-

This page lists improvements made to MYOB Practice in previous years.

-

For improvements made to MYOB Practice in the current year, see What's new in MYOB Practice.

-

For tax issues, see also the known issues page.

Can't see these features in Practice Compliance? Clear your browser's cache and refresh the Practice Compliance tab. If you still can't see it, your practice may not have access to that feature.

2025 improvements

February 2025

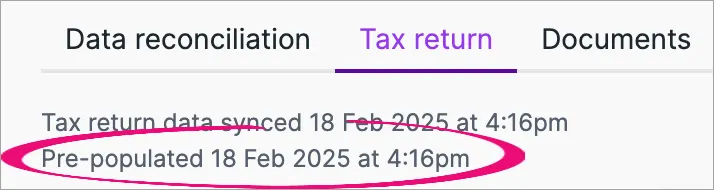

Better visibility on the status of pre-populated tax data

You'll see a message with the date and time that pre-populating data into a tax return is complete.

If pre-populating the data isn't successful, the date and time will be blank.

You'll also see a message at the top of the return when the pre-population succeeds or fails, with more information to help you troubleshoot any issues.A better way to manage file access

You can give MYOB Practice users access to client files all within MYOB Practice. You no longer need to go to my.myob to manage file access. This new method is faster, more reliable and gives you a more consistent experience all within MYOB Practice.Updated Use of Money Interest (UOMI) rates

We’ve updated UOMI rates to match the new Inland Revenue rates.

UOMI in unlocked tax notices will be recalculated to incorporate the new rate.

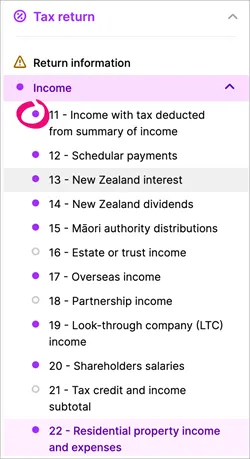

Learn more about working with UOMI in MYOB Practice.Identify which tax return sections have data

The tax return navigation bar shows a purple indicator on which sections and subsections have data. This gives you visibility on which sections have been completed when preparing or reviewing tax returns.

The indicators will appear if items have:yes or no default selected

rolled over data from the prior year.

As you enter data into the return, the purple indicators will appear after you refresh the return or click Validate.

2024 improvements

Tax improvements

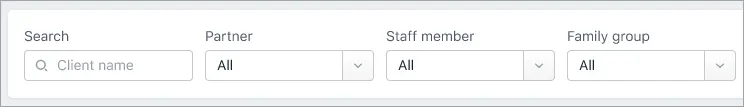

Quick access to RIT amounts

18 December

The Compliance list now has a RIT ($) column. This let you quickly review the amounts without having to open individual tax returns.

This column shows amounts for returns that meet the following conditions:

Return types other than IR526 and IR7.

Returns with a status of Ready for client review. If the status changes back to In progress, the amounts won’t be shown until the return is no longer in progress.

Newly created returns for the 2023 tax year onwards. In 2025, we’ll be making these columns available for existing returns for the 2023 tax year onwards.

More tax data sharing options for faster return preparation

10 December

You can share tax data by distributing income from 2024 onwards, from an IR6 and IR7 to an IR3NR, IR4, IR6, IR7, IR8 and IR9 tax return. You could previously share from an IR4, IR6 and IR7 to an IR3 individual returns only.

See Distributing data between tax returns for details.

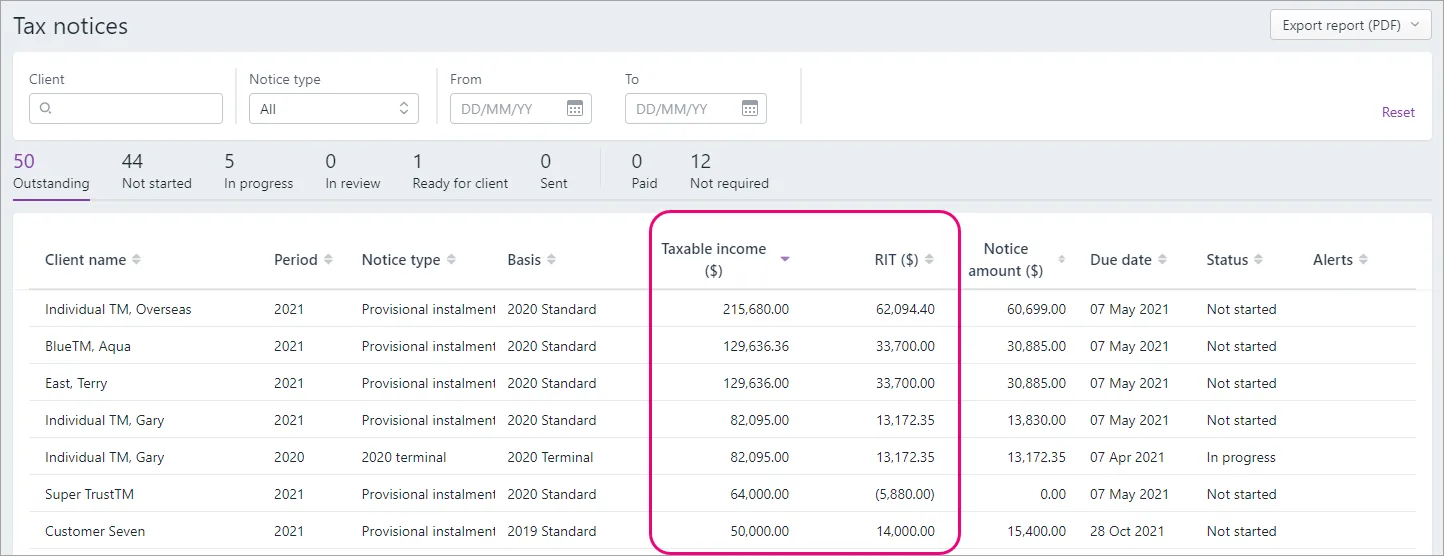

New hub for all your clients' tax information

4 October

The Tax clients page is a new area in MYOB Practice for viewing all your key tax information for all your clients.

29 September - New status date field in compliance

On the Compliance page, we've created a new Status date column.

You can sort the returns using this field and keep the progress of your returns.

22 August – A better way to add association details

Tax returns from 2024 onwards let you easily add association details using existing data, including the date of birth and addresses for beneficiaries.

This applies to 2024 tax returns onwards for IR4 shareholders, IR6 beneficiaries or settlors and IR7 partners or owners. It applies to transfers in IR3, IR3NR, IR4, IR526, IR6, IR8 and IR9.

-

You can still enter the association details directly into the tax return, but if you then add the details with this new method using existing data, the details will be added twice. This includes any details added to a return before this feature was released.

-

With this quick new way of adding associations being available, association details will no longer be pre-populated when a 2024 return is created.

29 July - IR7 Partnership and Look-through-company return updates

The income and tax amounts will be calculated immediately for each partner or owner after entering the percentage, rather than when the total allocation is 100%.

Only one error will be shown when the allocation doesn't equal 100%, rather than on each partner or owner percentage field.

2 July - Tax threshold changes for 2025 tax notices

IR3, IR3NR and unincorporated IR9 only

We've applied new rates for tax notices that use the estimation method.

The 2025 tax year uses transitional rates, and the final rates will be used from the 2026 tax year onwards.

Learn more about personal income tax threshold changes on the IR website.

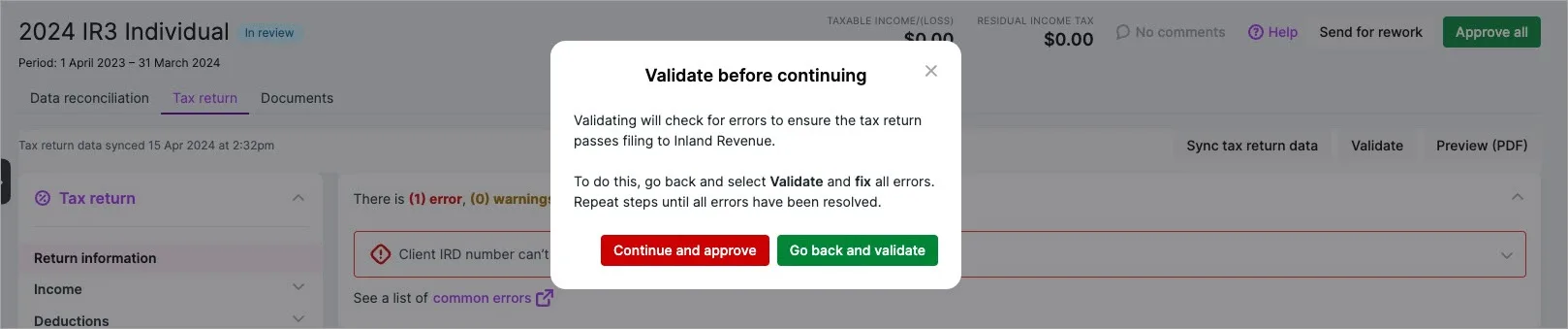

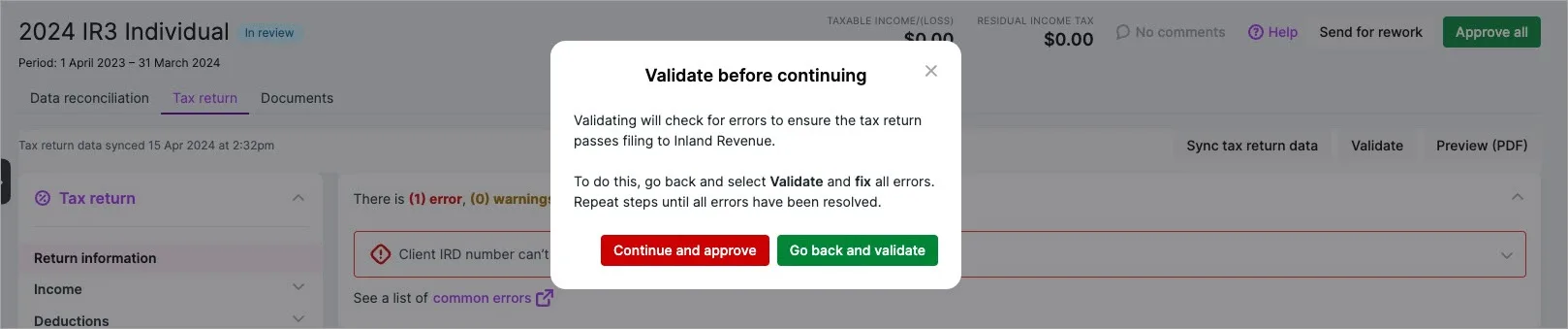

23 April - Tax validation message

You'll see a message to warn you if you approve a tax return that has validation errors or hasn't been validated, with an option to continue or go back and validate.

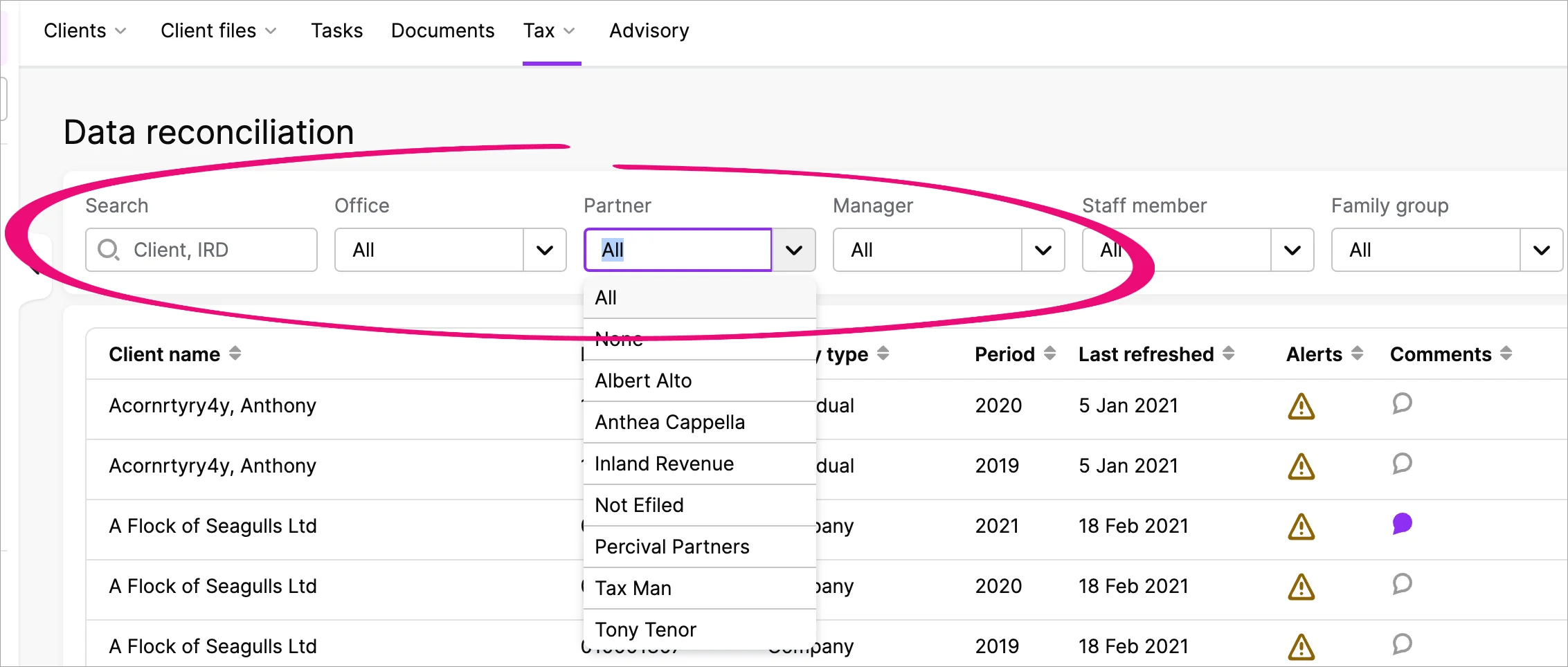

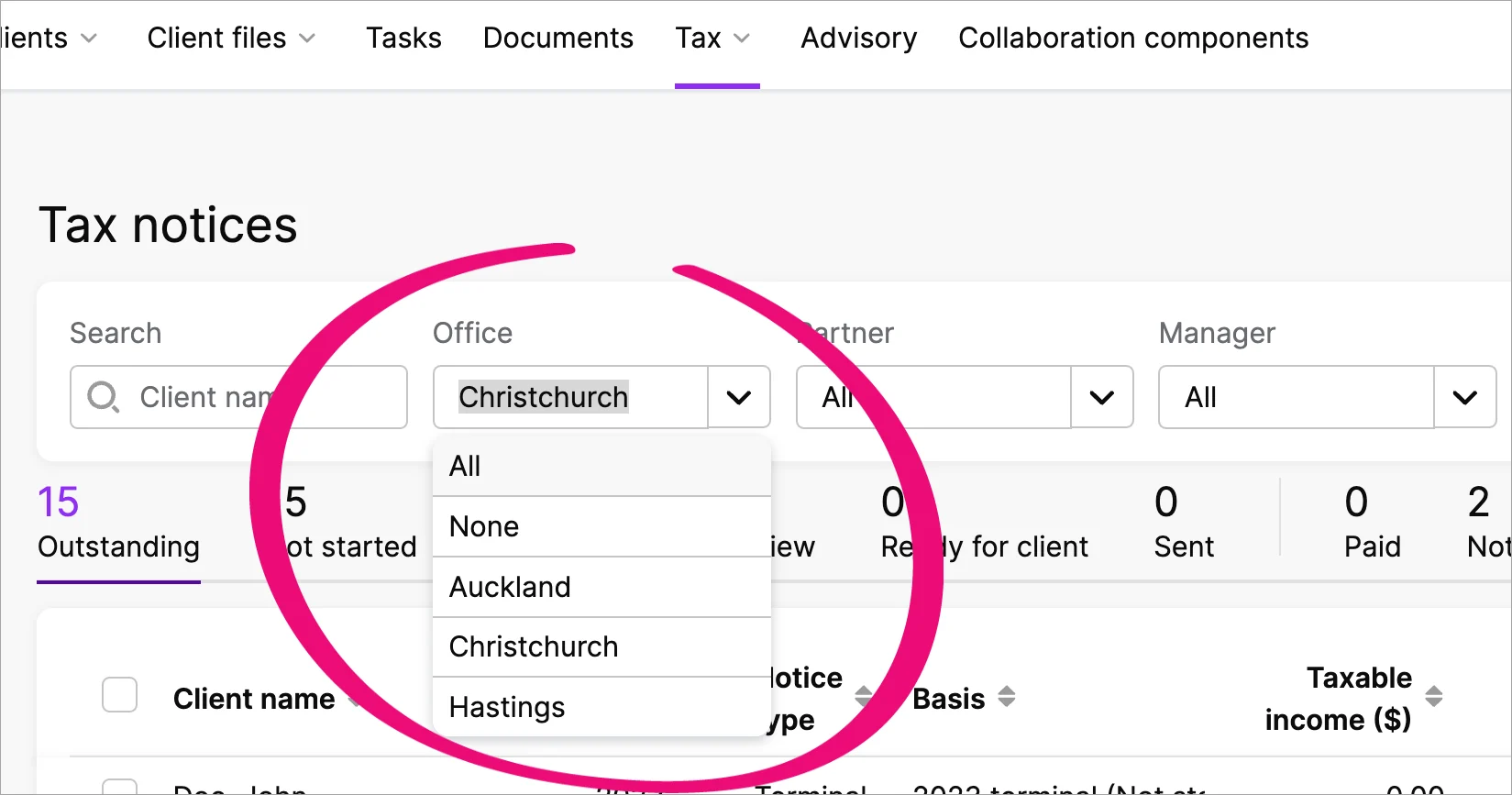

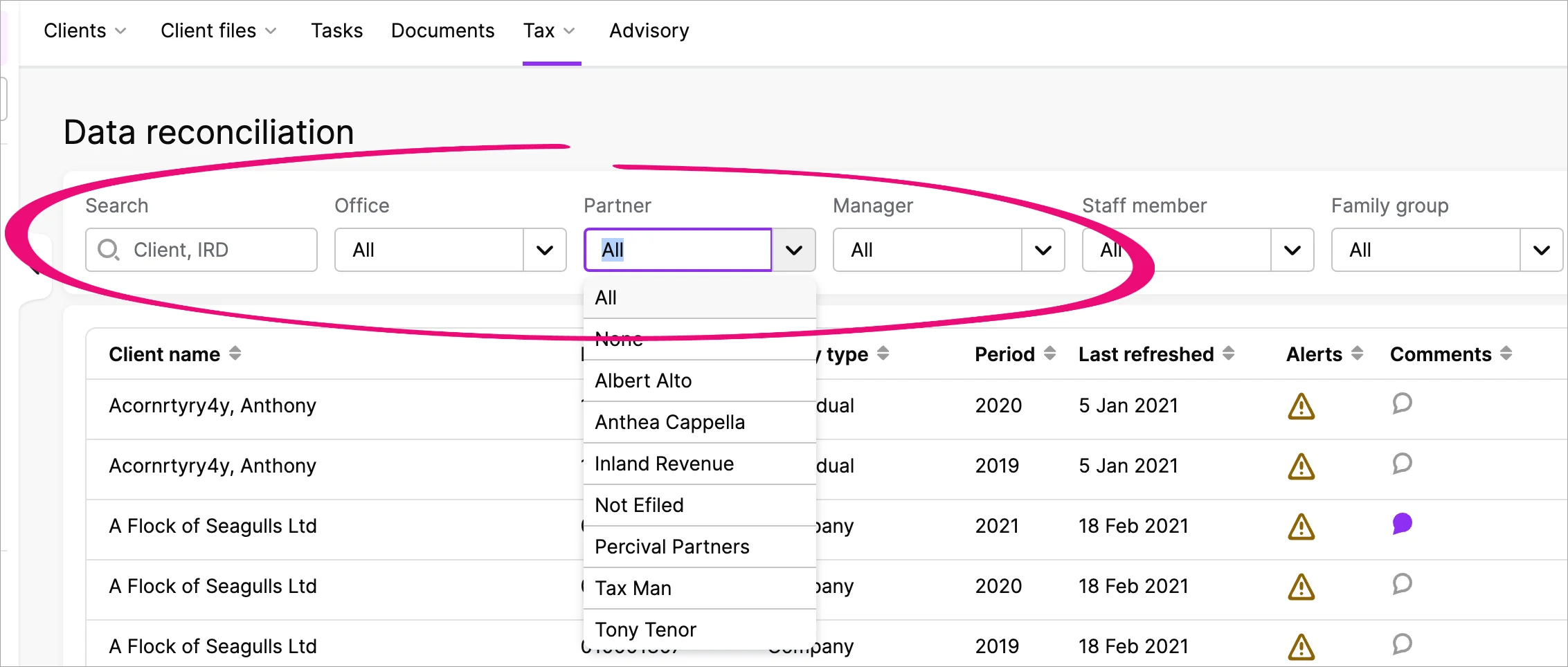

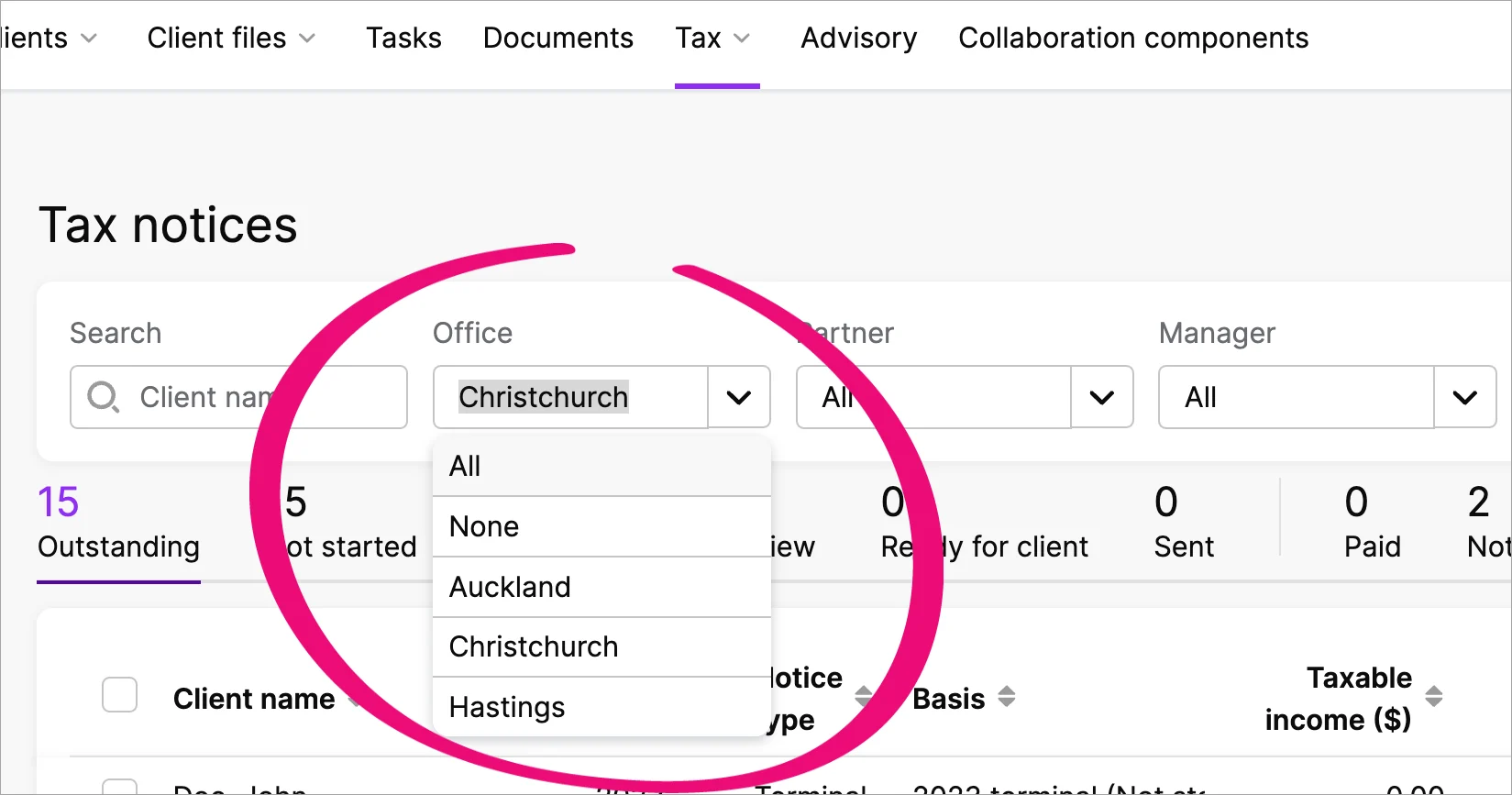

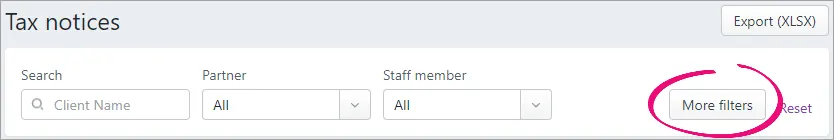

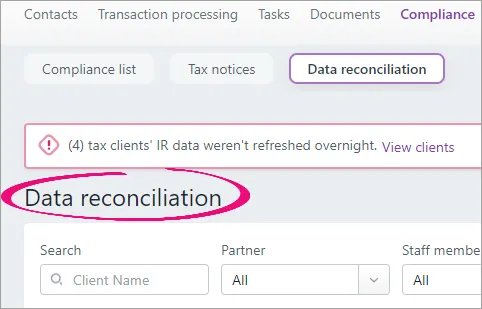

23 April - More ways to filter lists to quickly find what you’re looking for

Filter and field updates

In the Compliance list only:

The Search field lets you search by client code.

In the Compliance list, Tax notices and Data reconciliation pages:

You can filter by Manager.

The Partner filter is available whether or not you have MYOB AE/AO.

The Staff member filter only shows a name, instead of a name and role.

Filter by the client’s office category

This only applies if you have MYOB Practice and MYOB AE/AO.

If you applied an office category to your clients in MYOB AE/AO, you can filter by office on the MYOB Practice Compliance list, Tax notices and Data reconciliation pages in All clients view. For example, if you want to find all tax returns from clients with an office category of Christchurch.

2 April - Tax compliance for 2024 is here!

You've got all the latest updates you need for the new tax year, including:

rolling over tax return and compliance settings data from the previous year

More pre-populated data from IR

rate changes

IR6 changes

other changes and resolved issues.

Learn more about the 2024 tax compliance changes.

28 May - Improvements to how the Data reconciliation Period summary fields work

If the IR balance owing and Total IR assessment value fields have no value, the fields won't show any value and will appear empty. The fields previously showed a value of $0.00 if they had no value. Now the fields will only show $0.00 if the fields have a value of 0, rather than no value.

15 March - View all tax clients in Data reconciliation

All tax clients are now included in the Data reconciliation page and spreadsheet export. Clients with no account or period available will default to the current tax year for the period. Previously, you wouldn't see tax clients in Data reconciliation if they didn't yet have an account or period applied due to no available IR information.

23 April - Tax validation message

You'll see a message to warn you if you approve a tax return that has validation errors or hasn't been validated, with an option to continue or go back and validate.

23 April - More ways to filter lists to quickly find what you’re looking for

Filter and field updates

In the Compliance list only:

The Search field lets you search by client code.

In the Compliance list, Tax notices and Data reconciliation pages:

You can filter by Manager.

The Partner filter is available whether or not you have MYOB AE/AO.

The Staff member filter only shows a name, instead of a name and role.

Filter by the client’s office category

This only applies if you have MYOB Practice and MYOB AE/AO.

If you applied an office category to your clients in MYOB AE/AO, you can filter by office on the MYOB Practice Compliance list, Tax notices and Data reconciliation pages in All clients view. For example, if you want to find all tax returns from clients with an office category of Christchurch.

2 April - Tax compliance for 2024 is here!

You've got all the latest updates you need for the new tax year, including:

rolling over tax return and compliance settings data from the previous year

More pre-populated data from IR

rate changes

IR6 changes

other changes and resolved issues.

Learn more about the 2024 tax compliance changes.

15 March - View all tax clients in Data reconciliation

All tax clients are now included in the Data reconciliation page and spreadsheet export. Clients with no account or period available will default to the current tax year for the period. Previously, you wouldn't see tax clients in Data reconciliation if they didn't yet have an account or period applied due to no available IR information.

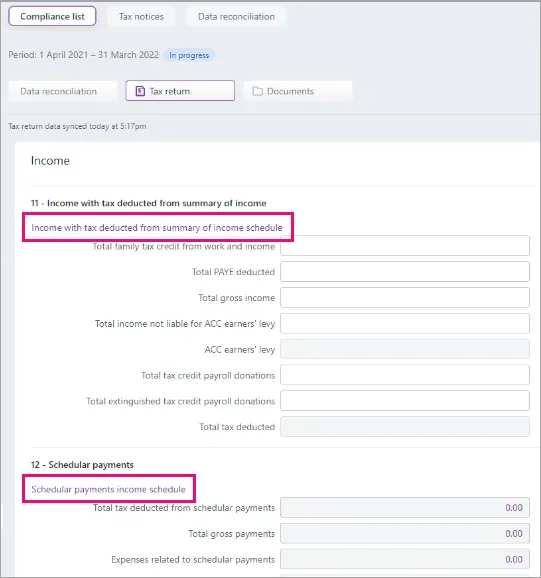

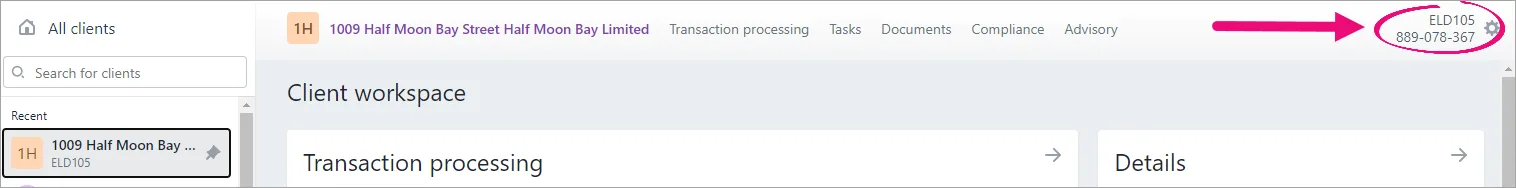

9 January - Focus on information in schedules with a cleaner interface

When you open a schedule, it'll expand to fill the whole browser tab. Other settings, menus and the client sidebar will be hidden. You'll see the client name, client code and IRD number above the schedule.

User management

14 August - Simplified workflow for removing client file access

This only applies if you have MYOB Practice without MYOB AE/AO

When you remove a user, their access to client files will also be removed. This means you no longer need to remove file access in my.myob. By keeping more of your workflow within MYOB Practice, you get a more consistent, focussed experience.

Deleting the user won't remove their access to client files if the user is marked as Admin in my.myob.com > My account > Manage online file access. To remove file access for Admin users, contact us.

25 June - User management improvements

MYOB Practice users without MYOB AE/AO only

It's easier than ever to add new users to MYOB Practice. You no longer need to create a my.myob account, and you can do all the setup steps from within MYOB Practice.

There are also two new permissions available to control who can manage practice users and online file access.

You may notice some updated permission and label names while doing user management tasks. For example, the Administrator permission is now Practice administrator, the Staff menu is now User and the Roles menu is now Permissions.

Read all about the details about adding users and assigning permissions.

2023 improvements

In-product help

MYOB Practice in-product help is here!

Learn about the workflows by watching a video, reading our Help pages, or taking a quick tour without having to leave the product.

You'll see this banner on the following pages in MYOB Practice

Transaction Processing

Contacts

Portals

Use the toggle button (up arrow) on the top right of the panel to close the window if you no longer need it.

Partner Hub improvements

To find the Partner Hub, select Practice (the stack of three squares) on the left side of MYOB Practice.

6 December

Reward preferences in Partner Hub

You now view and edit your reward preferences from Partner Hub instead of through my.myob. This lets you control more in one location, from MYOB Practice.

23 February

Improvements to finding your way around the Partner Hub

We've added a new navigation bar to the top of the Partner Hub, so that you can easily find everything you need to know about the Partner Program and your team activity.

Contacts and other improvements

4 October

Import contacts in bulk

Quickly add multiple contacts by downloading a CSV template, entering their details, and import the CSV into MYOB Practice. Learn more about importing in bulk.

26 September

Link a client file to multiple practices

When a client invites you to work on a file, accepting their invitation takes you to a new page where you can select which practice or practices you want to link to the file.

11 May

Find clients that staff are working on

In the Contacts list, you can now filter to see the clients that staff are working on.If you’re using MYOB Practice and not AE/AO, you can now also assign the staff to clients in MYOB Practice.

If you use AE/AO with MYOB Practice, you can still assign staff in AE/AO that will appear in MYOB Practice.

Learn more about assigning staff to clients.

8 February

A better look and feel

We’ve improved the visuals in MYOB Practice. You may notice a difference in the colours, buttons and other areas. These changes improve accessibility, making MYOB Practice easier to read and work with.This just changes the way things look; you don’t have to learn anything new and the way you work won’t change.

Tax improvements

15 December

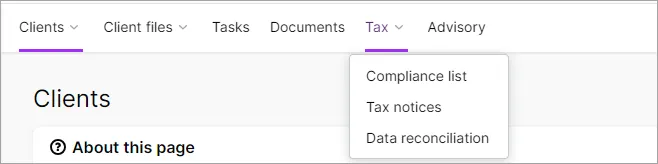

New navigation menus

We've changed some of the menu items in the top navigation bar as part of our new and improved experience. There are no changes to the functionality of the software, just a fresh new name.

Contacts is now called Clients with a submenu of Client list and Portal list.

Transaction processing is now called Client files with submenus for Online files and Desktop files.

Compliance is now called Tax and has a drop-down for Compliance list, Tax notices and Data reconciliation.

11 December

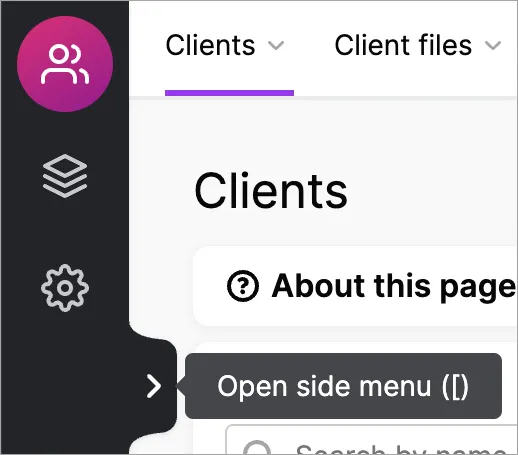

Improved tax return navigation experience

The navigation panel is moved from the right of the page to the left.

The navigation panel will highlight which section and subsection you're in to help you quickly scan the list of sections and see where you’re located.

Each section of the navigation panel has its own scroll bar, instead of the one scroll bar for the whole panel. When you scroll one section, the other sections will no longer be scrolled out of view.

The Tax workpapers & schedules and IR attachments sections in the navigation bar are renamed and combined into an Attachments and schedules section and divided into subsections for each of these types of attachments.

You may notice some other changes to the navigation bar order to create a consistent experience.

When you scroll through a tax return, the section header will remain at the

top of the page so that you always know which section you’re in.When you open a tax return, the Contacts side menu will be hidden to let you focus on the tax return. You can always show the side menu again by clicking Open side menu (the > greater than symbol) or by pressing the square bracket ([) keyboard shortcut.

16 November

Transfers out are easier to work with

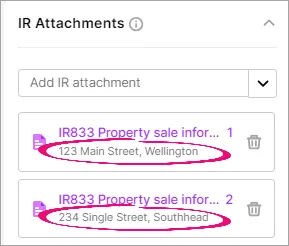

When you add transfers out to a tax return, they'll be shown in the tax statement separately to the Payments and transfers section.Easily identify attachments, workpapers and schedules

You'll see a unique identifier beneath the name of the attachment, workpaper or schedule on the panel next to the return if there are multiple attachments, etc. of the same type:

An IR833 will show address line 1.

The Business income statement will show the type of business.

The Rental income statement will show the full address.

19 October

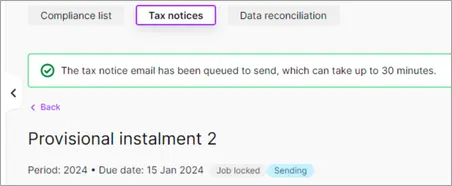

Easily know when a tax notice has sent

When you send a tax notice to your client, you'll see a new Sending status in the opened tax notice and the list of all notices. You'll also see a message explaining that the email is queued to send and that sending can take up to 30 minutes.

When sending completes, the status changes to Sent.

If you can't see the Sending status, try clearing your browser's cache.

4 October

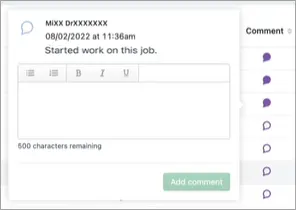

More ways to add comments to tax returns

In September we introduced the ability to add comments to the Compliance list page.

Now you can also add comments when you open an individual tax return from the Compliance list page. You can add and view the comment from the Data reconciliation, Tax return or Documents sub tabs.

Comments are synced between an opened tax return and the Compliance list views.

Learn more about adding comment.

27 September

Make notes about tax returns and share your thoughts with your colleagues

You can add comments to tax returns to track and share information with other users in your practice. Learn more about adding comments.

31 August

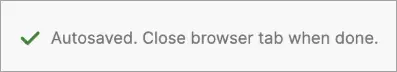

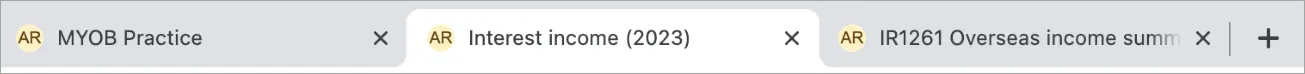

Improvements to working with workpapers and schedules

When you enter data in a workpaper or schedule and the changes are automatically saved, you'll see a message saying "Autosaved. Close browser tab when done." This helps you know that it's safe to navigate away from the page without losing data.

Your browser tab title shows the name of the workpaper or schedule that's opened, along with initials to help identify the client or contact (for example, AR). This makes it easier to switch between tabs without gettings lost when you have multiple MYOB Practice tabs open. Previously, all MYOB Practice tabs had the same title.

The workpaper or schedule name will remain displayed at the top of the page if you scroll down the page. This makes it easier to remember which workpaper or schedule you're in if you switch to another tab or window and then return to the workpaper or schedule.

15 August

IR1261 Overseas income schedule filing requirements update

When filing an IR1261 Overseas income schedule with an IR3 individual tax return:

you'd get error 2370 if overseas income and overseas tax credits claimed were both nil

you couldn't claim tax credits and also file the IR1261 if the income was 0.00 or a loss.

However, there are some situations where you should be allowed to do these things. Inland revenue (IR) have updated their filing requirements, so we've removed error 2370 and made the Tax credits claimable amount editable in the Overseas income summary section of the schedule.

14 August

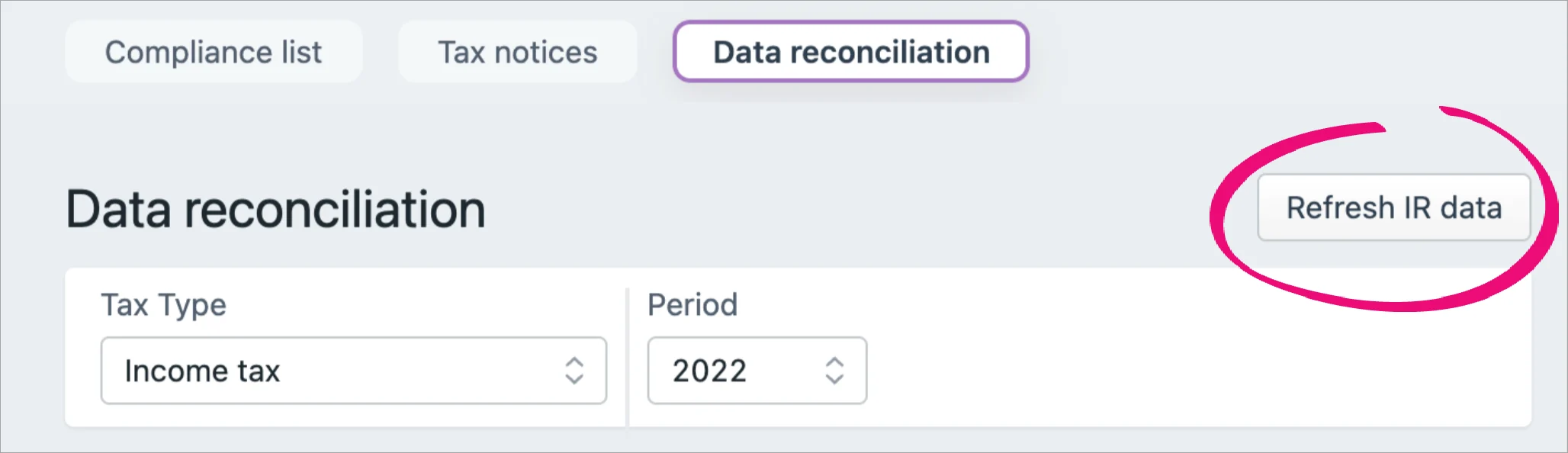

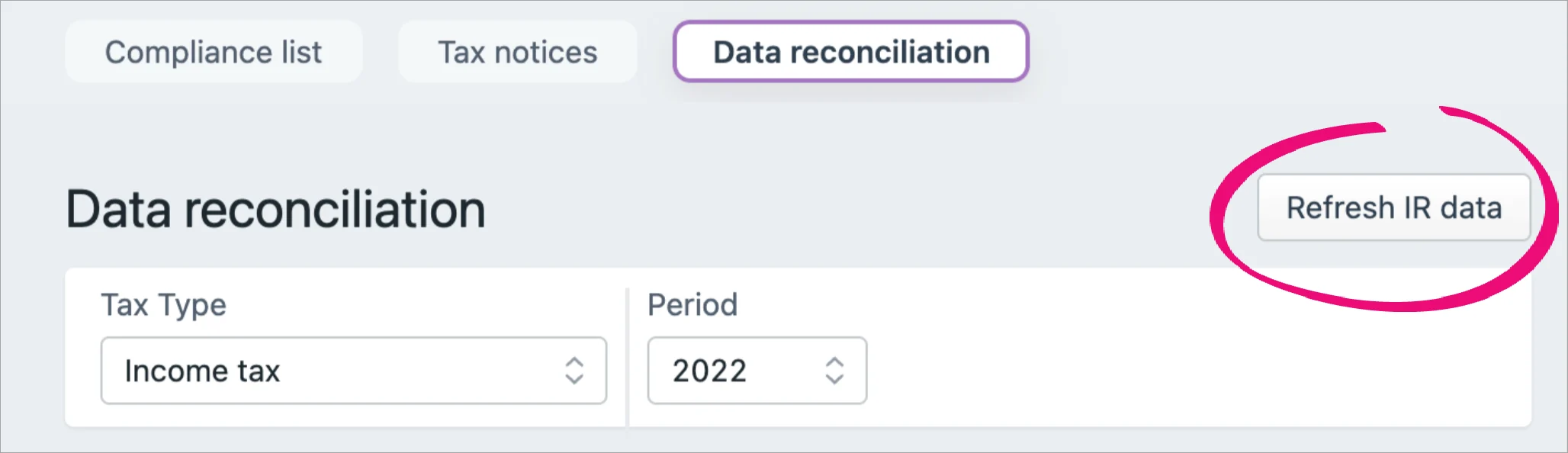

Updates to Transaction Data Service (TDS)

Inland Revenue (IR) have made changes to the TDS model. This changes the way that receiving your client's data works when the data is refreshed automatically or when you click Refresh IR data.

This new model improves the way that data is retrieved so that it can happen faster. There's nothing you need to do to enable this and there are no changes to your workflow.

We're releasing this update to different groups of customers over the coming weeks.

3 August

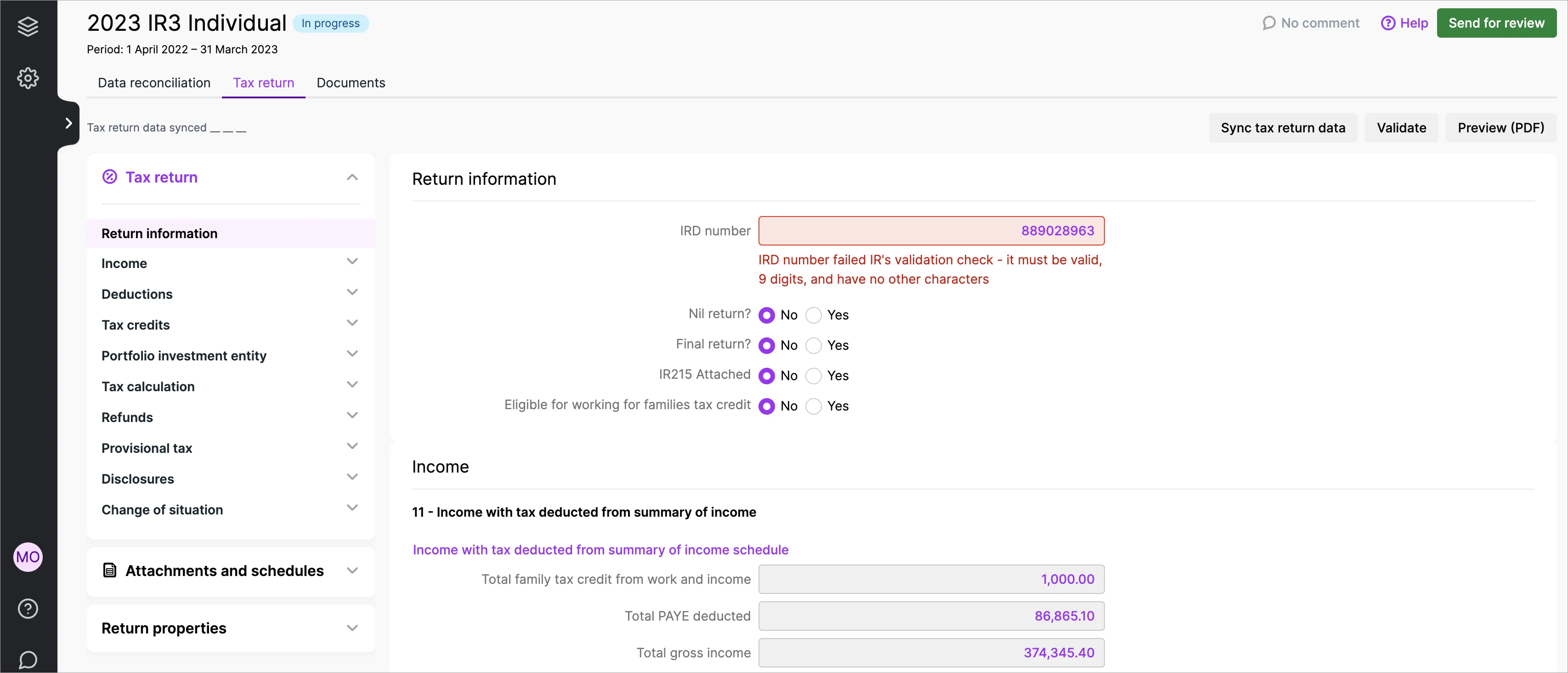

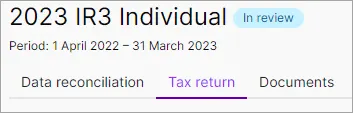

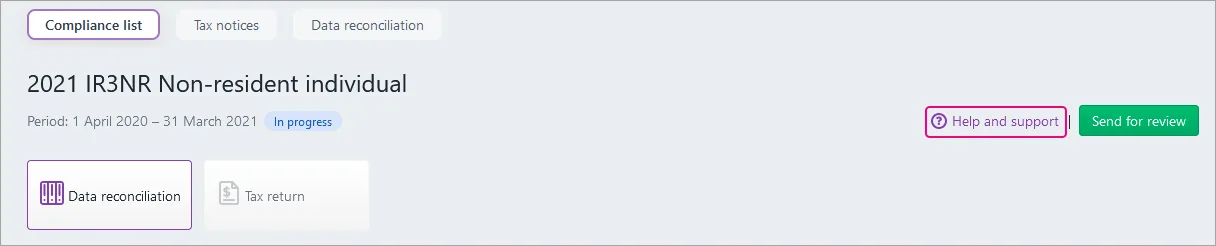

Improved tax return header

We've improved the header area at the top of tax returns. Most of the changes were made to display the information in a way that uses less space, so that you see more of the tax return by default. Here's what's changed:Replaced the big Data reconciliation, Tax return and Documents tiles with smaller tabs.

Open the Tax return tab by default.

Moved the status indicator (for example, In review) next to the tax return title.

Raised the position of the period a little higher.

On the right of the page, aligned the buttons and help link with the header.

The header will remain displayed when you scroll the page.

Example of the new header.

12 July

Quickly see the most relevant tax returns

The Compliance list Period filter defaults to the current financial year.

30 May

Tax return schedules are easier to read

We've removed the dollar symbol from all schedules to improve readability. Now only tax statement column headings display a dollar symbol.Pre-populated Portfolio investment entity (PIE) data

IR3NR, IR4, IR6 and IR7PIE income will now pre-populate into all tax returns if Inland Revenue holds a PIE certificate for the client, regardless of whether the income is a profit or loss. This means the PIE schedule will no longer roll over detail from a previous year.

PIE income can't be filed if the tax credits are negative, so you may need to remove any negative PIE for these return types.

12 May

More data in spreadsheet exports

The IRD number and other contacts information is included when you export compliance data to a spreadsheet.

2 April

Tax compliance for 2023 is here!

You've got all the latest updates you need for the new tax year, including:rolling over tax return and compliance settings data from the previous year

rate changes

residential property income

IR3 – Overseas income

IR3NR – Jurisdiction of tax residency

IR8 – Māori authorities

IR9 – Clubs or societies

other changes and resolved issues.

Learn more about all the details.

31 March

Manage your practice’s tax-related roles

You can now turn on and off tax-related roles for your practice. These roles let your practice decide which staff can approve, unlock and file tax returns. Previously, you needed to contact MYOB to enable these roles. Learn more about enabling tax roles

27 February

Student loan notices

Individuals only. NZ tax residents only.

The MYOB Practice Tax notices page now supports interim student loan notices in addition to the usual provisional tax notices. Having separate notices for student loans and provisional tax is helpful because the two types of notices may have different due dates. Interim student loan notices replace the need for voluntary adjustments in a provisional tax notice.

19 January

More Use of money interest (UOMI) calculation methods for terminal tax notices

You can automatically include the UOMI calculation from the tax return, or select a date range to use for calculating expected UOMI for returns. You may want to use these methods if UOMI from IR isn't available because the return isn't yet assessed.

Enhancements when adding a section (in a tax return)

We've made improvements when adding a section; you'll be able to add or delete sections as required. This will reduce any error 21 XML rejections from the IR that have been occurring due to a blank record.

2022 improvements

NZ tax

20 December

Use of money interest (UOMI) calculation for terminal tax notices

In addition to terminal tax notices including UOMI from Inland Revenue (IR) when a tax return is assessed, an extra calculated amount is now included by default. This amount covers the interest from the date IR has calculated interest up to the terminal tax payment due date.

You can override or exclude the UOMI amount. You can also select another date to use for the extra interest amount or exclude the extra interest amount.The UOMI calculation applies to all tax years. If you need to change terminal tax notices before the 2022 tax year, which have passed their due date, check and correct the calculation if necessary.

Use of money interest (UOMI) rates updated

We've updated the UOMI calculation in tax returns and tax notices to use Inland Revenue's (IR) latest interest rates. To learn more about the rates and the date that they come into effect, see the IR website.

Contacts

1 December

Group your clients and contacts

If you only use MYOB Practice, you can now group:individuals

companies

trusts

other organisations.

When you've created a group, you can search for members using their group name and navigate between them more easily. Each client and contact can belong to multiple groups. Learn more about groups.

If you use MYOB AE/AO, you’ll be able to see your family groups from the desktop software in MYOB Practice through contact sync.

November 2022

General

11 November

Less disruption and waiting, more productivity and efficiency!

MYOB Practice got a speed boost. We think you’ll notice improvements in a few different places, including tax rollover and upgrades completing within 10 to 20 seconds, and some key pages loading faster. Load times are halved in some cases, helping you stay in the flow while you work.

October 2022

Partner Hub

25 October

Added referrals and active files to Overview page

As part of our updates to the Partner Program, you can now earn points through referrals and active client files. The points you earn from referrals and active files are now visible in the Overview page of the Partner Hub. We've also improved the Activities summary area on the Overview page so that it's clearer to see the activities that earn you points and a summary of your practice's progress.

Contacts

25 October

Add and view salutations for your clients and contacts

If you only use MYOB Practice, you can now add salutations for your clients. Go to Contacts > Contact list and select a client by clicking anywhere in the client row to view their details on the same page. On the right side, you can edit the client and add their preferred name or title in the Salutation field.

If you use MYOB AE/AO, you’ll now see the salutation when you look at a client in your Contact list and in Client details.

NZ tax

24 October

Tax returns can be made Ready to file in bulk

You can change the status of multiple tax returns at the same time from Pending signature to Ready to file.

Filing in bulk was previously mostly useful if you used portal in MYOB Practice to automatically move returns to a Ready to file status. This change makes it easier to file tax returns in bulk if you’re not a portal user.

Learn more about updating the return status.

17 October

Calculate the use of money interest (UOMI) amount

IR3, IR3NR, IR4 and IR6 only, 2022 tax year onwards

Tax returns now include a UOMI calculator that you can use to work out the amount for you. You can change the calculation parameters to change how the UOMI amount is calculated, or completely override the calculation to enter your own manually calculated UOMI amount.

If you previously entered a manually calculated UOMI amount, you can still view it for your reference. But if you want to include the UOMI amount in the tax statement, you need to use the new UOMI calculator fields.

Learn more about entering data in a tax return.

4 October

Resolved issue with Compliance settings data failing to save

We've changed the requirements for compliance settings so that you only need to enter the current year. Learn more about the resolved issue.

September 2022

NZ tax

21 September

The Tax notices page spotlights the most urgent tax notices

The All clients view of the Tax notices page will be filtered to show the tax notices that are due next. This helps you see the most relevant upcoming tax notices straight away.

At the start of each month, the From date will be set to the 1st of the current month, and the To date will be set to the 15th of the next month (or the next closest working weekday). For example, on the 1/10/22 the tax notices are filtered to show those due between 1/10/22 to 15/11/22. Learn more about finding and filtering tax notices.

15 September

Add comments in the Data reconciliation All clients view

You can add comments to an entry in the All clients view of the Data reconciliation page. This can help you keep track of Data reconciliation work at a higher level than the individual transaction level. You could previously only add comments to transactions when you opened the Data reconciliation entry.

Learn more about adding comments to a Data reconciliatoin entry.

7 September

Delete MYOB assessment transactions with a $0.00 value in Data reconciliation

If you don't receive an IR tax return assessment because it has a $0.00 value, you previously couldn't delete the related MYOB assessment transaction in Data reconciliation, although you could delete all other transaction types with a $0.00 value. Now you can delete MYOB assessment transactions with a $0.00 value so you don't end up with unreconciled transactions that are no longer needed. Learn more about deleting a transaction.

August 2022

NZ tax

18 August

Add comments in Data reconciliation entries

You can add comments to transactions when you open a client’s Data reconciliation entry. Learn more about adding comments to a Data reconciliation entry.

12 August

Improved tax notice updates when settings change

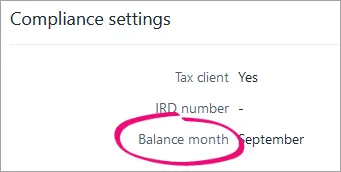

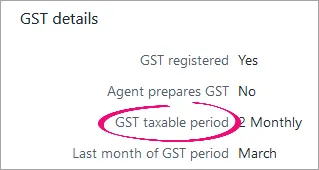

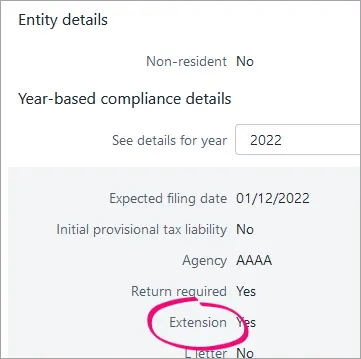

If you change the GST taxable period, Balance month or Extension in your client's Compliance settings, we’ll automatically recreate future-dated tax notices to use the new due dates. You previously had to use a workaround to update the dates.

Sent or Paid tax notices in the same tax year will become read only and you’ll only be able to change their status from Sent to Paid.

8 August

Download a convenient tax calculator

You can download a spreadsheet to help you easily calculate your client's tax. Learn more about the tax calculator.

July 2022

NZ tax

29 July

Creating new tax returns rolls over data

Creating tax returns in MYOB Practice rolls over details from the previous year's tax return, if you already have a return in MYOB Practice.Learn more about what data is rolled over and not rolled over, and your different options for creating a return.

22 July

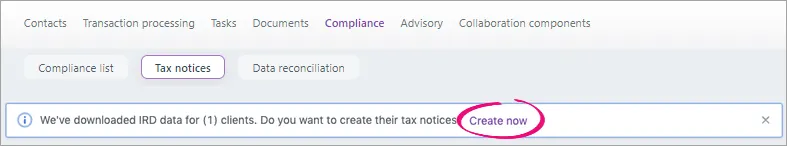

Tax notices are automatically created

MYOB Practice will automatically create tax notices for all your clients 3 months before they're due. You don’t need to do anything to create the notices. But if you prefer, you can also create an individual client's tax notices for the entire tax year. Learn more about preparing a tax notice.

Soon we’ll also be improving updates to tax notices when settings change. If your client has a change of balance month, GST taxable period, or extension, the future tax notices will be automatically updated to the new due dates. We’ll let you know when this features is available.

Portal

21 July

Save time when managing your tasks

We’ve redesigned tasks so that you can select up to 100 tasks to complete and reopen in one action. You can also now sort tasks by client and due date so that you quickly find the most relevant tasks. Learn more about tasks.

20 July

Improved task reminders

We’ve improved the interface for Tasks so that it’s clearer that you’re sending your clients a reminder, not a new task. Your clients will also be sent improved email reminders that clearly show they’re task reminders, not new tasks. Learn more about sending a task reminder.

NZ tax

14 July

More data included in Data reconciliation exports

Extension of Time data is now included when you export Data reconciliation transactions to a spreadsheet. Learn more about exporting Data reconciliation data to a spreadsheet.

6 July

MYOB Practice checks your data’s accuracy

When you’re working in MYOB Practice, you can have a high level of confidence that your client’s tax data is correct. Background processes in MYOB Practice ensure that the data’s aligned with the data that comes from IR. If something does go wrong, we’ve improved the error messaging for the TDS data feeds and IR data refresh to help you understand the issue.Learn more about refreshing IR data about receiving your client’s IR data.

June 2022

NZ tax

21 June

Use a 50/50 split for provisional tax instalments

You can now select whether a client is eligible to pay provisional tax in two equal instalments instead of the usual three instalments. This will calculate provisional tax using a 50/50 split and will be reflected in the tax return and tax statement. If you select this option, it will only be reflected in existing tax notices, returns and statements if they are in progress and aren't locked.

This option is only valid to use for one year for eligible clients. In the client's subsequent tax years, we’ll automatically change the two instalments to three instalments.

Previously, you had to use a voluntary adjustment to allow a 50/50 split.

Learn more about payable provisional tax notices, or set it up now in the year-based Compliance settings section of Client settings.

8 June

Filing tax returns is faster and more convenient

You can file tax returns in bulk! Select all the returns you want to file from the Compliance list and click File to send them all to IR.

Learn more about filing a tax return.Export Data reconciliation transactions to Excel

You can export MYOB and IR transaction data from Data reconciliation to an XLSX spreadsheet file. This can be a handy way to review the data, and to make and share notes and comments. You can filter that data before exporting.Learn more about exporting Data reconciliatoin data to a spreadsheet.

Partner Hub

1 June

Share your practice's Partner Program tier

In the Partner Hub, you can now download your status badge with your practice's Partner Program tier. Add the badge to your website, email signature or social media to showcase your tier. Learn more about downloading your status badge.

May 2022

Partner Hub

26 May

View the status credits you've earned from events

If your practice has earned status credits from attending an event, you can now see this under Program Activities. To see more detail and check who has registered for an event, click View Team Progress History and select the Events tab. Learn more about viewing team activities.

NZ tax

25 May

Display the Data reconciliation entry you’re looking for faster

When you open a Data reconciliation entry, the entry that opens will now be for the most logical period based on where you open the entry from. Previously, when you opened a Data reconciliation entry, it would always open the latest period for the client and you’d often have to navigate to another period.

Learn more about Data reconciliation individual client entries.

19 May

Quickly and easily see which Data reconcliation entries have alerts

The Data reconciliation list is sorted to display entries with alerts at the top of the list by default.

Partner Hub

16 May

MYOB can provide you with targeted support more easiliy

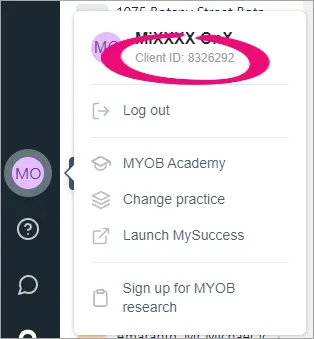

Your Client ID is displayed in the menu when you click the Your Profile button (your initials on the bottom left of the page) in the left menu bar. MYOB support may ask you for your client ID when you contact them for help.

NZ tax

10 May

Control how attribution of income/loss is distributed

In an IR7 partnership or look-through company return, you can edit the automatically calculated income/loss attribution values. Editing the value lets you specify the amount to be allocated, which is useful if the distribution isn't percentage based. Learn more about editing income/(loss) attribution.

Portal

9 May

Improvements for Client Portal

Your clients can now upload multiple documents in one process. When clients do this, you'll receive one email notification for all the documents they've added in one upload.

Partner Hub

5 May

Program Activities added to Overview page

On the Overview page, you can now view a summary of your team’s activities and the amount of status credits they've earned. To see more detail of your team’s progress, click View Team Progress History to view their progress on certifications and the status credits they’ve earned during promotions. Learn more about viewing your team activity.

NZ tax

28 April

Refresh data for all tax types

Individuals only

The Refresh IRD INC data button in Data reconciliation is now the Refresh IR data button. You can use it to refresh data for all four tax types (Income tax, Tax credits, Student loan and Working for families). The previous button only refreshed data for income transactions.

27 April

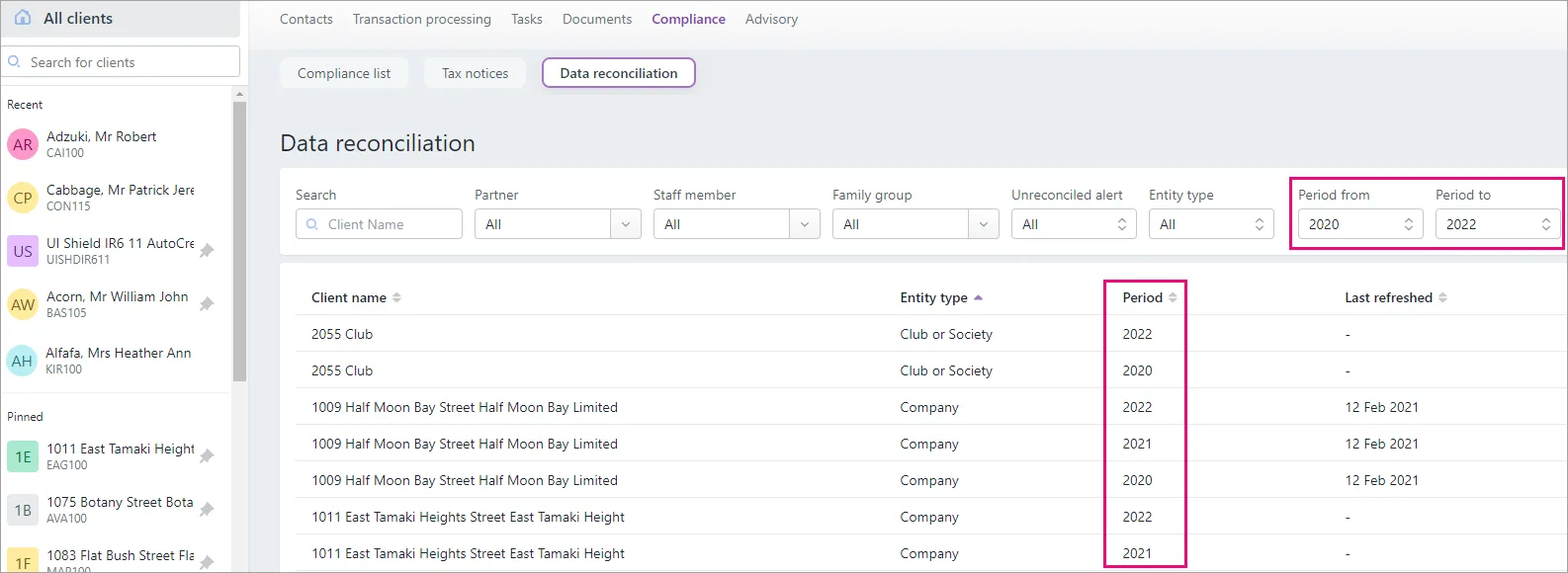

Better visibility on the period in which a Data reconciliation transaction took place

When viewing the Data reconciliation page in All clients view, each period is now displayed as its own row in the list of entries. Previously, each client’s entry displayed as one combined range of periods.

You can use new Period from and Period to drop-down lists to filter the entries by a period range or by a single period, to help you find the entry you’re looking for.

You can also click a column header to sort the list of entries. For example, if you want to see all the entries with alerts at the top of the list, click the Alerts column header. If there are multiple entries for one client, these rows will always be displayed next to each other, to make it easier to see which entries belong to each client.

Learn more about Data reconciliation.

22 April

Easily create the right schedule or workpaper

If a section of the Compliance list > Tax return page has a related schedule or workpaper, you can click a link to add the schedule or workpaper directly from that section of the tax return.

19 April

Display local date and time

Timestamps will be based on your system's local date and time, and will use a consistent format. You'll notice these changes in timestamps throughout your compliance work. For example, in the timestamps of filed returns.

13 April

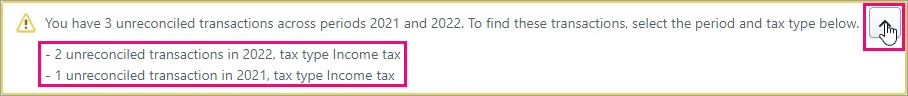

Find unreconciled transactions from different periods more easily

When you open a Data reconciliation entry with unreconciled transactions, an alert at the top of the page displays the number of unreconciled transactions in each period, for each tax type.

Click the expand icon (down arrow) to display the full alert.

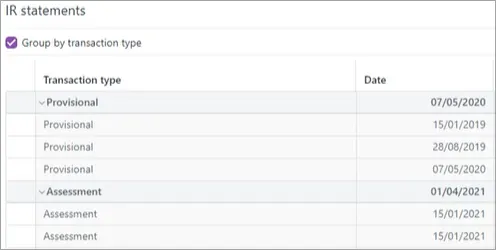

More flexibility in how to view IR statement transactions

In the IR statements section of a Data reconciliation entry, you can select a Group by transaction type checkbox to sort the statement rows into collapsible groups.

5 April

Automatic Overseas income schedule calculation

IR3 and IR4 only

The Overseas income schedule automatically calculates the claimable New Zealand tax credit portion of overseas tax payments. You may need to override the calculation in some circumstances.

Documents

5 April

Client’s profile automatically added to documents

When you receive documents in MYOB Practice from your clients through the Client Portal, the documents will now automatically have the client’s profile added to them. We’ll only add a client’s profile to documents when there is one client in the Client Portal.

NZ tax

1 April

Tax compliance for 2022 is here!

You've got all the latest updates you need for the new tax year, including:rolling over tax return and compliance settings data from the previous year

rate changes

residential rental properties

trust returns

business continuity test

government subsidy

Working for families

IRD number validation and errors

2022 tax statement usability and readability

other tax return changes and resolved issues.

Documents

25 March

Fix for profiled documents

Previously, you may have had some issues with loading the Documents page when you’d added more than three profiles to a document. We’ve fixed this by reducing the amount of profiles you can see when you hover over the Clients column. Now, you will see up to three clients and if you’ve added more than three clients, it will show as Client, Client, Client, … more+

You can still view and edit all the profiles added to a document when you’re looking at the document’s details. The Client search also still works for finding clients that are profiled to a document. Learn more about profiling documents.

NZ tax

23 March

Improved basis information for tax notices

More useful information is used and displayed in the Basis year field in provisional tax notices, and in the Basis column in the tax notice list view for provisional and terminal notices:The basis value will include the specific status of the tax return that's used as the basis for the tax notice. That status will be Not Started, Draft, Approved, Filed or Assessed.

Draft could be In progress, In review or Ready for client. Approved could be Pending client signature, Ready to file or Rejected.

The Basis year value inside provisional notices will be displayed in a year-status format. For example, 2020 (Not Started).

For provisional tax notices, the Basis column in the tax notices list view will be displayed in a year-method-status format. For example, 2020 standard (Not Started).

For terminal tax notices:

The Basis column in the tax notices list view will be displayed in a year-type-status format. For example, 2020 terminal (Not Started).

The Notice type column won’t display the year, only the type Terminal.

The status will also be displayed if you export the tax notices to a spreadsheet using the Export (XLSX) option.

If there’s no assessed, filed or approved tax return for last year or the year before last, we’ll use the year before last’s return as the basis year, which will have a Not Started or Draft status. Previously, the last year was used in this scenario. For example, following this change in 2022, if there was no approved return in 2020 and 2021, the basis year will default to 2020 instead of 2021.

Learn more about tax notices.

Learn more about exporting tax notices to a spreadsheet.

10 March

Use tax return data in terminal tax notices without having to file the return

These changes apply to unlocked terminal tax notices (notices with a status of In progress, Not started or In review.) If you want to apply these changes to locked terminal tax notices, you need to unlock them first. You may need to check the amounts of your unlocked notices if you previously entered amounts.

Previously, terminal tax notices were populated with tax return data such as RIT, taxable income and the notice amount when the tax return had a status of Filed.

Now, terminal tax notices are first populated with return data when you click Send to client on the return to change the return status to Pending client signature. Tax notices are populated with return data again when you click File with IR on the return to change the return status to Filed.

This makes it easier to get terminal tax notices with data from returns to your clients sooner, and means terminal tax notice data population works the same way as it does for provisional tax notices.Other ways that terminal tax notices get populated are by reconciled assessments received from IR, or from amounts that you manually enter into the notice.

Learn more about terminal tax notices.

Learn more about tax return compliance workflow statuses and the tax notice workflow statuses.

7 March

Improved 2020 and 2021 tax statement usability and readability

Bolded the labels of the totals.

Increased the font size of the amounts and labels.

Increased the margin sizes.

Decreased the size of the section headings to make the amounts and labels more prominent.

Alphabetised the schedule order.

We’ve also alphabetised the order of workpapers and schedules that you add to a return in MYOB Practice on the panel next to the return.

1 March

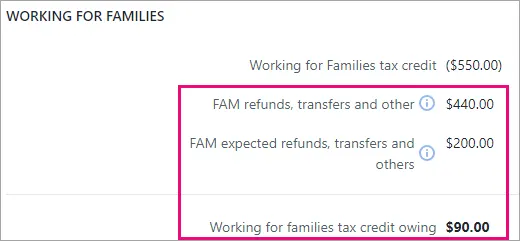

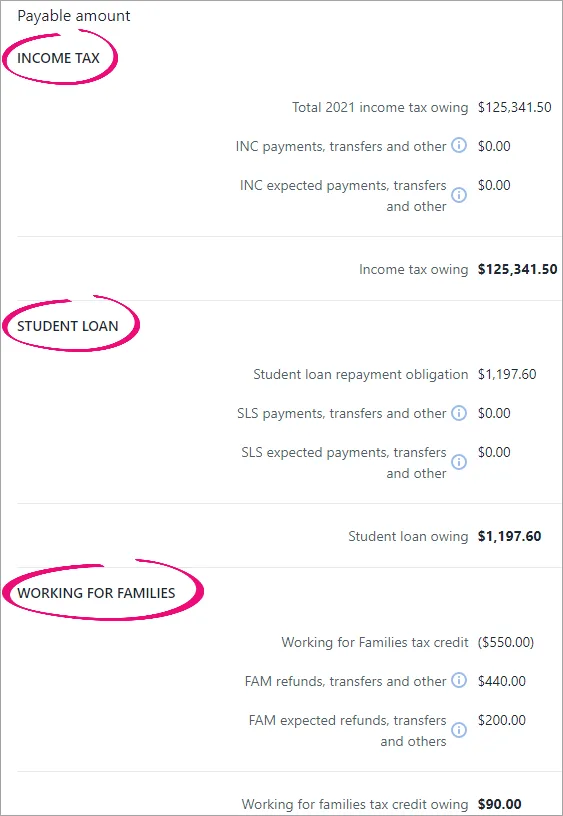

Terminal tax notices automatically populate Working for families value

Individuals onlyThese changes apply to unlocked terminal tax notices (notices with a status of In progress, Not started or In review.) If you want to apply these changes to locked terminal tax notices, you need to unlock them first. You may need to check the amounts of your unlocked notices if you previously entered amounts.

We’ve added three fields to the Terminal tax notices page to capture the breakdown of Working for families refunds received from, or owed to, IR.

These fields automatically populate their amounts, and the amounts will be reflected in the Terminal tax - FAM field in the Tax notice summary section of the page.

You no longer need to use a FAM voluntary adjustment to display the correct amount on the tax notice PDF when Working for families is overpaid.

Now that we’ve added these and other fields to the Payable amount section over the last few months, we’ve also added subheadings so it’s easier to see what tax types the amounts fall into.

Learn more about the Working for families fields and other fields in the Payable amount section.

Learn more about tax notice and tax return statuses.

Partner Hub

18 February

You can now update your team size so that your practice earns the right amount of status credits. Learn more about the MYOB Partner Program.

NZ tax

15 February

Add comments to tax notices to make note of key points and to share your thoughts with your colleagues

You can add comments to tax notices to track and share information about a tax notice with other users in your practice. The comments are included if you export the Tax notices data to a spreadsheet. Learn more about comments in tax notices.

Partner Hub

15 February

In the Partner Hub Overview, we've added a progress bar for status credits so that you can now see how many status credits you've got.

NZ tax

19 January

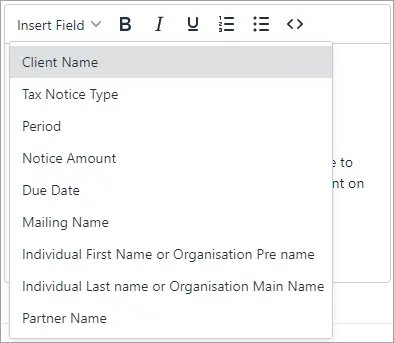

Partner Email in tax notice messages

We’ve added a new Partner Email field variable that you can insert into the email or Portal task text that’s used when you send tax notices to your clients. This field variable displays the email address of the partner in your practice who is associated with the client receiving the message. The email address that is used is the same email address that the partner uses to log in to my.myob.

Insert the new field variable in MYOB Practice from the Insert Field drop-down in Settings > Compliance > Cover email text.

Assessment filter on the Tax notices page

We've added an Assessment drop-down to the More filters options in the Tax notices filter bar. This filter lets you display tax notices that have income tax, Working for families or student loan assessment amounts. The filter checks for a value in residual income tax (INC), student loan repayment obligation (SLS) or Working for Families tax credit (FAM).

The assessment data is also included when you export the tax notices to a spreadsheet, depending on your Assessment drop-down selection.

Learn more about filtering.

13 January

Salutation in tax notice messages

We’ve added a new Salutation field variable that you can insert into the email or Portal task text that’s used when you send tax notices to your clients. This field variable displays a shorter version of the recipient’s name, for a more appropriate way of beginning a tax notice message. For example, Dear John instead of Dear John James Smith.

The Salutation value comes from your MYOB AE/AO desktop software. The value would have been set when you created the client. You can edit the value from the Client - [Name] > Main tab.

Insert the new field variable in MYOB Practice from the Insert Field drop-down in Settings > Compliance > Cover email text.

Learn more about setting up email land Portal task options.

2021 improvements

NZ tax

21 December

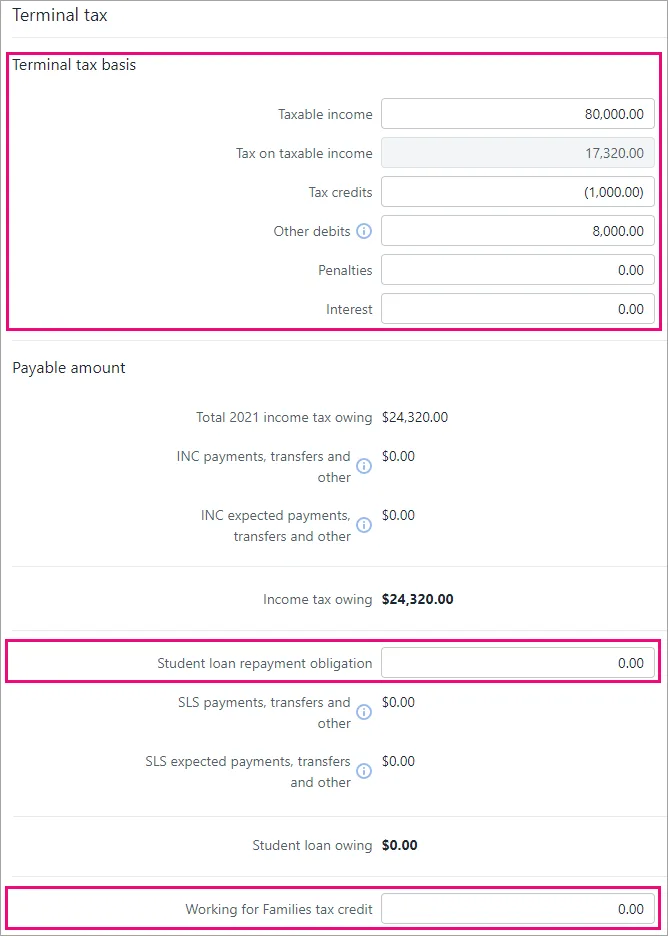

Terminal tax notices automatically populate more values

-

These changes apply to unlocked terminal tax notices (notices with a status of In progress, Not started or In review.) If you want to apply these changes to locked terminal tax notices, you need to unlock them first. You may need to check the amounts of your unlocked notices if you previously entered amounts.

-

There is an important voluntary adjustment workaround for an overpaid Working for families amount.

The Student loan repayment obligation field, Working for Families tax credit field and the fields in the Terminal tax basis section of the Tax notices page automatically populate their values from Data reconciliation or tax returns. Learn more about the Terminal tax basis and Payable amount sections.

-

NZ tax

30 November

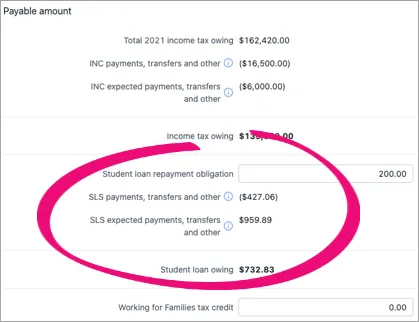

Student loan terminal tax field improvements

Individual entities only

We’ve added to and renamed the student loan fields in the terminal Tax notices page to make them more useful and informative.

Student loan repayment obligation—We’ve renamed this field from Student loan repayment. This field is editable and you’ll need to manually enter the value. We’re working on making this field automatically calculate its value in a future update.

SLS payments, transfers and other—This new field displays reconciled IR student loan transactions from the Data reconciliation page.

SLS expected payments, transfers and other—This new field displays unreconciled MYOB student loan transactions from the Data reconciliation page.

Student loan owing—We’ve renamed this field from Student loan repayment amount. This field displays the amount owing to IR.

If you’ve been using voluntary adjustments for recalculated student loan amounts, you’ll no longer need to use this workaround. These student loan field updates will automatically display the recalculated amounts.

We’re continuing to work on bringing even more student loan improvements.

8 November

More tax notice email customisation options

If your MYOB Practice Administrator's added a footer or logo in the MYOB Practice Email notifications settings, the logo will be included when you send a tax notice.

If you edit the default tax notice email or Portal task text, it's easier to apply formatting. Choose from the Cover email text field options, or click the source code icon () to use HTML elements.

There are also more Insert Field variable options.

Learn more about setting up tax notice email and Portal task options.

4 November

Some MYOB transactions are automatically created

Some MYOB transactions will be automatically created in Data reconciliation when you file a tax return after 4 November 2021:

When you file an IR3 or IR3NR with an attached Student loan (SLS) or Working for families (WFF) schedule, transactions created will include tax return assessments and transfers in.

When you file an IR526 for Tax credits (REB), the transactions created will include tax return assessments, refunds and transfers out.

Portal

1 November

Role to manage task templates

MYOB Practice administrators can assign users to a role that allows them to manage task templates. Learn more about creating task templates and assigning roles.

Documents

29 October

Document tile in Compliance

Access and upload documents for a particular year within the compliance. Learn more about Documents within MYOB Practice.

NZ tax

27 October

Performance improvements on locked forms

We've improved the time it takes to open locked forms when you're filing a return.

22 October

Details about transfers from other returns (Transfers received schedule)

You can create a Transfers received schedule that shows what a tax return’s Transfer from other returns value consists of. The schedule displays the tax type, client names and IRD numbers associated with incoming refund transfers. Previously on tax returns, you could only see the outgoing details of transfer recipients.The IRD number, tax type and amount will also continue to be visible in the tax statement. Note that Account type has been renamed to Tax type in the tax statement.

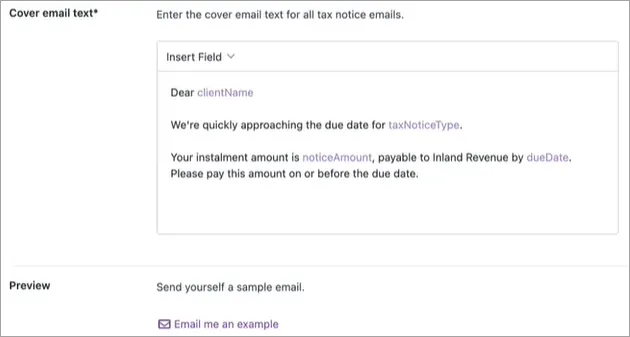

Edit the default tax notice email or Portal task text

MYOB Practice Administrators can edit the default email and Portal task text that’s used each time you send a tax notice. Edit the text in the Cover email text field in your MYOB Practice settings.

You can insert field variables to automatically populate specific sections of the email with relevant text, like the client name.

You can use HTML elements to apply formatting to the email text. For example, you can enter a sentence between <p> and </p> to create a paragraph, or place a word between <b> and </b> to bold that word. Learn more about HTML text.

There’s also an option to send yourself a sample email to preview what the output will look like.

Learn more about setting the default text.

-

Changes you make to the Cover email text apply to all tax notice emails and Portal tasks sent to your practice’s clients. But if you're sending an individual tax notice rather than multiple tax notices in bulk, you’ll be given an opportunity to make once-off edits to the default text before sending the tax notice.

-

We’ll be adding more field variable options soon. We're also looking into making additional enhancements to email editing options over this quarter. (Now available from 8 November!)

Portal

26 October

Save time with task templates

You can save time by creating and using a task template when sending general tasks to your clients. Learn more about creating a task template.

NZ tax

7 October

Easier access to help for compliance

We've added a handy link in Data reconciliation, Tax return under Compliance list to access all help topics and updates.

Click Help and support to access the page in the product or check out the page.

NZ tax

30 September

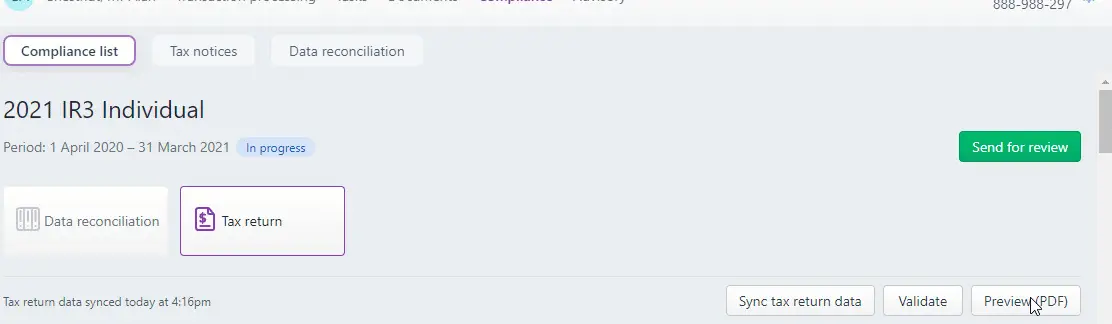

Tax return PDF improvements

You can now choose to preview a tax return PDF in a new browser tab or download it directly. You could previously only download it. You can also choose to add a DRAFT watermark to the PDF.

As part of these changes, the Download button has changed to Preview (PDF) in the Compliance list > Tax return page, and the options are presented in a Preview documents window. Learn more about sending a tax return to a client.

Easily sync, validate or preview a tax return from any section

When you scroll through a tax return, the Sync tax return data, Validate and Preview (PDF) buttons will remain visible.

28 September

Delete transfers and refunds in Data reconciliation

You can now delete transfers and refunds created when you file a tax return. Learn more about deleting a transaction.

21 September

Validation error improvements

In tax returns, you can now click See a list of common errors to access the validation error help page.

Learn more about validating a tax return.

20 September

Data reconciliation, MYOB transactions, and Working for families and Student loan schedules

We've got a lot of big and exciting features for you in this update! Read on to learn about improvements to Data reconciliation, MYOB transactions, and Working for families and Student loan schedules.

Some of these updates will impact how you work. We'd like to reassure you we're making these changes based on your feedback to improve our software and your experience in the long term.Working for families calculations now available

IR3 only

Working for families tax credits calculations just got easier! Amounts are automatically calculated based on the data that you enter into the schedule. You previously had to manually calculate and enter the amounts.You can no longer manually enter or edit the tax credit entitlement amounts, but any previously entered amounts will remain in the schedule.

If you want to use automatic calculations, delete the schedule, then add the schedule again and enter the dependant's details.

Working for families schedule field is now prepopulated

The Working for families tax credits paid by Inland Revenue field is automatically populated with data synchronised from Data reconciliation transactions. You previously had to complete this field by manually entering the data. Learn more about adding a return.Before September 20 2021, the Total repayments made to IR and 20xx Total interim repayments made to IR fields weren't automatically populated and could only be manually populated.

-

If you already have manually entered data...

...in the Working for families tax credits paid by Inland Revenue field of an existing schedule, this data won’t be overwritten with data from Data reconciliation transactions. If you want the field to use data synchronised from Data reconciliation transactions, delete the schedule, then add the schedule again and complete any manually editable fields. The automatically calculated fields will already be populated. -

If you have in-progress tax notices...

...where you've added any voluntary adjustments, check the amounts in these tax notices. The voluntary amounts may already be taken into account by the fields automatically synchronised from Data reconciliation. If this is the case, you'll have a duplicated amount from the manual and automatic adjustment.

To fix tax notices with duplicated amounts, remove the voluntary adjustments in the tax notice.

-

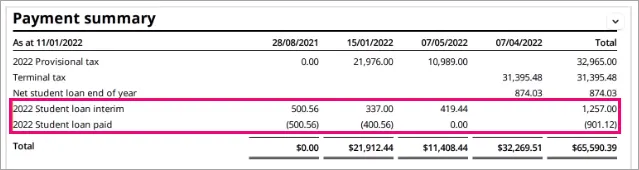

Student loan schedule fields are now prepopulated and included in tax statements

IR3 and IR3NR 2021 onwards

The Total repayments made to IR and 20xx Total interim repayments made to IR fields are automatically populated with data synchronised from Data reconciliation transactions. You can't manually edit these fields. 20xx Total interim repayments made to IR is a new field, and you previously had to complete Total repayments made to IR by manually entering the data.

The data from these fields is displayed in the tax statement in the Payment summary section in two new fields: 20xx Student loan interim and 20xx Student loan paid.

If you have any approved tax notices with a status of Ready for client and you want to use the automatically populated data, you need to click Send for rework at the top of the tax notice to change the status back to In progress.

Before September 20 2021, the Total repayments made to IR and 20xx Total interim repayments made to IR fields weren't automatically populated and could only be manually populated.

-

If you already have manually entered data...

...in the Working for families tax credits paid by Inland Revenue field of an existing schedule, this data won’t be overwritten with data from Data reconciliation transactions. If you want the field to use data synchronised from Data reconciliation transactions, delete the schedule, then add the schedule again and complete any manually editable fields. The automatically calculated fields will already be populated. -

If you have in-progress tax notices...

...where you've added any voluntary adjustments, check the amounts in these tax notices. The voluntary amounts may already be taken into account by the fields automatically synchronised from Data reconciliation. If this is the case, you'll have a duplicated amount from the manual and automatic adjustment.

To fix tax notices with duplicated amounts, remove the voluntary adjustments in the tax notice.

-

Data reconciliation tax types and period summary

As part of the rollout of this feature, you may notice some unreconciled IR transactions from the last couple of days. If this happens, you can simply reconcile the transactions.

We've automatically reconciled all transactions for the last 2 years for the SLS, WFF and REB tax types.

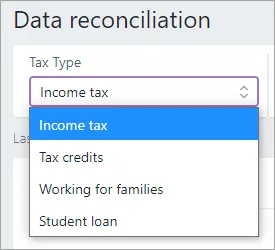

View more tax types in Data reconciliation

When viewing the Data reconciliation page in the client-centric view, you can select the Tax Type to display data related to that particular tax type.

For individual entities, the Tax Type options are Income tax, Tax credits, Working for families or Student loan.

For other entities, the Tax Type option is Income tax.

Previously, you could only display income tax (INC) transactions for all entity types.

The Tax Type options for individual entities give you more information for evaluating your clients' liability, giving you a complete picture of what a client’s tax position is for each tax type. These details will be included when preparing tax notices and tax returns, reducing the need for manual MYOB transactions or voluntary adjustments.

We’ve also renamed the Refresh IR data button to Refresh IRD INC data because it can only refresh income tax data, regardless of which Tax Type you selected.}

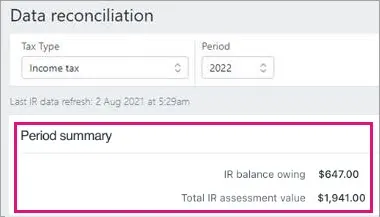

New Period summary section in Data reconciliation

When viewing the Data reconciliation page in the client-centric view, you now have a quick way to check the balance owing and assessment value for the selected period. You can view this information in the IR balance owing and Total IR assessment value fields under Period summary.

IR balance owing – The balance value from the IR data feed for the tax type and period.

Total IR assessment value – The total assessment value from the IR statements section of the page, for the tax type and period.

The Period summary section is available for all tax types.

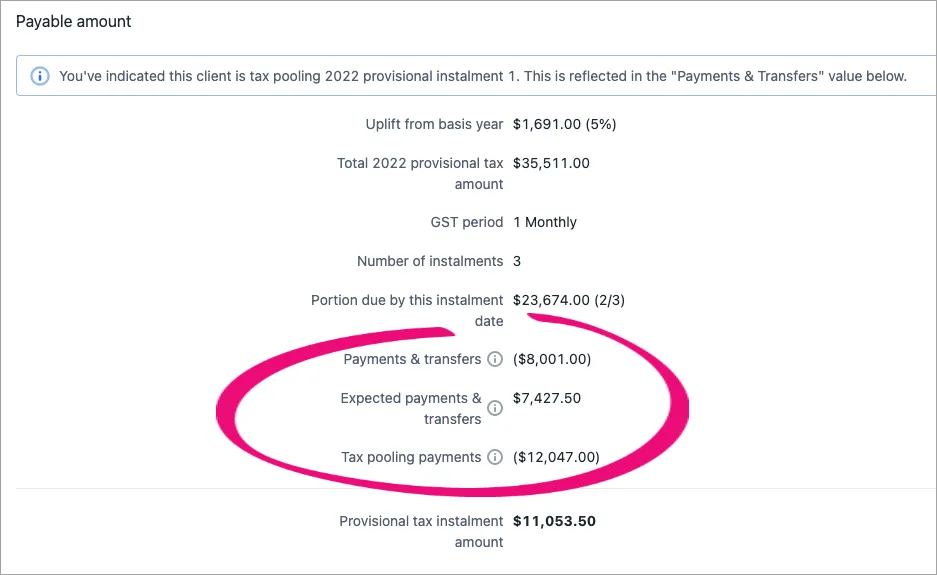

Learn more about Data reconciliation.Capture MYOB transactions for provisional tax notices

We’ve made it easier to track MYOB transactions for expected future payments. There are a couple of new fields on the provisional Tax notices page to help with this, and a change to an existing field.

Payments & transfers – This existing field now only displays reconciled IR transactions from Data reconciliation.

Expected payments & transfers – This new field displays unreconciled MYOB transactions from Data reconciliation and transfers that aren’t covered by IR transactions.

Tax pooling payments – This new field displays the tax pooling payment amount that was previously displayed alongside the Payments & transfers amount. The calculation hasn’t changed, but it’s easier to work with the amount in its own field.

This changes how tax notice calculations work. It's important that you check that amounts in any in-progress tax notices are correct before sending the notice for approval. Learn more about the payable amount.

Learn more about provisional tax, the Tax notices workflow and the Data reconciliation workflow.

16 September

New fields added when exporting Tax notices into Excel. Learn more about exporting tax notices data to a aspreadsheet.

9 September

Audit history

Administrators now have access to an audit history. It shows any changes made to the status of tax returns and any changes made to staff role assignment. Learn more about audit history.

6 August

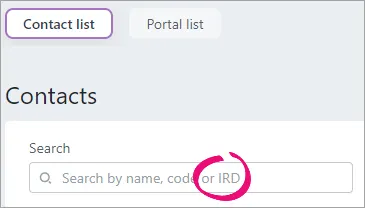

You can search, filter and sort the Contact list.

We've changed the display name on the Contact list to be Last Name, First Name, consistent with the Compliance list format.

NZ tax

31 August

Provisional tax option filter on the Tax notices page

We've added a Provisional tax option drop-down to the More filters options in the Tax notices filter bar. This filter lets you choose whether to display provisional tax notices using only the standard option, only the estimation option, or all tax notices regardless of whether they are provisional tax notices. Learn more about filtering.

27 August

Voluntary adjustments filter on the Tax notices page

We've added a Voluntary adjustments drop-down to the More filters options in the Tax notices filter bar. This filter lets you choose whether to display tax notices that have a voluntary adjustment. You can display:tax notices with a specific voluntary adjustment type (for example, FAM, FBT, GST, INC or SLS)

all tax notices with any voluntary adjustment type

tax notices that don't have a voluntary adjustment

all tax notices whether they have a voluntary adjustment or not.

Learn more about filtering.

Learn more about voluntary adjustments for provisional tax or terminal tax.

26 August

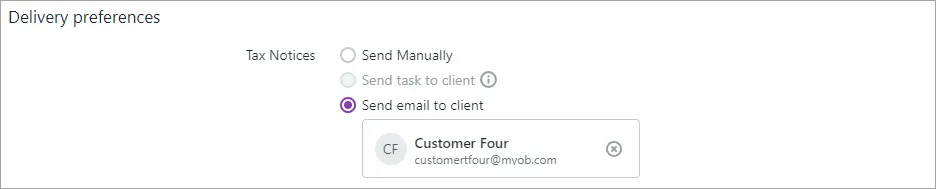

Delivery preference filter on the Tax notices page

We've added a Delivery preference drop-down to the More filters options in the Tax notices filter bar. This filter lets you choose whether to display tax notices that are set to Send manually, Send task to client, Send email to client or All.

This is a useful filter to apply when selecting tax notices to send in bulk. The tax notices that need to be sent manually can't be sent in bulk, so this filter lets you easily exclude those tax notices. It also lets you easily see just those tax notices that you need to prepare for sending manually.

Learn more about finding and filtering tax notices.

18 August

Assign users to roles in bulk

Now there's an easier way to control which users can perform certain actions in MYOB Practice in bulk. Learn more about roles and permissions.

First, you'll need to have opted in to Access Management to assign staff to roles in bulk.

17 August

New filter options on the Tax notices page

We’ve added a Nil balance checkbox and Tax pooling drop-down to the More filters options in the Tax notices filter bar. You can use these options to filter the results displayed on the Tax notices page, which can be useful for performing bulk actions on a set of tax notices.

Nil balance amounts:

Select the Nil balance checkbox to display tax notices with a 0.00 amount.Tax pooling:

Select an option from the Tax pooling drop-down (Yes, No or All) to display tax notices based on whether the client is using tax pooling.

Learn more about filtering, or tax pooling for provisional or terminal tax notices.

13 August

Send a copy of tax notice emails to your practice

When you send emails with tax notices to your clients, your practice can now receive a copy of the email. Your MYOB Practice Administrator will need to set a CC email address to use this feature.

Learn more about sending tax notices and about setting up the CC email address.

6 August

Easily access IRD numbers

You can see your clients' IRD number on the top right of MYOB Practice. This is convenient as a quick reference when you’re working on data reconciliation, tax notices or tax returns. The IRD number is displayed on any page when you select a client from the Contact list or client sidebar.

You can search for your client’s IRD number in the Search field on the Contact list page. Type in an IRD number and the page will show you the associated client.

Contacts

6 August

You can search, filter and sort the Contact list.

We've changed the display name on the Contact list to be Last Name, First Name, consistent with the Compliance list format.

NZ tax

2 August

Minor Data reconciliation and Tax notices improvements

You can see the Unreconciled transactions panel in Data reconciliation even when there are no currently unreconciled transactions. This means you can always access the Add MYOB transaction function. Learn more.

In the Data reconciliation and Tax notices sections, wherever there were references to IRD in the user interface, these references are now displayed as IR.

We’ve added a Data reconciliation heading above the filters in the All clients view.

Documents

1 August

New limits when downloading from Documents within MYOB Practice

To improve the performance of Documents within MYOB Practice, we've introduced limits on the quantity and size of documents you can download in one go. You can now download 150 documents or 1 GB worth of documents, whichever one of these limits you reach first. Learn more about opening and downloading documents.

NZ tax

21 July

Export Compliance list and Tax notices data to Excel

Reviewing compliance work just got easier! You can export data to an XLSX spreadsheet file, which can be a handy way to make and share notes and comments while reviewing. If you want to only include certain data sets, like only data relevant for a particular practice partner, you can also filter the data before exporting.

We've also removed the Export report (PDF) button. This option to export to Excel replaces the option to export to PDF.

Learn more about exporting in the Compliance list or in Tax notices.

19 July

Precise calculations when distributing income between partners in IR7 returns

Distribution calculations will use percentages to 4 decimal places instead of 2. IR allows percentages to 2 decimal places to be reported, so we’ve also added a new Percentage filed with IR field. See Entering data into a tax return in this link to learn more.

13 July

Automatically create tax workpapers when prepopulating returns

You no longer need to work out which workpaper or schedule to create when receiving data for prepopulating returns. We'll create the appropriate workpaper for you! Learn more about pre-populating data into a tax return.

9 July

Visibility of bank account details for refunds

When a tax return includes an amount to be refunded, you can see the bank account details that you previously set up in myIR and that will be used for the refund. If the bank account details in MYOB Practice don’t look right, you can refresh them to synchronise with the latest details in myIR. Learn more about pre-populating bank account details.

8 July

Sending tax notices via email and in bulk

You can send tax notices to clients via email from within MYOB Practice. You can also send tax notices in bulk by email or as Portal tasks. Learn more about sending a tax notice to a client.If you use Tax Manager in MYOB AE/AO on the desktop, read section 8. Send notices of the Tax notices workflow for important information.

NZ tax – Resolved issues

15 July

Fix for tax notices

When accessing tax notices, you won't get this error anymore: 'Something went wrong' (support ref: 00717130). Learn more about the resolved issue.

13 July

Fix for tax notices

When you create a tax notice, the due date now shows correctly for six monthly clients with a June or December balance month (support ref: 00701371). Learn more about the resolved issue.

7 July

Improvements and fixes for tax notices and returns

In tax notice emails, the subject line now includes the name of the tax notice recipient (support ref: 00703152). Learn more about the resolved issue.

When you email your clients their tax notice, the attached notice will now be a PDF (support ref: 00648185). Learn more about the resolved issue.

You can now change the provisional tax option when the due date has passed (support ref: 00663088). Learn more about the resolved issue.

When schedular income is negative, it'll now be taken into account on your tax statement and displayed in Net schedular payments (support ref: 00672041). Learn more about the resolved issue.

If you change your client's name after you've created their tax notice, the tax notice will now show the updated name.

After you've created a tax notice, the first instalment is correctly calculated in all cases. Previously, some notice's first instalments were incorrectly reduced by $1.

Some tax notice's provisional tax was not being calculated when RIT was above $5000.

NZ tax

28 June

Tax workpapers and schedules have an improved PDF layout

When you use the Tax workpapers & schedules side panel to create multiple workpapers and schedules for a tax return, they are combined onto one page wherever possible, without related content breaking across multiple pages. Learn more about preparing a tax return.Access management for Tax notices and Data reconciliation

If you opt in to access management, you can use three new roles to control access to Tax notices and Data reconciliation functionality.Tax notice approval role – Lets you approve and unlock tax notices.

Sent tax notices role – Lets you send tax notices and change the tax notice status to Sent.

Data reconciliation role – Lets you add, delete, reconcile or unreconcile transactions in a compliance data reconciliation.

If you've already opted in to access management, now only Administrators will have access to certain Tax notices and Data reconciliation functionality. To give access to other users, the Administrator must assign the new roles to those users.

If you haven't opted in yet, you can register your interest to access all the features.

Learn more about roles and permissions for tax access management.

24 June

Deleting IR526 returns

You can delete an IR526 if it has a status of In progress.

22 June

Added a validation to the IR4 company return

You’ll now see an error message if you haven't entered a value in the Lowest economic interests of shareholders percentage field.Improved paragraph customisation

While editing paragraphs in tax notices and tax statements, you could previously press Enter to display the text on a new line break in the field. Now the line break will also display in the final tax notice or tax statement paragraph. We’ve also increased the maximum character limit in the Opening paragraph, Declaration and Footer paragraphs. Learn more about editing default paragraphs for tax notices and tax statements.

16 June

Fixed known issue in tax returns

Payment summary – incorrect when provisional tax paid exceeds instalment due amount (support ref: 00651081). Learn more about the resolved issue.

9 June

Fixed known issues

IR4 errors for losses claimed and subvention payments

For an IR4, we have changed the validation errors to warnings when there are losses claimed and subvention payments. We've also updated the wording on the validations.UOMI on tax statements

We've fixed an issue where a Use of money interest row was always printing in the IR4 and IR6 payment summary on the tax statement. The row will now only print if the amount is not 0.00.Depreciation calculation

We've changed depreciation so that it will now be limited to the opening tax value. Before, the depreciation section in the Rental schedule in some scenarios was calculating depreciation greater than the opening tax value.

3 June

Customise paragraphs in tax notices and tax statements

We’ve added the ability to edit the paragraphs displayed in tax notices and tax statements. We’ve also added an Additional text field, which will display an additional paragraph in tax statements. Some paragraphs come with default text, so you may want to review and edit these to suit your practice. Learn more about editing default paragraphs for tax notices and tax statements.This feature doesn't include editing logos.

NZ tax

28 May

Business income schedule update

Based on your feedback, we've added a Depreciation subsection in the Other expenses section of the Business income schedule. This includes a new Depreciation field. The previously available Depreciation field is still available in the Expenses table to ensure previously entered data isn’t affected. You only need to complete one depreciation option.

Learn more about tax workpapers and schedules on the Compliance workflow page, in the Prepare a return > Table of tax workpapers & schedules section.

27 May

We've completed adding support for prepopulating tax return data from Inland Revenue

You can see the schedules that are supported in this table about workpapers and schedules that get pre-populted from IR.

14 May

Tax compliance updates

Individual entity types only: We’ve updated 2022 provisional and 2021 terminal tax notices to meet IR’s requirements. This applies to all existing and newly-created tax notices. Learn more about provisional and terminal tax notices.Removed Partner and Family group filters for non AE/AO users

If you’re an MYOB Practice user who hasn’t come from MYOB AE/AO, we’ve removed the Partner and Family group filters from the Compliance, Tax notices and Data reconciliation lists. This is because partner and family group filters require data from AE/AO. You can still use the Staff member filter.

7 May

We're expanding support for prepopulating tax return data from Inland Revenue

We've made data prepopulation from IR available for more schedules, and we'll be adding support for even more. You can see the schedules that are supported in this table about workpapers and schedules that get pre-populated from IR.

Update: 27 May—We've completed adding support for prepopulating data.

6 May

Even more data to share data between tax returns... with less effort!

You can distribute income from an IR6 tax return to a beneficiary's IR3 tax return, for the 2021 financial year onwards.

Plus you no longer need to work out which schedule to create! We'll create the appropriate schedule for you when you distribute from an IR4, IR6 or IR7 return to the IR3 return, if it's not already created. Learn more about distributing data between tax returns.

Transaction processing

6 May

Create coding reports for MYOB Business files

You can now generate coding reports for clients with MYOB Business files. Previously, this was only possible for MYOB Essentials and MYOB AccountRight files.

NZ tax

23 April

Improvements to sending tax return details to clients

You can print and send one document that includes the Tax Statement and the associated schedules to your clients. Learn more about sending a tax return to a client.

21 April

New roles to help control user access to Compliance work

You can opt-in to access management. This gives your practice two new user roles for greater control over who can action Compliance work, like approving and filing returns. Learn more about roles and permissions for tax access management.

18 April

Save time by updating the status of tax notices in bulk

You can update the status of tax notices in bulk to Not started, In progress, In review, Ready for client, Sent, Paid or Not required, from the Tax notices list page. So if you have a lot of tax notices that you don't need to prepare or send, you can update all their statuses to Not required in one go without having to open the tax notice first. Learn more about updating the status of tax notices.

Update—April 26: We added two more status update options: Not started and In progress.

12 April

View and edit GST settings

You can view and edit client GST settings that were imported from AE/AO. You can edit the details, but they won't sync back to AE/AO. Learn more about configuring your client's compliance settings.

8 April

Filter Compliance list by staff, partner and/or family group

Effectively organise your workload with new filters for staff, partners and family group in the All clients view of the Compliance list page.

Staff and partner assignments come from your clients' Responsibility tab in AE/AO, so make sure you've set up your team responsibility first. For family groups, you'll need to have set up family groups in AE/AO also. Learn more about the compliancae list.

7 April

Even more data to share data between tax returns