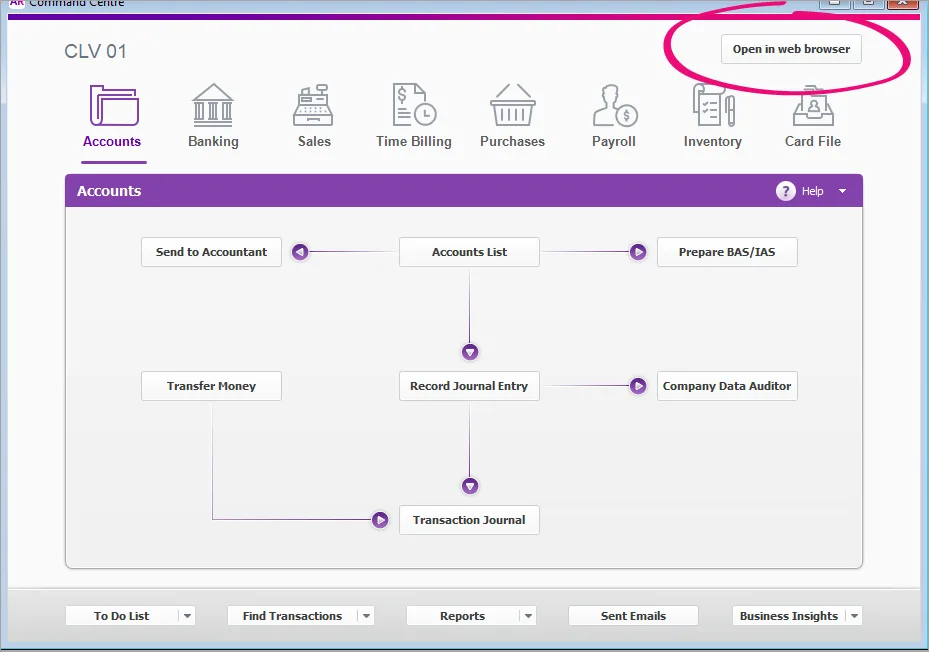

AccountRight Command Centre is receiving an uplift to make it easier for you to see what tasks are up next and help you get to where you need to go with fewer clicks. The early access program will be starting shortly for a limited number of customers.

After each release, we retire an older version

We usually release an AccountRight update around the middle of the month with improvements and fixes.

As updates are released, older versions are decommissioned and no longer work online. If you're using an older version and your file's online, you must update to the latest AccountRight version to keep working.

If you're using AccountRight version 2025.1, you must update by 25 March*.

Shut down AccountRight when you're not using it. If you leave AccountRight open all the time, you may miss out on automatic updates.

* All dates are indicative only and subject to change.

How to get this update

If you use AccountRight PC Edition (version 2021.1 or later) or AccountRight Server Edition (version 2022.4 or later) you'll automatically be updated to the latest release of AccountRight. The next time you log in after that, you'll be prompted to restart AccountRight to complete the update.

If you use AccountRight Server Edition version 2022.3 or earlier you can download the latest version for your server (AccountRight subscription required). Learn more about updating an AccountRight network.

Not sure what edition you're using? If you can see SE in the desktop shortcut description, you're using Server Edition. Otherwise, you're probably using the PC Edition.

If you're updating from an older AccountRight version, like AccountRight Classic (v19), learn how to upgrade.

If you see a message that AccountRight needs updating when you open AccountRight, you need to restart AccountRight to install any pending updates. See Getting the latest version.

Previous releases

2025

2025.1 (February 2025)

Payroll

Helping you stay compliant with Single Touch Payroll Phase 2 (Australia only)

STP Phase 1 will be switched off 27 February. So, if you haven't switched to STP Phase 2, you need to do so now to continue reporting to the ATO. How to move

Suppliers

Wise bank account numbers are now supported for suppliers (New Zealand only)

You can now enter a Wise bank account number in the Payment Details tab of a supplier card.

Usability improvements

If you sort company files in the Library Browser window by clicking the Version column, the company files are now sorted correctly.

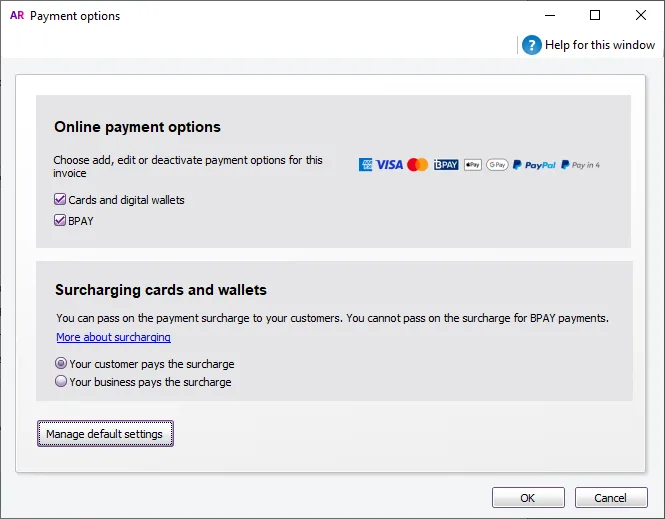

(Online Payments, Australia only) You can now enable or disable BPAY payments on recurring invoices.

Bug fixes

We fixed an issue that could cause AccountRight to crash when you close the Library Browser window.

Under the hood

We're always working on things behind the scenes that you might not see (or might not see yet), but lead to new time-saving features, better security, or improved performance. Here's an example:

We'll be making it easier to identify different types of sales transactions by giving you the ability to set up a different prefix and numbering sequence for your invoices, quotes, and sales orders.

2024

2024.11 (December 2024)

Version 2024.11.1 – released 7 January

This patch fixes a bug that caused a crash for some users when they clicked the Sales Register in the Sales command centre.

Payroll

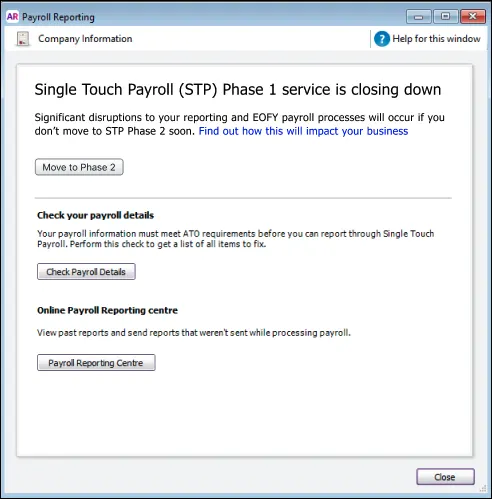

Helping you stay compliant with Single Touch Payroll Phase 2 (Australia only)

If you still report payroll using Single Touch Payroll (STP) Phase 1, you'll receive a reminder that STP Phase 1 is being retired and you'll need to move to STP Phase 2, including a link for more information:

Why you need to move to STP Phase 2

Banking

Smarter matching of transfer money transactions

To be available shortly after the release of 2024.11

AccountRight bank feeds now uses the bank description, amount and date to help identify and match money transferred between accounts, reducing the need to find and match transactions manually.

Bug fixes

We've fixed a bug that caused AccountRight to crash when you tried to delete an online payment. You're now prompted to delete the associated fee transaction first.

2024.10 (November 2024)

Version 2024.10.1 – released 21 November

This patch fixes two bugs that:

-

prevented emailing remittance advices in bulk after making selections in the Advanced Filters window

-

resulted in users having to complete a 2FA check every time they opened AccountRight (2FA checks are only required at least once every 24 hours when you're working in AccountRight).

Online company file usability improvements

Easier access to online company files

As most AccountRight users work with online company files, we’ve made it simpler to open them. The sign-in for online company files is now the first option you’ll see in the Open a company file window:

Online company file options are also now the first options you’ll see when you create a new company file, restore a backup file or upgrade a file:

Bug fixes

When you try to open a company file that was created in a decommissioned version of AccountRight, you're now prompted to upgrade it to the current version.

(Online payments) Surcharging is now correctly selected on invoices created from a recurring invoice template.

Fixed an issue that sometimes prevented the Easy Add button from appearing from the Supplier list when entering a purchase.

2024.9 (October 2024)

Payroll (Australia only)

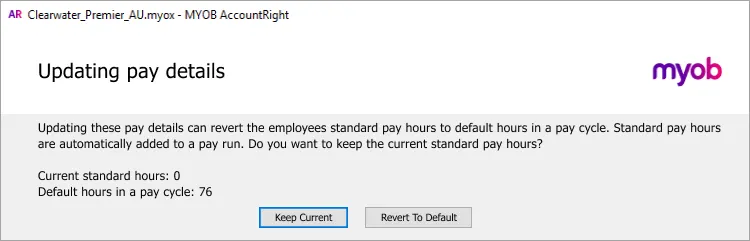

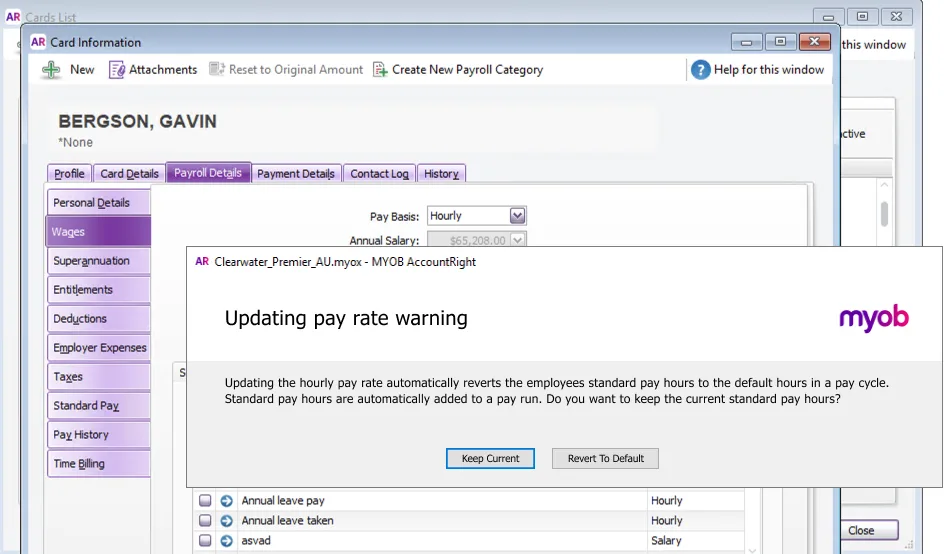

More control when updating hourly employees

When you update an hourly employee's pay rate or pay cycle and it affects their standard pay hours, you can now choose to revert or keep their current standard pay hours. For example, if you've set their standard pay hours to 0 (because they're a casual employee with varying hours), you can keep this if you change their pay cycle.

Helping you stay STP compliant

If you're still reporting to the ATO via STP Phase 1, when you start a pay run you'll now see a helpful reminder to move to STP Phase 2. Support for Phase 1 is ending soon and you'll need to make the move to continue reporting your pays – and avoid an ATO fine. Make the move to STP Phase 2.

Banking

Smarter automatic matching of supplier bills

AccountRight bank feeds now uses supplier names and invoice numbers to make automatic matching more efficient and accurate, further reducing the need to manually match transactions.

Under the hood

We're always working on things behind the scenes that you might not see, but lead to new time-saving features, better security, or improved performance. Here's an example:

From next month, all AccountRight users* will have access to Priority Support. This gives you access to priority phone support and 1 to 1 bookings with a dedicated support agent, so you can get the help you need faster. You'll be able to access Priority Support by quoting your Client ID when calling support, or book a time in My Account.

*This is available to AccountRight Plus and Premier customers paying directly only. Customers paying via their accountants or bookkeepers will continue to have access to our exclusive partner support team.

2024.8 (September 2024)

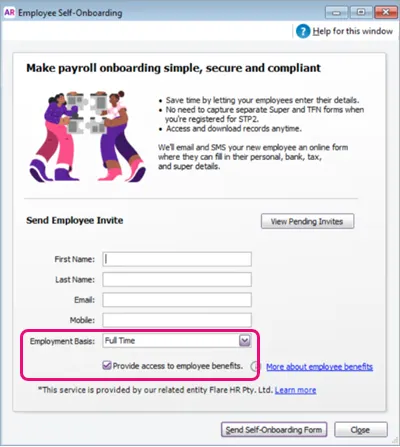

Helping you stay compliant with super guarantee rules

The ATO requires every business to have a default super fund. If you don't have one set in AccountRight, when you send a new employee a self-onboarding request you'll now see a more prominent message to set your default super fund.

This feature was released 3 September 2024.

Bug fixes

We fixed an issue that prevented bank transactions showing in the Bank Feeds window.

API improvements

When you rename custom Price Levels in AccountRight, the updated names can now be retrieved through our Public API. We've built a new endpoint for customised price list names, allowing third-party developers to access this information directly. Find out more at the API support centre

Under the hood

We're always working on things behind the scenes that you might not see, but lead to new time-saving features, better security, or improved performance. Here's an example:

We’re working on a message to prompt you to either keep an employee’s current Standard Pay hours or revert them to the default hours per pay frequency when you change their pay rate or frequency in the Payroll Details > Wages tab. This is for Australia only and will keep you aware of how changes in wages affect Standard Pay and give you greater control when updating hourly employees.

2024.7 (August 2024)

Payroll (Australia only)

Even easier final pays

Previously, we released the ability to pay unused annual leave in an employee's final pay using AccountRight in a web browser. Now, you can also pay unused long service leave for employees who are leaving voluntarily.

Faster SMSF confirmation email

We've improved the delivery speed of the email that's sent to the company file owner when they set up a self-managed super fund.

Online payments (Australia only)

More control with online payment surcharging

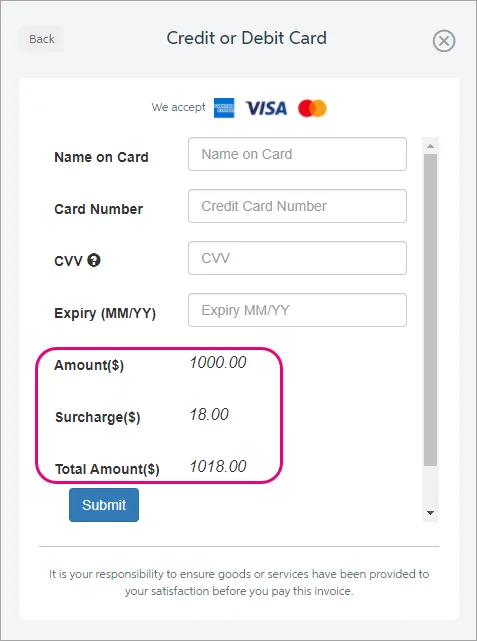

All fees associated with online payments (the 25c transaction fee + 1.8% of invoice value) can now be surcharged to the customer (excluding BPAY)

You can choose to exclude BPAY as a payment option on your online invoices. Doing this means that if you surcharge your customers, you can now pass on all of your online payment transaction fees.

Bug fixes

Fixed a bug that caused an unnecessary message to appear when online invoice payments settings for an invoice was updated. This bug also prevented users from printing or emailing an invoice in a locked period.

Under the hood

We're always working on things behind the scenes that you might not see, but lead to new time-saving features, better security, or improved performance. Here are some examples:

Along with bug fixes, our developers are continuing to identify and fix other areas of AccountRight where crashes have been reported.

It's an ATO requirement in Australia that every business must have a default superannuation fund that new employees can choose to join. To keep you in the good books with the ATO, if you haven't set a default super fund in AccountRight we're introducing a more prominent message to set one up when you add an employee. This change is coming soon.

2024.6 (July 2024)

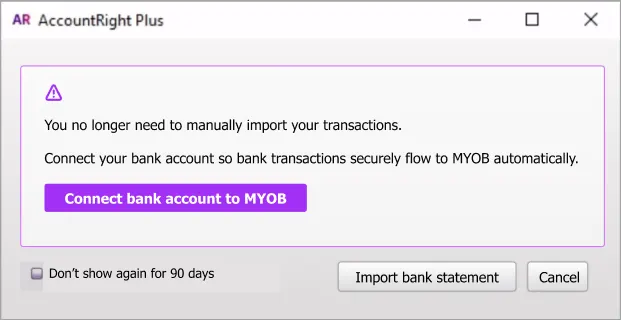

Bank feeds

Smarter way to get bank transactions

As bank feeds saves you time on data entry and importing bank statements, you're now prompted to connect your bank accounts when you import a bank statement, or add bank account information. You can choose not to get these prompts again for 90 days.

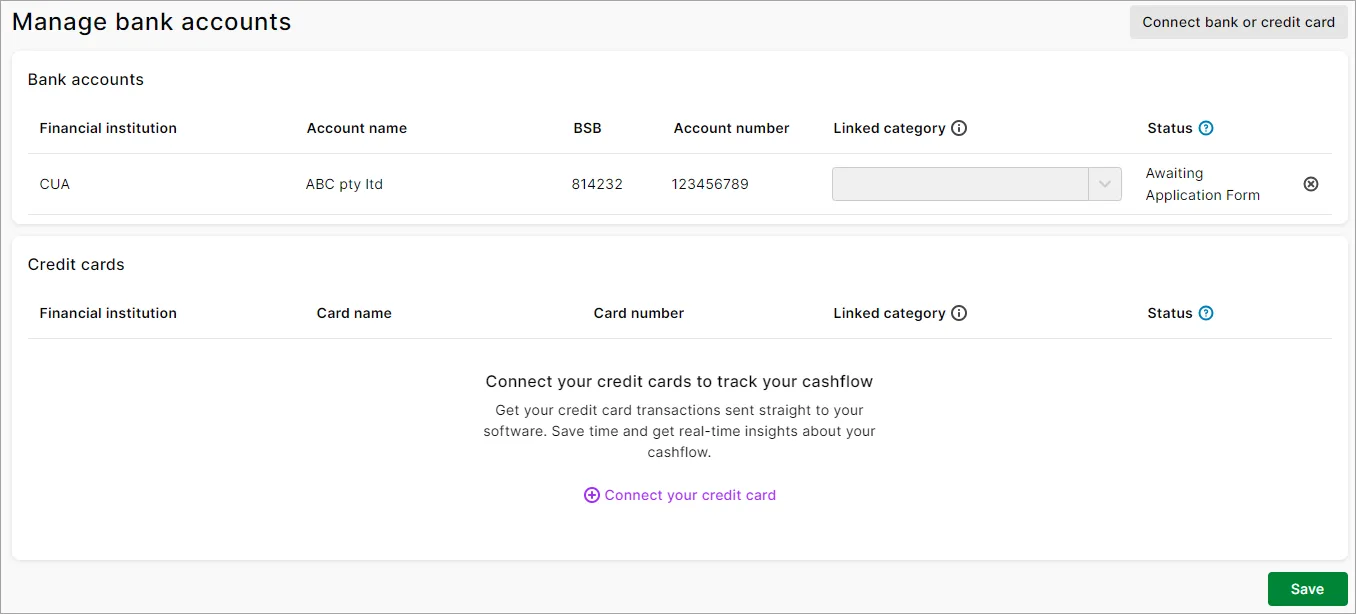

Easier bank feed management

If your company file is online, you'll now set up and manage bank feeds in the web browser version of AccountRight instead of my.MYOB. This is a simpler, more streamlined process to connect and manage your bank accounts.

Usability improvements

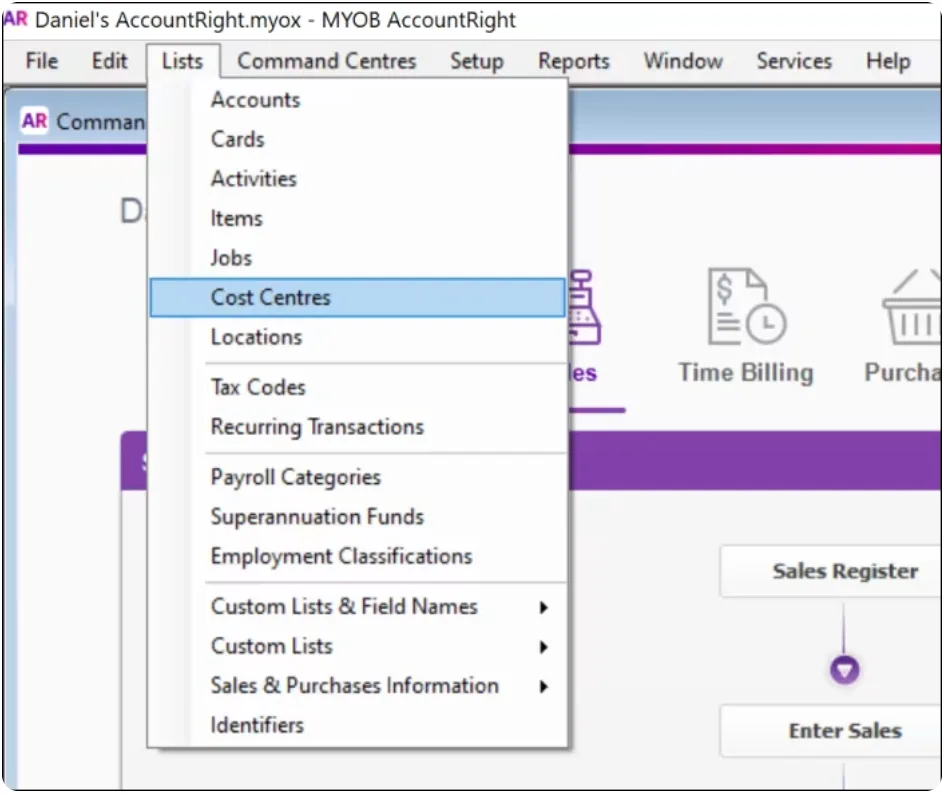

Clearer cost centre messaging

We've updated 'category' to 'cost centre' in the message that appears prompting you to assign a cost centre to a transaction (if you use cost centres).Tidying up some old messages

We've removed an outdated message about super guarantee increases that used to appear when you started a pay run in the new financial year. (Australia only)

Bug fixes

We've fixed a few issues that could cause AccountRight to crash. These issues could occur when you create a purchase or spend money transaction, switch the company file you were using, or filter the Sales Register window.

We've removed the prompt to set up bank feeds if you're using a trial version of AccountRight

We've removed an incorrect bank feeds support number from the Cannot get bank feeds error message

Under the hood

We're always working on things behind the scenes that you might not see, but lead to new time-saving features, better security, or improved performance. Here are some examples:

Along with the bug fixes above, our developers are continuing to identify and fix other areas of AccountRight where crashes have been reported.

We're also putting the finishing touches on the final pay enhancements for Australia which will help pay out long service leave. You'll hear more about this in a future release.

It's an ATO requirement in Australia that every business must have a default superannuation fund that new employees can choose to join. To keep you in the good books with the ATO, if you haven't set a default super fund in AccountRight we're introducing a more prominent message to set one up when you add an employee. This change is coming soon.

2024.5 (June 2024)

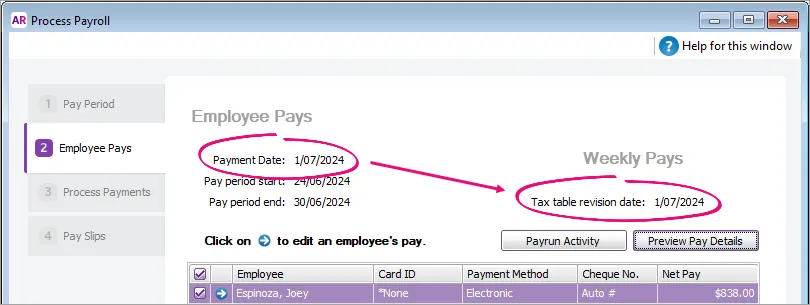

Payroll (Australia only)

Keeping you compliant for the new payroll year

The tax tables have been automatically updated and will apply for pays dated 1 July 2024 onwards.

Helping you automate the super rate increase

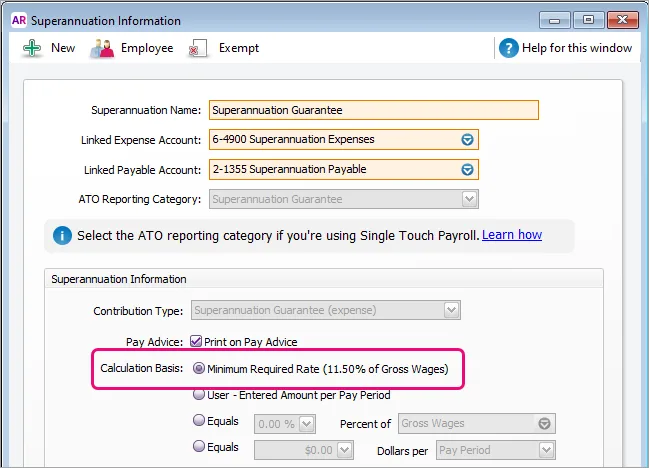

Any super guarantee payroll categories with the calculation basis set to Minimum Required Rate will be automatically updated to 11.5% when you do your first pay run with a payment date on or after 1 July 2024.

Easier Fair Work compliance

If your business isn't covered by the Fair Work System, you can now choose to prevent new employees being provided the Fair Work Information Statement (FWIS) when you invite them to self-onboard.

Cost Centre reports

Following on from the recent name change of Categories to Cost Centres in AccountRight, we've made the same changes in the cost centre reports. These reports no longer refer to categories in the column headings and report filters.

Bug fixes

We fixed an issue that could cause AccountRight to crash when entering an ABN for a Self-Managed Super Fund (SMSF). (Australia only)

We fixed a bug that could cause AccountRight to crash in the Find Transactions window.

Under the hood

We're always working on things behind the scenes that you might not see, but lead to new time-saving features, better security, or improved performance. Here are some examples:

Along with the bug fixes above, our developers are continuing to identify and fix other areas of AccountRight where crashes have been reported.

We're also putting the finishing touches on the final pay enhancements for Australia which will help pay out long service leave. You'll hear more about this in a future release.

2024.4 (May 2024)

2024.4.0 patch was released 30 May to fix an issue that caused AccountRight to crash if a tax code was changed on an invoice (if you use Online Invoice Payments).

Payroll (Australia only)

Easier final pays

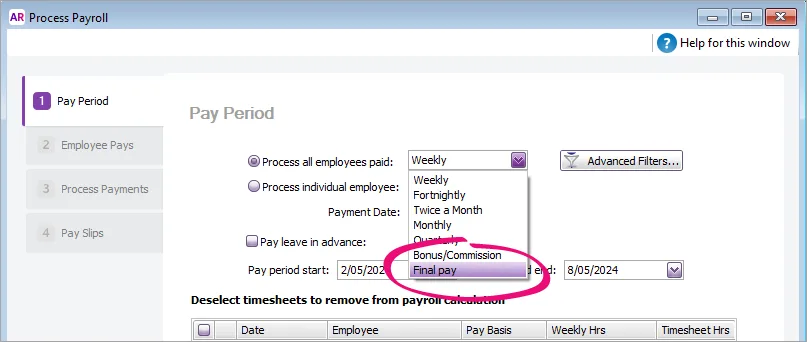

We're working on a new final pay feature for online company files, and the first stage is here. With this release, there's a new pay frequency called Final Pay. This opens the web browser version of AccountRight and guides you through the payment of unused annual leave – initially for employees who are leaving voluntarily. We'll add other final payment types, like unused long service leave, in future releases.

Sales

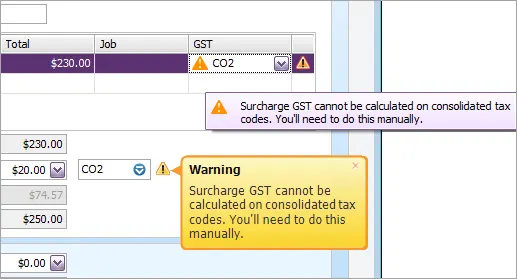

If you're using online invoice payments with surcharging enabled, you'll now see a warning if an invoice contains a consolidated tax/GST code.

Security enhancements

Avoid getting locked out by setting up another 2FA method

Give yourself more options to sign in by setting up more than one 2FA method. For example, you could set up SMS 2FA on your phone and the 2FA authenticator app on a tablet. Then, if you don't have your phone handy and can't receive SMS, you can still get your 2FA code using the authenticator app on the tablet.

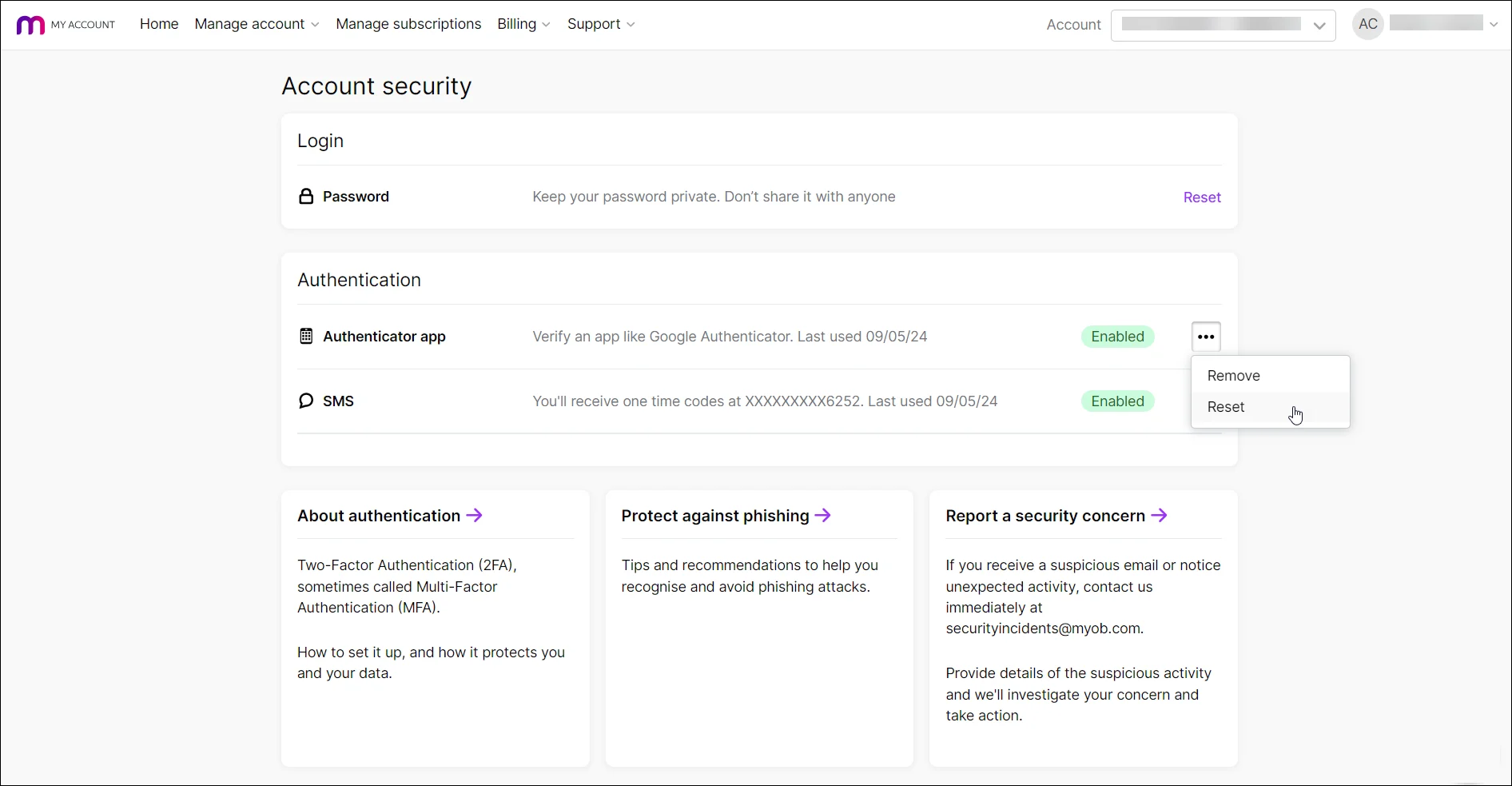

Reset 2FA without having to contact MYOB Support

Once you’ve set up another 2FA method, you’re able to change your 2FA settings yourself:

In the Account security section of My Account, you can easily change your 2FA phone number for SMS 2FA, re-link or change your authenticator app, or set up authenticator app on a new phone.

Faster and clearer account update alert

We've improved the content and delivery speed of the email that's sent to the company file owner when one of your employee's bank account details are added or updated.

Bug fixes

We fixed a broken help link on the Employee Self-Onboarding window (Australia only)

We fixed an issue that could cause AccountRight to crash when switching between online and offline files.

Under the hood

We're always working on things behind the scenes that you might not see, but lead to new time-saving features, better security, or improved performance. Here's an example:

Our developers are looking into the diagnostic data that gets generated if AccountRight crashes or times out. This helps them work out why crashes happen so they can fix the root cause. It's slow going as there are lots of variables and tons of data to go through. But it's worth it.

2024.3 (April 2024)

Categories are now Cost Centres

We've updated the language in AccountRight to use more natural words you're familiar with. So, in this release we've renamed 'categories' to 'cost centres'. Most businesses use this feature to keep track of departments or cost centres, so this makes it a good fit.

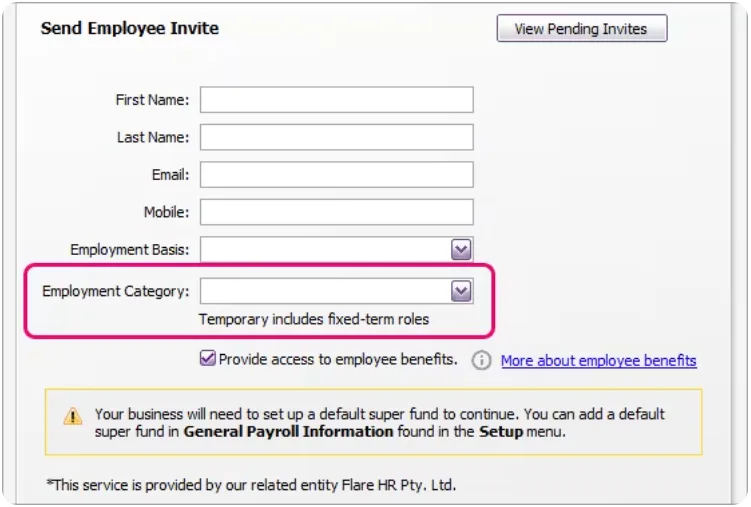

Payroll

Helping you stay compliant (Australia only) When you add an employee, you'll now choose if they're permanent or temporary (which includes fixed-term roles). This ensures temp employees are provided the correct Fair Work Information Statement when they self-onboard or check their details.

Security enhancements

We've improved the content and delivery speed of the email that's sent to the company file owner when one of your supplier's bank account details are added or updated.

Bug fixes

We fixed an issue that caused AccountRight to crash in a few places, like when printing an invoice or removing an attachment from the In Tray.

Backordered items in foreign currencies are no longer showing in local currency when previewing the invoice.

Under the hood

We're always working on things behind the scenes that you might not see, but lead to new time-saving features, better security, or improved performance. Here are some examples:

We'll continue fixing parts of AccountRight where crashes have been reported. We fixed a few of these in this release, but there's a couple of trickier ones that we'll keep working at.

(Australia only) We're continuing our work on a better final pay experience for online files to help you pay out employees when they leave your business. Initially it'll help you create a final pay for voluntary termination paying out unused annual leave only, but we'll keep working on it to include other payment types, like long service leave. This will be a big time-saver and you'll hear more about it closer to its release.

2024.2 (March 2024)

Usability improvements

We've removed the error message that shows if you haven't specified a linked account for late fees and surcharges that you manually add to invoice payments. This avoids confusion with online invoice payment surcharging, which is a separate feature.

Under the hood

We're always working on things behind the scenes that you might not see, but they lead to new time-saving features, better security, or improved performance. Here's an example:

(Australia only) We're working on a better final pay experience for online files to help you pay out employees when they leave your business. We've laid the groundwork in this release and started our testing. Initially it'll help you create a final pay for voluntary termination paying out unused annual leave only, but we'll keep working on it to include other payment types, like long service leave. This will be a big time-saver and you'll hear more about it closer to its release.

2024.1 (February 2024)

Payroll (Australia only)

Get employees to check their details (available from 6 Feb)

If you've manually set up an employee (instead of self-onboarding) you can send them a secure request to review their details. The employee can then submit any changes straight into your AccountRight company file. Here's all the details.

Bug fixes

We fixed an issue that was resulting in an error message when you attempted to close some popup messages in AccountRight.

2023

2023.11 (December 2023)

Payroll

Get employees to check their details AUSTRALIA ONLY

If you've manually set up an employee (instead of self-onboarding) you can send them a secure request to review their details. They can submit any changes straight into your AccountRight company file.

Bug fixes

Resolved an issue where some clients who had upgraded from AccountRight v19 were not receiving a message to do some additional upgrade tasks.

2023.10 (November 2023)

Usability improvements

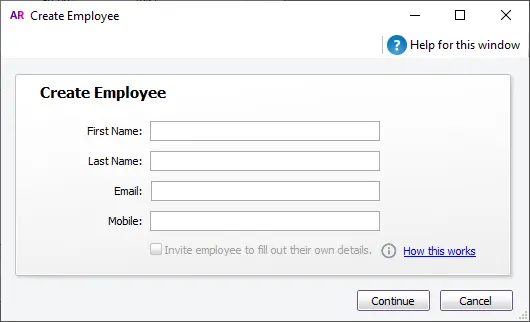

If you create a new employee from the Pay Liabilities window or the Easy Setup Assistant, you'll now have the option to invite the employee to self-onboard. AUSTRALIA ONLY

Bug fixes

Fixed an issue where some invoices were not appearing on customer statements on the last day of the reporting period.

2023.9 (October 2023)

Payroll AUSTRALIA ONLY

Employment Basis added to new employee creation

When you add a new employee, you'll now choose their Employment Basis at the start of their setup, such as full time, part time or casual. This is required for STP reporting, and if the employee self-onboards it ensures they're provided the applicable Fair Work Information Statement.Give new employees access to benefits

When you're inviting a new employee to submit their own details via self-onboarding, you can now choose to give them access to employee benefits. If you’ve already set up employee benefits you won’t see this option as your employee will already get access to benefits once they’ve completed entering their own details.

Usability improvements

If you create a new employee from the Enter Timesheet window, you'll now have the option to invite the employee to self-onboard. AUSTRALIA ONLY

Bug fixes

We've removed the Employee Self-Onboarding button from AccountRight Basics and Standard. This is a payroll feature that's only available for AccountRight Plus and Premier. AUSTRALIA ONLY

2023.8 (September 2023)

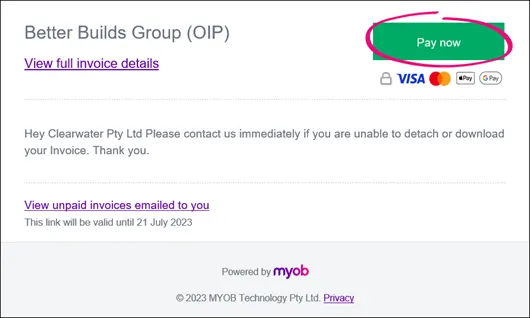

Online invoice payments – available for New Zealand from 14 September!

Online invoice payments is a secure payment service that gives your customers an easier and faster way to pay you. Your customers can pay your invoices online anywhere, anytime, using their preferred payment method (VISA, Mastercard, Apple Pay or Google PayTM).

Simplified employee self-onboarding AUSTRALIA ONLY

When you create a new employee card (from the Cards List window), you now see a clear option to invite the employee to fill out their own details. This option is selected by default when you enter an email address, but you can deselect it if you prefer to manually enter all of the employee's details yourself.

2023.7 (August 2023)

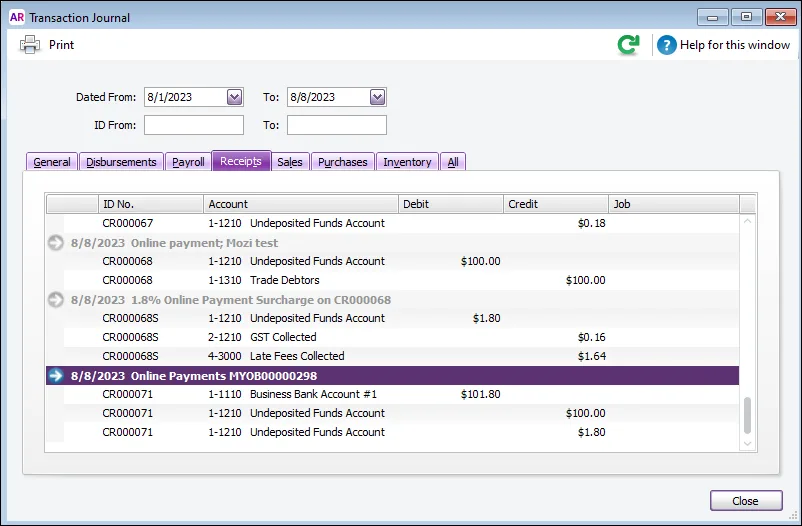

Online Invoice Payments AUSTRALIA ONLY

It's easier to identify Online Invoice Payments in AccountRight

When Online Invoice Payments funds are disbursed into your settlement bank account, 'Online Payments' will appear in the Memo for the automatically created bank deposit.

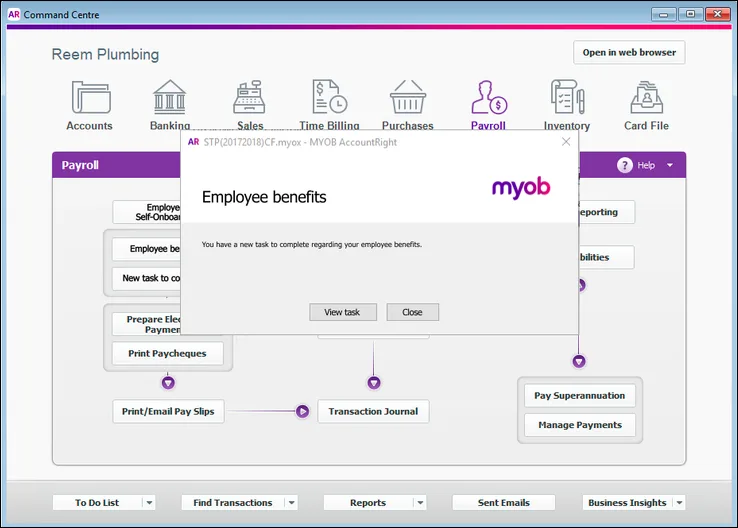

Employee benefits and salary packaging AUSTRALIA ONLY

Be prompted to complete employee benefits tasks

You are now prompted to complete any tasks for setting up or managing employee benefits.

Just click View task to find out what you need to do.

Be alerted to complete salary packaging tasks

When you have any employee salary packaging setup tasks to complete, such as for novated car leasing, the New task to complete button in the Payroll command centre will indicate the number of tasks. Just click the button and you'll be guided through each step of the setup.

2023.6 (July 2023)

(AccountRight Server Edition only) Version 2023.6.1 – released 18 July

This release fixes an issue that affects a small number of AccountRight Server Edition users who open a decommissioned online file from the AccountRight client on their workstations.

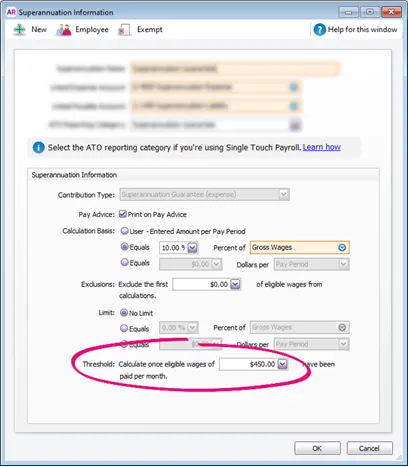

Superannuation (Australia only)

We've removed the Threshold field from superannuation payroll categories where the Contribution Type is set to Superannuation Guarantee (expense). This is because from 1 July 2022, the Australian Government removed the $450 per month threshold for super guarantee eligibility (that's the amount an employee can earn in a calendar month before you have to pay them super). You don't need to do anything, we've just removed this field as it's no longer needed.

Here's what it used to look like:

Bug fixes

The help search field in command centres now works (no longer results in a 403 error).

2023.5 (June 2023)

Payroll (Australia only)

Keeping you compliant for the new payroll year

The tax tables have been automatically updated and will apply for pays dated 1 July 2023 onwards.Helping you automate the super rate increase

Any super guarantee payroll categories with the calculation basis set to Minimum Required Rate will be automatically updated to 11% when you do your first pay run with a payment date on or after 1 July 2023. Learn more...

Online Invoice Payments (Australia only)

More payment options for your customers

Your customers can now pay your online invoices using PayPal or PayPal Pay in 4, which now appear as payment options in online invoices.

Usability improvements

If you open a version of AccountRight that we've retired and a new version is available, you'll see a more helpful message that prompts you to update. When you click Update now in the message, AccountRight restarts and completes updating.

When you email an Online Invoice Payments invoice via Microsoft Outlook, you now have the option to not show the confirmation message again. (Australia only)

API improvements

Implemented changes to better identify deleted transactions from the Public API, resulting in faster calls and better performance.

2023.4 (May 2023)

Payroll (Australia only)

Helping you avoid pay history errors

Information and a help topic link have been added to the Payroll details > Pay history tab of an employee, explaining how to use pay history to enter opening balances for employees who start part-way through the year and how to adjust the next pay to fix pay history errorsClearer pay slips for casuals

If you use the default pay slip form, Annual Salary no longer appears on pay slips for employees with an Employment Basis of Casual. This doesn't affect customised pay slip forms.

Online Invoice Payments (Australia only)

You can activate Online Invoice Payments for imported invoices

If you use Online Invoice Payments, you can activate them on imported invoices (as well as the option to pass on the surcharge). When you email these invoices, they reflect the settings you've chosen. Online Invoice Payments options have been added to the Match Fields step of the Import and Export Assistant.Improved experience with SMS

We've improved the design of error messaging and added more helpful information in the SMS section of the Email Information window.

Usability improvements

Links to support pages have been added to the Activation/Confirmation assistant. If you're not able to activate or confirm online, you can now click a Contact us link to start a live chat session with a support team member or submit a support request via My Account.

More helpful error message when emailing. If you try to email a transaction such as an invoice, and the Selected Form field of the Email Information window is blank, you're now prompted to chose a form.

As we've mentioned previously, if you open a version of AccountRight that we've retired and a new version is available, you'll see a more helpful message that prompts you to update. When you click Update now in the message, AccountRight restarts and completes updating. This new messaging takes effect from the decommission of 2023.3.

We've added a tasks to complete notification in the Payroll command centre. For now, this notification displays No tasks to complete and will be functional in a future release. (Australia only)

Bug fixes

Fixed an issue that resulted in an error when a customer tried to view an online invoice when the default customised form for the invoice had been deleted. The online invoice now opens in a standard AccountRight template.

When paying multiple Lump Sum E payments in a pay run, the $1200 threshhold is now applied to the consolidated amount. Previously the threshhold was being applied to each Lump Sum E payment. (Australia only)

2023.3 (April 2023)

Online Invoice Payments (Australia only)

When you email an invoice set up for Online Invoice Payments using AccountRight's email service, there's now an option to also send an SMS with a link to the online invoice. This helps your customers see your invoices and prevents them getting lost in a busy inbox.

Usability improvements

If you open a version of AccountRight that we've retired (from the decommission of 2023.3 onwards) and a new version is available, you'll see a more helpful message that prompts you to update. When you click Update now in the message, AccountRight restarts and completes updating.

Bug fixes

We fixed an issue that affected some businesses when a pay run with paid liabilities is reversed. The liability reversal is now correctly reflected in Pay Liabilities and Pay Super.

2023.2 (March 2023)

Payroll (Australia only)

More help for fixing STP submission errors

If your last STP report was rejected by the ATO or contained errors, when you start a pay run you'll now see clearer messaging about it and what you need to do.Helping you to set up leave correctly

You are now warned if you haven't linked a wage payroll category to a leave entitlement payroll category (if the Calculation Basis in the leave entitlement payroll category is set to Equals XX Percent of XX). This will ensure leave is paid out correctly when an employee takes leave.

Usability improvements

If you email invoices via Microsoft Outlook, you'll no longer see the Invoice sent message after each send.

Performance improvements

We've improved performance for bank reconciliations.

Bug fixes

Fixed an issue in imported invoices with Online Invoice Payments enabled that was preventing the Pay now button appearing. (Australia only)

Fixed an issue in bank feed rules that could result in an out-of-balance amount when reconciling.

Fixed an issue that sometimes caused an error when deleting general journals.

2023.1 (February 2023)

Online invoice payments (Australia only)

Your customers can now pay your online invoices using Google Pay on their Android devices, so Google Pay now appears as a payment option in the Sales window, in field help, invoice PDFs and on invoice emails sent from Microsoft Outlook.

We'll provide links to relevant updated help topics when these changes are released.

Performance improvements

We've improved performance for creating, editing and deleting General Journals.

API improvements

Contract documentation has been updated with the new Journal Transaction History endpoint.

You can now create, update or delete build transactions created through the adjustment endpoint.

For more information about our API improvements, visit the API Support Centre.

Bug fixes

We've fixed an issue that prevented users seeing the View PDF or View completed super choice PDF buttons.

The correct set up, payment or view invoice options now appear in the Sales window, depending on whether Online Invoice Payments has been applied for or enabled.

Fixed a FK_BusinessEventLine_BusinessEventOriginal exception error that occurred when deleting a General Journal.

2022

2022.11 (December 2022)

Payroll (Australia only)

Easier leave setup

When you set up a new company file, AccountRight now comes with a default set of annual and personal leave payroll categories (for salaried and hourly pay basis) which you can assign to your employees, making it easier to set leave up and ensure it's accrued and paid out correctly.Leave accrual balance is now set to print on pay slips by default

As employees want to keep track of their leave balances, the Show leave balance on pay slips option (previously called Print on Pay Advice), is now selected by default when you create a new leave entitlement payroll category.Helping you to set up leave correctly

You are now warned if you haven't linked a wage payroll category or an exemption to a leave entitlement payroll category (if the Calculation Basis in the leave entitlement payroll category is set to Equals XX Percent of XX). This will ensure leave is paid out correctly when employee takes leave.Super fund details are protected from accidental changes

When you open an employee's super fund information (Cards List > Employees > Employee > Payroll Details tab > Superannuation > Superannuation Fund), the details in the Superannuation Fund Information window are no longer editable, preventing accidental changes to funds that affect all employees. You can still change the fund details from the List menu > Superannuation Funds.Helpful reminder to move your business to STP Phase 2

If you haven't yet moved your business to STP Phase 2, you'll get a reminder to do so when you complete a pay run, enabling you to start the move or learn more about it.Avoid employment termination payment (ETP) reporting errors

If you've moved to STP Phase 2 and you've saved a payroll category that has been assigned an ETP reporting category, this reporting category can no longer be changed. This prevents errors in reporting ETP.

We'll provide links to relevant updated payroll help topics when these changes are released.

Customer payments

More streamlined bulk invoice emailing

When using Online Invoice Payments and emailing invoices in bulk via Microsoft Outlook (from the Review Sales Before Delivery window > To be emailed tab), the Set up payment notifications reminder now only appears once.As we discontinued the MYOB Direct Debit service from 20 September 2022, we've removed the Direct Debit Requests button from the Sales command centre.

Company file information

Avoid errors when entering the company file email address

When you create a new company file (using the New Company File Assistant), the email address you enter is checked for the correct format.

API improvements

We've optimised the GET /Sale/Invoice/* endpoint to retrieve only relevant information from the database.

You're now able to create, edit or remove a Bill of Materials (BOM) definition when you call the endpoint to create items.

Fixed a bug that occurs when creating a supplier payment on a purchase using a Hybrid layout via the API.

The cash method for the balance sheet is now available via the API.

For more information about our API improvements, visit the API Support Centre.

Bug fixes

The Pay now button in invoices now works for online invoice payments sent via Microsoft Outlook. When Online Invoices Payments is switched off for an invoice, or the service has been cancelled, View invoice appears instead, enabling users to view the invoice online.

You no longer receive a 404 error when you click View invoice, Pay now, or View full invoice detail in an invoice sent via Microsoft Outlook that uses a form with the # or & character in the form's name.

Fixed timeout errors when running the Auto-Build Items report.

2022.10 (November 2022)

Online invoice payments (Australia only)

More flexible and convenient online invoice payments

You can now use Microsoft Outlook to send your online invoices to allow your customers to pay you online — you no longer need to be sending those invoices directly from AccountRight.Easier to find Online Invoice Payments settings

We've added an Online Invoice Payments button to the Sales command centre, making it easier to set up online invoice payments or edit your online invoice payment settings.Apple Pay mobile payment option is now visible in invoices

As your customers can now pay your online invoices using Apple Pay on their iPhones or other Apple devices, Apple Pay now appears as a payment option in the Sales window and on invoices sent from Microsoft Outlook.

We'll provide links to updated online invoice payments help topics when these changes are released.

Payroll (Australia only)

Helping you fix rejected STP reports

If you're doing a pay run and your previous pay submission has the ATO error CMN.ATO.GEN.XML03, you'll see a message alerting you to this. You can click from the message to the STP reporting centre to view the reason the pay was rejected and how to fix it.

API improvements

Users can now retrieve build transactions.

We've improved response times for sales invoice endpoints to reduce 504 Gateway timeout errors.

For more information about our API improvements, visit the API Support Centre.

Bug fixes

Resolved an issue that prevented sending emails from AccountRight when the email address contained an apostrophe.

You no longer receive multiple Choose Profile prompts when sending an email via Microsoft Outlook when it's closed. (Australia only)

When the Online Payments option is deselected in an invoice, the Pay now button no longer appears in the online invoice when sent via Microsoft Outlook — View invoice appears instead. (Australia only)

Fixed an issue that was preventing businesses moving to STP Phase 2 if they had more than 200 employee cards. (Australia only)

2022.9 (October 2022)

Payroll (Australia only)

STP 2 is back and better

In July we paused transitions to STP Phase 2 to improve the in-product experience. But the wait is over – you can now make the move to STP Phase 2. Find out how...Helping you fix rejected STP reports

If a report is rejected by the ATO, depending on the reason, you’ll now see a message about it the next time you start a pay run.

We've also improved the messaging in the STP reporting centre to help fix some rejected reports.Quicker employee setup

A new employee card is now created as soon as a self-onboarding invitation is sent, allowing you to enter employee payroll information straight away. You can also quickly check the status of the employee's self-onboarding in the Profile tab of their employee card.More guidance when paying employees aged under 18

If a pay run includes an employee aged under 18, regardless of pay frequency you're reminded to confirm their hours worked. This helps you stay on top of your super obligations.Improved super calculations

Super guarantee amounts are now calculated only on the current pay period.

If a threshold is set in a super expense payroll category (not super guarantee) the super calculation will only include previous pay periods if the threshold is exceeded.

Online invoice payments

Fast, secure and convenient mobile payments with Apple Pay

Your customers can now pay your online invoices using Apple Pay on their iPhones or other Apple devices. Apple Pay now appears as a payment option on your online invoices.

Security enhancements

A user with the Purchases role can no longer access the prepare electronic payments feature. This removes the possibility of a user without Payroll access seeing employee pay amounts.

2022.8 (September 2022)

Payroll (Australia only)

Easily check employee self-onboarding details

You can now download a record of your employee's submitted details (employee Card information window > Payroll details tab > Personal details > View PDF button). Learn more...Quick download of completed Super Choice form

You can now download the completed Superannuation Choice form for self-onboarded employees (employee Card information window > Payroll details tab > Superannuation > View completed super choice PDF button). Learn more...Improved employment termination payment (ETP) handling

If you're reporting via STP, pays that include an ETP can now only be reversed and not deleted. This ensures your AccountRight payroll information matches the ATO records.

Bug fixes

Fixed an issue that could cause AccountRight to crash when paying an under 18 employee. (Australia only)

Resolved an issue that could cause AccountRight to crash when adding an employee. (Australia only)

Fixed the super guarantee calculation for under 18 employees so it only calculates on the current pay period. (Australia only)

Fixed an issue that was causing hourly wage categories to be checked incorrectly for STP compliance during a pay run. (Australia only)

Fixed a Balance Sheet issue that could occur if a header account was changed to a detail account.

Fixed an issue that was preventing the use of $ and & in email addresses.

API improvements

Fixed an issue that was causing a 409 error on POST requests on endpoints.

For more information about our API improvements, visit the API Support Centre.

2022.7.1 patch was released to fix a bug that caused AccountRight to crash when recording general journal transactions from a recurring transaction. This occurred when the recurring transaction had a frequency set to Never.

2022.7 (August 2022)

Employee self-onboarding (Australia only)

More streamlined employee self-onboarding

You're prompted to send an employee self-onboarding request when creating an employee card.Send new employee self-onboarding requests via SMS

Enter a mobile phone number if you want to send your new employee a self-onboarding request via an SMS message as well as by email.Easily track employee self-onboarding requests

We've added a button to the Employee Self-Onboarding window to display a list of employee self-onboarding invitations and their status.

Loans and finance (Australia only)

Quick access to business loans and invoice financing

We've added a Loans and Finance button to the Banking command centre. This gives you access to tailored business loans with Valiant and invoice financing with Butn.

Bug fixes

Fixed a bug that was causing incorrect year-to-date figures to show in STP reports for previous payroll years. (Australia only)

2022.7.1 patch was released to fix a bug that caused AccountRight to crash when recording general journal transactions from a recurring transaction. This occurred when the recurring transaction had a frequency set to Never.

2022.6 (July 2022)

Payroll changes (Australia only)

Helping you stay compliant with super for under 18s — Employees aged under 18 who are paid weekly and have worked less than or equal to 30 hours in the week will no longer have super calculated in their pay.

Improved transitions to STP Phase 2 — Inactive and terminated employees (paid in the current payroll year) will now be included in the employee details check when moving to STP Phase 2. You'll also now be prompted to send an update event after moving to STP Phase 2 to ensure the ATO has your employees' latest year-to-date payroll information.

Better reporting for STP Phase 2 — When you send an update event from the STP reporting centre, the year-to-date payroll totals for inactive and terminated employees (paid in the current payroll year) are now included.

Performance improvements

More accurate general journals — foreign currency general journal transactions are now checked for missing details

Save time entering transactions — we've improved the response time to display information when creating sales and purchases, such as supplier or item details

Bug fixes

Fixed a bug that was causing the custom library location to be reset when updating AccountRight.

Fixed a bug that closed AccountRight when updating account details.

Fixed a bug that caused an incorrect opening balance for some foreign currency accounts.

Fixed a bug in AccountRight Server Edition that sometimes resulted in duplicate payments when entering pre-paid invoices.

General Ledger report (Summary and Detail) now balances correctly when spanning multiple financial periods. This issue affected the Current Year Earnings and Retained Earnings accounts.

Converting a purchase order with a 100% discount to a bill no longer causes AccountRight to crash.

2022.5 (June 2022)

Payroll changes (Australia only)

Helping you stay compliant with super for under 18s — If a pay run includes an employee aged under 18, an alert now appears advising you to check how much super you need to pay them. Learn about paying super for under 18s

Avoid mistakes when fixing termination payments — You'll now be prevented from entering negative Employment Termination Payment (ETP) amounts to fix a previously recorded ETP pay, and you’ll be prompted to reverse the incorrect pay instead. Learn about fixing ETPs

Helping you automate the super rate increase — Any super guarantee payroll categories set to 10-10.5% of Gross Wages will be automatically updated to 10.5% when you do your first pay run with a payment date on or after 1 July 2022. Learn more...

Usability improvements (Australia only)

Added Employee Self-Onboarding button to the Card File command centre. This button is now available in both the Card File and the Payroll command centres. Learn about employee self-onboarding

Performance improvements

Improved the response time of the Sales Register and Items Register windows, and when opening item sales.

Bug fixes

We fixed a bug where incorrect COGS amounts were being applied to edited sales. Now, if you edit an item sale, the item's average cost and associated cost of sales are no longer affected. Learn more...

Resolved an issue where incorrect COGS amounts were being applied to returned goods. Now, if you sell multiple items as a unit, like a box or case, and some of those items are returned, the unit's average cost and associated cost of sales are calculated correctly. Learn more...

Fixed a display issue that did not affect calculations, but appeared to show an incorrect calculation basis in non-superannuation guarantee payroll categories. (Australia only)

AccountRight Server Edition - reminder

Never manually update your network again — If you're using AccountRight 2022.4 Server Edition, the 2022.5 update will download and install automatically. So that's less downtime for your business and more frequent improvements to AccountRight. Learn more...

2022.5.1 patch was a minor update to fix the following bugs:

-

You'll no longer get an error if you try to change the details of an account that's linked to a card.

-

We've re-introduced a safeguard to stop you changing an account to a header account, or changing the account subtype, if the account has been used in a sale or purchase.

2022.4 (May 2022)

Superannuation changes (Australia only)

Helping you automate the super rate increase — a new option has been added to super guarantee payroll categories to automatically increase the rate to 10.5% for pays dated 1 July onwards Learn more...

Simplifying super calculations — the $450 super earnings threshold is automatically removed from super calculations for pays dated 1 July onwards Learn more...

Helping you stay compliant with ATO super reporting — the correct ATO reporting category is now set as the default for all super guarantee payroll categories Learn more...

AccountRight Server Edition

Never manually update your network again — once you update to AccountRight 2022.4 Server Edition, all future updates will happen automatically. So that's less downtime for your business and more frequent improvements to AccountRight. Learn more...

API improvements

Bill of Materials endpoint now allows querying of a single item

For more information about our API improvements, visit the API Support Centre.

Bug fixes

We fixed a bug that prevented you from printing a receipt for a payment recorded from a bank feed transaction

Fixed a DataInvalid error that prevented you from editing or deleting transactions

Performance improvements

Improved the response time of the Items Register window

2022.3 (April 2022)

What's new

Save time and minimise STP ATO rejections — your payroll details are checked each time you do a pay run and you're advised if anything needs to be fixed Learn more...

Better reporting for Single Touch Payroll Phase 2 — the Payrun Activity [Detail] report within the payrun now includes STP Phase 2 ATO reporting categories

More personalised invoice emails — if you've set up a new file and use AccountRight in a web browser, the default invoice email now pulls in customer information, such as customer name and invoice number

API improvements

API can now retrieve the Bill of Materials (Auto-Build list) for an item

2022.2 (March 2022)

What's new

You can now move from STP Phase 1 to STP Phase 2 — you'll see a prompt in the STP Payroll Reporting Centre and you'll be guided through the move. See Getting ready for STP Phase 2.

See what information needs to be fixed when sending an employee self-onboarding invitation email, with an improved Failed to send message

Increased character limit in employee self-onboarding fields (First name, Last name and Email)

Bug fixes

Fixed the ORMDataException error which occurred when transactions were failing to record in a network environment

Resolved an issue preventing you from saving changes to sales or purchases containing inventory items with zero on hand

Fixed an issue that was causing an incorrect prompt for double authorisation on super payments

2022.1 (February 2022)

New features

Employee Self-Onboarding button added to the Payroll command centre to make it easier to add employees — learn more

Employee self-onboarding contact details are checked to make sure they're complete and in the right format

Pay Super users (AccountRight Plus and Premier, Australia only)

SuperChoice Clearing House now processes all super payments, reducing payment times

There's a new Product Disclosure Statement and a new Direct Debit Agreement

Bug fixes

Resolved scenarios where incorrect COGS inventory values were calculated and used in transactions

Plus we've tidied up the look and performance of specific windows in AccountRight, and added other general performance improvements.

2022.1.1 patch was released to AccountRight PC Edition users to fix an issue that was causing an incorrect prompt for double authorisation on super payments. For Server Edition users, this fix will be included in the 2022.2 release due on March 16.

2021

2021.8 (December 2021)

New features

When using AccountRight in a web browser, you can now:

Re-download a bank file from the electronic payment transaction

Enter up to 255 characters in the Customer PO number field in invoices (previously, 18 characters)

API improvements

Resolved an issue where AccountRight API used incorrect pricing on an item

STP Phase 2 (AccountRight Plus and Premier, Australia only)

We're continuing to get AccountRight ready for STP Phase 2

If you're setting up STP after installing 2021.8, you'll be setting up for STP Phase 2

The ETP Benefit Type button appears when you process a pay with ETP payroll categories that use STP Phase 2 reporting categories

2021.8.1 update (January 2022)

This is a minor update containing performance improvements.

2021.7 (November 2021)

New features

(When using AccountRight in a web browser) Invoices now support longer alphanumeric invoice prefixes in invoice numbers

Performance improvement to the Adjust Inventory window

Bug fixes

Fixed an error causing AccountRight to close when recapping Transfer money

Fixed an error causing AccountRight to close when deleting a Receive money

Plus we've added general performance improvements and we're continuing to get AccountRight ready for STP Phase 2.

2021.6 (October 2021)

New features

Can now assign Lump Sum E reporting category and associated year for STP Phase 2. If you've paid a lump sum E payment this financial year, you'll need to assign a financial year to it. Learn more

Bug fixes

(When using AccountRight in a browser) Bank feed transactions no longer get stuck as "matched"

(When using AccountRight in a browser) E-invoices with blank lines can now be emailed

Online Invoice Payments (OIP) feature on invoices no longer displays after cancelling the OIP service

Purchases with 0 quantity items now total correctly in the Item Register

General performance improvements

API improvements

Fixed an issue with # of selling units

Plus we're continuing to get things ready under-the-hood for STP Phase 2.

2021.5 (September 2021)

(Australia) Last financial year-to-date amounts are now correctly sent to the ATO.

An extra page no longer prints when printing invoices.

An error no longer occurs when previewing or printing sales.

New features

Get ready for STP Phase 2 with new fields and reporting categories

Bug fixes

Newly invited users can now access online AccountRight files in a web browser

Users can now import QIF Files containing transactions dated in previous financial years

NullReferenceException error no longer appears when recording spend money transactions

System.IndexOutOfRangeException error no longer appears when recording transactions

ItemTotalAmountUnBalanced error no longer occurs when entering data on quotes and orders

Item Register values are now correct when an item is used more than once on an inventory adjustment

API improvements

The character limit in the Customer PO field has increased to 255 for ARL Public API - Sales & Purchases endpoints.

2021.4 (July 2021)

New features

Implemented the ability to select a form when sending an invoice to disk

Added a new Direct debit requests button to the Sales command centre that opens a hyperlink to the Direct Debit portal in the user’s default Web browser (Australia only)

Bug fixes

Resolved a recently introduced issue where receipts incorrectly show as unprinted in Sales > Print Receipts

Resolved an issue with Profit and Loss [Cash] report not calculating correctly for imported transactions

Resolved an issue where AccountRight was not remembering window sizes and locations from prior versions after being upgraded automatically

Resolved an issue where AccountRight was incorrectly removing previous version information after automatically updating

Resolved multiple issues with linked accounts on newly created files affecting both Accounting & pay runs (Australia only)

Fixed an issue where an error was displayed for some users when processing your first payroll for 2022 financial year (Australia only)

Improved handling of employee names on payslips (Australia only).

API / Developer General Improvements and fixes

API / Developers: Add Attachment endpoints to the AccountRight SDK

Public API / Developers: Added validation on Deposit to account for receive payments transactions.

2021.4.1 update (August 2021)

This is a minor update containing performance improvements

2021.3 (June 2021)

e-invoicing improvements

We're continuing to improve the functionality and ease of use of e-invoicing in AccountRight’s browser interface.

Find e-invoices easily: You can now filter your invoice list to show only e-invoices, and there’s an icon to show which of the invoices in the list are e-invoicing enabled.

Improved Tracking: You can now track the status of your e-invoice as it moves through your customer’s accounts payable process. You can see the status on the invoice list and the activity history on the invoice itself. A full list of the statuses can be found on this help page.

To see these e-invoice statuses in MYOB, your customer’s software must be enabled to send them.

Payroll improvements (Australia only)

We're rolling out a few changes to provide better coverage in more tax scenarios as well as helping your business make the transition to paying Superannuation at the new rate of 10% from July 1.

STSL Tax tables: For employers who have employees undertaking higher education and training programs we previously had separate tax scales for FS / HELP / FS + HELP, these have now been combined into one table called STSL.

Working Holiday Maker - Not registered Tax scale: For Employers who have not registered for paying working holiday makers, we have added a new tax scale to support Working Holiday Maker - Not registered.

Default Superannuation % change from 9.5% to 10%: The Super Guarantee (SG) rate goes from 9.5% to 10% as of July 1, for all new files created post-July 1 we will be defaulting the SG to 10%.

General improvements and fixes

Fixed an issue causing documents to sometimes not upload when dragged and dropped from Microsoft Outlook

Addressed a bug with some new company files being created with incorrect linked accounts

Fixed an issue with Profit and Loss [Cash] not reporting correctly for imported transactions

Fixed an issue causing AccountRight to crash when opening

Resolved an error when the 'Update Now' button is clicked

2021.2 (April 2021)

Information for Server Edition users

We found a bug in the pre-release version of AccountRight 2021.2 (released earlier this month) that affects what's shown in PDF versions of bills. AccountRight 2021.2.1 fixes this.

If you installed the earlier 2021.2 Server Edition, you'll need to uninstall it and install 2021.2.1 (available from my.myob: Australia | New Zealand).

To check your current version, open AccountRight and go to the Help menu > About AccountRight.

AccountRight 2021.2.1 is now available

Information for PC Edition users

We've had some reports of a System.AggregateException error occurring when starting AccountRight.

We're releasing a minor update that'll be automatically downloaded to fix this issue, so you might be prompted to restart AccountRight to complete the installation.

AccountRight 2021.2.1 has arrived and brings with it a powerful new way to send transaction information to customers using e-invoicing, as well as smaller fixes and enhancements.

This is also the first AccountRight release that will be delivered via the new automatic update experience for PC installer users.

Sending e-invoices will be available in AccountRight 2021.2.1 within the web browser interface. This allows the seamless exchange of transaction data between buyers and suppliers with compatible software.

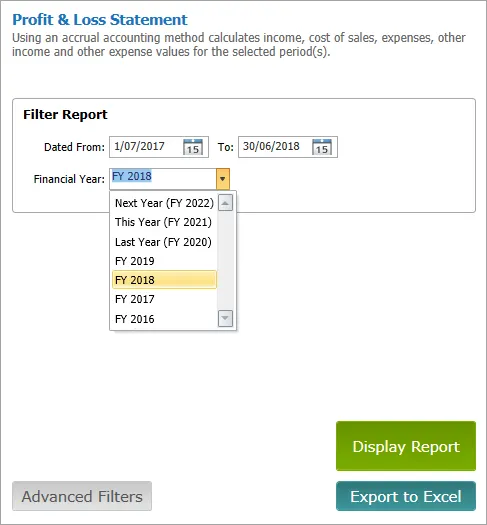

Reporting enhancements we’ve removed the date range restrictions on more reports, allowing you to run multi period balance sheet and profit and loss reports across unlimited date ranges.

Reminder for Server Edition users if you’re accessing offline company files across a local network using AccountRight Server Edition, you need to make sure that all installations of AccountRight are also the Server Edition version.

As always, we've also included some general improvements and fixes.

Sending e-invoices

E-invoicing is a government-backed initiative that allows invoices to be exchanged directly between buyers and sellers’ accounting software. This will not only cut down on manual data entry, but reduces the risk of human error and helps businesses get paid faster.

In AccountRight 2021.2.1, users in both Australia and New Zealand will be able to send e-invoices to customers using the service. Currently, this is mainly government agencies and large businesses, but the network of users is growing continuously.

Find out more about eInvoicing.

Reporting enhancements

We've removed the data range restrictions on more reports in AccountRight 2021.2.1. Now the multi period profit and loss, the multi period balance sheet and the profit and loss (with year to date) reports can be run over unlimited financial year periods provided there’s data available to report. Previously these reports were restricted to being run one year forward or back from the current financial year set in your business.

Reminder - changes for AccountRight Server Edition users

If you’re using AccountRight Server Edition to share offline files across a network, you’ll need to make sure that all users accessing those files are also using Server Edition, including those workstations accessing the server.

This is to make sure that all versions of AccountRight across your network stay the same, since any PC Edition installer versions will automatically update while the server version won’t. Learn more about updating an AccountRight network.

General improvements and fixes

We’re always working to make AccountRight faster and more reliable and 2021.2.1 is no exception. We’ve made some further performance optimisations in this version and fixed a couple of bugs that were causing AccountRight to crash when an update was installed in the background.

API Improvements and fixes

New endpoint alert!

You can now POST to the /{cf_uri}/Purchase/Bill/{Layout}/{PurchaseTxnId}/Attachment endpoint, enabling you to insert bill attachments via the public API as you can with spend money transactions (via the /{cf_uri}/Banking/SpendMoneyTxn/{Spend_Money_UID}/Attachment endpoint).

For more information, head to the MYOB Developer Centre.

2021.1 (February 2021)

This release will save you time and effort when it comes to how you install and manage your software.

Automatic updates Having to manually install software is so 2020. With automatic updates, your software will update to the latest version in the background without you needing to do anything.

Superannuation status improvements (AU only) We’ve improved how superannuation lodgement status is labelled to make things clearer and prevent overpayment.

Bug fixes and stability improvements As usual, there are plenty of under-the-hood improvements to make your experience using AccountRight better than ever.

To find out about previous AccountRight releases, see Previous releases.

Automatic updates for AccountRight

We’ve had feedback from you that the process for updating AccountRight isn’t always easy.

Having to download and manually install updates can be time consuming, especially if you have multiple PCs in your business using AccountRight. We want to keep our promise to deliver you more value more regularly, without creating extra effort for you to manage updates.

AccountRight 2021.1 will check for available updates, download them and update you to the latest version automatically. This means no more having to pick a time to stop your business using the software, downloading and installing the update and upgrading your file. When a new version is available, the next time you open AccountRight it will be on the latest version – just like that!

Automatic updates are only available for the AccountRight PC installer (which is the vast majority of users). If you’re using AccountRight server edition, automatic updates will be available for you later this year. For more information on how this impacts AccountRight server edition, see below.

Some things to note about automatic updates

The shortcuts for the 2021.1 release look different. Use the new shortcuts to distinguish the silent installer edition from other PC/SE installed versions.

Desktop icon:

Start menu icon

Automatic updates are available for all PC Edition users whether their company file is online or offline. Only an internet connection is required for automatic updates to work.

After installing AccountRight 2021.1, AccountRight will prompt the user when an update is downloaded and ready to install. The update is triggered when AccountRight restarts. The user can choose whether to restart AccountRight now or do it later.

Customers using both PC and Server Edition on their network will get out of sync. To prevent this, we recommend customers using AccountRight in a network install Server Edition on all PCs needing access to the company file. See the information for Server Edition users below.

We'll still need to decommission versions until all users have access to automatic updates. This includes those customers using Server Edition. Automatic updates for Server Edition will be available later in 2021.

Once you've installed AccountRight 2021.1 and upgraded your company files, you can uninstall older AccountRight versions. If you don't need to open files in older versions of AccountRight, it's a good idea to remove them.

Clearwater sample files are no longer supplied with AccountRight. You can however download sample files that will work with AccountRight 2021.1. See Using the sample company file (Clearwater).

We'll update relevant online topics with information about automatic updates once we start to make AccountRight 2021.1 generally available to customers.

If you're using on offline file and access third party apps using the Add-on connector, you'll need to restart the Add-on connector after installing 2021.1. For information on how to do this, see Add-ons.

Changes for AccountRight server edition users

If you’re using AccountRight Server Edition to share offline files across a network, you’ll need to make sure that all users accessing those files are also using Server Edition, including those workstations accessing the server. This is to make sure that all versions of AccountRight across your network stay the same, since any PC installer versions will automatically update while the server version won’t.

To check if you're using the Server Edition, look for SE in your desktop shortcut description.

Here's an example:

If there's no SE, you're using the PC edition.

Reminder – support for Windows 7

Microsoft discontinued support for Windows 7 on January 4th, 2020. MYOB ended its extended support of AccountRight on Windows 7 on March 31st, 2020.

If you’re using Windows 7, it’s important that you upgrade to a supported operating system to keep your system secure and operating reliably.

For more information, check out the Windows 7 end of support page from Microsoft, or speak to your IT provider.

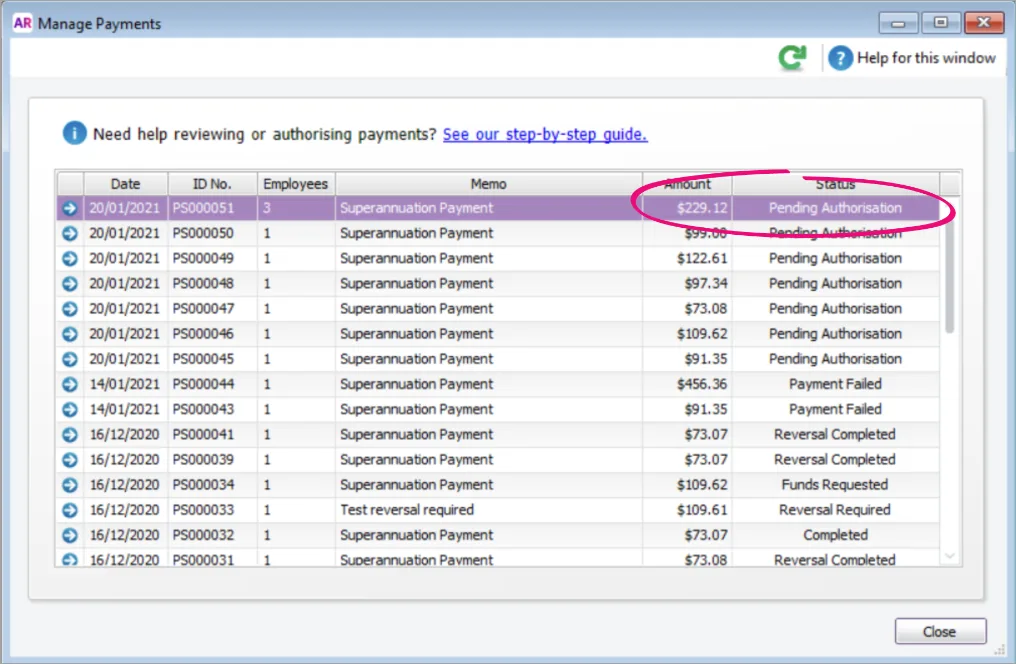

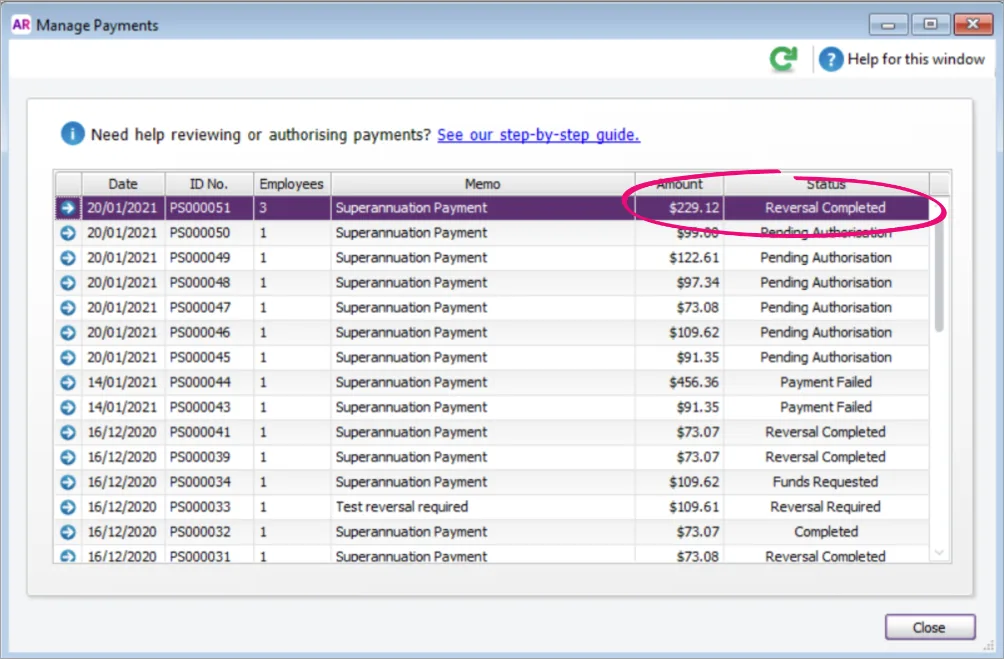

Superannuation status for reversed pay runs

We’ve improved the statuses of superannuation payments to make it clearer when a payment has been reversed. Previously, when you reversed a superannuation payment transaction, the status did not update to reflect that the transaction had been reversed. This meant another user might not realise the transaction was reversed and authorise the payment to the fund.

Now, when a payment is reversed, the status will update to Reversal completed, alerting all users that the payment has been reversed to prevent payment being completed.

Now when payments with the following statuses are reversed, the status will change to Reversal completed:

Pending authorisation

Partial authorisation

Payment failed

Withdraw failed

Reversal required

General improvements and fixes

That’s not all! We have the usual enhancements and fixes to make your experience using AccountRight even better in 2021.1.

Job number character limit We’ve extended the character limit for job numbers from 15 to 30 characters

Importing and exporting journals in foreign currencies You can now export your foreign currency general journal transactions, extending the functionality of the recent foreign currency general journal release

Importing activity slips with decimals in the ‘units’ field This is now supported when a payroll category is allocated (AU only)

Bug fixes and stability improvements No release of AccountRight would be complete without squashing some pesky bugs. We’ve improved support for transactions entered via AccountRight’s browser interface as well as smaller bugs using foreign currencies, printing reports and more. And of course, we’ve given AccountRight further tune ups to make it faster and more reliable than ever.

API Improvements and fixes

‘Custom list’ endpoints The custom list feature allows you to set up lists of predefined attributes and assign them to your items and contacts to enhance and organise your data. You can now read the custom lists and their values via the API.

2020

2020.4 (December 2020)

A new release of AccountRight, 2020.4.2, is now available. This release addresses an issue discovered in testing of 2020.4 that prevents some users from printing a remittance advice on a customised remittance template. AccountRight 2020.4.2 is now available at my.myob AU | NZ and will be rolled out to users via in-product messages soon.

AccountRight 2020.4 promises to be one of our biggest releases yet, giving you access to an entirely new way to work with AccountRight, along with further enhancements to reporting, multi-currency and more.

Access AccountRight via a web browser You can now access your online AccountRight files through a web browser interface, giving you the best of AccountRight anywhere on any internet-connected device.

Pass online invoicing card transaction fees to customers When your customers pay you with debit or credit cards using online invoice payments, you can pass along the 1.8% card transaction fee to them. And, we've made reconciliation of online invoicing payments easier.

Multi-currency enhancements We've made more improvements for users working in multiple currencies. You can now create general journals for more account types and we now support foreign currency remittance advices.

Reporting improvements We've removed date range restrictions, allowing you to run key reports across an unlimited period.

Bug fixes and stability improvements We’ve continued the stability and performance focus from AccountRight 2020.3 into this release, with further crash and bug fixes making this release even more reliable and easy to use.

Access your AccountRight file via your web browser

You can now access your online AccountRight file via your web browser. This allows you to perform your most common tasks from any online device, including mobile and tablet devices.

Send an invoice on site, code your bank transactions on the train, check your business performance in the coffee queue – browser access for AccountRight brings new levels of flexibility to the power of the AccountRight platform.

Find out more about working with AccountRight in your browser.

Only online files with a current subscription can be accessed from your web browser.

Just open your AccountRight company file as you normally would and click the Open in web browser button.

Online invoice payments (Australia only)

2020.4 is a big release for online invoice payments users, with the top two feature requests making their way to AccountRight.

Pass on card transaction fees (surcharging): In AccountRight 2020.4, you can pass along the 1.8% card transaction fee to your customers. The surcharge will be added to the invoice total and settled to your account after payment. Surcharging is only applicable to invoices paid with credit or debit cards (AMEX, Mastercard and Visa). BPAY fees cannot be passed on.

Easier payments reconciliation: When funds from online invoice payments are settled into your account, AccountRight can automatically create a bank deposit transaction and clear the corresponding transactions from undeposited funds. This will save considerable time previously spent allocating the settlement amount to the individual payments.

Multi-currency improvements

This release improves the functionality of foreign currency general journals, introduced in AccountRight 2020.3:

You can now post general journals in foreign currencies to other asset and other liability account types (this was previously limited to bank and credit card accounts)

Foreign currency remittance advice is now supported for pay bills and spend money transactions.

Reporting improvements

AccountRight 2020.4 builds on the previous release by removing date range restrictions on more key reports, allowing you to run reports across unlimited periods that would have previously required you to restore a backup of that financial year.

You can now run the profit and loss statement and balance sheet reports across unlimited periods.

The date restrictions on the ‘send to accountant’ (.MYE export) functionality have also been removed.

Exporting the profit and loss and balance sheet reports to Microsoft Excel has been improved, providing better formatting within the workbook.

Defect and crash fixes

We improved stability in AccountRight 2020.3 by over 60% and we’re continuing this focus with further crash and bug fixes, making 2020.4 the most reliable release yet.

When importing activity slips with decimals in the unit column, the payroll category wasn’t importing correctly. This has been resolved.

Fixed display issues with longer item numbers

We’ve also fixed the most common crashes that happened when

Processing payroll

Adding/removing attachments to transactions

Resizing or closing multiple windows.

API Improvements and fixes

New BalanceSheetSummary endpoint

API users currently call the {cf_uri}/GeneralLedger/AccountRegister endpoint to retrieve the data they require from ARL to calculate an Account Balance which carries a number of limitations, particularly around dates. These limitations required manual calculation work which is cumbersome and can be inaccurate.

The new BalanceSheetSummary endpoint allows users of the API to quickly and easily retrieve account balances for balance sheet accounts as at a date for postable accounts. This endpoint will return accrual balances.

API bugfixes

The incorrect order type was being returned from Sales and Purchases when performing a GET on the Sales Order and Purchase Order endpoints.

The default Price Level field in the Company Preferences endpoint was returning an incorrect value.

The Item Price Matrix endpoint was returning a 404 not found when retrieving items that were created using the API.

To download older AccountRight versions, visit our downloads page.